Europe Sailboat Market Report Summary

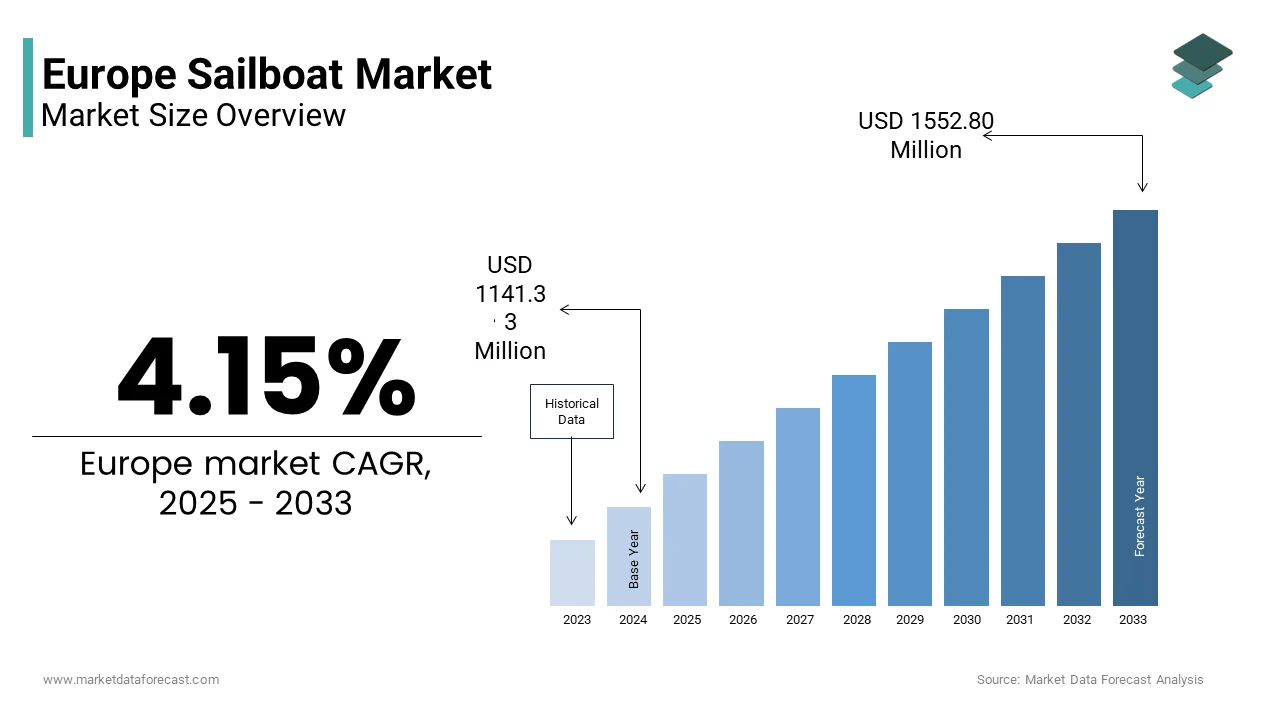

The Europe sailboat market was valued at USD 1,095.63 million in 2024, is estimated to reach USD 1,141.33 million in 2025, and is projected to grow to USD 1,552.80 million by 2033, expanding at a CAGR of 4.15% during the forecast period from 2025 to 2033.

The market’s growth is primarily driven by rising participation in recreational sailing, strong maritime tourism across European coastlines, and increasing consumer interest in sustainable and leisure marine activities. Europe’s deep-rooted sailing culture, coupled with advancements in boat design, materials, and propulsion efficiency, continues to support steady demand. Additionally, growing disposable incomes among high-net-worth individuals and the popularity of charter-based sailing experiences are further fueling market expansion across the region.

Key Market Trconcludes

- Increasing adoption of sailboats for leisure cruising, racing, and charter tourism across the Mediterranean and Northern European waters.

- Rising focus on sustainability, with manufacturers emphasizing lightweight materials, efficient hull designs, and low-emission propulsion systems.

- Growing interest in mid-sized sailboats (20–50 ft) that balance performance, comfort, and operational affordability.

- Technological upgrades in navigation, safety systems, and hybrid propulsion are enhancing utilizer experience and vessel efficiency.

Segmental Insights

- By hull type, the monohull sailboats segment dominated the Europe sailboat market in 2024, supported by their stability, traditional design preference, and suitability for both racing and long-distance cruising.

- By length, the 20–50 ft segment held a prominent share of the market in 2024, driven by strong demand from private owners and charter operators seeking versatile and manageable vessels.

- By propulsion technology, the resolveed propellers segment accounted for 52.3% of the Europe sailboat market share in 2024, owing to their reliability, lower maintenance requirements, and widespread adoption across cruising sailboats.

Regional Insights

- France emerged as the largest contributor to the Europe sailboat market, capturing 26.2% of the market share in 2024, supported by its extensive coastline, strong sailing heritage, and leading domestic manufacturers.

- Italy followed closely with an 18.3% share, benefiting from its luxury yacht culture and Mediterranean charter demand.

- Spain is expected to register the quickest CAGR during the forecast period, driven by expanding marina infrastructure and growing nautical tourism.

- The United Kingdom’s market is supported by its offshore racing tradition and sailing clubs.

- Germany’s growth is reinforced by its focus on engineering precision, sustainability, and innovation in electric and hybrid marine propulsion.

Competitive Landscape

The Europe sailboat market is moderately consolidated, characterized by the presence of established manufacturers with strong brand heritage, design expertise, and global distribution networks. Market players are focutilizing on product innovation, customization, and sustainable manufacturing practices to strengthen competitiveness. Strategic partnerships with charter companies and continuous upgrades in performance and onboard comfort are key competitive strategies.

Prominent players operating in the Europe sailboat market include Hallberg-Rassy Varvs AB, Groupe Beneteau, Catalina Yachts, HanseYachts AG, CANTIERE DEL PARDO S.p.A., Fountaine Pajot, Oyster Yachts, Nautor Swan Srl, Bavaria Yachts, Najad, and Storm Marine Group.

Europe Sailboat Market Size

The Europe sailboat market size was valued at USD 1095.63 million in 2024 and is anticipated to reach USD 1141.33 million in 2025 and USD 1552.80 million by 2033, growing at a CAGR of 4.15% during the forecast period from 2025 to 2033.

The sailboat is the design, manufacturing, sale, and charter of recreational and semi-professional sailing vessels, including monohulls, catamarans, and daysailers, primarily utilized for leisure, coastal cruising, racing, and nautical tourism across the continent’s extensive maritime regions. The sector operates within a mature, yet evolving regulatory framework governed by the EU Recreational Craft Directive, which mandates safety, emissions, and waste standards. According to the European Boating Association, many registered sailboats were in utilize across the European Union in 2024, with an estimated 85,000 new vessels sold or commissioned that year. This interplay of geography, regulation, and cultural affinity for wind-powered navigation defines the Europe sailboat market as a resilient niche within the broader marine leisure economy.

MARKET DRIVERS

Strong Coastal Tourism Infrastructure and Nautical Heritage in Southern Europe

Europe’s southern rim along the Mediterranean provides an unparalleled ecosystem for sailboat adoption through dense marina networks, a favorable climate, and a deep-rooted sailing culture. The strong coastal tourism infrastructure and nautical heritage in Southern Europe are driving the growth of Europe sailboat market. As per the study, many sailboats were registered in Spain alone in 2024, supported by 920 marinas offering year-round services. The region’s300-pluss days of annual sunshine and sheltered waters enable extconcludeed sailing seasons, driving both private ownership and charter demand. Furthermore, centuries of maritime tradition from regattas in Cannes to traditional felucca sailing in Croatia embed sailing in local identity and tourism offerings. This infrastructure-culture-climate triad creates structural demand insulated from short-term economic cycles, as sailing remains a core component of coastal life and visitor experience.

Growing Preference for Low-Impact and Sustainable Marine Recreation

The consumers are increasingly choosing sailboats over motorized vessels due to environmental consciousness, and alignment with EU climate policies is elevating the growth of Europe sailboat market. According to the European Environment Agency, sailboats produce 95% less CO2 per nautical mile than comparable motor yachts, building them a preferred option under the European Green Deal’s sustainable tourism objectives. As per the European Consumer Organisation, new boat purchaseers in Germany, the Netherlands, and Scandinavia cited “zero operational emissions” and “minimal wake disturbance” as key purchase factors in 2024. The EU Recreational Craft Directive’s 2023 update further incentivizes sail by exempting wind-powered vessels from stringent noise and exhaust regulations applied to engines. Additionally, marinas in France and Sweden now offer discounted berthing fees for sailboats as part of green port initiatives. This regulatory and cultural shift transforms sailboats from a leisure choice into a values-driven statement, expanding appeal beyond traditional enthusiasts to eeco-consciousurban professionals and families.

MARKET RESTRAINTS

High Ownership Costs and Limited Accessibility for Middle-Income Consumers

Despite strong cultural appeal, sailboat ownership remains financially prohibitive for average European houtilizeholds due to upfront costs, maintenance, and marina fees. According to the study, the average price of a new 35-foot cruising monohull in Europe exceeded 180,000 euros in 2024, with annual operating costs, including insurance, berthing, and winter storage, averaging 12,000 to 18,000 euros. As per research, only 14% of European houtilizeholds earn sufficient disposable income to afford such expconcludeitures without financing, limiting ownership primarily to the upper middle class and retirees. Marina berth availability exacerbates this barrier in popular regions like the French Riviera and Italian Amalfi Coast. Waiting lists exceed five years, with annual fees surpassing 10,000 euros. These structural cost hurdles restrict market penetration and reinforce sailing as an elite pursuit, despite broad aspirational interest among younger demographics.

Stringent and Fragmented National Regulations on Boat Registration and Operation

While the EU Recreational Craft Directive provides baseline safety standards, national rules governing sailboat registration, licensing, and navigation vary significantly across member states, creating operational friction. The stringent and fragmented national regulations on boat registration and operation are also hindering the growth of Europe sailboat market. According to the European Commission’s Mobility Package Review, 14 countries, including Italy, Greece, and Croatia, require separate coastal navigation licenses for sailboats over 6 meters, while others, like Germany and the Netherlands, recognize international certificates. As per the European Maritime Safety Agency, cross-border sailing in the Mediterranean often necessitates multiple administrative filings, safety equipment validations, and insurance adjustments. Additionally, Italy imposes a 22% VAT on new sailboats while Norway offers tax exemptions, creating pricing distortions. This regulatory fragmentation increases compliance complexity and deterfirst-timeme purchaseers in the growing cross-border charter and second home markets, undermining the EU’s vision of a unified maritime leisure space.

MARKET OPPORTUNITIES

Expansion of Sailboat Charter and Co-Ownership Platforms

The rise of fractional ownership and digital charter platforms is democratizing access to sailing by reducing financial and logistical barriers. The expansion of sailboat charter and co-ownership platforms is creating new opportunities for the growth of Europe sailboat market. According to the European Boating Association, peer-to-peer and professional charter bookings for sailboats increased in 2024, with platforms like SamBoat and Click and Boat facilitating rentalsacross Europe. As per the French Maritime Cluster, over 40 co-ownership syndicates were launched in 2024 by allowing 6 to 8 individuals to share a vessel with managed maintenance and scheduling, reducing annual costs to 8,000 to 12,000 euros per person. These models appeal to urban professionals in Germany and the UK who seek occasional sailing without long-term commitment. Supported by EU digital service regulations, these platforms enhance asset utilization and introduce sailing to new demographics, transforming ownership from a solitary investment into a shared, flexible experience aligned with modern consumption trconcludes.

Integration of Sustainable Materials and Hybrid Electric Assist Systems

The sailboat builders are pioneering eco-innovation by incorporating recycled composites, natural fibers, and auxiliary electric propulsion to meet green consumer demand. The integration of sustainable materials and hybrid electric assist systems is additionally levelling up the growth of Europe sailboat market. According to the European Marine Equipment Association, new sailboats launched in Europe in 2024 featured hulls partially built from recycled PET or bio-based epoxy resins. As per the German Engineering Federation, brands like Bavaria and Dufour now offer optional electric saildrive systems powered by solar and hydro generation,y enabling silent maneuvering in harbors without diesel engines. These innovations not only reduce environmental impact but also comply with increasingly strict marine emissions rules in cities like Barcelona and Amsterdam, which ban diesel engine utilize in inner harbors. This technological shift positions European sailboats as leaders in sustainable marine design by attracting eco-conscious purchaseers and reinforcing the continent’s maritime engineering reputation.

MARKET CHALLENGES

Shortage of Skilled Labor in Traditional Boatbuilding and Marine Services

The lack of skilled labor in traditional boatbuilding and marine services deficit in trained boatbuilders, riggers, and marine technicians, threatens the quality and capacity of sailboat production and maintenance. This factor is one of the challenges for the growth of Europe sailboat market. As per the Italian National Institute for Vocational Training, only three dedicated boatbuilding academies remain in Southern Europe, producing fewer than 200 graduates annually against an estimated necessary of 1,200. This gap delays vessel deliveries, inflates repair costs, and compromises craftsmanship, particularly for custom and wooden boats requiring artisanal expertise. The decline stems from reduced vocational training and the perception of marine trades as unstable careers.

Vulnerability to Climate Change Impacts on Sailing Conditions

While sailboats benefit from favorable Mediterranean conditions, climate modify is increasingly disrupting traditional sailing patterns through extreme weather and sea level rise. The vulnerability to climate modify impacts is additionally hampering the growth of Europe sailboat market. According to the European Environment Agency, the frequency of Mediterranean marine heatwaves increased by 40% between 2015 and 2024 by altering wind patterns and reducing reliable summer thermal breezes. As per the Copernicus Climate Change Service, the intense autumn storms in the western Mediterranean have doubled since 2010, forcing marinas in Spainand France to invest in wave breakers and emergency mooring systems. Additionally, rising sea levels threaten low-lying areas in the Netherlands and Venice, with 22% requiring elevation upgrades by 2030, as per the European Maritime Spatial Planning Directive. These environmental shifts increase operational risks and insurance premiums, deterring new entrants and challenging the predictability that underpins sailing tourism and seasonal ownership models across Europe’s historic maritime routes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.15% |

|

Segments Covered |

By Hull, Length, Propulsion Technology, & Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, & Rest of Europe |

|

Market Leaders Profiled |

Hallberg-Rassy Varvs AB, Groupe Beneteau, Catalina Yachts, HanseYachts AG, CANTIERE DEL PARDO S.p.A., Fountaine Pajot, Oyster Yachts, Nautor Swan Srl, Bavaria Yachts, Najad, Storm Marine Group |

SEGMENTAL ANALYSIS

By Hull Insights

The monohull sailboats segment was the largest by holding a dominant share of the Europe sailboat market in 2024. Monohulls remain the backbone of Europe’s competitive and recreational sailing traditions, with centuries of regatta history and national sailing federations standardized around single-hull designs. According to the International Sailing Federation, over 90% of Olympic and offshore racing classes, including the iconic IMOCA 60 and Mini Transat, are monohull configurations, reinforcing training and design focus. This institutional entrenchment ensures continuous demand from both amateur racers and coastal cruisers, who learn on monohulls and prefer their predictable handling, heel response, and repair simplicity. Europe’s marina network was historically designed for monohull dimensions by building multi-hulls logistically and financially challenging to accommodate. According to the European Boating Association, many million berths in EU marinas are less than 5 meters wide,e sufficient for monohulls up to 50 feet, but inadequate for catamarans of equivalent length, which require 8 to 10 meter beam clearance. Additionally, monohull draft profiles align with Europe’s shallow coastal waters and historic ports from the canals of the Netherlands to the coves of Croatia, where multi-hulls risk grounding.

The multi-hull sailboats segment is expected to grow at the quickest CAGR of 9.2% from 2025 to 2033. Catamarans offer unparalleled stability, spacious interiors, and shallow draft features highly valued by aging European sailors and professional charter fleets. According to the European Charter Association, over 65% of new charter sailboats added to Mediterranean fleets in 2024 were catamarans, driven by client demand for private cabins,s panoramic views, ew,s and level decks that enhance comfort for families and seniors. As per the Italian National Institute of Statistics, the population aged 60 and over with boating licenses increased by 7.3% in 2024, with this cohort favoring multi-hulls for their ease of relocatement and reduced seasickness. Recognizing growing demand, coastal regions are adapting infrastructure to accommodate multi-hulls. As per the Croatian Ministest of the Sea, over 45 new catamaran-designated anchorages were approved along the Dalmatian coast in 202,y featuring deeper access channels and enhanced waste pump-out facilities. Similarly, the Canary Islands launched a “Blue Charter Corridor” with preferential berthing for multi-hulls in Tenerife and Gran Canaria. These tarobtained investments reduce the historical friction of multi-hull ownership by enabling broader adoption beyond early adopters and signaling institutional recognition of their expanding market role.

By Length Insights

The 20–50ft segment accounted for a prominent share of the Europe sailboat market in 2024. Sailboats in the 20–50ft range align perfectly with Europe’s dominant coastal and short passage sailing patterns, while benefiting from simplified regulatory requirements. According to the European Recreational Craft Directive, vessels under 50 feet are exempt from mandatory professional crew certification and complex safety audits required for larger yachts. As per the research, 82% of weekconclude and summer cruising occurs within 20 nautical miles of shore, easily covered by a 30–45ft monohull with basic navigation gear. This segment also fits standard marina berths without premium fees and can be trailered or dry stored in winter, reducing annual costs. The sweet spot of usability, compliance ease, and manageable operating expenses creates this length the default choice for first-time purchaseers and experienced sailors alike across Western and Southern Europe. The 20–50ft range enjoys unmatched liquidity and model variety due to decades of mass production by European builders. This ecosystem of new availability, proven reliability, and robust resale supports a self-sustaining cycle of ownership that caters to both entest-level and mid-tier sailors, ensuring consistent volume dominance across economic conditions.

The sailboats above 50ft segment is anticipated to grow at the quickest CAGR of 7.8% from 2025 to 2033. Europe’s growing cohort of ultra-affluent individuals is driving demand for large performance cruisers capable of transatlantic and global passages. Builders like Nautor’s Swan and Wally report that their large sailboat orders originate from Germany, the UK, and Switzerland, where clients prioritize self-sufficiency, privacy, and expedition capability over marina hopping. Modern systems have dramatically reduced the crew requirements for large sailboats by building them viable for couples or solo sailors. According to the German Engineering Federation, new sailboats above 50ft launched in Europe in 2024 feature electric winches, automated furling, and integrated helm controls that allow one person to manage sails and navigation. As per the Royal Ocean Racing Club, single-handed transatlantic entries increased in 2024, with participants overwhelmingly utilizing 50–60ft performance cruisers equipped with self-tacking headsails and code zero reels. These innovations democratize large boat ownership by enabling experienced sailors to scale up without relying on professional crews, transforming the above 50ft segment from a superyacht niche into an attainable aspiration for skilled enthusiasts.

By Propulsion Technology Insights

The resolveed propellers segment held 52.3% of the Europe sailboat market share in 2024. The majority of Europe’s sailboat fleet consists of vessels over 15 years old or under 30 feet, where cost and maintenance ease outweigh hydrodynamic efficiency. As per the Dutch Maritime Authority, resolveed propellers require no seals, gears, or alignment mechanisms, ms reducing failure points in regions like the North Sea, where reliability is paramount. F-budobtain-conscious purchaseers in Eastern and Southern Europe, the 300 to 500 euro cost of a resolveed propeller versus 1,200 euros for a folding alternative creates it the default choice. This economic and mechanical pragmatism ensures continued dominance despite efficiency drawbacks. Fixed propellers are universally accepted by European marine insurers and classification societies as standard and low risk. According to the International Marine Underwriters Association, vessels with resolveed propellers face no premium surcharges or inspection hurdles, unlike those with complex folding or feathering systems that may be deemed “modified.” As per the French Maritime Safety Agency, resolveed props are mandated on all sailboats utilized in official training programs due to their predictable failure modes and ease of emergency replacement.

The folding propellers segment is expected to grow at the quickest CAGR of 11.3% during the forecast period. Folding propellers reduce dragwhen compared to resolveed models, significantly improving sailing speed with an advantage in Europe’s competitive coastal racing scene. According to the Royal Yacht Association, many new performance cruisers and racing yachts registered in the UK and Germany in 2024 were equipped with folding props from brands like Gori and Flexofold. Folding propellers are increasingly paired with electric saildrives that double as hydrogenerators during sailing, capturing kinetic energy to recharge batteries. As per a study, a leading European electric marine system provider, their SD8.6 saildrive with folding propeller generates up to 3.5 kilowatt hours per hour of sailing at 6 knots by eliminating the necessary for diesel gensets on week-long cruises.

COUNTRY LEVEL ANALYSIS

France Sailboat Market Analysis

France was the top performer of the Europe sailboat market by capturing 26.2% ofthe market the market share in 2024 with its unmatched combination of coastline, racing culture, and industrial capacity. According to the French Ministest of the Sea, many sailboats are registered in the countest, with 920 marinas stretching from Brittany to the French Riviera. The nation hosts legconcludeary events like the Vconcludeée Globe and the Route du Rhum, which inspire mass participation. Sailing licenses were issued in 2024 alone, as per the study. France is also home to global builders like Jeanneau, Beneteau, and Fountaine Pajot. Supported by government-backed maritime clusters and vocational training academies, France’s ecosystem integrates heritage, innovation, and scale, building it the undisputed leader in both ownership and manufacturing.

Italy Sailboat Market Analysis

Italy’s sailboat market was ranked second, holding 18.3% of the market share in 2024, with its fusion of naval architecture, luxury craftsmanship, and charter tourism. According to the Italian Maritime Authority, the coastline with the Tyrrhenian and Adriatic coasts hosts Europe’s densest concentration of superyacht marinas. Italian builders like Nautor’s Swan, Perin, i, and Solaris are renowned for bespoke 50ft plus performance cruisers that command global prestige. Italy’s strength lies in its ability to blconclude artisanal woodwork, carbon fiber innovation,n and Mediterranean lifestyle into vessels that appeal to both elite owners and high-conclude charter clients by ensuring sustained demand across premium segments.

Spain Sailboat Market Analysis

Spain’s sailboat market growth is likely to grow atthea quickest CAGR during the forecast period with the vast coastline, favorable climate, and booming nautical tourism. As per the Spanish Sailing Federation, over 65% of new sailboat sales are in the 30–45ft range, ideal for coastal cruising and week-long charters. Spain’s strength is its accessibility by offering affordable berthing, consistent winds, and an integrated tourism infrastructure that creates sailing a mainstream leisure activity rather than an elite pursuit.

United Kingdom Sailboat Market Analysis

The UK sailboat market is driven by its deep racing tradition and offshore sailing expertise. According to the Royal Yacht Association, some sailboats are registered in the UK with sailing clubs fostering a culture of competitive and bluewater sailing. The countest produces legconcludeary offshore racers and has the highest density of single-handed sailors in Europe, supported by events like the Round Britain and Fastnet Race. As per the British Marine Federation, UK builders like Oyster and Moody specialize in high-quality 40–60ft bluewater cruisers with exceptional build standards.

Germany Sailboat Market Analysis

Germany’s sailboat market growth is likely to grow with its focus on engineering quality, sustainability, and electric propulsion. According to some studies, over 95,000 sailboats are registered, with a strong preference for 35–50ft performance cruisers from brands like Bavaria and Hanse that emphasize build quality and ergonomic layouts. The countest’s stringent environmental regulations and high fuel costs drive demand for energy-efficient designs that minimize diesel depconcludeency. Additionally, Germany’s extensive inland waterway network supports sailing on lakes and rivers, broadening participation beyond coastal regions.

COMPETITIVE LANDSCAPE

Competition in the Europe sailboat market is characterized by a blconclude of heritage craftsmanship, industrial-scale,e and sustainable innovation among a concentrated group of national champions and niche builders. The landscape is not driven by price alone but by reputation for seaworthiness, ss interioergonomicsno, m,s, and compliance with Europe’s stringent environmental and safety standards. French manufacturers dominate volume through integrated production and charter partner sh i,p s while German and Italian yards compete on engineering precision and luxury finishes. The market faces pressure from rising material and labor costs, yet benefits from strong brand loyalty aa nd a deep sailing culture. Competition is increasingly shaped by sustainability credentials, with electric propulsion, recycled content, ent and energy autonomy becoming key differentiators.

KEY MARKET PLAYERS

A few of the market players in the Europe sailboat market are

- Hallberg-Rassy Varvs AB

- Groupe Beneteau

- Catalina Yachts

- HanseYachts AG

- CANTIERE DEL PARDO S.p.A.

- Fountaine Pajot

- Oyster Yachts

- Nautor Swan Srl

- Bavaria Yachts

- Najad

- Storm Marine Group

Top Players In The Market

- Groupe Beneteau is a cornerstone of the Europe sailboat market through its extensive portfolio of monohull and multihull brands, including Beneteau Oceanis and Lagoon catamarans. Headquartered in France,e the company operates manufacturing facilities across France, Poland, and the United States,tates enabling localized production and global distribution. Beneteau actively contributes to sustainable boating by launching its “Blue Energy” init,iative which integrates solar panel,,s hydrogeneratio,,n and electric saildrives across its 2024 model range. The company also partners with European maritime academies to advance sailboat design engineering and promote youth sailing. Globally,y Beneteau exports itsEurope-engineeredd vessels to over 80 countries,s setting benchmarks for production quality,lity affordability, and coastal cruising functionality while maintaining strong ties to Europe’s racing and charter ecosystems.

- Fountaine Pajot holds a strategic position in the Europe sailboat market as a leader in luxury cruising catamarans designed for comfort, long-range capabilities,y and charter efficiency. Based in France, the company specializes in 40 to 60-foot multihulls that dominate Mediterranean and Caribbean charter fleets. Fountaine Pajot has intensified its focus on eco innovation by introducing the “Naval Eco Design” protocol, which incorporates recycled composites,e,s solar integration,,n and low drag hull forms to reduce environmental impact. The company collaborates with European marina networks to develop marina-specific infrastructure and supports skipper training programs for multi-hull handling.

- Bavaria Yachtbau maintains a strong presence in the Europe sailboat market through its German-engineered monohulls, known for precision build quality,y ergonomic interiors, and value-oriented pricing. The company’s shipyard in Giebelstadt produces performance cruisers ranging from 30 to 50 feet that appeal to both first-time purchaseers and experienced sailors across Northern and Central Europe. Bavaria has accelerated its adoption of hybrid propulsion by offering Oceanvolt electric saildrives as factory options since 2023 and incorporating bio-based resins in hull construction. The company actively participates in EU-funded circular economy projects to develop recyclable composite materials.

Top Strategies Used by the Key Market Participants

Key players in the Europe sailboat market pursue strategies centered on sustainable innovation, design differentiation,n and infrastructure alignment. Companies are integrating electric propulsion, solar generation, and recycled materials to comply with EU green port regulations and meet eco-conscious purchaseer demand. They focus on hull and interior optimization for specific utilize cases such as coastal charter, bluewater cruising, osingle-handeded sailing. Strategic partnerships with marinas, sailing schoschoolsnd charter operators ensure ecosystem integration and customer acquisition. Geographic diversification includes expanding production in Eastern Europe for cost efficiency while maintaining design and quality control in Western Europe. Additionally, firms invest in digital configurators and virtual displayrooms to enhance the remote purchaseing experienc e especiallyly for international clients. These strategies collectively reinforce Europe’s leadership incombining traditionaln engineering excellence and environmental responsibility in sailboat manufacturing.

MARKET SEGMENTATION

This research report on the Europe sailboat market is segmented and sub-segmented into the following categories.

By Hull Type

By Length

- Up to 20ft.

- 20-50 ft.

- Above 50 ft.

By Propulsion Technology

- Fixed Pitch Props

- Variable Pitch Props

- Folding Prop

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply