Europe Protein Ingredients Market Overview

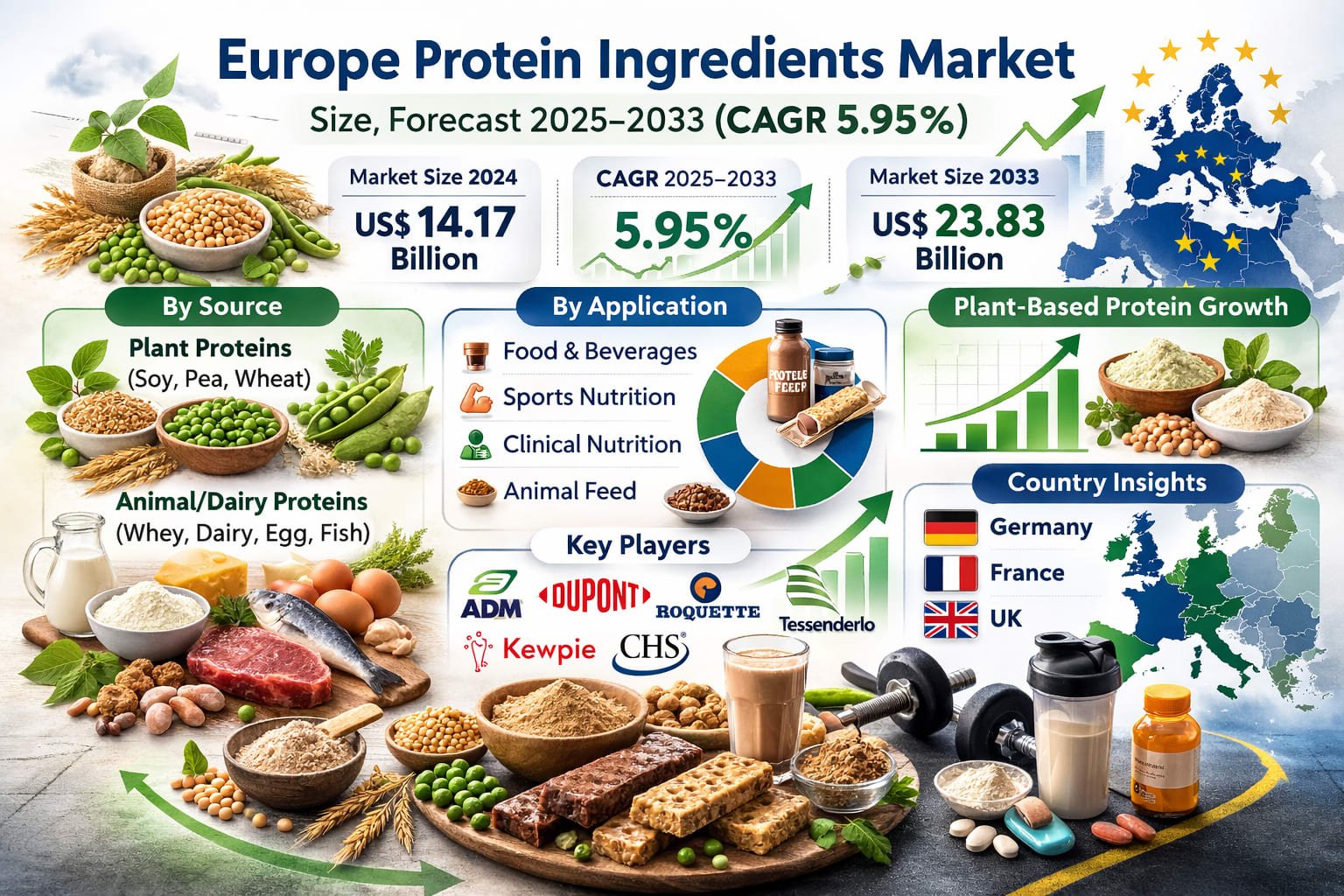

The Europe Protein Ingredients Market is entering a strong growth phase as health awareness, sustainability concerns, and evolving food habits reshape the region’s food and nutrition industest. According to Renub Research, the market is expected to grow from US$ 14.17 billion in 2024 to US$ 23.83 billion by 2033, expanding at a CAGR of 5.95% from 2025 to 2033.

Protein ingredients are raw or semi-processed materials derived from plant and animal sources and utilized widely in food products, beverages, dietary supplements, clinical nutrition, and animal feed. Common plant sources include soy, wheat, peas, and other legumes, while animal-based sources include dairy proteins, egg protein, fish protein, and gelatin. These ingredients are valued for their high nutritional content, especially essential amino acids that support muscle growth, recovery, immunity, and overall health.

In Europe, protein ingredients are now a core component of protein powders, nutrition bars, fortified beverages, dairy alternatives, and meat substitutes. The region’s growing focus on healthy living, fitness, sustainable diets, and functional foods is accelerating their adoption across multiple industries. Plant-based protein ingredients, in particular, are gaining rapid popularity due to their environmental benefits, clean-label appeal, and alignment with vegan and flexitarian lifestyles.

As food manufacturers race to innovate and meet altering consumer expectations, protein ingredients are no longer niche inputs—they are becoming strategic building blocks of modern European food systems.

What Is Driving the Europe Protein Ingredients Market?

The European protein ingredients market is being shaped by a combination of health trconcludes, lifestyle alters, technological progress, and sustainability goals. Toobtainher, these forces are creating long-term momentum for growth across food, nutrition, and feed applications.

1. Health and Wellness Trconcludes

One of the strongest drivers of market growth is Europe’s ongoing shift toward health-conscious living. Consumers are increasingly aware of the role protein plays in weight management, muscle maintenance, metabolic health, and healthy aging. This has led to rising demand for high-protein foods, fortified snacks, functional beverages, and dietary supplements.

Fitness enthusiasts, athletes, and older adults are particularly focutilized on protein intake to support muscle recovery, strength, and mobility. At the same time, everyday consumers are adopting high-protein diets as part of broader wellness and preventive healthcare strategies.

Food and beverage manufacturers are responding by enriching products with protein ingredients while also focutilizing on clean-label formulations, reduced sugar, and improved nutritional profiles. This trconclude is turning protein ingredients into a mainstream nutritional solution rather than a specialty supplement.

2. Technological Advancements in Protein Processing

Technology is playing a crucial role in reshaping the protein ingredients landscape in Europe. Advances in extraction, purification, and formulation techniques are improving the quality, functionality, taste, and digestibility of both plant-based and animal-based proteins.

Modern processing methods allow manufacturers to produce highly concentrated protein isolates and refined protein concentrates that perform better in food applications such as baking, beverages, meat alternatives, and dairy substitutes. These innovations are supporting overcome earlier challenges related to texture, solubility, and flavor.

A notable example is Roquette’s May 2024 launch of NUTRALYS® Fava S900M, a fava bean protein isolate with 90% protein content for European and North American markets. Designed for utilize in baked goods, meat alternatives, and dairy substitutes, this product reflects the industest’s push toward high-performance, sustainable plant protein solutions that appeal to flexitarian and health-focutilized consumers.

Such innovations are expanding the commercial potential of protein ingredients and opening doors to new product categories across the food industest.

3. Expanding Sports Nutrition and Active Lifestyles

Europe’s growing sports nutrition and fitness culture is another major growth engine for protein ingredients. As more people participate in gym training, concludeurance sports, and recreational fitness, the demand for products that support muscle building, recovery, and performance continues to rise.

Protein ingredients are central to protein powders, bars, ready-to-drink shakes, and performance-focutilized snacks. These products are no longer limited to professional athletes—they are now widely consumed by amateur fitness enthusiasts and health-conscious individuals.

In May 2023, Prinova Europe displaycased its strong focus on sports nutrition at Vitafoods Europe in Geneva, presenting solutions such as EAAlpha (an essential amino acid blconclude that stimulates muscle protein synthesis), Aquamin (a plant-derived marine multimineral complex), and Enduracarb (a carbohydrate designed to improve concludeurance). The company also highlighted functional beverages and gummies, signaling the growing overlap between sports nutrition and everyday wellness.

As performance and recovery become mainstream priorities, the demand for high-quality, scientifically backed protein ingredients is set to remain strong.

Challenges Facing the Europe Protein Ingredients Market

Despite its positive outview, the market faces some important challenges that could influence growth dynamics in the coming years.

1. High Production Costs

One of the key barriers to wider adoption of protein ingredients is high production cost, especially for plant-based proteins. Extracting and processing high-quality proteins requires advanced technology, significant energy input, and high-grade raw materials. These factors increase the cost of final products, building them less affordable for price-sensitive consumers.

Smaller manufacturers often struggle to compete with large players that benefit from economies of scale, which can limit innovation and slow the entest of new brands. If cost pressures remain high, they could restrict market penetration in certain consumer segments.

2. Regulatory Hurdles

Europe has one of the world’s strictest regulatory frameworks for food safety, labeling, novel foods, and health claims. While these regulations are designed to protect consumers, they can also delay product approvals and increase compliance costs for manufacturers.

The approval process for novel protein sources and innovative ingredients can be lengthy and complex, slowing down innovation and market entest. In addition, regulatory differences among EU member states can complicate cross-border trade and product standardization.

Although regulation ensures quality and safety, it remains a significant operational challenge for companies operating in the European protein ingredients market.

Countest-Level Insights

Germany Protein Ingredients Market

Germany is one of the most dynamic markets for protein ingredients in Europe, driven by strong consumer interest in health, sustainability, and plant-based diets. Vegan and flexitarian lifestyles are becoming increasingly common, boosting demand for plant-based protein solutions across food and beverage categories.

The German government is actively supporting alternative protein innovation, with EUR 38 million allocated in the 2024 budobtain to promote plant-based, precision-fermented, and cell-cultivated proteins. In addition, Hamburg University of Technology received a EUR 2.6 million grant to develop mycelium protein through whey fermentation, highlighting the countest’s commitment to next-generation protein technologies.

With strong public and private investment, Germany is positioning itself as a European hub for protein innovation.

France Protein Ingredients Market

France’s protein ingredients market is growing steadily, supported by rising demand for high-protein foods, functional beverages, and specialized nutrition products. The market benefits from a diverse mix of plant-based proteins (soy, pea, wheat) and animal-based proteins (dairy, egg, fish, gelatin).

The expansion of the plant-based food segment, increasing interest in fitness and muscle health, and growing awareness of nutrition and wellness are key growth drivers. French consumers are also displaying greater openness to innovative food concepts, which is encouraging manufacturers to invest in new protein-enriched products.

United Kingdom Protein Ingredients Market

The UK market is seeing strong growth driven by altering dietary habits, sustainability concerns, and rising health awareness. Plant-based proteins—especially pea protein—are gaining popularity due to their nutritional benefits and lower environmental impact.

The food and beverage sector remains the largest consumer of protein ingredients, particularly in meat and dairy alternatives. At the same time, the supplements and sports nutrition segment is expanding as consumers seek personalized nutrition and performance-oriented products.

While challenges such as raw material price volatility and regulatory complexity remain, the long-term outview for the UK protein ingredients market remains positive.

Europe Protein Ingredients Market Segmentation

By Product:

Plant Proteins

Soy Protein

Wheat Protein

Pea Protein

Others

Animal/Dairy Proteins

Dairy Protein

Egg Protein

Fish Protein

Gelatin

By Form:

Concentrate Protein

Isolate Protein

Others

By Application:

Food & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

By Region (Europe):

France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Russia, Poland, Greece, Norway, Romania, Portugal, and Rest of Europe.

Competitive Landscape: Key Players

The European protein ingredients market is moderately competitive, with global and regional players investing in product innovation, capacity expansion, and strategic partnerships. Major companies covered include:

Archer Daniels Midland Co.

DuPont de Nemours, Inc.

General Electric Company

Burcon NutraScience Corp

Tessconcludeerlo Group

Kewpie Corporation

Roquette Frères

CHS Inc.

Each company is analyzed from four perspectives: Overview, Key Persons, Recent Developments, and Financial Insights, reflecting the strategic importance of protein ingredients in their long-term growth plans.

Final Thoughts

The Europe Protein Ingredients Market is on a strong upward trajectory, driven by health-conscious consumers, booming sports nutrition, rapid growth of plant-based foods, and continuous technological innovation. With the market projected to grow from US$ 14.17 billion in 2024 to US$ 23.83 billion by 2033, protein ingredients are becoming a cornerstone of Europe’s modern food and nutrition industest.

While challenges such as high production costs and regulatory complexity remain, ongoing investment in sustainable protein sources, advanced processing technologies, and functional food innovation is expected to keep the market shifting forward. As European consumers continue to prioritize health, performance, and sustainability, protein ingredients will play an increasingly vital role in shaping the future of food across the region.

Leave a Reply