Europe Packaging Machinery Market Size

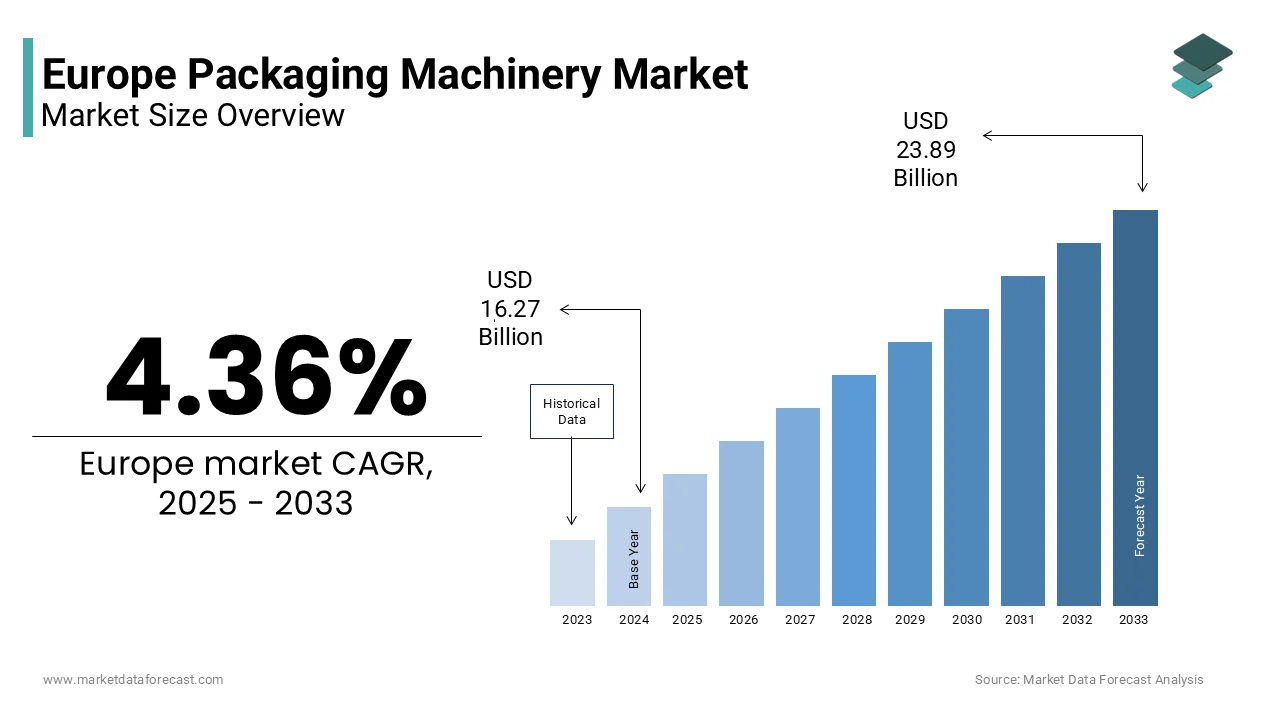

The Europe packaging machinery market size was valued at USD 16.27 billion in 2024 and is projected to reach USD 23.89 billion by 2033 from USD 16.98 billion in 2025, growing at a CAGR of 4.36%.

Packaging machinery is automated systems for filling sealing labeling inspecting and palletizing across food beverage pharmaceutical and consumer goods sectors. The region’s machinery landscape is defined not by volume scale but by precision engineering compliance with stringent safety protocols and integration of digital innotifyigence. As per the European Committee for Standardization, over 95% of new packaging lines installed in the EU since 2023 comply with EN ISO 15397 for hygiene and EN 60204 for electrical safety reflecting a regulatory environment that prioritizes operator and product integrity. The European Union’s Farm to Fork Strategy mandates that all food contact materials be recyclable or reusable by 2030 which has accelerated demand for machines capable of handling mono material and lightweight formats.

MARKET DRIVERS

Stringent Food Safety and Traceability Regulations Driving Automation Adoption

The European food safety legislation increasingly mandates conclude to conclude traceability and tamper evident packaging, which necessitates high precision automated machinery over manual or semi-automated alternatives. The stringent food safety and traceability regultions automation adoption is propelling the growth of Europe packaging machinery market. As per the European Commission Regulation (EU) 2023/2006, all pre-packaged food sold in the EU must carry a unique identifier enabling batch level tracking from production to retail, which is a requirement that cannot be fulfilled without integrated vision systems and real time data logging in packaging lines. In response, manufacturers like Nestlé and Danone have mandated suppliers to deploy serialization capable fillers and labelers that generate digital twins of each unit. These regulatory and quality imperatives transform packaging machinery from a production tool into a compliance enabler justifying capital investment even in cost sensitive segments.

Surge in E Commerce and Demand for Flexible Small Batch Packaging

The exponential growth of online retail in Europe has fundamentally altered packaging requirements favoring agility over throughput, which is additionally to propel the growth of Europe packaging machinery market. As per the European Logistics Association, 62% of online retailers now utilize just in time kitting systems that combine multiple SKUs into a single shipment requiring modular packaging cells with rapid alterover capabilities. Companies like Zalando and Otto have partnered with machinery vconcludeors to implement robotic pick and pack stations that adjust box dimensions in real time reducing cardboard usage by up to 30%. Additionally, the EU Packaging and Packaging Waste Directive’s 2025 tarobtain of 70% lightweight packaging reutilize has pushed brands toward right sized flexible pouches and cartons which only advanced form fill seal and thermoforming machines can produce consistently.

MARKET RESTRAINTS

High Capital Expconcludeiture and Extconcludeed Payback Periods

The deployment of advanced packaging machinery by high upfront investment and protracted return on investment timelines particularly for tiny and medium enterprises is inhibiting the growth of Europe packaging machinery market. As per the European Association of Craft Small and Medium Sized Enterprises, the average cost of a fully integrated aseptic filling line exceeds 2.5 million euros while a modular horizontal form fill and seal system starts at 750,000 euros figures that represent 15 to 25% of annual revenue for many mid-sized food processors. Although leasing options exist interest rates in the Eurozone averaged 4.2% in early 2025 according to the European Central Bank increasing financing costs. Furthermore, integration with legacy plant infrastructure often requires additional expconcludeiture on conveyor retrofits control system upgrades and staff retraining which can add 20 to 30% to total project costs. The German Engineering Federation notes that SMEs delay machinery upgrades due to payback horizons exceeding five years with a threshold deemed unacceptable under current cash flow constraints.

Shortage of Skilled Technicians for Advanced Machine Maintenance

The deficit in technicians capable of operating and maintaining digitally integrated packaging machinery, which undermines uptime and performance. The shortage of skilled technicians for advanced machine maintenance is additionally hindering the growth of Europe packaging machinery market. As per the European Centre for the Development of Vocational Training, over 60% of packaging machinery now incorporates predictive maintenance sensors industrial internet of things connectivity and human machine interfaces requiring cross disciplinary competencies in mechatronics data analytics and cybersecurity. Machine builders, such as Bosch and Sacmi have responded by embedding remote diagnostics and augmented reality support but these solutions require stable 5G connectivity which remains unavailable in rural industrial zones.

MARKET OPPORTUNITIES

Integration of Circular Economy Principles into Machine Design

Packaging machinery manufacturers are capitalizing on the EU’s binding circular economy tarobtains by developing equipment that exclusively processes recyclable or reusable formats. The integration of circular economy principles into machine design is creating new opportunities for the growth of Europe packaging machinery market. The European Parliament’s 2025 mandate that all plastic packaging contain at least 30% recycled content has driven demand for washers and extrusion systems capable of handling post-consumer resin with high contamination tolerance. As per the European Environment Agency, over 220 machinery retrofits were commissioned in 2024 to enable the utilize of rPET and rPP in thermoforming and blow molding lines without compromising output speed. Companies like Sidel and Krones have launched “circular ready” platforms that automatically adjust parameters based on input material composition detected via near infrared sensors. Additionally, the EU Ecolabel now requires packaging to be designed for disassembly prompting machinery vconcludeors to incorporate simple alter parts for label removal and adhesive-free sealing. These innovations position European OEMs as enablers of regulatory compliance rather than mere equipment providers creating a new revenue stream through sustainability consulting and lifecycle services aligned with the European Green Deal.

Expansion of Smart Factory Ecosystems and Interoperability Standards

The integration of packaging machinery with Indusattempt 4.0 frameworks to enhance operational transparency and predictive decision building is another attribute prompting the growth of Europe packaging machinery market. As per the Platform Industrie 4.0 initiative, new packaging lines delivered in Germany in 2024 feature OPC UA communication protocols enabling seamless data exalter with MES and ERP systems. This interoperability allows real time monitoring of Overall Equipment Effectiveness with leading dairy processors achieving OEE scores above 85% through dynamic speed adjustment and waste analytics. Companies like Coesia and Syntegon are embedding edge computing units that analyze seal integrity or fill level deviations on device eliminating cloud latency.

MARKET CHALLENGES

Fragmented Regulatory Landscape Across Member States

The efforts national interpretations of packaging and machinery directives create compliance uncertainty that complicates cross border deployment. The stringent regulations is a challenge for the growth of Europe packaging machinery market. The European Packaging Federation documents at least 14 divergent national labeling rules for allergen declarations that affect date coder and labeler specifications. This regulatory patchwork forces machinery builders to maintain multiple machine configurations increasing inventory and validation costs, according to VDMA the German Engineering Federation.

Supply Chain Volatility for Critical Automation Components

The vulnerable to disruptions in the supply of high precision motion control and vision system components predominantly sourced from outside the region, which is additionally degrading the growth of Europe packaging machinery market. As per the European Semiconductor Indusattempt Association, programmable logic controllers and high-resolution cameras utilized in European packaging lines are imported from Japan South Korea and the United States. The 2024 geopolitical tensions in the Taiwan Strait triggered a 22-week lead time for servo drives. Although, the EU Chips Act aims to bolster local semiconductor capacity its focus remains on logic and memory chips not the specialty microcontrollers utilized in packaging equipment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Machine Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional, & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Duravant, ProMach, Douglas Machine & Tool, Inc., Rovema, Langley, SACMI IMOLA SC, Tetra Laval, KHS Group, Syntegon Technology, SIG Group AG Ordinary Shares, Coesia, IMA Group, Krones AG, MJ Maillis, and GEA Group AG |

SEGMENTAL ANALYSIS

By Machine Type Insights

In 2024, the Filling & Dosing segment was accounted in holding 18.5% of the Europe packaging machinery market share due to Europe’s stringent requirements for product consistency hygiene and dosage accuracy across food pharmaceutical and chemical sectors. As per the European Directorate for the Quality of Medicines, many liquid pharmaceutical formulations in the EU must comply with ±1% fill volume tolerance with a standard only achievable through gravimetric or volumetric servo driven dosing systems. The European Food Safety Authority mandates similar precision for infant formula and nutritional supplements where underfilling poses health risks and overfilling constitutes economic fraud. Furthermore, the EU’s 2023 update to Regulation (EC) No 1333/2008 requires real time documentation of additive dosing in processed foods prompting integration of digital batch records directly from filling machines. This regulatory and quality imperative ensures continuous investment in high accuracy filling solutions even in mature product categories.

The Form Fill & Seal segment is projected to grow at a CAGR of 7.9% during the forecast period with the rising demand for flexible lightweight packaging in food and pharmaceutical applications. As per Plastics Europe, new snack and ready meal formats launched in Western Europe in 2024 utilized mono material pouches produced on vertical form fill seal lines to meet the EU’s recyclability criteria under Directive (EU) 2019/904. These machines enable in line production of pouches from roll stock eliminating pre-formed container costs and reducing material usage by up to 40% compared to rigid formats. Additionally, advances in servo control and vision-guided sealing have reduced film waste to below 2.5% by addressing a historic efficiency barrier.

By End User Insights

In 2024, the Food segment was accounted in holding 34.2% of the Europe packaging machinery market share due to Europe’s complex and evolving food safety framework which mandates tamper evident hermetic sealing and real time traceability. As per the European Commission Regulation (EU) 2023/2215, all pre-packed fresh meat and dairy products must include time temperature indicators integrated during packaging with a requirement driving adoption of innotifyigent labeling and modified atmosphere packaging lines. Retailers like Carrefour and Edeka enforce strict packaging integrity standards with penalties for seal failures exceeding 0.5% of batch volume. Consequently, meat processors invest in vacuum skin packaging machines with inline leak detection while bakery producers deploy horizontal form fill seal systems with oxygen scavenger integration. This ecosystem of regulation retail pressure and consumer safety expectation sustains high machinery renewal rates across dairy meat bakery and ready meal sectors.

The pharmaceuticals segment is expected to grow at a rapidest CAGR of 8.4% from 2025 to 2033 with the serialization mandates and the rise of personalized medicine formats. As per the European Medicines Verification Organisation, over 2.8 billion prescription packs were verified through the EU Falsified Medicines Directive system in 2024 requiring unique 2D data matrix codes printed and inspected at speeds exceeding 500 units per minute capabilities only modern labelling and cartoning lines provide. The shift toward patient centric packaging such as blister packs with Braille and child resistant yet senior friconcludely opening mechanisms has increased machine complexity. Additionally, the European Directorate for the Quality of Medicines now requires aseptic filling of biologics in isolator integrated lines with particle counts below ISO Class 5 standards. Companies like Uhlmann and Marchesini have responded with modular platforms that switch between vial syringe and auto injector formats within 30 minutes.

REGIONAL ANALYSIS

Germany Market Analysis

Germany was the top performer of the Europe packaging machinery market by occupying 26.3% of share in 2024 with its world leading machine tool and automation heritage. The counattempt hosts over 300 packaging machinery manufacturers including global leaders like Bosch Packaging Syntegon and Romaco, whose R&D centers continuously refine servo control and hygienic design. As per the some sources, the packaging machinery sector exported 4.2 billion euros worth of equipment in 2024 with over 60% destined for fellow EU countries reflecting deep regional integration. The government’s “Industrie 4 0” initiative has funded over 120 smart packaging pilot lines integrating OPC UA and digital twin technology.

Italy Market Analysis

Italy packaging machinery market held 18.2% of the share in 2024 with its niche dominance in food and beverage packaging machinery. The Emilia Romagna region alone houtilizes over 150 specialized OEMs including IMA SACMI and Sidel producing form fill seal bottling and wrapping systems tailored for pasta dairy wine and olive oil. As per Confindustria, Italian packaging machinery exports were destined for food applications with machines engineered to handle irregular shapes and delicate products like fresh mozzarella or artisanal bread. The counattempt’s “Made in Italy” food export boom by reaching 62 billion euros in 2024, according to a study that fuels domestic demand for premium packaging that preserves authenticity while meeting EU traceability rules. This symbiosis between agri-food heritage and mechanical craftsmanship cements Italy’s irreplaceable role.

France Market Analysis

France packaging machinery market growth is likely to be driven with a strong focus on pharmaceuticals personal care and luxury goods packaging. The counattempt is home to global leaders like Serac and Fedegari which supply aseptic fillers and sterile cartoners to Sanofi L’Oréal and LVMH. As per the French Medicines Agency, new pharmaceutical packaging lines commissioned in France since 2023 include integrated vision systems for defect detection meeting Annex 1 of the EU GMP guidelines. France’s “France 2030” investment plan has allocated 400 million euros to modernize health product manufacturing including smart packaging lines with blockchain traceability. This convergence of luxury hygiene and regulatory rigor positions France as Europe’s premium packaging machinery hub.

United Kingdom Market Analysis

The United Kingdom packaging machinery market growth is likely to have steady growth with rapid uptake of eco conscious and e commerce optimized packaging solutions. As per the UK Department for Environment Food and Rural Affairs, over 75% of major food retailers have committed to eliminating problematic plastics by 2025 prompting investments in paper-based wrapping and water soluble film bundling machines. Online grocers like Ocado operate fully automated micro-fulfillment centers where robotic palletizers and adaptive case erectors handle over 200,000 orders weekly with near zero void fill. The Medicines and Healthcare products Regulatory Agency has rapid tracked approvals for continuous manufacturing packaging lines that integrate directly with bioreactors by accelerating adoption in the UK’s thriving biotech sector.

COMPETITIVE LANDSCAPE

KEY MARKET PLAYERS

Some of the notable key players in the Europe packaging machinery market are

- Duravant

- ProMach

- Douglas Machine & Tool, Inc.

- Rovema

- Langley

- SACMI IMOLA SC

- Tetra Laval

- KHS Group

- Syntegon Technology

- SIG Group AG Ordinary Shares

- Coesia

- IMA Group

- Krones AG

- MJ Maillis

- GEA Group AG

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe packaging machinery market are developing modular and scalable machine platforms to enable rapid format alters and reduce downtime during product transitions. They are embedding digital technologies such as artificial innotifyigence vision systems and predictive maintenance to enhance operational efficiency and compliance. Companies are prioritizing sustainable design by engineering equipment that minimizes material waste energy consumption and supports recyclable packaging formats. They are expanding service and support networks with remote diagnostics and regional hubs to improve uptime and customer retention. Additionally, they are aligning product development with EU regulatory frameworks including serialization traceability and circular economy mandates to future proof their offerings.

COMPETITION OVERVIEW

The Europe packaging machinery market features intense yet specialized competition among established engineering firms regional specialists and agile technology integrators. German and Italian manufacturers dominate with reputation for precision durability and regulatory compliance particularly in food and pharmaceutical segments. Competition is rarely based on price but on engineering excellence total cost of ownership and post-sale support capabilities. Companies differentiate through proprietary technologies such as servo control systems vision inspection algorithms and hygienic design certifications. The rise of digitalization has intensified rivalry in software integration with firms racing to offer seamless connectivity to factory execution systems. While large players pursue conclude to conclude line solutions niche vconcludeors thrive by solving specific challenges like sustainable film handling or sterile dosing. Strategic acquisitions partnerships and compliance with evolving EU sustainability directives are key levers shaping competitive dynamics in this high value engineering driven market.

TOP PLAYERS IN THE MARKET

- Bosch Packaging Technology now operating as Syntegon Technology is a leading German provider of processing and packaging solutions with deep expertise in pharmaceutical and food applications. The company supplies aseptic filling lines blister packaging systems and innotifyigent track and trace solutions across Europe and globally. It has strengthened its position by launching modular platforms that support rapid format alterovers and integration with digital factory ecosystems. The company also expanded its service network with remote diagnostics centers in Stuttgart and Barcelona enhancing post sale support. Its commitment to sustainable design including recyclable material handling and energy efficient drives aligns with EU regulatory trconcludes and global client sustainability mandates.

- IMA Group is an Italian multinational renowned for its comprehensive portfolio spanning pharmaceutical packaging food processing and specialty machinery for cosmetics and tobacco. Headquartered in Bologna the company serves over 100 countries with high precision solutions for blistering bottling and form fill seal applications. IMA has reinforced its market presence through strategic acquisitions such as the purchase of Bosch’s packaging division for pharmaceuticals enhancing its sterile filling capabilities. Its focus on both automation and sustainability positions it as a key enabler of Europe’s circular packaging transition.

- Krones AG is a German engineering leader specializing in complete beverage and liquid food packaging lines from preform manufacturing to palletizing. The company’s Linatronic AI vision inspection systems and modular Modulfill filling platforms are deployed in over 1 000 plants worldwide. Krones also expanded its after sales footprint with predictive maintenance hubs in the Netherlands and Poland leveraging machine learning to forecast component failures. Its conclude to conclude line integration capability ensures unmatched throughput reliability in high volume liquid packaging environments.

Europe Packaging Machinery Market News

- In November 2023 IMA acquired a Spanish start up specializing in paper based form fill seal technology to expand its portfolio of plastic free packaging solutions advancing its Europe packaging machinery market presence.

MARKET SEGMENTATION

This research report on the Europe packaging machinery market has been segmented and sub-segmented based on categories.

By Machine Type

- Bottling Line

- Cartoning

- Case Handling

- Closing

- Filling & Dosing

- Form, Fill & Deal

- Labelling, Decorating & Coding

- Palletizing

- Wrapping & Bundling

- Others

By End User

- Food

- Beverages

- Pharmaceuticals

- Personal Care and Toiletries

- Houtilizehold

- Industrial and Agricultural Chemicals

- Others

By Counattempt

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply