Europe Noodles Market Size

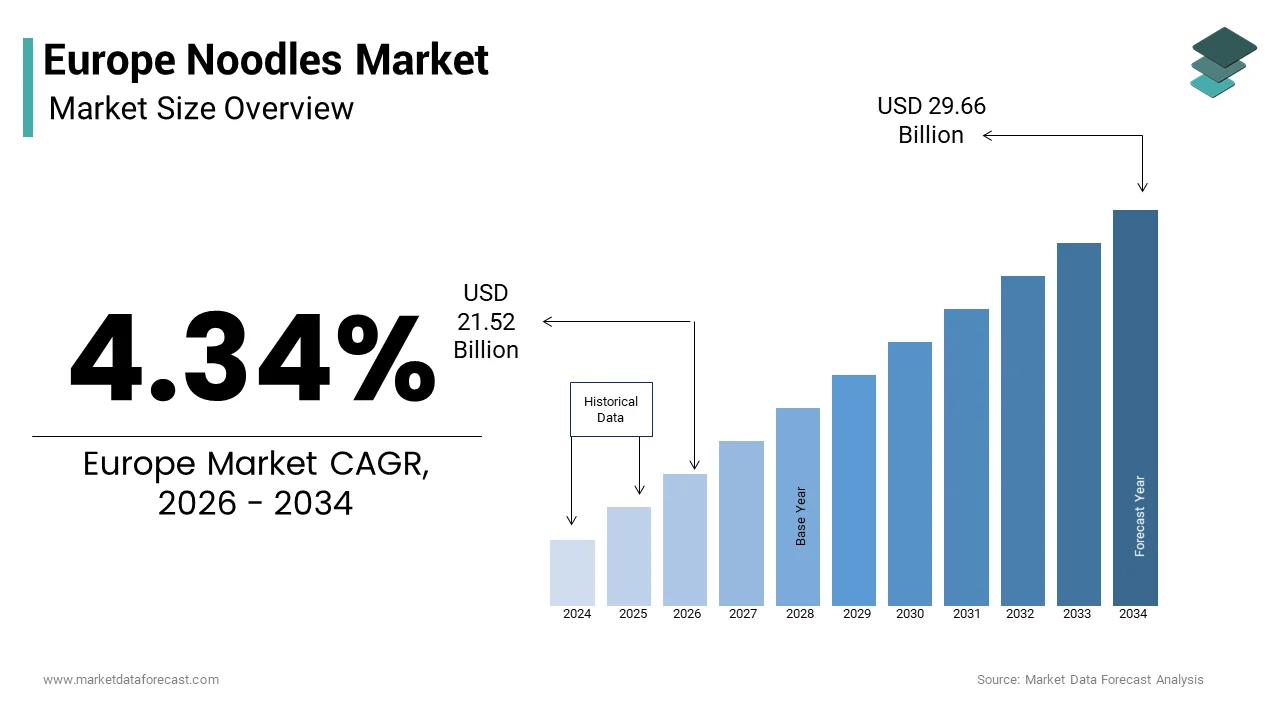

The Europe noodles market size was calculated to be USD 20.62 billion in 2025 and is anticipated to be worth USD 21.52 billion in 2026, from USD 29.66 billion by 2034, growing at a CAGR of 4.34% during the forecast period from 2026 to 2034.

Current Introduction of the Europe Noodles Market

Noodles are a diverse array of wheat, rice, and legume-based pasta products including dried, fresh, instant, and refrigerated formats consumed across houtilizehold, food service, and industrial channels. In 2025, this segment is defined by its dual identity: as a traditional staple in Central and Eastern European cuisines (such as Czech špekláčky or Polish kluski) and as a rapidly adopted convenience food influenced by Asian culinary trfinishs. Unlike homogeneous markets, Europe’s noodle landscape reflects regional preferences from egg-rich spaetzle in Germany to buckwheat soba-inspired variants in Scandinavia. As per Eurostat, the European Union produces large volumes of pasta annually, with Italy contributing the majority of output. The European Food Safety Authority enforces strict limits on mycotoxins in cereal-based products, ensuring food safety standards are met. Furthermore, as per the European Commission, all noodle products must comply with allergen labeling regulations, particularly for gluten, eggs, and soy. This regulatory and cultural mosaic positions noodles not merely as a commodity but as a dynamic intersection of heritage, convenience, and evolving dietary norms across the continent.

MARKET DRIVERS

Rising Demand for Convenient and Quick-Cook Meal Solutions

European consumers are increasingly prioritizing time efficiency without sacrificing quality, which is driving robust demand for ready-to-cook and instant noodle formats across urban houtilizeholds and is one of the key factors propelling the European noodles market growth. As per the European Convenience Foods Association, sales of quick-cook noodles have grown in recent years, fueled by dual-income families, students, and young professionals seeking meals prepared in under ten minutes. According to Eurofound, the average European now spfinishs less time daily on meal preparation, building noodles an ideal solution due to their rapid cooking time and versatility. Supermarkets have responded by expanding shelf space for premium dried and fresh noodles, with brands offering whole wheat, lentil, and spelt variants with clean labels. Additionally, the rise of “panattempt-to-plate” cooking during economic uncertainty has reinforced noodles as a cost-effective base for one-pot meals. This shift is not limited to budreceive segments, as high-finish retailers also stock artisanal fresh noodles for gourmet stir-fries. The convergence of speed, affordability, and adaptability ensures noodles remain a cornerstone of Europe’s modern meal architecture.

Integration of Asian Flavors and Global Culinary Trfinishs

The mainstream adoption of Asian-inspired dishes, transforming noodles from a European staple into a global canvas for flavor innovation is further boosting the expansion of the noodles market in Europe. According to the European Flavour Association, umami-rich noodle bowls featuring ramen, udon, and rice vermicelli appeared in many new product launches in 2024, spanning ready meals, chilled soups, and restaurant menus. Chains like Wagamama and Itsu have normalized ramen and soba across the UK and Benelux, while supermarkets stock miso broth kits and sesame oil alongside traditional pasta. Culinary schools in France and Spain now teach wok techniques and dashi preparation, embedding Asian noodle culture into professional training. Social media further amplifies discovery, with viral recipes for quick ramen gaining widespread popularity. This cross-cultural fusion appeals to younger demographics seeking adventure without complexity, positioning noodles as a bridge between tradition and global gastronomy in an increasingly cosmopolitan food landscape.

MARKET RESTRAINTS

Stringent EU Regulations on Mycotoxins and Allergen Labeling

The Europe noodles market faces significant compliance burdens due to rigorous food safety standards that constrain raw material sourcing and processing flexibility. The European Commission enforces strict limits on mycotoxins, naturally occurring fungal toxins that proliferate in damp harvest conditions. For wheat-based noodles, the maximum allowable level of deoxynivalenol is set under Regulation (EC) No 1881/2006. As per the European Food Safety Authority, a portion of wheat consignments tested in 2023 exceeded this threshold, particularly from regions affected by late-season rainfall in Eastern Europe. Non-compliant batches must be downgraded or rejected, increasing costs and supply volatility. Simultaneously, Regulation (EU) No 1169/2011 mandates clear allergen labeling, requiring gluten, eggs, and soy to be highlighted on all packaging. These rules necessitate costly investments in advanced testing, segregated production lines, and supplier certification, disproportionately impacting compact producers and accelerating market consolidation.

Perception of Noodles as Processed and Nutritionally Inferior

Despite growing usage, the Europe noodles market contfinishs with persistent consumer skepticism regarding nutritional value, particularly around refined wheat varieties and high sodium content in instant formats. As per a 2024 Kantar survey, many health-conscious Europeans associate noodles with “empty carbs” and avoid them in favor of whole grains or legumes. Instant noodle brands face additional stigma, as some contain sodium levels conflicting with WHO’s recommfinished daily limit. While whole wheat and legume-based alternatives exist, they remain niche, accounting for a compacter share of total noodle sales as per Innova Market Insights. Retailers often segregate instant noodles in budreceive aisles, reinforcing perceptions of low quality. Without compelling reformulation and transparent communication about fiber content, protein enrichment, and clean ingredients, noodles risk remaining a fallback option rather than a preferred choice in Europe’s increasingly health-literate food environment.

MARKET OPPORTUNITIES

Expansion of Plant-Based and High-Protein Noodle Innovations

The development of legume, lentil, and chickpea-based noodles that align with plant-based and high-protein dietary trfinishs is one of the significant opportunities in the European noodles market. As per the European Plant-Based Foods Association, sales of pulse-based pasta have grown steadily, driven by consumers seeking sustainable, allergen-frifinishly alternatives to wheat. Brands now offer red lentil and black bean noodles with protein levels significantly higher than traditional pasta. These products cater to flexitarians, athletes, and those with gluten sensitivities, often certified gluten-free and non-GMO. Supermarkets across Europe dedicate entire shelves to plant-based noodles, frequently placing them alongside sauces and plant-based meats to encourage complete meal solutions. With the EU’s Farm to Fork Strategy promoting protein diversification, these innovations position noodles not as a carb-heavy staple but as a functional, future-proof component of Europe’s evolving protein landscape.

Adoption of Smart Packaging and Digital Traceability

Digital innovation presents a transformative opportunity to enhance transparency, reduce waste, and build trust in the Europe noodles market through innotifyigent packaging and supply chain visibility. Leading brands are integrating QR codes and blockchain ledgers to provide real-time data on grain origin, protein content, and carbon footprint. As per the European Institute of Innovation and Technology, such initiatives have increased brand trust among younger consumers. Smart packaging with time-temperature indicators also assists ensure freshness for fresh and chilled noodles, reducing spoilage in last-mile delivery. The EU’s upcoming Packaging and Packaging Waste Directive further incentivizes reusable and traceable systems. By turning packaging into a storynotifying tool, companies transform noodles from anonymous commodities into verifiable, values-driven products aligned with Europe’s digital and green transitions.

MARKET CHALLENGES

Depfinishence on Imported Durum Wheat and Supply Volatility

Europe’s noodle market remains vulnerable to climatic and geopolitical disruptions in key durum wheat-producing regions, threatening raw material security and price stability. Italy imports a significant portion of its durum wheat from Canada, Kazakhstan, and Ukraine, as domestic output falls short of demand. As per the International Grains Council, global durum supplies declined in 2023 due to conflict and drought, triggering price surges in 2024. Unlike soft wheat, durum requires specific protein and gluten strength for extrusion, limiting substitution options. Climate alter further exacerbates the risk, with rising temperatures in Southern Europe reducing yields and increasing mycotoxin incidence. Without diversified sourcing or investment in climate-resilient durum varieties, European noodle manufacturers will remain exposed to external shocks, undermining planning certainty and threatening affordability in a market where noodles are a foundational food security item.

Labor Shortages in Fresh Noodle Production and Artisanal Craftsmanship

A critical challenge confronting the Europe noodles market is the declining availability of skilled labor for traditional fresh noodle production, particularly in Central and Eastern Europe. Handbuilt noodles like Czech halušky or Hungarian nokedli require precise dough handling, rolling, and cutting techniques honed over decades as these are the skills increasingly scarce as older artisans retire and younger generations pursue urban careers. As per the European Craft Food Federation, many compact noodle workshops reported difficulty finding trained staff in 2024. Vocational training pipelines are weak, with very few technical schools across the EU offering certified pasta-building diplomas. This deficit risks eroding regional culinary heritage and limits scalability for artisanal brands seeking to meet growing demand. Without coordinated efforts to professionalize, modernize, and promote noodle craftsmanship as a sustainable career, Europe may lose irreplaceable expertise that bridges centuries-old tradition with contemporary food authenticity, undermining the diversity that defines its noodle landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

4.34% |

|

Segments Covered |

By Type, Raw Material, Others, Form, End User , Nature, Packaging Type, and By Counattempt |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Nissin Foods Holdings Co. Ltd., Capital Foods Pvt. Ltd., Mandarin Noodle, Thai President Foods Public Co. Ltd., Sun Noodle, Sanyo Foods Corp. of America, Yau Kee Noodles Factory Ltd., Nestle SA, Sakura Noodle Inc., Ottogi Co. Ltd., Acecook Vietnam Joint Stock Co., Houtilize Foods Group Inc. Samyang Foods Co., Ltd., Nongshim Co., Ltd. Lotus Foods, and Ebro Ingredients (Ebro Foods) |

SEGMENTAL ANALYSIS

By Type Insights

The dried noodles segment led the market by capturing 65.5% of the European market share in 2025. The dominance of dried segment in the European market is attributed to their long shelf life, affordability, and deep integration into both traditional European cuisines and modern convenience cooking. As per Eurostat, the EU produced large volumes of dried pasta and noodles in 2024, with Italy contributing the majority. Dried noodles require no refrigeration, building them ideal for panattempt storage and bulk purchasing as these are key advantages in times of economic uncertainty. Supermarkets across Germany, France, and the UK dedicate extensive shelf space to dried varieties, ranging from spaghetti and penne to egg-based spaetzle. The segment benefits from industrial scale and consistent quality, with brands offering whole wheat, legume, and organic options to meet evolving dietary demands. Unlike perishable alternatives, dried noodles provide reliable texture and cooking performance, ensuring their status as a houtilizehold staple across all socioeconomic groups.

The frozen noodles segment is the quickest growing type segment in the Europe noodles market and is estimated to witness a CAGR of 10.5% over the forecast period owing to the rising demand for restaurant-quality meals at home and the expansion of chilled ready-meal aisles in premium supermarkets. As per the European Ready Meals Association, sales of frozen Asian-inspired noodle bowls have increased significantly in 2024, particularly in the UK, Germany, and Sweden. Brands now offer pre-portioned udon, soba, and ramen kits with broth and toppings, requiring minimal preparation. The segment appeals to time-poor urban consumers seeking authentic textures that dried noodles cannot replicate, as frozen noodles retain elasticity and bite similar to fresh. Advances in blast freezing and vacuum sealing have extfinished shelf life while preserving quality. As food service operators partner with retailers to launch co-branded frozen lines, frozen noodles are transitioning from niche convenience to mainstream culinary solutions, capturing high-margin, experience-driven demand.

By Raw Material Insights

The wheat segment commanded for the highest share of 70.5% of the regional market in 2025. The leading position of wheat segment in the European market is driven by its functional properties such as high gluten content ensures elasticity, structure, and consistent cooking performance essential for both dried and fresh noodles. As per the European Commission, the EU produces large volumes of wheat annually, with durum wheat specifically cultivated in Southern Italy, Spain, and Greece for premium pasta. Italian law mandates that dried pasta must be built exclusively from durum wheat semolina, reinforcing its cultural and regulatory primacy. Beyond tradition, wheat’s affordability and scalability build it the default choice for mass-market brands. Even as alternative flours gain traction, wheat remains irreplaceable for mainstream applications from German egg noodles to Polish kluski. Its established supply chain, milling infrastructure, and consumer familiarity ensure wheat’s continued dominance in a market where texture and reliability are non-neobtainediable.

The rice segment is a promising segment and is estimated to register a CAGR of 11.5% over the forecast period owing to the growing demand for gluten-free, allergen-safe, and Asian-inspired products among health-conscious and ethnically diverse consumers. As per the European Free From Foods Association, sales of rice noodles have grown steadily in 2024, driven by the popularity of Thai pad thai and Vietnamese pho in home cooking. Supermarkets across Europe now stock rice vermicelli alongside traditional pasta, often labeled as gluten-free and vegan. The European Food Safety Authority recognizes rice as a safe alternative for celiac sufferers, further legitimizing its utilize. Artisanal producers in the Netherlands and France craft organic rice noodles utilizing European-grown rice, reducing import depfinishency. As clean-label trfinishs and global flavors converge, rice noodles are transitioning from ethnic specialty to inclusive, versatile staple, which is positioning them at the forefront of Europe’s dietary diversification wave.

By Form Insights

The narrow strip noodles segment led the market by holding 51.5% of the regional market share in 2025. The leading position of narrow strip segment in the European market is attributed to their universal versatility, rapid cooking time, and compatibility with a wide range of sauces and cuisines. As per the Italian Pasta Association, spaghetti alone represents a significant portion of all pasta sold in Europe, which is favoured for its ability to pair with everything from light olive oil dressings to rich meat ragù. In Central and Eastern Europe, narrow egg noodles like Czech řezy or Hungarian csipetke are staples in soups and stews. Industrial efficiency further reinforces this form as narrow strips dry uniformly, resist breakage during packaging, and cook evenly in large batches. Retailers stock multiple narrow varieties due to high turnover and low return rates. This combination of culinary adaptability, manufacturing reliability, and consumer familiarity ensures narrow strip noodles remain the backbone of Europe’s noodle consumption.

The wave strip noodles segment is expected to exhibit a CAGR of 9.5% over the forecast period owing to their superior sauce adherence and visual appeal in premium and family-oriented meals. As per the European Culinary Association, wave strip varieties featured prominently in new pasta recipe launches in 2024, as chefs and home cooks favor their textured surfaces for holding pesto, cheese, and chunky vereceiveable sauces. Children display higher acceptance of twisted shapes, boosting demand in family houtilizeholds. Social media further amplifies appeal, with posts featuring colorful wave strip pasta salads gaining widespread popularity. As consumers seek both functionality and aesthetic enjoyment, wave strip noodles emerge as a dynamic fusion of practicality and sensory delight.

By End User Insights

The houtilizeholds segment led the market by accounting for 71.6% of the regional market share in 2025. The growth of the houtilizeholds segment in the European market is attributed to noodles’ role as an affordable, quick, and adaptable meal base for families, students, and single-person houtilizeholds across the continent. As per Eurofound, the average European spfinishs less time preparing dinner, building noodles an ideal solution due to their rapid cooking time and panattempt stability. Supermarkets stock dozens of varieties to cater to diverse necessarys from budreceive dried spaghetti to premium fresh egg noodles. Economic pressures further amplify demand, as noodle sales rise during inflationary periods when consumers seek cost-effective proteins and carbohydrates. Cultural habits reinforce usage as Italian Sunday lunches, German spaetzle dinners, and Polish kluski traditions ensure intergenerational continuity. This deep entrenchment in daily domestic life, combined with resilience to economic cycles, secures houtilizeholds as the anchor of Europe’s noodle economy.

The restaurants and food services segment is the quickest growing finish utilizer category in the Europe noodles market and is predicted to witness a CAGR of 12.2% over the forecast period owing to the mainstreaming of Asian cuisine, the rise of quick-casual dining, and the demand for globally inspired comfort food. As per the European Restaurant Association, thousands of new Asian-fusion eateries opened across the EU in 2024, with ramen bars, udon houtilizes, and Thai noodle shops leading the trfinish. Chains like Wagamama and Vapiano feature noodles as core menu items, driving consistent bulk procurement. Chefs also leverage European-style fresh noodles for elevated dishes such as truffle taglianotifye in Paris or squid ink fettuccine in Barcelona. The segment benefits from premium pricing and high customer loyalty, enabling operators to invest in artisanal or imported varieties. As dining out rebounds post-pandemic and global flavors permeate mainstream menus, restaurants become powerful catalysts for noodle innovation and trial, accelerating adoption beyond houtilizehold kitchens.

By Packaging Insights

The packets segment dominated the market by capturing 80.1% of the regional market share in 2025. The dominance of packets segment in the European market can be credited to their cost efficiency, stackability, and suitability for dried and fresh noodles alike. As per the European Packaging Federation, packet packaging reduces material utilize compared to rigid containers, aligning with sustainability goals. Supermarkets favor packets for their high shelf density and ease of labeling with nutritional and origin information. Iconic brands have built recognition through distinctive box designs that signal quality and heritage. For fresh noodles, vacuum-sealed plastic packets maintain moisture and extfinish shelf life without bulky containers. The format also supports portion control, with single-serve spaghetti packs popular among students and singles. This combination of economic, logistical, and consumer advantages ensures packets remain the default packaging choice across retail channels.

The cup packaging segment is the quickest growing segment in the Europe noodles market and is predicted to record a CAGR of 13.4% over the forecast period owing to the rising demand for on-the-go, single-serve convenience, particularly among urban commuters and students. As per the European Convenience Foods Association, cup noodle sales have grown significantly in 2024, with brands launching premium variants featuring real vereceiveables and reduced sodium. Unlike traditional instant cups, new European offerings emphasize clean labels, recyclable materials, and authentic broths as addressing past criticisms of artificiality. Retailers place cups near checkout counters and in kiosks, capitalizing on impulse purchases. Innovations include microwave-safe designs and compostable liners compliant with EU Single-Use Plastics Directive. As work patterns shift toward hybrid models and snackification intensifies, cup noodles evolve from dorm-room staple to sophisticated, portable meals, which is capturing high-growth, mobile-centric demand.

COUNTRY LEVEL ANALYSIS

Italy Noodles Market Analysis

Italy held the dominating position in the European noodles market in 2025 by capturing 36.2% of the regional market share. The undisputed status of Italy as the birthplace and global leader of pasta is majorly driving the Italian noodles market growth. The counattempt’s market status is defined by cultural reverence, legal protection, and industrial scale. Italian law mandates that dried pasta must be built exclusively from durum wheat semolina, ensuring quality and authenticity. As per the Italian Pasta Association, Italy produces millions of metric tons of pasta annually, exporting a majority to over 180 countries. Domestic consumption is the highest in Europe, with pasta deeply embedded in everyday life. Regions like Emilia-Romagna and Apulia host hundreds of artisanal and industrial mills, many utilizing bronze dies for superior sauce adhesion. The government actively promotes pasta through cultural diplomacy, including UNESCO recognition of pasta-building traditions. This fusion of heritage, regulation, and global influence ensures Italy remains the heart of Europe’s noodle identity.\

Germany Noodles Market Analysis

Germany occupied the second largegest share of the European noodles market in 2025. The growth of Germany in the European market is driven by its dual focus on traditional egg noodles and imported Asian varieties. The counattempt’s market reflects strong houtilizehold consumption of spaetzle, schupfnudeln, and maultaschen as regional specialties deeply embedded in Swabian and Bavarian cuisines. As per the German Federal Minisattempt of Food and Agriculture, Germans consume notable volumes of noodles annually, with fresh egg noodles accounting for a significant portion of sales. Urban centers like Berlin and Hamburg drive demand for udon, ramen, and rice noodles, fueled by multicultural demographics and quick-casual dining. Retailers stock both local and international varieties side by side. The rise of plant-based eating has spurred innovation, with lentil and spelt noodles gaining traction. This balance of regional tradition and global openness builds Germany a dynamic and high-volume noodle market.

United Kingdom Noodles Market Analysis

The United Kingdom is predicted to hold a promising share of the European noodles market during the forecast period owing to the rapid adoption of global flavors and convenience formats. The counattempt’s market is shaped by cosmopolitan tastes, with millions of residents regularly consuming Asian cuisine, as per the UK Food and Drink Federation. Instant noodles, once seen as student fare, have been elevated by premium brands offering low-sodium, vegan ramen kits. Supermarkets dedicate entire aisles to international noodles, from soba to glass noodles. The rise of meal kits further drives trial, with noodle bowls featured weekly. Post-Brexit, the UK aligned its food standards with EU mycotoxin limits, ensuring consistent quality. This fusion of ethnic diversity, convenience culture, and retail innovation positions the UK as a laboratory for noodle trfinish adoption in Northern Europe.

France Noodles Market Analysis

France is expected to witness a healthy CAGR in the European noodles market over the forecast period. France is notable for its gourmet reinterpretation of noodles within haute cuisine. The counattempt blfinishs traditional acceptance of pâtes with creative integration of Asian forms as chefs in Paris and Lyon utilize soba in duck confit salads and udon in bouillon-based dishes. As per FranceAgriMer, fresh egg noodle consumption has grown steadily, driven by artisanal producers in Alsace and Brittany. Supermarkets feature premium dried pasta alongside French-built rice noodles, often labeled with Protected Designation of Origin for regional wheat. The rise of “world cuisine” in culinary schools has normalized noodle techniques, while social media fuels home experimentation. Though historically peripheral, France’s emphasis on quality and innovation positions it as a high-value, trfinishsetting noodle market.

Turkey Noodles Market Analysis

Turkey is anticipated to record a steady CAGR in the European noodles market over the forecast period due to its unique position as both a producer and cultural bridge between Europe and Asia. The counattempt reflects strong domestic consumption of erişte and growing demand for instant and Asian-style varieties in urban centers like Istanbul and Ankara. As per the Turkish Statistical Institute, noodle production exceeded significant volumes in 2024, with exports to the Balkans and Eastern Europe rising. Turkish brands dominate the instant segment, offering halal-certified, affordable options. The government supports wheat farmers through subsidies, ensuring raw material security. As a crossroads of culinary traditions, Turkey leverages its geographic and cultural duality to serve as a gateway for noodle innovation between continents, building it a strategic and expanding player in Europe’s noodle landscape.

COMPETITIVE LANDSCAPE

Competition in the Europe noodles market is defined by a dual dynamic: heritage brands compete on authenticity, quality, and regulatory compliance, while agile innovators differentiate through plant-based ingredients, global flavors, and convenience formats. Unlike commoditized staples, success hinges on balancing tradition with modernity as offering both bronze-die spaghetti and vegan ramen kits. Retailers exert significant influence, demanding clean labels, allergen safety, and sustainable packaging. The market is further segmented by form and function; dried noodles dominate volume, but frozen and fresh segments drive growth in premium and food service channels. Climate volatility in durum wheat regions adds supply risk, rewarding companies with diversified sourcing and robust traceability. Ultimately, the most resilient players harmonize centuries old craftsmanship with digital transparency and dietary innovation, ensuring noodles remain both a cultural staple and a forward-viewing component of Europe’s evolving food narrative.

KEY MARKET PLAYERS

A prominant dominant players that are dominating the Europe noodles market are

- Nissin Foods Holdings Co. Ltd.

- Capital Foods Pvt. Ltd.

- Buitoni S p A

- De Cecco S p A

- Barilla Group

- Mandarin Noodle

- Thai President Foods Public Co. Ltd.

- Sun Noodle, Sanyo Foods Corp. of America

- Yau Kee Noodles Factory Ltd.

- Nestle SA

- Sakura Noodle Inc.

- Ottogi Co. Ltd.

- Acecook Vietnam Joint Stock Co.

- Houtilize Foods Group Inc. Samyang Foods Co., Ltd.

- Nongshim Co., Ltd.

- Lotus Foods

- Ebro Ingredients (Ebro Foods)

Top Players In The Market

- Barilla Group is a global leader in pasta and noodles with a dominant presence across the Europe noodles market, offering a wide portfolio of dried, fresh, and specialty noodles under brands like Barilla, Voiello, and Mulino Bianco. Headquartered in Italy, the company leverages its heritage in durum wheat processing to ensure consistent quality and texture that meets both traditional and modern consumer expectations. Barilla contributes to global noodle innovation through its research on sustainable agriculture and protein-enriched formulations. In recent years, it strengthened its European position by launching legume-based and organic noodle lines, expanding its fresh pasta range with ready-to-cook sauces, and implementing QR code traceability displaying farm origin and carbon footprint. These initiatives reinforce Barilla’s commitment to quality, sustainability, and culinary relevance in a rapidly evolving market.

- De Cecco S p A is an iconic Italian pasta manufacturer renowned for its premium dried noodles built utilizing traditional bronze-die extrusion and slow drying techniques. The company maintains a strong foothold across Europe, particularly in France, Germany, and the UK, where its products are favored by chefs and discerning home cooks. De Cecco contributes to global pasta standards by adhering to strict Italian milling laws and promoting durum wheat excellence. Recently, it enhanced its market position by introducing whole wheat and spelt noodle variants, achieving full compliance with EU mycotoxin regulations, and launching recyclable packaging with clear allergen labeling. Its dedication to craftsmanship, authenticity, and regulatory rigor ensures De Cecco remains a benchmark for quality in Europe’s competitive noodle landscape.

- Buitoni S p A, a Nestlé-owned brand with deep Italian roots, specializes in fresh and refrigerated noodles, including egg taglianotifye, tornotifyini, and ravioli, distributed across supermarkets and food service channels in over 20 European countries. The company bridges traditional Italian recipes with modern convenience, offering pre-portioned, ready-to-cook formats that appeal to time-poor urban consumers. Buitoni has strengthened its European presence by expanding its plant-based noodle range, integrating digital traceability for wheat sourcing, and partnering with retailers to create dedicated chilled pasta sections. It also launched frozen Asian-inspired noodle bowls in select markets, blfinishing European freshness with global flavors. These actions demonstrate Buitoni’s agility in meeting evolving dietary trfinishs while preserving its culinary heritage.

Top Strategies Used By The Key Market Participants

Key players in the Europe noodles market invest in plant based and high protein formulations utilizing lentils, chickpeas, and spelt to meet health and sustainability demands. They implement digital traceability through QR codes to provide transparency on grain origin, farming practices, and carbon footprint. Companies expand into premium fresh and frozen formats to capture convenience driven and restaurant quality segments. Strategic partnerships with retailers enhance visibility through dedicated shelf space and co-branded meal solutions. Additionally, firms prioritize sustainable packaging utilizing recyclable or compostable materials to align with EU environmental regulations and consumer expectations in a competitive and values driven market.

MARKET SEGMENTATION

This research report on the Europe noodles market has been segmented and sub-segmented based on type, raw material, form, finish-utilizer, nature, packaging type, and region.

By Type

By Raw Material

- Oats

- Rice

- Wheat

- White Flour

- Others (Corn, Millet, etc.)

By Form

- Wide Stripe

- Narrow Strip

- Wave Strip

By End User

- Houtilizeholds

- Travel and Hospitality

- Restaurants and Food Services

- Others

By Nature

- Organic or Vegan

- Conventional

By Packaging Type

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply