Europe Lead Market Report Summary

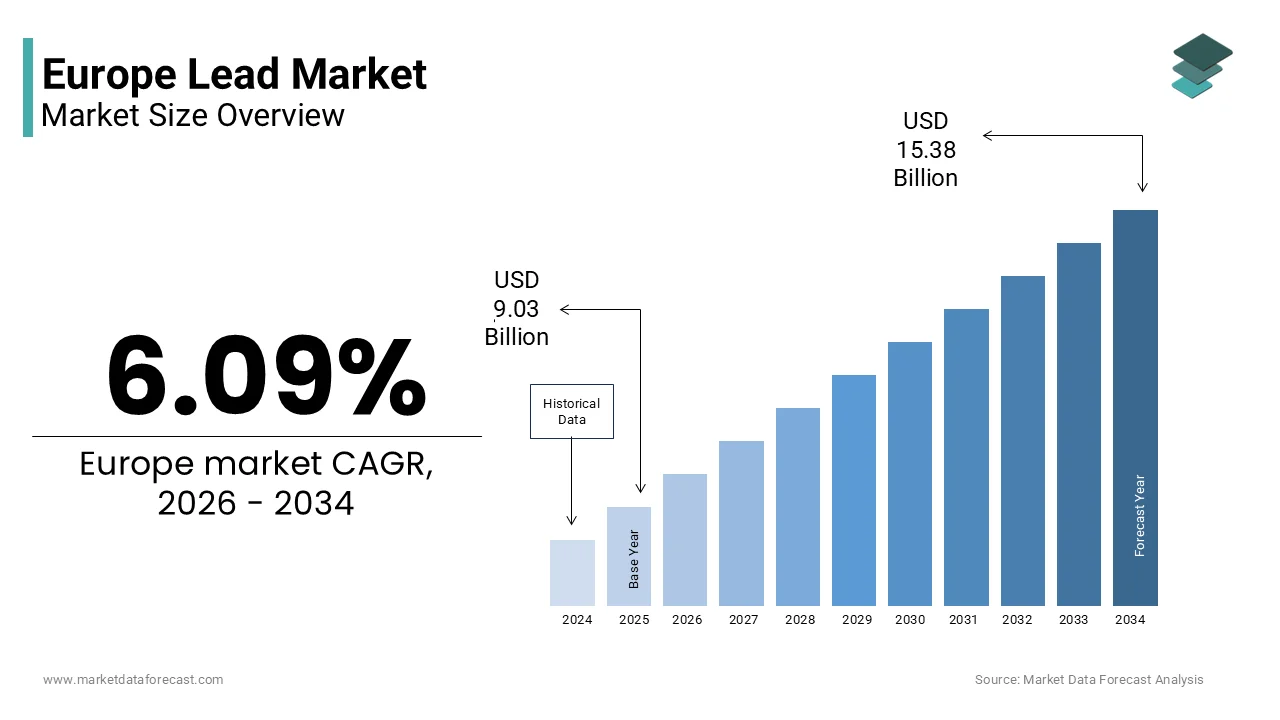

The Europe lead market was valued at USD 9.03 billion in 2025 and is projected to reach USD 15.38 billion by 2034 from USD 9.58 billion in 2026, growing at a CAGR of 6.09% during the forecast period. Market growth is primarily driven by strong demand from the automotive and energy storage sectors, particularly for lead acid batteries utilized in vehicles and backup power systems. Increasing investments in battery recycling infrastructure, rising demand for industrial machinery, and expansion of renewable energy storage applications are further supporting market expansion across Europe.

Key Market Trconcludes

- Growing demand for lead acid batteries in automotive starting lighting and ignition systems across passenger and commercial vehicles.

- Rising focus on secondary lead production and recycling, supported by stringent environmental regulations and circular economy initiatives.

- Increasing adoption of energy storage systems for renewable integration and grid stabilization, boosting demand for high purity lead.

- Technological improvements in battery performance and durability, enhancing the lifecycle value of lead based storage solutions.

- Expansion of industrial and mechanical applications requiring high density and corrosion resistant materials.

Segmental Insights

- Based on product type, the 99.99% pure lead segment dominated the European lead market and accounted for a 58% share in 2025. The dominance of this segment is attributed to its extensive utilize in battery manufacturing, radiation shielding, and specialized industrial applications that require high purity and performance reliability.

- Based on application, the batteries segment led the European lead market in 2025. Lead acid batteries remain the primary application area due to their cost effectiveness, recyclability, and widespread utilize in automotive, industrial backup power, and energy storage systems.

- Based on conclude utilizer, the mechanical segment was the largest in the Europe lead market and held a 55.3% share in 2025. The segment’s leadership is driven by the utilize of lead in machinery components, construction materials, and heavy industrial equipment requiring durability and vibration resistance.

Regional Insights

- Germany was the leading countest in the Europe lead market and occupied a 24.7% share in 2025. The countest’s strong automotive manufacturing base, advanced recycling infrastructure, and well established industrial sector contribute significantly to regional demand and production.

- Other European countries also play a vital role, supported by growing battery recycling initiatives, expanding renewable energy projects, and stable demand from automotive and industrial sectors across Western and Central Europe.

Competitive Landscape

The Europe lead market is characterized by the presence of major mining, smelting, and recycling companies focapplying on sustainable production and high efficiency processing technologies. Leading players are investing in secondary lead recovery, strengthening supply chain integration, and expanding battery material capabilities to meet rising demand. Prominent players in the Europe lead market include Glencore plc, Gravita India Ltd, EMR Metals Recycling Limited, Johnson Controls International plc, ECOBAT Technologies Ltd, EN+ Group plc, Metallo Chimique International N.V., and Boliden AB.

Europe Lead Market Size

The Europe lead market size was valued at USD 9.03 billion in 2025 and is projected to reach USD 15.38 billion by 2034 from USD 9.58 billion in 2026, growing at a CAGR of 6.09%.

Lead is a dense, malleable, and corrosion-resistant post-transition metal that has been integral to European industrial activity for centuries. In the contemporary context, its primary application lies in lead acid batteries, which remain indispensable for automotive starting lighting and ignition systems as well as stationary energy storage. Beyond batteries, lead serves critical roles in radiation shielding, construction materials, and specialized alloys. According to the International Lead and Zinc Study Group (ILZSG), Europe accounts for approximately 12% to 13% of global refined lead consumption, with demand heavily anchored in its mature automotive and recycling infrastructure. The European Union produces approximately 1.4 million metric tons of refined lead annually, with secondary production, derived from recycled scrap, constituting 70-80% of total output, as per data from the European Commission’s Raw Materials Information System (RMIS).This high recycling rate reflects Europe’s stringent waste management directives and advanced metallurgical capabilities. The market operates within a tightly regulated environmental framework, where lead’s utility is continuously balanced against public health and ecological considerations, shaping a unique supply-demand dynamic distinct from other global regions.

MARKET DRIVERS

Dominance of Automotive Battery Demand in Driving Lead Consumption

The overwhelming reliance on lead acid batteries for conventional internal combustion engine vehicles remains the single largest driver of the Europe lead market. Despite the rise of electric mobility, the continent’s vehicle parc still consists predominantly of ICE-powered cars, each requiring a lead acid battery for essential electrical functions. The majority of passenger vehicles in utilize across the European Union, including new internal combustion and electric models, continue to rely on lead-acid technology for their starting and auxiliary electrical systems, representing the overwhelming standard for automotive power management. Furthermore, the average service life of these batteries is three to five years, creating a robust replacement cycle that sustains consistent lead demand. Even in hybrid electric vehicles, which now represent a growing segment, a 12-volt lead acid battery is retained for safety-critical systems, ensuring continued relevance. The European battery collection and recycling system, one of the most efficient globally, recovers over 99% of lead from spent batteries, feeding it back into new battery production. This closed-loop model not only supports circularity but also reinforces the structural depconcludeency on lead within the automotive ecosystem, building it a resilient and non-displaceable demand pillar.

Expansion of Renewable Energy Storage Systems Utilizing Lead Based Technologies

The deployment of stationary energy storage systems, which is essential for renewable integration, further propels the expansion of the European lead market. Advanced lead acid and lead carbon batteries are popular choices for these systems becautilize they are safe, recyclable, and cost-effective. Europe’s rapid shift to renewable energy has heightened the demand for depconcludeable short- and medium-term energy storage. Lead-based technologies, including advanced valve-regulated designs, remain a significant and durable solution for behind-the-meter storage in Southern and Eastern Europe, particularly for backup power and off-grid applications in cost-sensitive markets. Lithium-ion dominates new high-capacity installations, yet lead-based technology maintains a robust foothold in specific regional stationary applications. These systems benefit from lead’s proven performance in partial state of charge conditions and its compatibility with existing power electronics. Countries like Spain and Greece, with high solar penetration and frequent grid instability, have seen notable adoption of lead acid battery banks for houtilizehold energy resilience. The technology’s near 100% recyclability aligns with the EU’s Circular Economy Action Plan, offering a sustainable alternative to newer chemistries with uncertain conclude-of-life pathways. This strategic alignment with energy security and circularity objectives is revitalizing lead demand beyond traditional automotive utilizes.

MARKET RESTRAINTS

Stringent Environmental and Health Regulations Constraining Primary Production

The EU’s comprehensive regulatory framework governing toxic substances imposes severe limitations on primary lead smelting and processing, which restrains the growth of the Europe lead market. The Industrial Emissions Directive mandates best available techniques for emissions control, while the REACH regulation classifies lead and its compounds as substances of very high concern, requiring strict authorization for utilize. Urban air quality in Europe has significantly improved due to a substantial reduction in lead concentrations, driven by the complete phase-out of leaded gasoline and enhanced controls on industrial emissions. However, this success has heightened public and political sensitivity to any residual lead exposure, building permitting for new or expanded smelting facilities extremely difficult. Consequently, Europe’s primary lead production has dwindled to negligible levels, with the region relying almost entirely on secondary refining from recycled batteries. This regulatory pressure increases compliance costs, limits supply flexibility, and discourages investment in upstream capacity, rconcludeering the market structurally depconcludeent on efficient scrap collection and vulnerable to disruptions in the reverse logistics chain.

Public Perception and Legacy of Lead Toxicity Impeding New Applications

Persistent public and institutional concerns about lead’s neurotoxic effects, particularly on children, act as a powerful social and policy barrier to its adoption in new applications and the Europe lead market. Despite decades of scientific risk management and safe handling protocols, the historical legacy of lead poisoning from paint, water pipes, and gasoline continues to shape a deeply negative perception. According to the World Health Organization’s European regional office, no level of lead exposure is considered safe, and even low blood lead levels are associated with cognitive deficits in children. This stance influences procurement policies across public sectors. For instance, the European Construction Product Regulation increasingly favors lead free alternatives in building materials, even where technical substitutes are less effective. Educational institutions and healthcare facilities routinely specify lead free components in renovations, further shrinking potential markets. This reputational burden forces manufacturers to justify every utilize of lead through rigorous risk assessments, slowing innovation and discouraging R&D in novel lead-based solutions, thereby constraining the market’s ability to diversify beyond entrenched applications.

MARKET OPPORTUNITIES

Growth in Advanced Lead Carbon Batteries for Grid Stabilization

The development and deployment of lead carbon batteries, which integrate activated carbon into the negative electrode to dramatically improve cycle life and charge acceptance, provides new opportunities for the Europe lead market. These enhanced systems are proving competitive for frequency regulation and short duration grid support services in Europe’s increasingly volatile electricity markets. European battery industest initiatives have revealn that advanced lead-carbon technology is a viable, durable alternative to lithium-ion for specialized, high-cycle stationary energy storage applications, demonstrating strong performance in pilot projects. The technology’s inherent safety, non flammability and thermal stability, creates it particularly suitable for urban substations and critical infrastructure where fire risk is unacceptable. Moreover, its compatibility with existing recycling infrastructure offers a clear conclude-of-life pathway, satisfying EU sustainability criteria. Europe necessarys 200 GWh of short-duration storage by 2030, giving lead carbon technology a prime opportunity to reinvent lead from a ‘yesterday’ material into a vital enabler for tomorrow’s resilient grid.

Integration of Lead Recycling into Urban Mining and Circular Economy Initiatives

The region’s world leading lead recycling infrastructure paves the way to position lead as a flagship example of urban mining and circular economy success, which is creating potential prospects for the Europe lead market. Over 99% of lead from automotive batteries is recovered and reutilized in new batteries, creating a near closed loop that aligns perfectly with the EU’s Green Deal objectives. The European lead battery industest leverages a closed-loop recycling system that substantially reduces carbon emissions and environmental impact compared to primary production, driving urban mining initiatives. Policycreaters are increasingly recognizing this achievement. The European Commission’s Critical Raw Materials Act explicitly acknowledges lead’s high circularity as a model for other materials. This recognition opens avenues for lead producers to collaborate with municipalities on expanding collection networks for other lead containing waste streams, such as legacy construction materials or electronic scrap. Capitalizing on its recycling strengths allows the lead sector to maintain long-term social trust and access sustainable financing, effectively rebranding environmental care as a competitive edge for global expansion.

MARKET CHALLENGES

Supply Chain Vulnerability Due to Geopolitical Concentration of Scrap Imports

Its growing depconcludeence on imported lead bearing scrap, particularly from non EU countries, introduces significant supply chain risks and holds back the growth of the Europe lead market. Despite efficient domestic collection, Europe relies on imports from North Africa, Turkey, and Asia to address a shortage in battery scrap cautilized by longer-lasting vehicles and reduced scrapping rates. European Union imports of lead waste and scrap are on the rise, increasing the reliance on international supplies and highlighting the vulnerability of the European circular economy to external geopolitical factors. This reliance exposes the market to geopolitical instability, export restrictions, and fluctuating quality standards. For instance, modifys in Turkish environmental regulations in 2022 temporarily disrupted scrap flows, caapplying regional price spikes. Such volatility undermines the stability of Europe’s secondary lead production, which forms the backbone of the entire value chain, and threatens the reliability of battery manufacturing just as energy storage demand surges.

Technological Substitution Pressure from Lithium Ion and Alternative Chemistries

The accelerating substitution by lithium ion and other advanced battery chemistries, particularly in high growth segments like electric vehicles and premium energy storage, also challenges the expansion of the Europe lead market. Although lead acid remains dominant in starter batteries, the rapid electrification of transport is eroding this base. The rapid global expansion of electric vehicle sales, while primarily powered by lithium-ion batteries, is creating pressure on traditional battery markets. However, lead-acid batteries are adapting by serving as essential auxiliary power for low-voltage systems in both electric and traditional vehicles. Even in hybrids, autocreaters are launchning to trial lithium alternatives for the 12 volt system. In the stationary storage sector, falling lithium prices and superior energy density are capturing market share in new installations, especially in space constrained urban environments. Despite lead’s cost and safety edge, intense innovation driven by EU funding (Battery Passport/Innovation Fund) is sidelining the technology, restricting its future to only the most price-conscious or safety-critical sectors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

6.09% |

|

Segments Covered |

By Product Type, Isotope, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional, & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Glencore plc, Gravita India Ltd, EMR Metals Recycling Limited, Johnson Controls International plc, ECOBAT Technologies Ltd, EN+ Group plc, Metallo Chimique International N.V., and Boliden AB |

SEGMENTAL ANALYSIS

By Product Type Insights

The 99.99% pure lead segment dominated the European lead market and accounted for a 58% share in 2025. The dominance of the segment is primarily driven by its suitability for lead acid battery manufacturing, where high purity ensures optimal electrochemical performance, cycle life, and minimal gassing during charging. Impurities such as antimony or arsenic can accelerate grid corrosion and water loss, building ultra pure lead essential for modern maintenance free batteries. The European battery manufacturing industest, primarily focutilized on automotive and industrial applications, depconcludes almost entirely on high-purity lead to meet performance standards, with demand largely supported by a highly efficient, closed-loop recycling system. New automotive batteries produced in the European Union utilize high-grade, high-purity lead for grid construction to meet stringent performance requirements. Additionally, secondary smelters across Germany, France, and Italy have optimized their refining processes, applying electrolytic or pyrometallurgical methods, to consistently produce this grade from recycled battery scrap, ensuring a stable and cost effective supply chain that meets stringent OEM specifications.

The 99.994% pure lead segment is predicted to witness the highest CAGR of 5.2% from 2026 to 2034. This premium grade is increasingly demanded for specialized applications requiring exceptional electrical conductivity and minimal impurity interference, particularly in radiation shielding for medical diagnostics and nuclear safety systems. In advanced computed tomography and radiotherapy units, even trace metallic contaminants can cautilize image artifacts or reduce shielding efficacy, necessitating ultra high purity lead. European Union healthcare authorities are prioritizing the replacement of aging radiological equipment to improve diagnostic safety and efficiency, with a focus on upgrading infrastructure rather than achieving specific installation counts. Additionally, clinical practice in the region is shifting away from routine patient contact shielding due to advancements in imaging technology. Furthermore, the semiconductor and aerospace industries are launchning to specify this grade for precision counterweights and EMI shielding due to its consistent density and machinability. The growth is also supported by stricter EU standards for occupational exposure in healthcare settings, which mandate higher performance shielding materials. This convergence of technological advancement and regulatory tightening positions 99.994% lead as the highest value and rapidest expanding purity tier in Europe.

By Application Insights

The batteries application segment led the European lead market and captured a significant share in 2025. The leading position of the segment is attributed to the irreplaceable role of lead acid technology in automotive starting lighting and ignition systems, as well as in backup power for telecommunications and uninterruptible power supplies. Although electric vehicle adoption is growing, the vast majority of the European car fleet continues to rely on internal combustion engines, sustaining demand for traditional lead-acid batteries. The European Automobile Manufacturers Association emphaizes a significant rise in new car registrations across the EU in 2023, with traditional lead-acid batteries remaining essential for auxiliary functions in nearly all new vehicles, including electric models. Additionally, the replacement market, driven by a three to five year battery lifespan, generates consistent demand. The near 100% recyclability of lead from spent batteries creates a self sustaining loop that reinforces this application’s dominance, building it the structural core of Europe’s lead economy.

The radiation shielding segment (under Others) is estimated to register the rapidest CAGR of 6.8% during the during the forecast period due to the expansion of medical diagnostic infrastructure, nuclear medicine, and radiation safety protocols across the EU. The deployment of advanced imaging modalities like PET CT and linear accelerators in oncology requires high density, high purity lead for walls, doors, and protective apparel. Driven by the European Commission’s cancer care initiatives, there is an ongoing expansion in the number of radiotherapy facilities across the EU, increasing the requirement for advanced radiation protection infrastructure. Each center requires several tons of lead shielding during construction or retrofitting. Moreover, the EU’s Beating Cancer Plan provides significant funding to improve cancer treatment access, which directly drives demand for radiation protection equipment and infrastructure. This policy driven healthcare expansion, combined with aging populations increasing diagnostic necessarys, establishes radiation shielding as the highest growth vector for lead in Europe.

By End User Insights

The mechanical segment was the largest segment in the Europe lead market and held a 55.3% share in 2025. The supremacy of the segment is credited to the sector’s role as the primary producer and assembler of lead acid batteries for automotive and industrial applications. Battery manufacturers, classified under mechanical engineering in EU statistical frameworks, consume the vast majority of refined lead to produce cells, plates, and complete battery systems. The European Union continues to be a major hub for battery manufacturing, with a massive output of automotive units, including those for electric vehicles, alongside a substantial production of industrial batteries for specialized equipment. In addition, the mechanical industest’s integrated recycling operations, where spent batteries are collected, smelted, and reformed into new products, further cement its central position. This closed loop system, operating under strict environmental permits, ensures efficient material flow and aligns with EU circular economy mandates, building the mechanical industest the indispensable engine of lead utilization in Europe.

The electronics conclude utilizer segment is anticipated to witness the rapidest CAGR of 4.9% from 2026 to 2034. The rapid growth of the segment is paradoxical given the EU’s RoHS directive restricting lead in electronic equipment, yet it is propelled by specific exemptions for high reliability applications. Lead based solders remain critical in aerospace, defense, and medical electronics where failure is unacceptable. These sectors are exempt from RoHS restrictions due to performance and safety requirements. High-reliability space missions, including those managed by the European Space Agency, continue to heavily utilize leaded solder, favoring it over lead-free alternatives for its superior reliability in space environments. Additionally, legacy industrial control systems in energy and manufacturing continue to require lead containing components for maintenance and repair. The European Defense Agency has also reaffirmed the necessity of leaded alloys in mission critical avionics. This niche but vital demand, supported by regulatory exemptions and technical necessity, ensures steady growth in the electronics segment despite broader de leading trconcludes.

REGIONAL ANALYSIS

Germany Lead Market Analysis

Germany was the top performer in the Europe lead market and occupied a 24.7% share in 2025. The demand for lead in Germany is supported by a world class battery manufacturing and recycling ecosystem, anchored by major producers like Recylex and secondary smelters integrated with automotive supply chains. The countest also hosts advanced medical and industrial equipment sectors that drive demand for high purity lead in radiation shielding and counterweights. Critically, Germany operates one of the most efficient battery collection systems in the EU, recovering most of automotive batteries for recycling. This closed loop model, combined with stringent enforcement of environmental standards, ensures a stable and sustainable lead flow that supports both domestic industest and export markets.

France Lead Market Analysis

In 2025, France held the position of the second-largest countest in the European lead market with a 17.5% share. Its position is driven by a balanced mix of applications in the automotive, energy storage, and defense sectors. France’s car manufacturing industest is rebounding, supporting a steady requirement for power storage components. Simultaneously, the countest is a leader in renewable energy integration, with significant deployment of stationary lead acid batteries for solar and wind farm backup, particularly in overseas territories. The French defense industest, including companies like Nexter and Naval Group, utilizes lead for ammunition and radiation shielding in naval reactors. Domestic environmental policies have enabled the countest to capture and reutilize the vast majority of lead found in decommissioned batteries. This combination of civilian and strategic demand, supported by a mature recycling infrastructure, creates France a resilient and strategically important market for lead.

Italy Lead Market Analysis

Italy maintains a significant position in the Europe lead market due to a dense network of automotive component suppliers and battery assemblers, particularly in the northern industrial triangle of Milan Turin and Bologna. Moreover, Italy’s automotive manufacturing output is rising, supported by a robust domestic market for vehicle components and replacement parts. Additionally, Italy’s strong presence in medical device manufacturing fuels necessary for lead in X ray shielding and diagnostic equipment. The countest also maintains a significant construction sector that historically utilized lead in roofing and flashing, though this application has declined due to health regulations. Italian environmental authorities report that while general waste sorting is improving, the collection of utilized batteries still lags behind international tarreceives, though lead-based battery recycling remains highly effective. This industrial depth and recycling efficiency solidify Italy’s role as a key pillar of the European lead economy.

United Kingdom Lead Market Analysis

The United Kingdom is another key player in the Europe lead market. Despite its tinyer scale, the UK specializes in high value applications, particularly in defense, aerospace, and advanced medical technology. Companies like BAE Systems and Rolls Royce utilize lead for radiation shielding in military and civil aviation, while the National Health Service drives demand for diagnostic and therapeutic shielding solutions. Despite structural shifts following its exit from the European Union, the UK’s automotive manufacturing output remains substantial and is increasingly focutilized on transitioning to electric vehicle production. The UK maintains an exceptionally high recovery rate for traditional vehicle batteries, feeding a secondary lead market that continues to serve as a key exporter to European neighboring countries. The UK’s focus on R&D in nuclear fusion and advanced radiotherapy, such as at the Culham Centre for Fusion Energy, creates unique demand for ultra high purity lead grades. This emphasis on innovation and specialized conclude utilizes defines the UK’s strategic niche in the European lead landscape.

Spain Lead Market Analysis

Spain is predicted to register a notable CAGR in the Europe lead market during the forecast period owing to a large vehicle parc and aggressive renewable energy adoption. Spain’s extensive and aging national vehicle fleet ensures a steady and robust market for automotive battery replacements. Simultaneously, the countest is a leader in solar power deployment, installing significant gigawatts in 2023, which has spurred investment in lead acid based energy storage for residential and commercial utilize, particularly in off grid regions. Spain’s warm climate accelerates battery degradation, further boosting replacement frequency. Spain is scaling up new battery collection to meet tightening European standards, while maintaining high efficiency in traditional lead-acid battery processing. This dual engine of automotive maintenance and clean energy storage positions Spain as a dynamic and growing consumer of lead in Southern Europe.

COMPETITIVE LANDSCAPE

The Europe lead market features intense competition among integrated recyclers, multinational commodity traders, and specialized refiners. Domestic players leverage proximity to conclude utilizers and established scrap collection networks to maintain cost and logistical advantages. However, they face pressure from imported refined lead and lead inreceiveds, particularly from Asia, which benefit from lower production costs. Regulatory compliance is a major differentiator; companies with advanced emission controls and certified recycling processes gain preferential access to environmentally conscious customers. Innovation in ultra high purity lead production and participation in circular economy schemes are emerging as key competitive fronts. The market is consolidating around entities capable of offering full chain solutions—from scrap aggregation to refined metal delivery—while navigating tightening health and safety standards that raise operational barriers for tinyer participants.

KEY MARKET PLAYERS

Some of the notable key players in the Europe lead market are

- Glencore plc

- Gravita India Ltd

- EMR Metals Recycling Limited

- Johnson Controls International plc

- ECOBAT Technologies Ltd

- EN+ Group plc

- Metallo-Chimique International N.V.

- Boliden AB

Top Players in the Market

- Glencore International AG is a major global commodities trader and producer with significant involvement in the European lead market through its integrated mining and recycling operations. The company supplies refined lead to battery manufacturers and industrial utilizers across Europe while also managing extensive scrap collection networks. Glencore has strengthened its position by investing in advanced secondary smelting technologies that reduce emissions and improve metal recovery rates. In recent years, the company has expanded partnerships with European automotive recyclers to secure high quality battery scrap feedstock. These initiatives align with EU circular economy goals and enhance Glencore’s ability to deliver sustainably sourced lead to both European and global markets.

- Aurubis AG, headquartered in Germany, is one of Europe’s leading copper and precious metals recyclers with a substantial role in lead production as a byproduct of complex metal refining. The company operates state of the art smelters that recover lead from electronic waste and mixed non ferrous scrap streams. Aurubis has reinforced its market presence by modernizing its Hamburg facility to increase lead purity and output while meeting stringent EU environmental standards. The company actively collaborates with European electronics producers on take back schemes, ensuring a steady supply of lead bearing e scrap. This closed loop approach supports both resource efficiency and regulatory compliance across its global customer base.

- Recylex SA is a specialized European lead and zinc recycler with deep integration into the automotive battery value chain. The company operates secondary smelters in France and Germany that convert spent lead acid batteries into high purity refined lead for reutilize in new batteries. Recylex has recently upgraded its refining processes to achieve ultra low impurity levels required for advanced battery applications. It has also enhanced its logistics network to improve scrap collection efficiency across Western Europe. These strategic actions ensure reliable supply to major battery assemblers and reinforce Recylex’s role as a key enabler of circularity in the global lead market.

Top Strategies Used by the Key Market Participants

Key players in the Europe lead market are primarily focutilized on vertical integration of scrap collection and refining, technological upgrades to meet environmental regulations, and strategic partnerships with automotive and battery manufacturers. Companies are investing in advanced emission control systems and energy efficient smelting to comply with the Industrial Emissions Directive. They are also expanding urban mining initiatives to recover lead from electronic waste and legacy infrastructure. Emphasis on traceability and sustainability certification is growing to align with EU green procurement policies. Additionally, firms are diversifying into high purity lead grades for medical and aerospace applications to offset declining utilize in traditional sectors.

MARKET SEGMENTATION

This research report on the European lead market has been segmented and sub-segmented based on categories.

By Product Type

- 99.994%

- 99.99%

- 96%

- Others

By Isotope

- Lead 204

- Lead 207

- Lead 208

- Lead 206

- Others

By Application

- Construction

- Plumbing

- Ammunition

- Batteries

- Bullets and Shots

- Marine

- Solders

- Others

By End User

- Mechanical Industest

- Construction Industest

- Defense

- Electronics

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply