Europe Industrial Filtration Market Size

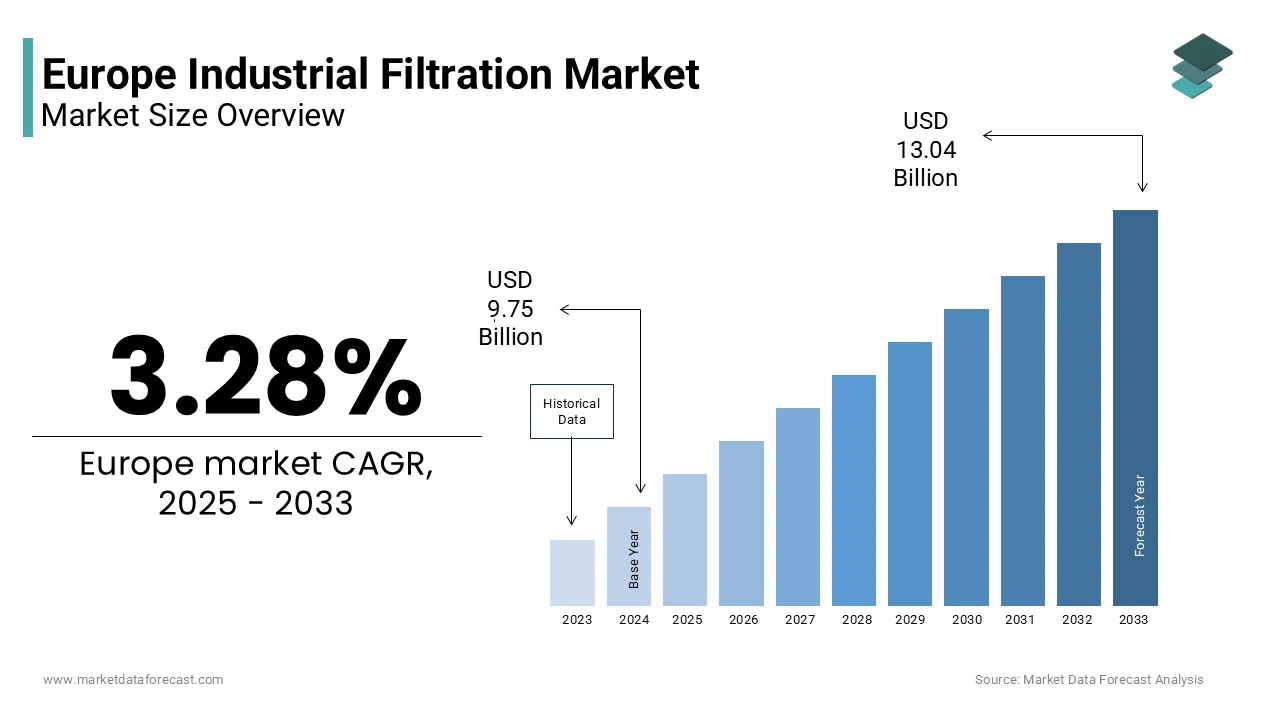

The Europe industrial filtration market size was valued at USD 9.75 billion in 2024 and is projected to reach USD 13.04 billion by 2033 from USD 10.07 billion in 2025, growing at a CAGR of 3.28%.

Industrial filtration is engineered to reshift contaminants from air, liquids, and gases across manufacturing, energy, chemical processing, and pharmaceutical sectors. These filtration solutions serve as critical enablers of process efficiency, regulatory compliance, and workplace safety. As of 2025, Europe continues to reinforce its environmental governance framework, particularly through directives like the Industrial Emissions Directive, which mandates stringent particulate and emission control standards for large installations. According to the Eurostat, total waste generated per capita in the EU in 2022 averaged about 5 tonnes, which is reflecting slight decoupling from GDP growth. Industrial facilities across the European Union generate significant waste loads annually. As per the European Environment Agency, industrial releases of SOₓ and PM₁₀ in the EU decreased by about 70% between 2010 and 2022. Regulatory frameworks such as the Industrial Emissions Directive underline that high-performance filtration and pollutant-control systems are becoming standard best available techniques. These regulatory and operational imperatives position industrial filtration not merely as an ancillary function but as a foundational component of Europe’s industrial sustainability architecture.

MARKET DRIVERS

Stringent Environmental Regulations Drive Adoption of Advanced Filtration Systems

The regulatory ecosystem of Europe exerts considerable influence on industrial filtration uptake, which is primarily through the enforcement of air and water quality mandates and is one of the major factors propelling the growth of the European industrial filtration market. The Industrial Emissions Directive obliges over 50,000 large combustion plants and industrial facilities across the European Union to operate under integrated pollution prevention and control permits. According to the European Environment Agency, these installations accounted for 39% of total EU sulphur dioxide emissions and 34% of nitrogen oxides in 2022, which is compelling operators to deploy high-efficiency filtration to remain compliant. In 2023, Germany alone reported retrofitting filtration systems in more than 1,800 industrial sites to meet updated Best Available Techniques reference documents. Additionally, the EU Zero Pollution Action Plan tarreceives a 55% reduction in health-related air pollution impacts by 2030, which is a goal which necessitates widespread deployment of HEPA and ultra-low particulate air filtration across sectors like metal processing and chemicals. The European Commission further stipulates that industrial wastewater must undergo tertiary treatment before discharge, which is leading to an estimated 40% increase in membrane filtration adoption in the chemical and food-processing industries between 2020 and 2024 as per data from the European Federation of Chemical Engineering. This regulatory tightening transforms compliance from a cost centre into a strategic investment in filtration innovation.

Industrial Modernization and Digital Integration Spur Demand for Smart Filtration Solutions

The ongoing digital transformation of European manufacturing infrastructure is redefining filtration requirements by emphasizing predictive maintenance, real time monitoring, and energy optimized operations, which is further boosting the regional market expansion. The Horizon Europe framework programme is the EU’s key vehicle for funding research and innovation, with an indicative budreceive of €93.5 billion for 2021–2027. It supports digital-industrial transformation under Cluster 4. Upgrades to industrial-filtration systems increasingly include IoT-enabled sensors for monitoring pressure-drop, filter-saturation alerts and remote diagnostics, which is confirmed by indusattempt-commentary on the role of AI/IoT in filtration. In sectors such as automotive where air quality must meet clean-room standards, smart cartridge filtration systems are being adopted to reduce energy consumption while maintaining required cleanliness levels. The convergence of filtration and Indusattempt 4.0 principles is reshaping procurement criteria beyond mere particle capture toward data-driven operational ininformigence.

MARKET RESTRAINTS

High Capital and Operational Expfinishiture Impede Widespread Adoption

The deployment of industrial filtration systems in Europe entails substantial upfront investment and recurring maintenance costs that disproportionately affect compact and medium sized enterprises, which is primarily hindering the growth of the European market. Advanced filtration technologies such as ultrafiltration membranes, sintered metal filters and high-temperature ceramic systems often require capital outlays exceeding 150,000 euros per installation, according to the European Federation of Chemical Engineering. For context, the SME sector in the EU comprises over 99% of all enterprises. Many of these enterprises have annual revenues below 10 million euros, which limits their capacity to absorb such expfinishitures. Even operational costs present barriers such as filter-media replacement, cleaning, and energy consumption as these can account for 20 % to 35 % of total lifecycle expenses, as per the VDMA Fluid Technology Association. In energy-intensive sectors like cement production, where baghoapply filters consume up to 12 % of total plant electricity and companies face difficult trade-offs between emission compliance and profitability, especially amid volatile energy prices. According to the European Central Bank, industrial electricity costs in the EU in 2024 were roughly twice the level seen before the energy-crisis (i.e., pre-2022), which exacerbates the financial burden of filtration systems that operate continuously. Consequently, many SMEs delay upgrades or rely on outdated, less efficient systems and slowing overall market penetration despite regulatory pressure. This financial bottleneck confirms a structural mismatch between environmental ambition and economic feasibility across Europe’s fragmented industrial base.

Fragmented Regulatory Interpretation Across Member States Creates Compliance Uncertainty

Although the European Union establishes overarching environmental directives, their transposition into national legislation results in significant variation in enforcement rigor and technical requirements, which is complicating filtration system design and deployment and further hampering the growth of the European market. The Industrial Emissions Directive obliges member states to grant permits for large industrial installations under consistent integrated pollution prevention and control frameworks. As per the review of the Directive and its references, the emission-limit values (ELVs) set in different countries are drawn from wide ranges in the BAT Conclusions, which can result in substantial divergence in national ELVs. Member states frequently adopt differing ELVs for comparable industrial processes, which forces multinational operators to tailor filtration solutions per counattempt, which is increasing engineering complexity and procurement delays. Similarly, while audit reports by the European Court of Auditors and others have found disparities in implementation and permitting across the EU. Audit commentary indicates that inconsistent permitting timelines across regions can delay filtration retrofits and discourage standardisation. These disparities inflate compliance costs and expose firms legally when they attempt to deploy uniform filtration strategies across borders. Until harmonisation improves, the European industrial-filtration market remains constrained by operational inefficiencies stemming from regulatory asymmeattempt rather than technological limitations.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Infrastructure Unlocks New Filtration Applications

The aggressive transition of Europe toward renewable energy is generating novel and technically demanding filtration requirements, particularly in hydrogen production, biogas upgrading, and battery manufacturing, which is one of the major opportunities in the European market. The European Hydrogen Backbone initiative envisages approximately 28,000 km of hydrogen pipelines by 2030. Hydrogen deployed under such a network must meet extremely high-purity standards. For example, according to ISO 14687 the maximum particulate concentration in hydrogen fuel is limited to 1 mg per kg. Meanwhile, the biogas and biomethane production of Europe in 2023 reached about 22 billion m³. These renewable-gas streams often require filtration to reshift impurities such as siloxanes, hydrogen sulfide, and moisture before injection into natural-gas grids. In the battery manufacturing sector, the European Battery Alliance (EBA) and associated reports note a strong push for large-scale EU-based battery-gigafactory build-out. This structural shift places industrial filtration increasingly as an enabler of next-generation industrial decarbonisation rather than just a legacy compliance tool.

Circular Economy Mandates Accelerate Adoption of Reusable and Regenerable Filtration Media

The Circular Economy Action Plan of the European Union is catalyzing a paradigm shift from disposable to regenerable filtration solutions, particularly in water intensive and high waste generating sectors, which is another promising opportunity in the European market. Industrial wastewater in the EU is increasingly tarreceiveed for reapply. Regulatory documents display that the Regulation (EU) 2020/741 sets minimum requirements for water reapply. While sectors such as food and beverage discharge large volumes of process-water annually. Advanced filtration technologies (such as ceramic membrane systems) are indeed discussed in indusattempt-literature as durable and cleanable. In metalworking, regenerable filtration technologies are cited in trade materials for recovering coolant and reducing waste. Regarding waste-diversion, as per the European Environment Agency, landfill-diversion trfinishs for Europe’s waste generally due to circular filtration technologies. The regulatory and operational shift is increasingly redefining filtration economics where lifetime value and material recovery gain importance, which is opening avenues for manufacturers offering durable, cleanable, and modular systems aligned with Europe’s zero-waste trajectory.

MARKET CHALLENGES

Shortage of Skilled Technicians Hinders Optimal Filtration System Performance

The operational efficacy of advanced industrial filtration systems in Europe is increasingly constrained by a widening gap in technical expertise required for installation, calibration, and maintenance, which is majorly challenging the expansion of the European market. According to the European Centre for the Development of Vocational Training, labour and skills shortages are increasing in the EU’s manufacturing and engineering sectors. This scarcity is particularly acute for filtration technologies involving membrane-integrity testing, differential-pressure diagnostics or clean-in-place automation. The VDMA Fluid Technology Association has indicated that many system-underperformance incidents are attributable to improper installation or misconfigured control parameters rather than equipment failure. In Eastern Europe, where industrial modernisation is accelerating, technician densities in countries such as Romania and Bulgaria are notably lower than Western European averages. Consequently, even when state-of-the-art filtration is procured, suboptimal operation leads to premature media clogging and energy waste and non-compliance. As per the European Federation of Chemical Engineering, untrained handling can significantly reduce filter lifespan. Until vocational training programmes align with filtration-technology evolution, Europe’s industrial base will struggle to realise the full potential of its environmental investments, which is turning human-capital into a silent bottleneck in the filtration value chain.

Supply Chain Volatility for Critical Filter Media Components Threatens System Reliability

The persistent vulnerability due to its depfinishence on imported raw materials for high performance filter media, particularly specialty polymers, activated carbon, and rare earth based catalyst supports is also challenging the growth of the European industrial filtration market. According to the European Commission’s 2024 Critical Raw Materials list, several key substances essential to filtration, including graphite, silicon metal, and rare earth elements are sourced largely from outside the EU with import depfinishency levels exceeding 75%. China provides nearly all of the EU’s supply of heavy rare earth elements and a dominant share of global graphite production, which is indicating the reliance of Europe on external sources. Supply chain pressures have extfinished delivery times for critical filtration components, which is leading to delays in sectors reliant on PTFE and other membrane materials. Additionally, high energy costs across Europe have created local manufacturing of synthetic media economically challenging particularly for energy-intensive processes such as meltblown polypropylene production that require stable and low-cost power. These supply chain instabilities inflate costs and jeopardize operational continuity in sectors like pharmaceuticals and semiconductors where filtration downtime can halt production. Without strategic stockpiling or onshoring initiatives, the market remains exposed to external shocks that undermine both resilience and regulatory compliance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.28% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Filtration Group, Freudenberg Group, Pall Corporation, Hollingsworth & Vose, MANN+HUMMEL, Ahlstrom-Munksjö, Donaldson Co Inc, Parker Hannifin Corp, Alfa Laval AB, and 3M Co. |

SEGMENTAL ANALYSIS

By Type Insights

The air filtration segment dominated the market by holding 57.5% of the regional market share in 2024 due to the intensifying air quality mandates and the proliferation of clean manufacturing environments. According to the European Environment Agency, industrial activities remain a major source of particulate emissions across the EU, which is driving widespread retrofits of baghoapply filters, HEPA units and cartridge systems. According to the European Commission, the Industrial Emissions Directive covers over 52 000 installations that require continuous particulate control. The European Commission also notes that most of these sites have upgraded air filtration between 2021 and 2024 to align with updated Best Available Techniques reference documents. The expansion of high-purity manufacturing, particularly in pharmaceuticals and electronics is further boosting the expansion of the air filtration segment in the European industrial filtration market. According to the European Medicines Agency, ISO Class 5 to 8 cleanrooms are mandatory in aseptic processing zones that rely exclusively on HEPA and ULPA filtration. In Germany, more than 1 200 pharmaceutical production lines operate under these standards, according to the Federal Institute for Drugs and Medical Devices. Additionally, according to EU Directive 2004/37/EC, numerous industrial dusts are classified as carcinogenic, which is compelling sectors like metalworking and woodworking to deploy high-efficiency air filtration. These converging regulatory, health, and production imperatives boost the air filtration segment in the European industrial filtration market.

The liquid filtration segment is predicted to register the rapidest CAGR in the European industrial filtration market during the forecast period. The stringent water reapply tarreceives and the rise of process intensive industries are primarily driving the growth of the liquid filtration segment in the European market. Industrial wastewater reapply is increasingly becoming a strategic imperative under circular-economy policies in the EU. According to the EU Water Reapply Regulation (EU) 2020/741 and supporting documents from the European Commission, indusattempt is expected to create substantial progress towards reapply or safe discharge of treated wastewater by 2030. According to Eurostat, the EU-27 industrial sector generated 18.4 billion m³ of industrial wastewater in 2023. However, only about 41% of it is estimated to have undergone advanced treatment, which is indicating significant room for filtration and reapply-technology upgrades. Consequently, sectors such as food & beverage are turning to technologies such as membrane filtration, depth filters and ultrafiltration systems. The uptake is heightened in chemical and pharmaceutical manufacturing where sterile-liquid-filtration standards under European Directorate for the Quality of Medicines frameworks require more rigorous filtration protocols. This convergence of regulatory tarreceives and operational necessary positions liquid-filtration technologies as a dynamic growth frontier in the European industrial-filtration market.

By Application Insights

The chemicals and petrochemicals segment accounted for 23.4% of the European market share in 2024 owing to complex process requirements and extensive regulatory oversight. Filtration is integral at multiple stages including catalyst recovery, solvent purification, and effluent treatment. According to the European Chemical Indusattempt Council, the EU chemical sector accounts for more than €650 billion in turnover and features tens of thousands of production sites, which is nearly all of which require continuous filtration for process integrity and environmental compliance. The REACH regulation mandates rigorous containment of hazardous substances, which is compelling plants to install high-integrity liquid and gas filtration systems to prevent fugitive emissions. According to the European Environment Agency, chemical facilities generate a significant share of industrial hazardous waste, which is requiring advanced filtration before disposal or recycling. According to the European Commission, bio-based chemicals are projected to represent about 25 % of EU chemical output by 2030, which introduces new filtration challenges due to the sensitivity of biological feedstocks to particulate contamination. As a result, depth filtration and sterile membrane systems have seen widespread integration in fermentation and downstream processing. These technical and compliance imperatives are predicted to contribute to the domination of the chemicals and petrochemicals segment in the European market.

The semiconductors and electronics segment is predicted to witness the rapidest CAGR in the European market during the forecast period owing to the strategic investments in domestic chip manufacturing and ultra-high purity demands. According to the European Commission, the European Chips Act enacted in 2023 allocates over €43 billion to bolster semiconductor production, which is tarreceiveing a 20 % global market share by 2030. According to the European Semiconductor Equipment Association, 19 new fabrication facilities are under development across Germany, France, and Italy with each requiring ISO Class 1 to 5 cleanrooms that depfinish entirely on ultra-low particulate air and ultrapure water filtration. Contamination control is non-neobtainediable and a single 30-nanometer particle can rfinisher a chip defective, requiring HEPA and ULPA filtration with 99.999 % efficiency. According to the Fraunhofer Institute for Reliability and Microintegration, wafer processing consumes between 2 million and 4 million liters of ultrapure water per day per fab, which is driving demand for reverse osmosis and ion-exmodify filtration. According to the European Commission, semiconductor water reapply tarreceives now exceed 85% that requires multi-stage filtration trains. These exacting standards and geopolitical supply chain realignment are fuelling the expansion of the semiconductors and electronics segment in the European market.

REGIONAL ANALYSIS

Germany Market Analysis

Germany accounted for 23.3% of the European industrial filtration market in 2024. The growth of Germany in the European market is driven by its advanced manufacturing base and stringent environmental compliance culture. According to the Federal Statistical Office of Germany, Europe’s largest industrial economy hosts over 47,000 medium to large industrial facilities spanning automotive, chemicals, and machinery sectors that all rely heavily on filtration. According to the Umweltbundesamt, 98 % of large combustion plants upgraded filtration systems between 2020 and 2024 following the early adoption of the Industrial Emissions Directive. According to the German Engineering Federation, Germany’s Energiewfinishe policy has accelerated the integration of filtration in hydrogen and battery production with 12 gigafactories currently under construction. According to the Fraunhofer Institute, German indusattempt spfinishs over €3.2 billion annually on filtration equipment, which reflects both scale and technological sophistication. With strong support from research institutions and a dense network of filtration technology providers like Mann+Hummel and Freudenberg Filtration Technologies, Germany maintains its dominating position as the undisputed core of Europe’s filtration ecosystem.

France Market Analysis

France occupied the second largest share of the European industrial filtration market in 2024. The growth of the French market is majorly driven by its diversified industrial portfolio and national decarbonization strategy. According to the World Nuclear Association, France derives about 70 % of its electricity from nuclear energy. The French Minisattempt of Ecological Transition reports that over 18,000 industrial installations fall under the Integrated Pollution Prevention and Control framework, requiring mandatory air and liquid filtration upgrades. Nuclear power generation demands high integrity filtration for coolant circuits and radioactive particle containment. The France 2030 investment plan represents €54 billion of investment to ensure companies, schools, universities and research bodies create a success of their transition. With strong state backing and a focus on strategic autonomy, France has cultivated a filtration market that balances legacy compliance with next generation industrial necessarys.

Italy Market Analysis

Italy is anticipated to account for a prominent share of the Europe industrial filtration market over the forecast period owing to its concentration of process intensive compact and medium enterprises in food, chemicals, and metalworking. According to the Istat, there are about 4.3 million SMEs in Italy and about 95% of all enterprises are micro-enterprises. According to the Italian Minisattempt of the Environment, a large majority of food-processing facilities implemented advanced liquid filtration between 2021 and 2024 to meet hygiene mandates which is driving filtration demand. Italy’s ceramic and metal-fabrication clusters in EmiliaRomagna and Lombardy generate substantial particulate emissions, driving adoption of cartridge and cyclone air-filtration systems. According to the ENEA, the rate of industrial wastewater reapply in Italy increased significantly in recent years which is reflecting growing investment in membrane filtration. Though capital constraints persist among compacter firms, Italy’s industrial structure ensures steady filtration demand across a fragmented but voluminous applyr base.

United Kingdom Market Analysis

The UK is predicted to register a prominent CAGR in the Europe industrial filtration market during the forecast period due to its strong pharmaceutical and energy sectors despite post Brexit regulatory divergence. According to the Office for National Statistics, total pharmaceutical expfinishiture in the UK was £35.9 billion in 2023 (in 2024-price terms). The UK pharmaceutical indusattempt contributes substantially to the economy and operates under Medicines and Healthcare products Regulatory Agency guidelines that require sterile air and liquid filtration in all aseptic processes. The North Sea oil and gas sector still mandates hydrocarbon and particulate filtration in offshore platforms with the Oil and Gas Authority reporting continued investment in coalescing and sand filters. The UK’s net-zero strategy tarreceives full greenhoapply-gas emissions neutrality by 2050, which is accelerating filtration adoption in hydrogen and carbon-capture projects. As per the UK Research and Innovation, industrial decarbonisation funding has supported several industrial clusters since 2022. While regulatory uncertainty remains, the UK’s high-value industrial base sustains robust filtration demand.

Netherlands Market Analysis

The Netherlands is projected to witness a healthy CAGR in the Europe industrial filtration market during the forecast period owing to its role as a logistics and chemical processing hub. The Netherlands hosts a major chemical and petrochemical cluster around the Port of Rotterdam with extensive apply of filtration for catalyst recovery, solvent drying and emissions control. The Netherlands’ industrial facilities around zones such as Chemelot and Botlek have created substantial investments in advanced filtration to comply with emissions standards. According to the Dutch Climate Act and related policy, the government aims to reduce greenhoapply-gas (GHG) emissions by 55 % by 2030 compared to 1990 levels, and achieve climate neutrality by 2050. The Dutch government’s Climate Agreement mandates a 55 % reduction in GHG emissions by 2030, which is driving sectors including food processing and semiconductor manufacturing toward higher-efficiency systems. The Netherlands added several semiconductor pilot lines in 2023 that require high-efficiency clean-room and filtration systems. With a compact but technologically dense industrial footprint, the Netherlands leverages filtration as a critical enabler of both environmental and economic competitiveness.

COMPETITIVE LANDSCAPE

KEY MARKET PLAYERS

Some of the notable key players in the Europe industrial filtration market are

- Filtration Group

- Freudenberg Group

- Pall Corporation

- Hollingsworth & Vose

- MANN+HUMMEL

- Ahlstrom-Munksjö

- Donaldson Co Inc

- Parker Hannifin Corp

- Alfa Laval AB

- 3M Co

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe industrial filtration market primarily employ technological innovation through smart and digital filtration systems to enhance predictive maintenance and energy efficiency. They pursue geographic expansion by establishing localized manufacturing and service hubs to reduce lead times and comply with regional regulations. Strategic acquisitions of niche filtration technology firms allow them to broaden their product portfolios and enter emerging application segments such as hydrogen and semiconductors. Sustainability driven product development focapplying on reusable and regenerable media aligns with EU circular economy mandates and strengthens customer loyalty. Additionally companies invest heavily in partnerships with industrial research institutions to co develop application specific filtration solutions that address tightening emission and purity standards across European member states.

COMPETITION OVERVIEW

The Europe industrial filtration market exhibits intense competition characterized by a mix of global technology leaders and specialized regional players. Competition is driven less by price and more by performance reliability regulatory compliance and lifecycle cost efficiency. Leading companies differentiate through digital integration advanced materials science and application specific engineering tailored to sectors like pharmaceuticals chemicals and semiconductors. The market sees continuous innovation in reusable media smart monitoring and ultra high purity systems in response to tightening EU environmental directives. Regional fragmentation adds complexity as companies must navigate varying national enforcement practices while maintaining standardized solutions. New entrants face high barriers due to certification requirements technical expertise and established relationships between incumbents and industrial finish applyrs. As a result the competitive landscape favors firms with deep regulatory knowledge strong R&D pipelines and agile localized support networks across European industrial corridors.

TOP PLAYERS IN THE MARKET

- Pall Corporation is a globally recognized leader in filtration separation and fluid purification technologies with deep integration across European industrial sectors. The company supplies advanced liquid and air filtration systems to pharmaceuticals chemicals and energy industries throughout Europe. In recent years Pall has intensified its focus on sustainability by launching membrane solutions that support industrial water reapply and emission reduction. It has also expanded its digital filtration monitoring platforms enabling predictive maintenance for European clients. Through strategic collaborations with European research institutes Pall continues to pioneer next generation filtration media aligned with EU environmental directives and circular economy goals.

- Donaldson Company maintains a strong presence in the Europe industrial filtration market through its extensive portfolio of air and liquid filtration products tailored for heavy indusattempt and manufacturing. The company serves key sectors including automotive metalworking and power generation with high efficiency filter systems designed for harsh operating conditions. Recently Donaldson has invested in localized production capabilities in Germany and Italy to shorten supply chains and enhance responsiveness. It has also introduced smart filtration solutions integrated with IoT sensors to support Indusattempt 4.0 adoption across European factories reinforcing its commitment to innovation and operational efficiency in the region.

- Mann+Hummel is a German based global filtration specialist with a legacy of engineering excellence and a dominant footprint in Europe’s industrial and process filtration landscape. The company provides customized filtration systems for applications ranging from cleanroom air purification to industrial coolant recycling. In recent years Mann+Hummel has accelerated its sustainability initiatives by developing regenerable filter media and closed loop filtration units that align with EU circular economy mandates. It has also strengthened its service network across Eastern Europe to support industrial modernization. Through continuous R&D and localized engineering support Mann+Hummel remains deeply embedded in Europe’s industrial decarbonization and efficiency transformation.

MARKET SEGMENTATION

This research report on the Europe industrial filtration market has been segmented and sub-segmented based on categories.

By Type

- Air Filtration

- Liquid Filtration

By Application

- Food & Beverages

- Power Generation

- Semiconductors & Electronics

- Chemicals & Petrochemicals

- Pharmaceutical Manufacturing

- Metals & Mining

- Paper & Paints

- Others

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply