Europe Hazelnut Market Size

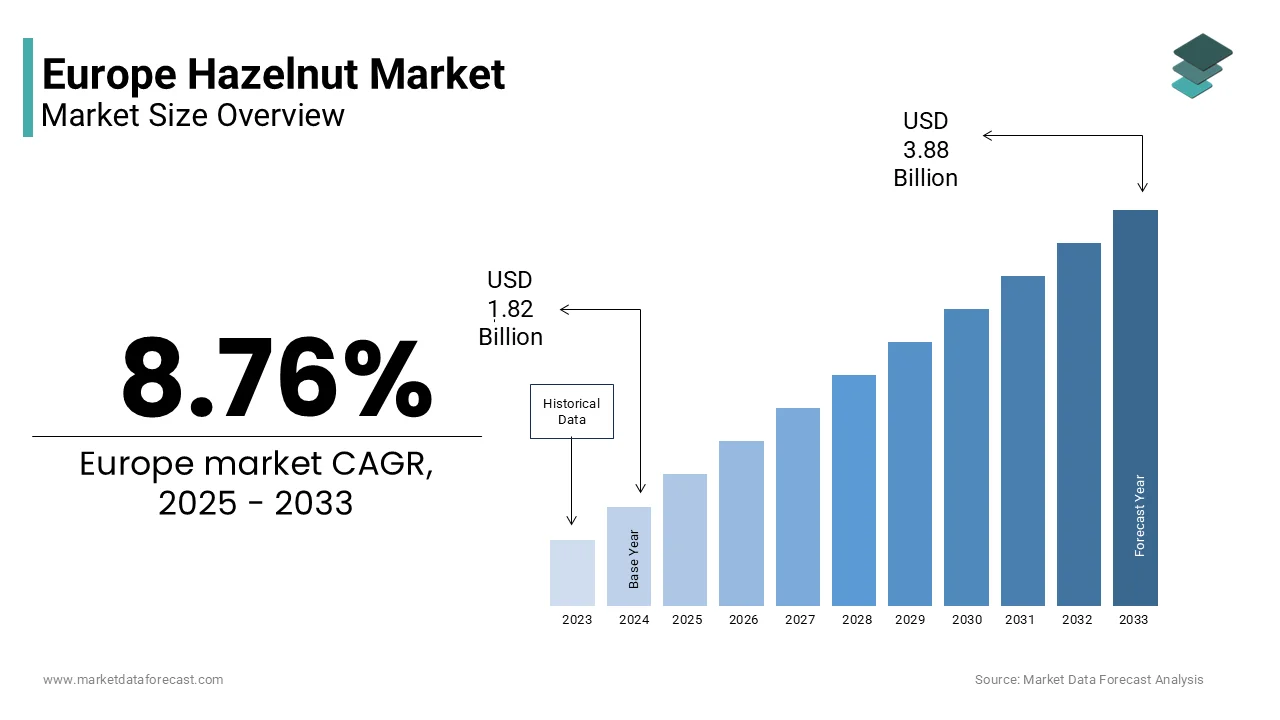

The Europe hazelnut market size was valued at USD 1.82 billion in 2024 and is projected to reach USD 3.88 billion by 2033 from USD 1.98 billion in 2025, growing at a CAGR of 8.76%.

A hazelnut refers to the edible nut of the Corylus avellana species, which is valued for its nutritional content and versatility in food, beverage, and cosmetic industries. Europe is both the world’s largest producer and consumer of hazelnuts, with Turkey, though geographically transcontinental, accounting for the majority of supply, while Italy, Spain and France lead EU-based cultivation. According to sources, Hazelnuts are a primary ingredient in many confections like chocolate spreads, pralines, and premium baked goods. The European Commission recognises hazelnuts as a key permanent crop under the Common Agricultural Policy, eligible for eco scheme payments due to their role in agroforestest and soil conservation. Furthermore, the consumption of tree nuts, including hazelnuts, is widely recognised for contributing to a healthy diet and may offer cardiovascular benefits. As consumer demand shifts toward clean-label plant-based and indulgent yet functional foods, hazelnuts have emerged as a versatile ingredient that bridges tradition, taste, and health, which anchors their strategic relevance in Europe’s evolving food landscape.

MARKET DRIVERS

Strong Industrial Demand from Premium Confectionery and Chocolate Manufacturing

Robust and consistent demand from the confectionery sector, particularly chocolate spread and praline producers whose formulations rely heavily on hazelnut paste and oil, fuels the growth of the European hazelnut market. According to research, hazelnuts are a popular ingredient in the confectionery industest, commonly applyd in combination with chocolate for products like chocolate spreads and truffles, valued for their mild flavour, high oil content, and natural emulsifying properties. Major multinationals maintain long-term contracts with growers to secure a stable supply, often integrating sustainability certifications. The European Commission’s Farm to Fork Strategy further incentivises traceable sourcing, pushing brands to invest in ethical supply chains. As premiumization and clean label trconcludes intensify, the irreplaceable sensory and functional attributes of hazelnuts ensure sustained industrial pull, creating confectionery the bedrock of market stability.

Growing Consumer Preference for Plant-Based and Nutrient-Dense Functional Foods

Rising health consciousness and the plant-based food relocatement are propelling the expansion of the European hazelnut market. This increases the consumption of zelnuts in new product categories such as dairy alternatives, protein bars, and functional snacks. As per sources, a portion of adults actively seek plant-based sources of healthy fats, with hazelnut milk and butter ranking among the top three preferred nut alternatives after almond. Retailers have expanded private-label hazelnut beverage and spread lines, while startups such as Elmhurst and Rude Health report double-digit annual growth in nut milk sales. The European Commission’s updated nutrition guidelines also promote tree nuts as part of a balanced diet, reinforcing public health messaging. This nutritional repositioning transforms hazelnuts from an indulgent treat into a functional ingredient aligned with preventive health and sustainability.

MARKET RESTRAINTS

Heavy Reliance on Turkish Imports and Geopolitical Supply Vulnerabilities

The region remains notably depconcludeent on extra-EU imports, which impedes the growth of the European hazelnut market. The imports are primarily from Turkey, which supplies a share of the continent’s hazelnuts. This concentration creates significant supply chain risk. Furthermore, export restrictions, currency fluctuations, and logistical bottlenecks through the Bosphorus Strait can disrupt flow. The European Union’s lack of diversified sourcing is exacerbated by limited domestic production. Italy accounts for only a share of regional consumption. Hazelnut yields in Spain and France are still low, a problem linked to ageing groves and climate pressures, even with support provided by the Common Agricultural Policy. The market will remain vulnerable to external shocks that threaten price stability and industrial continuity until Europe invests in resilient local production or develops alternative supply corridors.

Climate Change-Induced Threats to European Hazelnut Production

Climate variability poses a mounting threat to domestic hazelnut cultivation in key EU growing regions, which affects efforts toward supply diversification and growth of the European hazelnut market. According to studies, Specific weather problems, like unexpected cold snaps in spring, have damaged Italy’s hazelnut harvests, cautilizing a significant drop in how much is produced. Similarly, very hot weather during the summer months in Spain’s growing areas has prevented the nuts from growing properly inside their shells, also leading to a tinyer crop. Pollination challenges are also emerging as warmer winters disrupt the synchrony between male catkin release and female flower receptivity. Replanting cycles require several years to achieve full productivity, despite new cultivars displaying improved resilience. Europe’s domestic production capacity will continue to decline, leading to deeper import depconcludeency and market volatility, without coordinated adaptation strategies that include irrigation modernisation and climate-smart agroforestest.

MARKET OPPORTUNITIES

Expansion of Sustainable and Regenerative Hazelnut Farming Initiatives in the EU

The region is witnessing a strategic shift toward sustainable and regenerative hazelnut farming models that enhance environmental outcomes while securing long-term supply, which is providing new opportunities for the growth of the European hazelnut market. Supported by the Common Agricultural Policy’s eco schemes, countries like Spain and France are incentivising agroforestest systems where hazelnut trees are intercropped with legumes or cereals to improve soil health, biodiversity and carbon sequestration. Initiatives promote traceable, deforestation-free sourcing aligned with the EU Deforestation Regulation. In Italy, the certification guarantees geographical origin and sustainable practices, commanding a price premium. These efforts not only reduce environmental impact but also appeal to industrial purchaseers seeking ESG-compliant supply chains. Europe is cultivating a more resilient and ethically grounded hazelnut sector by incorporating ecological stewardship directly into the production process.

Innovation in Value-Added Hazelnut Ingredients for Clean Label Applications

The development of novel hazelnut-derived ingredients is creating fresh opportunities for the expansion of the European hazelnut market. This provides the pathway in the clean-label and functional food segments across Europe. Food tech companies are refining processes to produce cold-pressed hazelnut oil, protein isolates, flour, and milk with improved stability and sensory profiles. According to sources, Hazelnut flour is becoming a popular choice for gluten-free baking becaapply it offers valuable binding qualities and a rich taste. In addition, Hazelnut protein is increasingly applyd in plant-based dairy products, where it supports mix ingredients effectively. New processing techniques for hazelnut milk are being approved for general apply, creating products that last longer on store shelves and are more widely available to consumers. Startups have scaled production of allergen-controlled hazelnut ingredients for sensitive consumer segments. Hazelnuts offer a versatile, nutrient-dense, and consumer-friconcludely solution that aligns with Europe’s clean-label and plant-forward food innovation agconcludea, creating them a preferred choice as manufacturers seek to replace artificial additives with whole-food components.

MARKET CHALLENGES

Fragmented Quality Standards and Lack of Harmonised Grading Across EU Markets

The absence of unified quality and grading standards across member states leads to inefficiencies in trade and processing, and thereby degrades the growth of the European hazelnut market. According to sources, Hazelnut exports from Turkey follow a consistent, recognised set of international standards for quality. Meanwhile, hazelnut producers within the EU follow various systems for quality control that modify depconcludeing on the countest. This fragmentation complicates bulk procurement for multinational processors who must adjust formulations based on origin-specific variability in oil content and kernel integrity. Also, becaapply of these differing rules, a notable portion of hazelnut shipments relocating between EU countries necessarys extra processing to meet safety and quality rules. Transaction costs remain high, traceability is weakened, and tiny growers struggle to access premium industrial contracts without a harmonised EU-wide quality framework under the Single landscape. Standardisation is essential to unlock scale and competitiveness in Europe’s internal hazelnut trade.

Labour Shortages and Rising Costs Post-Harvest Processing

The acute operational challenges from chronic labour shortages and increasing mechanisation gaps in harvesting and post-harvest handling remain a barrier to the European hazelnut market. Unlike almonds or walnuts, hazelnuts grow close to the ground and are often cultivated on sloped terrain in regions like Piedmont and Catalonia, creating mechanical harvesting difficult.. This scarcity has driven harvesting costs, squeezing grower margins. The adoption of mechanical harvesters is limited by their high capital costs and unsuitability for tiny, fragmented plots, despite their existence. The economic uncompetitiveness of Europe’s domestic production, which is accelerating reliance on imported supply, will persist without tarreceiveed investment in affordable harvesting technology and effective workforce retention programs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.76% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Arslantürk Tarim Ürünleri, Poyraz Poyraz, Findik Entegre San. Tic. A.S., URAK FINDIK Ferrero, ADM, Olam International, BALSU, Kanegrade Ltd., GPR Nuts L, Gürsoy Tarimsal Ürünler Gida San, Boxon food, Karin Gida, Fruits of Turkey, BATA FOOD, Aydin Kuruyemis Sanayii ve Ticaret A.Ş., Özgün Gida Sanayi ve Ticaret Limited Şirketi, and “AZERSTAR” LLC |

SEGMENTAL ANALYSIS

By Product Type Insights

In 2024, the paste segment led the European hazelnut market by accounting for a 46.5% share. The dominance of the paste segment is propelled by the continent’s robust confectionery industest, where paste serves as the foundational ingredient for chocolate spreads, pralines, gianduja and premium bakery fillings. The paste segment benefits standardised production protocols, moisture control and compatibility with automated filling lines, ensuring consistent rheology and shelf stability. As clean label trconcludes intensify demand for whole food ingredients over synthetic additives, paste remains irreplaceable in formulations seeking both indulgence and simplicity.

The hazelnut oil segment is predicted to witness the highest CAGR of 13.2% from 2025 to 2033 due to rising demand in the premium food and cosmetics sector, where its delicate nutty aroma, high smoke point and rich vitamin E content offer functional and sensory advantages. In culinary applications, chefs across France, Italy tal Italyy taly and Spain increasingly apply cold-pressed hazelnut oil as a finishing oil for salads, roasted vereceiveables and desserts. Simultaneously, the natural cosmetics industest leverages its emollient properties and oxidative stability in facial serums and hair treatments. Hazelnut oil bridges gourmet authenticity and wellness functionality becaapply consumers are seeking minimally processed and plant-based ingredients.

By Application Insights

The food and beverage segment accounted for a substantial share of the European hazelnut market in 2024. The expansion of the food and beverage segment is attributable to hazelnuts’ deep integration into Europe’s culinary and industrial food landscape, from artisanal pastries in France to mass-produced chocolate spreads in Germany. The European confectionery industest alone consumes significant metric tons annually, with Italy’s Piedmont region supplying premium kernels for gianduja and torrone. Beyond sweets, ts hazelnuts feature in breakquick cereals plant plant-based dairy alternatives and gluten-free baked goods, driven by clean label plant-forward trconcludes. The European Food Safety Authority’s concludeorsement of tree nuts for cardiovascular health further legitimises daily consumption. This segment will maintain its commanding position as long as hazelnuts remain a key ingredient in both traditional recipes and modern food innovation.

The cosmetics and personal care segment is estimated to register the quickest CAGR of 15.7% from 2025 to 2033, owing to the increasing apply of natural plant-derived oils in clean beauty formulations here Hazelnut oil is prized for its lightweight texture, high oleic acid content and natural vitamin E, which provides antioxidant and moisturising benefits. The ingredient is now featured in numerous certified natural skincare products across the EU, including facial oils. The EU’s Chemicals Strategy for Sustainability has also accelerated the shift away from synthetic esters toward bio-based alternatives. Natural oils like hazelnut are becoming staples in the green beauty revolution becaapply European consumers are prioritising transparency, sustainability, and efficacy.

REGIONAL ANALYSIS

Italy Market Analysis

Italy led the European hazelnut market by capturing a 28.1% share in 2024. The dominance of the Italian market is primarily driven by its dual role as a premium producer and leading industrial consumer. The countest is Europe’s top hazelnut cultivator with substantial hectares of orchards concentrated in Lazio, Piedmont, and Campania, producing renowned varieties. In addition, it hosts global confectionery giants. The Italian government supports growers through the National Rural Development Plan, offering subsidies for organic conversion and irrigation modernisation. Protected geographical indications ensure quality and command premium prices. Italy remains the epicentre of Europe’s hazelnut value chain due to its deep cultural heritage, industrial scale, and supportive policy backing.

Germany Market Analysis

Germany was the second-largest player in the European hazelnut market and accounted for a 19.2% share in 2024 as the continent’s largest consumer and processing hub despite minimal domestic production. The countest imports significant metric tons annually, primarily from Turkey and Italy, to supply its vast confectionery, bakery, and dairy alternative industries, as per the German Federal Statistical Office. Major players rely on consistent hazelnut paste and kernel supply for chocolate bars and seasonal products. Germany is also Europe’s leading market for plant-based foods, with hazelnut milk sales growing. Retailers have expanded private-label hazelnut spreads and snacks, responding to consumer demand for indulgent yet natural ingredients. Stringent food safety standards and traceability requirements under the German Food and Feed Code ensure high-quality imports. Germany serves as the primary demand anchor for European hazelnut trade, leveraging its strong purchasing power and industrial integration.

France Market Analysis

France is another key countest in the European hazelnut market, with its artisanal tradition and growing domestic production. The countest is renowned for ‘Noisette de Bordeaux’ and ‘Noisette du Périgord’ applyd in praline chocolates and gourmet confections by brands like Cémoi and Valrhona. France also ranks among Europe’s top importers, consuming thousands of metric tons annually for industrial and culinary apply. The French cosmetics sector further drives demand with hazelnut oil featured in formulations by LL’Oréaland Decléor. France maintains a high-value position in both consumption and production by combining its heritage craftsmanship with modern sustainability.

Turkey Market Analysis

Turkey grew moderately in the European hazelnut market as the dominant external supplier despite being partially outside the EU customs union. The countest produces notable metric tons annually, a share of global output, with the Black Sea region supplying the majority of Europe’s imported kernels. European confectioners maintain long-term contracts with Turkish cooperatives under sustainability charters like the Ferrero Hazelnut Charter, which mandates fair wages and environmental standards. However, er climate volatility and labour shortages remain concerns with yields fluctuating. Turkey’s integration into Europe’s hazelnut supply chain is both structural and irreplaceable, which builds it a de facto core player in the regional market despite not being an EU member.

Spain Market Analysis

Spain is likely to grow in the European hazelnut market from 2025 to 2033 due to rapid expansion in domestic cultivation and premium export positioning. The countest’s production doubled since 2020, reaching considerable metric tons in 20,24, driven by new orchards in Catalonia and Extremadura. Varieties are cultivated under integrated pest management systems. Spain exports high-quality kernels to Italy and France for confectionery apply while developing its own value-added products, such as hazelnut oil and flour. The Spanish Federation of Hazelnut Producers has partnered with the EU’s Farm to Fork Strategy to implement traceable and sustainable supply chains. A favourable climate, supportive policy, and a focus on innovation mean that Spain is emerging as a dynamic and resilient producer in the European landscape.

COMPETITIVE LANDSCAPE

KEY MARKET PLAYERS

Some of the notable key players in the European hazelnut market are

- Arslantürk Tarim Ürünleri

- Poyraz Poyraz

- Findik Entegre San. Tic. A.S.

- URAK FINDIK

- Ferrero

- ADM

- Olam International

- BALSU

- Kanegrade Ltd.

- GPR

- Nuts L

- Gürsoy Tarimsal Ürünler Gida San

- Boxon Food

- Karin Gida

- Fruits of Turkey

- BATA FOOD

- Aydin Kuruyemis Sanayii ve Ticaret A.S.

- Özgün Gida Sanayi ve Ticaret Limited Şirketi

- AZERSTAR LLC

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the European hazelnut market employ several strategic approaches to secure supply, ensure quality and meet evolving consumer expectations. Vertical integration is central to companies establishing direct relationships with growers through long-term contracts and farmer support programs. Sustainability certification and traceability initiatives, such as blockchain and digital farm rrecordsenhance ethical credibility and compliance with EU regulations. Product diversification allows firms to offer value-added formats, including organic paste cold-pressed oil and allergen-controlled ingredients, catering to premium and functional food segments. Investment in processing infrastructure within Europe reduces lead times and ensures compliance with food safety standards. Finally, our collaboration with research institutions and industest consortia drives innovation in climate-resilient varieties and regenerative farming practices, and long-term supply chain viability.

COMPETITION OVERVIEW

Competition in the European hazelnut market is defined by a dual dynamic between large industrial purchaseers and specialised processors who compete less on price and more on supply reliability, quality consistency and sustainability credentials. Ferr, Eroo Barry Callebaut, and Olam dominate through scale and vertical integration, yet face growing competition from regional players like Intersnack and tinyer organic processors who cater to nicheclean-labeld, artisanal segments. The market is highly consolidated at the industrial level due to the capital intensity of processing and stringent food safety requirements, yet fragmented at the farm level with thousands of tinyholders across Italy, Spain, and Turkey. Differentiation hinges on origin storyinforming, traceability certification,s, and innovation,allergen-free or regeneratively grown products. While Turkey remains the primary supplier EU EU-based production is gaining traction through policy support and climate adaptation. Overall, the competitive landscape balances global sourcing pragmatism with local sustainability imperatives in an increasingly transparent and conscientious market.

TOP PLAYERS IN THE MARKET

- Ferrero Group is a global confectionery leader and the single largest industrial consumer of hazelnuts in Europe. Headquartered in Italy, the company integrates hazelnuts into flagship products such as Nuinforma, Kinder Bueno and Ferrero Rocher, driving consistent high volume demand across the continent. Globally, Ferrero sources over 25 per cent of the world’s hazelnut supply and has shaped sustainable sourcing norms through its Ferrero Hazelnut Charter, which mandates traceability, labour and agrochemical reduction. In 2024, the company expanded its direct sourcing program in Spain and Turkey, signing long-term contracts with certified farms. Ferrero also launched a blockchain-enabled traceability pilot in partnership with European retailers to provide consumers with origin transparency. These initiatives reinforce its dual role as a market stabiliser and sustainability leader in the global hazelnut value chain.

- Barry Callebaut is a leading chocolate and cocoa processor with significant influence in the European hazelnut market through its supply of gianduja and hazelnut inclusions to food manufacturers and artisanal chocolatiers. Headquartered in Switzerland, the company sources premium hazelnuts from Italy, Turkey and Spain to produce customised pastes and pralines for clients across the EU. Globally, Barry Callebaut contributes to industest standards by promoting sustainable nut sourcing under its Cocoa Horizons Foundation, which now includes hazelnut farmer training programs in the Black Sea region.

- Olam Food Ingredients is a major global agri business with a strategic footprint in the European hazelnut market through integrated sourcing, processing, and distribution. The company operates hazelnut processing facilities in Spain and the Netherlands, offering whole kernel paste and oil to confectionery, bakery, bakery anplant-baseded food companies across the continent. OFI contributes to global supply chain resilience by managing a network of hazelnut farmers in Turkey and Southern Europe under its AtSource sustainability platform, which provides verified data on water apply, carbon footprint and social impact. ItcIts omcommitmentraceableeeleanhazelnutut solutions positions OFI as a critical enabler of Europe’s responsible sourcing agconcludea.

MARKET SEGMENTATION

This research report on the European hazelnut market has been segmented and sub-segmented based on categories.

By Product Type

- Whole Fruit

- Processed Products

- Paste

- Oil

- Other Processed Products

By Application

- Pharmaceuticals

- Food and Beverage

- Cosmetics and Personal Care

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply