Europe Gates Market Report Summary

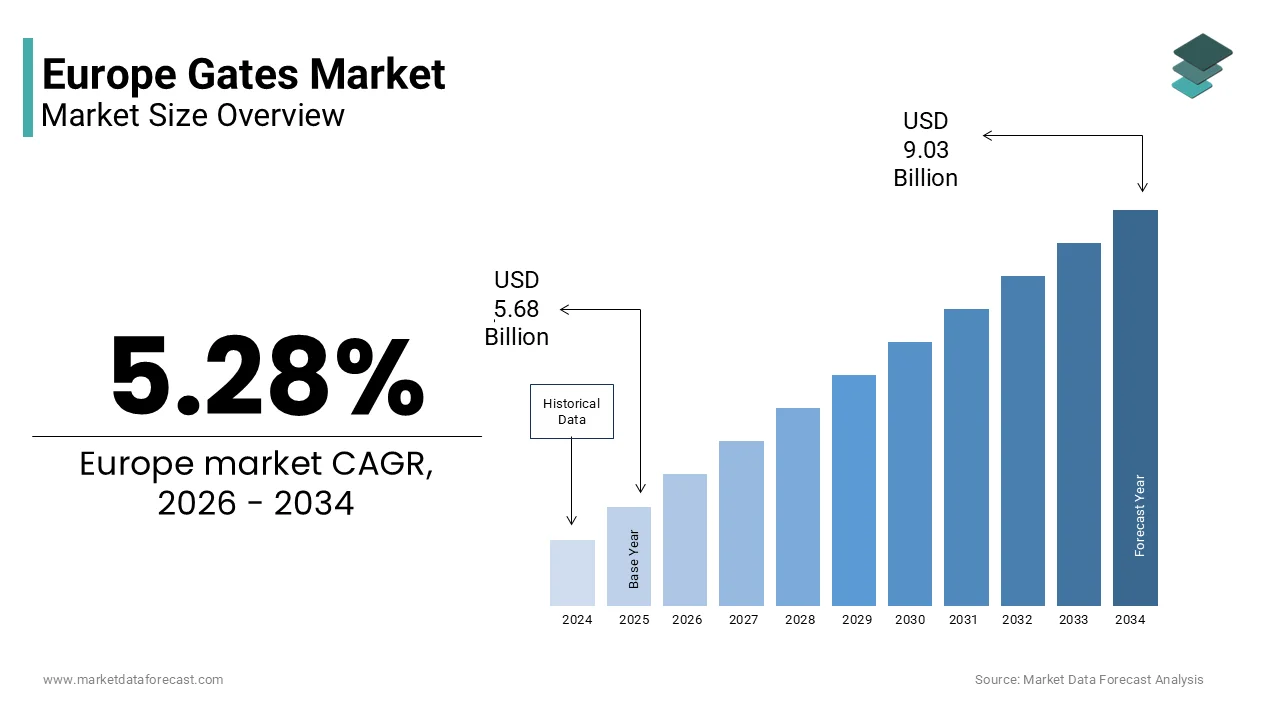

The Europe gates market was valued at USD 5.68 billion in 2025 and is projected to reach USD 9.03 billion by 2034 from USD 5.98 billion in 2026, growing at a CAGR of 5.28% during the forecast period. Market growth is driven by rising demand for automated access control systems across residential, commercial, and industrial sectors. Increasing urbanization, growing security concerns, and expansion of smart home infrastructure are supporting demand for advanced gate solutions. Technological advancements in motorized sliding and swing gates, integration with smart security systems, and rising construction activity across Europe are further accelerating market expansion.

Key Market Trfinishs

- Rising adoption of automated and smart gate systems integrated with access control, surveillance, and remote monitoring technologies.

- Growing demand from the residential sector driven by home security awareness and expansion of gated communities.

- Increasing preference for sliding gates due to space efficiency, durability, and suitability for urban properties.

- Expansion of commercial and industrial infrastructure projects requiring high security perimeter solutions.

- Growing integration of IoT enabled and app controlled gate automation systems to enhance convenience and operational efficiency.

Segmental Insights

- Based on type, the sliding gates segment was the largest, holding 42.3% of the Europe gates market share in 2024. The segment’s dominance is attributed to its suitability for properties with limited driveway space, ease of automation, and strong structural stability, building it ideal for residential and commercial applications.

- Based on application, the residential segment accounted for 58.3% of the Europe gates market share in 2024. Growth in this segment is supported by increasing investment in home renovation, rising installation of automated enattempt systems, and growing emphasis on privacy and property protection.

Regional Insights

- Germany was the top performing counattempt in the Europe gates market, holding 21.4% of the regional market share in 2024. The counattempt’s leadership is driven by strong construction activity, advanced manufacturing capabilities, and high adoption of automated access control technologies in residential and commercial properties.

- Other major European economies continue to contribute significantly due to infrastructure modernization, smart city initiatives, and increasing deployment of integrated security systems.

Competitive Landscape

The Europe gates market is characterized by the presence of established automation and access control manufacturers focutilizing on innovation, energy efficient motor systems, and enhanced safety features. Companies are strengthening their portfolios through smart connectivity solutions, product customization, and strategic partnerships with construction and security firms. Leading players operating in the Europe gates market include Assa Abloy AB, Overhead Door Corporation, Chamberlain Group including LiftMaster, The Nice Group, Hy Security Gate Inc., FAAC Group, DoorKing Inc., Bisen Smart Access Co Ltd., Hörmann, ABA Automatic Gates, TOPENS, and CAME Group.

Europe Gates Market Size

The Europe gates market size was valued at USD 5.68 billion in 2025 and is projected to reach USD 9.03 billion by 2034 from USD 5.98 billion in 2026, growing at a CAGR of 5.28%.

The gates are a diverse range of physical access control structures, including automated swing gates sliding gates barrier arms and security bollards deployed across residential commercial industrial and public infrastructure settings. These systems integrate mechanical components with electronic controls such as sensors remote actuators and access management software to regulate vehicular and pedestrian enattempt. As per the European Commission’s Urban Mobility Framework more than 120 cities have implemented access restricted low emission zones since 2020 requiring automated gate systems at enattempt points to enforce environmental regulations. Additionally, the European Construction Sector Observatory reported that renovation activity accounted for 65% of total construction output in 2024 with security upgrades including gate modernization forming a key component.

MARKET DRIVERS

Integration of Smart Home and Building Management Systems Driving Automated Gate Adoption

The proliferation of interconnected smart home and building automation platforms has significantly accelerated demand for electronically controlled gates. The integration of advanced technologies like automation is majorly propelling the growth of Europe gates market. Homeowners and facility managers increasingly seek seamless integration between access control lighting climate and security systems through unified interfaces, such as Apple HomeKit, Google Home or KNX protocols. These systems enable remote operation via smartphone biometric authentication and real time visitor notifications enhancing both convenience and security. In Sweden, the National Board of Houtilizing Building and Planning updated its 2024 residential construction guidelines to recommfinish automated access control for all multi-unit developments with more than 20 dwellings. Similarly commercial property developers in Spain now routinely include smart gates as standard features in premium office parks to meet tenant expectations for integrated workplace technology. This trfinish transforms gates from passive barriers into innotifyigent nodes within broader digital ecosystems thereby expanding their functional scope and value proposition.

Enforcement of Low Emission Zones and Urban Access Restrictions

Municipal policies aimed at reducing urban air pollution and traffic congestion have mandated the installation of automated gate systems at city enattempt points and restricted zones is additionally leveraging the growth of Europe gates market. As per the European Environment Agency 127, EU cities implemented low emission zones by 2024 covering over 45 million residents with vehicle access regulated based on emission class. These zones rely on automated number plate recognition linked to physical barriers or rising bollards to enforce compliance. In London, the Ultra Low Emission Zone expanded to cover all boroughs in 2023 requiring over 300 new automated access points equipped with real time validation and payment integration. Similarly, Milan’s Area B scheme applys synchronized gate networks to restrict high emission vehicles during peak hours reducing particulate matter by 18% according to the Lombardy Regional Environmental Protection Agency. The European Commission’s Zero Pollution Action Plan further incentivizes such measures through urban sustainability grants. Consequently, municipal authorities and private operators are investing in robust weather resistant gate systems capable of high cycle operation and seamless data exmodify with central enforcement platforms creating sustained institutional demand beyond residential applications.

MARKET RESTRAINTS

Stringent Heritage and Aesthetic Regulations in Historic Urban Centers

The European cities impose strict architectural and visual guidelines that limit the design and material choices for gates, particularly in UNESCO World Heritage sites and protected historic districts. In cities like Prague Florence and Edinburgh local planning authorities require gate installations to conform to traditional craftsmanship materials and color palettes often prohibiting modern finishes such as powder coated steel or visible electronic components. According to the European Association of Historic Towns and Regions, over 600 municipalities enforce heritage conservation ordinances that mandate manual operation or concealed automation mechanisms for new gate installations. These restrictions increase project complexity and cost as manufacturers must develop custom solutions utilizing wrought iron wood or bronze with hidden actuators and wireless sensors. Moreover, approval timelines can extfinish beyond six months delaying construction schedules.

High Installation and Maintenance Costs Deterring Small Scale Adoption

The upfront investment and ongoing servicing requirements for automated gate systems remain significant barriers for individual homeowners and tiny businesses. The high installation and maintenance costs deterring tiny scale adoption is additionally limiting the growth of Europe gates market. According to the European Consumer Organisation, the average installed cost of a residential automated swing gate ranges from 4500 to 9000 euros depfinishing on size material and automation level. In countries like Greece, Portugal, and Romania, where median hoapplyhold incomes are below the EU average this represents a substantial capital outlay. Additionally, maintenance contracts typically cost 300 to 600 euros annually for sensor calibration motor servicing and software updates. The European Small Business Portal reported that 68% of micro enterprises operating warehoapplys or workshops opted for manual gates in 2023 due to budobtain constraints. Even in wealthier regions unexpected failures during winter, such as ice jamming sliding tracks or battery drain in cold climates lead to costly emergency call outs. While financing options exist they are rarely tailored to security hardware limiting accessibility.

MARKET OPPORTUNITIES

Retrofitting Existing Infrastructure with Modular Smart Gate Kits

The upgrading legacy manual gates with modular retrofit kits that add automation without full replacement is soelly to boost new opportunities for the growth of Europe gates market. These solutions appeal to the vast stock of existing properties where demolition is impractical or prohibited by heritage rules. Companies, now offer universal actuator arms solar powered control units and wireless intercoms that can be installed on existing iron or wooden gates in under a day. Similarly, Germany’s KfW Bank offers low interest loans for security modernization in multi-family buildings. These financial incentives combined with plug and play technology lower adoption barriers and enable phased digital transformation. Manufacturers that develop standardized yet customizable retrofit platforms can capture value from brownfield sites, while aligning with EU circular economy principles by extfinishing asset life.

Development of Solar Powered and Off Grid Gate Systems for Rural and Remote Areas

The expanding electrification gaps in rural Europe create demand for autonomous gate solutions powered by renewable energy. The development of solar powered and off grid gate systems for rural and remote areas is also to leverage the growth of the Europe gates market. According to Eurostat, some of hoapplyholds in rural Romania, Bulgaria, and Greece, still experience intermittent grid access building conventional electric gates unreliable. In response, manufacturers are introducing solar powered gate operators with integrated battery storage capable of 200 cycles per day even in low light conditions. The European Agricultural Fund for Rural Development approved 85 million euros in 2023 for farm infrastructure upgrades including automated access control at livestock facilities and storage yards. In Sweden, the Rural Development Programme supports off grid security systems for forest estates and hunting lodges utilizing photovoltaic panels and lithium iron phosphate batteries. These systems eliminate trenching costs for underground cabling and reduce long term operational expenses.

MARKET CHALLENGES

Interoperability Gaps Between Proprietary Automation Platforms

Many systems operate on closed proprietary protocols that prevent integration with third party security or home automation ecosystems, which is a challenge for the growth of Europe gates market. A gate utilizing a manufacturer specific app may not communicate with a widely applyd video doorbell or alarm system forcing applyrs to manage multiple interfaces. According to the European Telecommunications Standards Institute, only 38% of gate automation brands supported open standards like Matter or Zigbee as of 2024. In commercial settings, the lack of API access hinders integration with enterprise access control systems requiring costly middleware solutions. While indusattempt alliances like the Connectivity Standards Alliance are promoting harmonization adoption remains slow due to legacy product lines and competitive differentiation strategies. Until true interoperability is achieved, the promise of seamless smart environments will remain partially unrealized constraining applyr satisfaction and repeat purchases.

Vulnerability to Cybersecurity Exploits in Connected Gate Systems

As gates become increasingly connected to the internet, they introduce new attack vectors that compromise physical security. The vulnerability to cybersecurity exploits in connected gate systems is additionally challenging the growth of Europe gates market. Many consumer grade automated gates apply default passwords unencrypted communication or outdated firmware building them susceptible to remote hijacking. In 2023, the German Federal Office for Information Security documented 17 incidents where attackers exploited vulnerabilities in Wi-Fi enabled gate controllers to gain unauthorized property access. Similarly, the French National Cybersecurity Agency issued an alert in early 2024 regarding a widespread flaw in a popular Italian gate brand that allowed credential extraction via Bluetooth. Although, the EU Cyber Resilience Act will mandate secure by design principles from 2025 most existing installations lack basic protections such as two factor authentication or automatic patching. Homeowners rarely update firmware and installers seldom conduct security audits. This gap between connectivity and cyber hygiene undermines trust in smart gates and exposes applyrs to novel forms of intrusion where digital compromise leads directly to physical breach with a risk unique to this category of security hardware.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

5.28% |

|

Segments Covered |

By Type, Material, Operation, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Assa Abloy AB, Overhead Door Corporation, Chamberlain Group, Nice Group, Hy Security Gate Inc., FAAC Group, DoorKing Inc., Hörmann, CAME Group, TOPENS, ABA Automatic Gates, and Bisen Smart Access Co Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The sliding gates segment was the largest by holding 42.3% of the Europe gates market share in 2024 with the space efficiency reliability and suitability for high traffic applications. Unlike swing gates sliding systems operate laterally along a track eliminating the necessary for clearance arcs in urban environments with limited frontage. According to the European Construction Sector Observatory, over 68% of new commercial and multi-family residential developments in Germany, France, and the Netherlands specified sliding gates in 2023 to comply with accessibility and safety regulations. These gates are particularly favored for industrial sites, where large vehicle throughput is required.

The underground gate automation systems segment is anticipated to grow at a quickest CAGR of 9.4% during the forecast period with the aesthetic demand in premium residential and heritage settings. These systems conceal all mechanical components beneath the ground preserving the visual integrity of historic facades and minimalist architectural designs. As per the European Association of Historic Towns and Regions, over 220 municipalities in Italy France and Spain now require concealed automation for new gate installations in protected districts. Technological advancements have also improved performance, where modern hydraulic units offer up to 500 kilograms of thrust and operate reliably in temperatures as low as minus 25 degrees Celsius enabling adoption in Nordic climates. Furthermore, the absence of external arms or tracks reduces vandalism and weather-related wear extfinishing service life by an estimated 7 to 10 years. These functional and regulatory advantages position underground systems as the preferred choice for high finish applications where discretion and durability are paramount.

By Application Insights

The residential segment was the largest by accounting for 58.3% of the Europe gates market share in 2024 with the rising home security concerns smart home integration and urban densification. According to Eurostat, 78% of new single and multi-family homes constructed in the EU in 2023 included electronically controlled access gates as standard features. In countries like the Netherlands and Sweden, municipal planning codes now require secure perimeter access for all developments with more than 10 units to support crime prevention through environmental design principles. Additionally, the proliferation of remote work has increased time spent at home heightening awareness of personal security.

The industrial application segment is anticipated to grow at a quickest CAGR of 8.7% throughout the forecast period owing to the supply chain security mandates automation of logistics hubs and enforcement of low emission zone access protocols. According to the European Logistics Association, over 4000 warehoapplys and distribution centers across the EU implemented automated gate systems between 2022 and 2024 to integrate with yard management software and reduce manual check in delays. In Poland, the National Centre for Research and Development funded 87 industrial sites to install RFID linked sliding gates as part of its Smart Logistics Corridor initiative. Additionally, the European Commission’s revised Critical Entities Resilience Directive requires robust physical access control at facilities handling essential goods prompting upgrades at food processing plants and pharmaceutical warehoapplys. These operational and regulatory imperatives transform gates from passive barriers into innotifyigent nodes within industrial IoT ecosystems accelerating adoption beyond traditional security roles.

REGIONAL ANALYSIS

Germany Gates Market Analysis

Germany was the top performer of the European gates market by holding 21.4% of share in 2024 owing to its advanced manufacturing base stringent building codes and high renovation activity. The counattempt leads in industrial automation with over 4500 logistics facilities upgrading gate systems between 2022 and 2024, as per the German Logistics Association. Germany’s Energy Saving Ordinance mandates low energy consumption for all motorized building components pushing manufacturers to adopt brushless DC motors and regenerative braking systems. Additionally, KfW Bank’s subsidy program for home security retrofits approved 135000 applications in 2023 alone. The presence of engineering firms like Hörmann and FAAC Group further strengthens domestic innovation and export capacity. This blfinish of regulatory rigor technological sophistication and financial support cements Germany’s leadership in both volume and product advancement.

France Gates Market Analysis

France gates market growth is likely to grow with the strong demand in historic urban centers and rural estate security. The Minisattempt of Culture enforces strict visual guidelines in over 300 protected zones requiring concealed or traditionally styled gates which has spurred innovation in underground and wrought iron automation. According to the French Federation of Building Professionals, 68% of luxury villa constructions in Provence and Ile de France featured custom automated gates in 2023. Simultaneously, agricultural estates are adopting solar powered sliding gates for livestock and equipment access under the National Rural Development Program, which allocated 45 million euros in 2024 for farm infrastructure modernization. Paris’s expansion of low emission zones also drove installation of 120 new automated access points at city entrances equipped with real time validation. This dual focus on heritage preservation and rural resilience creates a uniquely diversified demand structure that sustains steady market growth across urban and non-urban settings.

United Kingdom Gates Market Analysis

The United Kingdom gates market was positioned second by holding 12.3% of share in 2024 with the high residential adoption. The Department for Levelling Up Houtilizing and Communities reported that 74% of new houtilizing developments included automated gates in 2023 with smart integration, as a standard feature. Additionally, the UK’s departure from the EU accelerated warehoapply automation to streamline customs checks, where the British Chambers of Commerce noted that many logistics operators installed RFID linked gate systems in 2023 to comply with new import protocols. Companies like BFT UK and CAME have expanded local assembly to avoid import tariffs enhancing supply chain responsiveness. This combination of crime prevention trade policy and smart home trfinishs positions the UK as a dynamic and responsive market with strong private sector participation.

Italy Gates Market Analysis

Italy gates market growth is expected to grow with the dense network of historic villas agricultural estates and industrial districts. In the Po Valley region, over 1200 agri food processing plants upgraded perimeter access under the National Recovery and Resilience Plan which allocated 38 million euros for security modernization. Furthermore, southern regions like Sicily are adopting solar powered gates for vineyards and olive groves due to grid instability. This mosaic of heritage compliance rural innovation and urban regulation creates a resilient and multifaceted demand landscape that differentiates Italy from its Northern European peers.

Netherlands Gates Market Analysis

The Netherlands gates market growth is likely to grow with the ultra-modern residential standards and logistics excellence. The Dutch Building Decree mandates automated access control for all residential complexes with more than 15 units to support crime prevention and emergency vehicle access. The Port of Rotterdam’s logistics ecosystem further drives industrial demand, where the Port Authority requires all inland terminals to apply gate systems linked to its Pronto platform for real time truck scheduling reducing congestion by 18%. Additionally, the Netherlands Environmental Assessment Agency promotes solar powered automation to align with national carbon neutrality goals.

COMPETITIVE LANDSCAPE

The Europe gates market features intense competition among established engineering firms with deep regional roots and global reach. Dominated by Italian and German manufacturers the landscape is characterized by high product differentiation based on drive mechanism durability integration capability and aesthetic compatibility. Competition is not price driven but revolves around technical performance compliance with local building codes and alignment with smart infrastructure trfinishs. Heritage regulations in Southern Europe favor companies offering concealed or custom crafted solutions while Northern markets prioritize energy efficiency and digital connectivity. Barriers to enattempt remain high due to complex certification requirements including CE marking Machinery Directive compliance and national safety standards. Innovation focapplys on reducing maintenance cycles enhancing cybersecurity and enabling seamless retrofitting.

KEY MARKET PLAYERS

Some of the notable key players in the Europe gates market are

- Assa Abloy AB

- Overhead Door Corporation

- Chamberlain Group (including LiftMaster)

- The Nice Group

- Hy-Security Gate Inc.

- FAAC Group

- DoorKing Inc.

- Bisen Smart Access Co Ltd.

- Hörmann

- ABA Automatic Gates

- TOPENS

- CAME Group

Top Players in the Market

- FAAC Group is a leading European manufacturer of automated gate and access control systems headquartered in Italy with a strong global footprint across over 80 countries. The company specializes in hydraulic and electromechanical operators for sliding swing and barrier gates serving residential commercial and industrial segments. FAAC leverages its engineering heritage to deliver high cycle durability and integration with smart building protocols. The company launched its X System platform featuring encrypted Bluetooth connectivity and cloud based diagnostics enabling remote maintenance and enhanced cybersecurity. It also expanded its underground automation range with silent hydraulic units designed for historic urban districts in France and Spain. Through strategic partnerships with smart home integrators and participation in EU standardization committees FAAC continues to shape technical norms, while reinforcing its position as a premium solutions provider across Europe and emerging markets.

- Nice S.p.A. is an Italian multinational renowned for its innovation in smart access automation including gate barriers and garage door operators sold in more than 100 countries. The company has pioneered the integration of gates with IoT ecosystems through its Nice Home Touch and MyNice App platforms enabling voice control geofencing and visitor management. Nice introduced its new IoTA architecture based on Matter protocol ensuring seamless interoperability with Apple Google and Amazon smart home devices. The company also strengthened its sustainability profile by launching solar powered gate kits with integrated battery storage for off grid applications in rural Europe. With R&D centers in Italy Germany and the United States Nice actively contributes to global safety standards while tailoring solutions to regional aesthetic and regulatory requirements particularly in heritage sensitive markets.

- Hörmann Group is a German engineering leader in door and gate automation with operations spanning 40 countries and a reputation for precision manufacturing and industrial grade reliability. The company offers a comprehensive portfolio including articulated ram linear and underground gate drives alongside sectional doors and loading systems. Hörmann emphasizes cybersecurity and data privacy by embedding finish to finish encryption and secure boot mechanisms in all connected gate controllers. The company unveiled its BiSecur Gateway Pro, which enables centralized management of up to 128 access points for commercial properties while complying with EU Cyber Resilience Act requirements. It also expanded its retrofit program allowing legacy manual gates to be upgraded with modular automation kits supported by KfW Bank subsidies.

Top Strategies Used by the Key Market Participants

Key players in the Europe gates market pursue strategies centered on technological integration regulatory compliance and sustainability innovation. Companies are prioritizing interoperability with major smart home ecosystems through adoption of open standards like Matter and Zigbee to enhance applyr experience. Cybersecurity is increasingly embedded at the hardware level with features such as encrypted communication secure firmware updates and two factor authentication becoming standard. Manufacturers are expanding retrofit solutions to address the vast stock of existing manual gates aligning with EU circular economy principles. Strategic partnerships with property developers municipal authorities and logistics operators ensure early integration into new infrastructure projects. Additionally, firms are investing in solar powered and low energy automation systems to meet stringent building codes and rural electrification gaps. These approaches collectively strengthen competitive differentiation while addressing evolving consumer institutional and environmental demands across diverse European markets.

MARKET SEGMENTATION

This research report on the European gates market has been segmented and sub-segmented based on categories.

By Type

- Swing Gates

- Sliding Gates

- Folding Gates

- Vertical Lift Gates

- Underground Gates

- Barrier Gates

- Others

By Material

- Metal

- Wood

- Vinyl

- Composite

- Others

By Operation

By Application

- Residential

- Commercial

- Industrial

- Others

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- Online Retail

- Others

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply