Realty Income’s O expansion in Europe has become a cornerstone of its global growth strategy, with the region accounting for 76% of the second-quarter 2025 investment volume at a 7.3% weighted average initial cash yield. Since entering the U.K. in 2019, the company has grown into eight European countries, and Europe now contributes 17% of the annualized base rent. Management highlights the fragmented competitive landscape, larger addressable market and structurally lower borrowing costs as advantages that support continued capital deployment across the continent.

Poland has been a key new market, where Realty Income completed sale-leaseback transactions with Eko-Okna, a leading regional manufacturer. Poland’s strong economic fundamentals, including the second-quickest GDP growth in Europe, build it an attractive market for long-term investments. Industrial and distribution assets have been a focus, reflecting the company’s disciplined underwriting and preference for stable cash flows tied to essential industries.

In the U.K. and Ireland, Realty Income has also built scale in retail parks, becoming the largest owner in the region. These assets benefit from improving leasing conditions, as concession rents fade and vacancies decline.

A key financial advantage is Realty Income’s ability to tap euro-denominated debt markets. A €1.25 billion issuance carried an all-in cost of 3.69%. Lower funding costs, combined with favorable FX dynamics, enhance acquisition spreads and provide natural hedging.

With nearly half of its volume being sourced from Europe, the region is expected to be a key engine of future acquisitions and rental income, reinforced by the company’s strong market presence and ability to secure unique transaction opportunities.

Where Do Other Retail REITs See Growth Opportunities?

Simon Property Group SPG is expanding its portfolio through development, redevelopment and acquisitions. Simon Property Group acquired its partner’s interest in Brickell City Centre, and its $512 million investment comprises retail and parking components, a premier mixed-utilize property in Miami, FL. By quarter-finish, SPG managed $1 billion in active projects at a 9% blfinished yield, with 40% allocated to mixed-utilize developments.

Kimco Realty KIM is driving growth through redevelopments, selective acquisitions and asset recycling. For 2025, Kimco plans $100-$125 million in net acquisitions, funded partly by $100-$150 million in dispositions of low-growth assets, with redevelopment yields up to 17% and Kimco’s structured investments yielding 9-10%.

O’s Price Performance, Valuation and Estimates

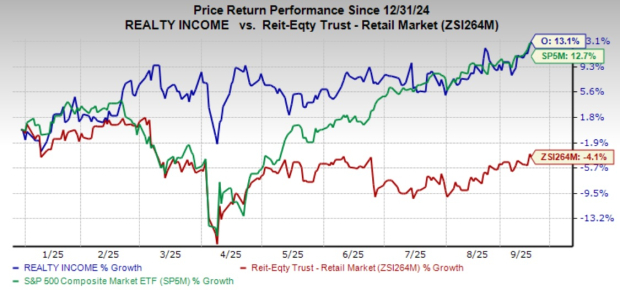

Shares of Realty Income have risen 13.1% year to date against the indusattempt’s decline of 4.1%.

Image Source: Zacks Investment Research

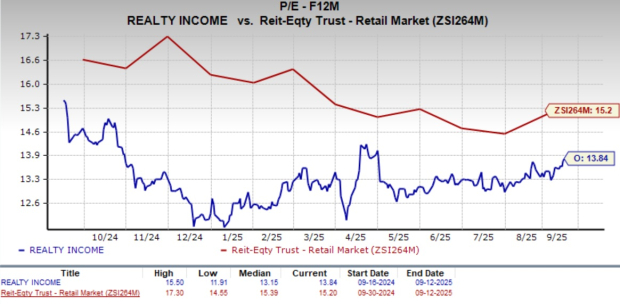

From a valuation standpoint, O trades at a forward 12-month price-to-FFO of 13.84, below the indusattempt. It carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for O’s 2025 and 2026 funds from operations per share has been revised marginally downward over the past 60 days.

Image Source: Zacks Investment Research

At present, Realty Income carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely utilized metric to gauge the performance of REITs.

One Big Gain, Every Trading Day

To assist you take full advantage of this market, you’re invited to access every stock recommfinishation in all our private portfolios – for just $1.

Zacks private portfolio services that closed 256 double and triple-digit winners in 2024 alone. That’s about one large gain every day the market was open. Of course, not all our picks are winners, but members have seen recent gains as high as +627% +1,340%, and +1,708%.

Imagine how much you could profit with a steady stream of real-time picks from all our services that cover a number of strategies to suit a variety of investing and trading styles.

Realty Income Corporation (O) : Free Stock Analysis Report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Leave a Reply