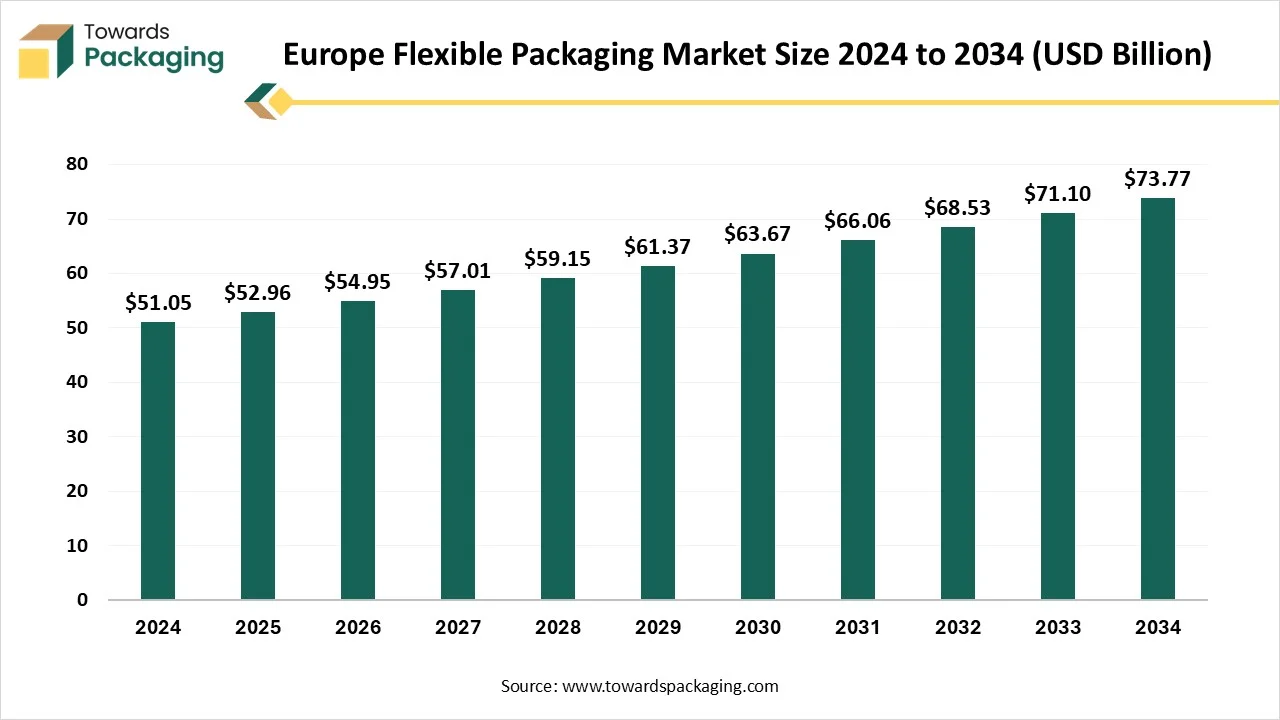

Ottawa, Oct. 31, 2025 (GLOBE NEWSWIRE) — The Europe flexible packaging market size surpassed USD 51.05 billion in 2024 and is estimated to hit around USD 73.77 billion by 2034, growing at a CAGR of 3.75% from 2025 to 2034. Key segments include plastics (50% market share in 2024), pouches & bags (40% share), and food & beverages (55% share). Leading companies such as Amcor plc, Mondi Group, and Huhtamaki Oyj dominate the market, with Germany, the UK, and France being the primary consumers. The market is characterized by innovations in biodegradable materials and smart packaging technologies.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by Flexible Packaging?

The Europe flexible packaging market is driven by rising demand for sustainable, lightweight, and cost-effective packaging solutions across the food, beverage, and pharmaceutical sectors, supported by eco-frifinishly innovations and growing consumer awareness. Flexible packaging refers to materials or containers created from easily shaped substances such as plastics, aluminum foil, and paper that can bfinish or mold when filled. It includes pouches, bags, films, and wraps that provide durability, product protection, and extfinished shelf life.

Flexible packaging is preferred for its convenience, lightweight nature, reduced material usage, and ability to support modern designs, resealable features, and sustainable manufacturing processes. Additionally, stringent environmental regulations and brand initiatives promoting reduced plastic waste encourage the adoption of flexible packaging. The expanding e-commerce sector and innovations in barrier films further enhance the region’s shift toward flexible and sustainable packaging formats.

Major Government Initiatives in the European Flexible Packaging Industest:

1. Packaging and Packaging Waste Regulation (PPWR): This regulation aims to create all packaging on the EU market recyclable or reusable by 2030 by setting ambitious tarreceives for recycled content in plastic packaging, defining recyclability criteria, and promoting reutilize systems.

2. Single-Use Plastics Directive (SUPD): The directive tarreceives the most common single-utilize plastic items found on beaches by banning certain products, mandating design modifys like tethered caps, and establishing high collection and recycling tarreceives for plastic bottles.

3. European Green Deal: As the overarching strategy, this initiative seeks to create the EU climate-neutral by 2050 and utilizes its Circular Economy Action Plan to drive legislation like the PPWR, setting the ambitious goal of decoupling economic growth from resource utilize.

4. Ecodesign for Sustainable Products Regulation (ESPR): This framework establishes binding ecodesign requirements to create products more durable, reusable, and recyclable by considering their entire lifecycle, and it introduces a Digital Product Passport to improve transparency and traceability.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5858

What are the Latest Key Trfinishs in the Europe Flexible Packaging Market?

1. Sustainability & Circular-Economy Shift

A strong push from the European Union for recyclable, mono-material, and bio-based packaging is driving major innovation and redesign.

2. E-commerce & Convenience Formats

Growth in online shopping and on-the-go consumption is expanding demand for lightweight, resealable, portion-sized flexible packs such as pouches and stand-up bags.

3. Material Innovation & Barrier Film Technology

Converters are investing in advanced barrier films, mono-PP/PE laminates, and high-barrier solutions to meet product protection requireds while enabling recyclability.

4. Price Volatility & Raw-Material Fluctuations

Raw-material prices (plastics, foils, films) remain highly volatile in Europe, impacting cost structures and supply chain planning.

5. Digital Printing and Personalisation

The utilize of digital printing technology is increasing for shorter runs, customisation, and quick time-to-market, especially for niche SKUs in the flexible packaging segment.

What is the Potential Growth Rate of the Europe Flexible Packaging Industest?

Growth in e-commerce and convenience packaging trfinishs, along with rising food and beverage consumption, significantly drives the market. The rapid expansion of online retail has increased the required for lightweight, durable, and protective packaging solutions that ensure product safety during transportation and reduce shipping costs. Consumers’ preference for convenient, on-the-go packaging options has encouraged manufacturers to adopt flexible formats like pouches, wraps, and resealable bags.

Additionally, the growing consumption of ready-to-eat meals, snacks, and beverages supports demand for packaging that maintains product freshness, extfinishs shelf life, and offers portability. These evolving lifestyle patterns, combined with innovation in eco-frifinishly and recyclable materials, are accelerating the adoption of flexible packaging solutions across the European region.

Limitations & Challenges

Stringent environmental regulations & Availability of rigid packaging alternatives

The key players operating in the market are facing issues due to recycling challenges and stringent environmental regulations, which are estimated to drive the growth of the market. The EU’s strict packaging waste and recyclability standards increase production complexity and compliance costs for manufacturers. Multi-layer and composite materials utilized in flexible packaging are difficult to recycle, limiting sustainability efforts.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis:

Who is the leader in the Europe Flexible Packaging Market?

Europe dominates the flexible packaging market due to strong regulatory support for sustainable materials, advanced recycling infrastructure, and high consumer awareness of eco-frifinishly packaging. The presence of leading packaging manufacturers, technological innovations, and increasing demand from the food, beverage, and pharmaceutical sectors further strengthens the region’s market leadership.

How Big is the Opportunity for the Growth of Germany in the flexible Packaging Market?

Germany dominates the market due to its strong manufacturing base, advanced packaging technologies, and high demand from the food, pharmaceutical, and chemical industries. The presence of leading packaging companies, focus on sustainable materials, and strict environmental regulations further drive innovation and adoption of flexible packaging solutions in the countest.

What are the Ongoing UK Market Trfinishs?

The UK’s quick growth in the market is driven by booming online grocery and e-commerce requiring lightweight mailers, strong retail private-label premiumisation, increasing food-to-go and ready-meal demand, and aggressive shifts toward sustainable and recycled-content packaging, spurred by regulation and consumer pressure.

More Insights of Towards Packaging:

- Flexible Packaging for Beverage Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Flexible Green Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA) and Companies

- Barrier Coated Flexible Paper Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Flexible Packaging Adhesive Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Eco-Frifinishly Flexible Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Germany Flexible Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Leak-Proof Flexible Packaging Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Flexible Industrial Packaging Market Drives at 4.93% CAGR (2025-34)

- North America Flexible Packaging Market Mergers & Green Innovations Fuel Growth

- Recycling Flexible Packaging Market Strategic Growth, Innovation and Investment Trfinishs

- Converted Flexible Packaging Market Research, Consumer Behavior, Demand and Forecast

- Multilayer Flexible Packaging Market Analysis, Demand, and Growth Rate Forecast 2034

- Flexible Polyurethane Foam Market Demand, Size, and Growth Rate Forecast 2034

- Flexible Plastic Pouches Market Recycling Rates and Technologies

- Medical Flexible Packaging Market Trfinishs, Share, and Growth Analysis 2034

- Flexible Paper Packaging Market Size Drives at 4.58% CAGR

- Nutraceutical Flexible Packaging Market Size, Trfinishs, Share, and Innovations 2034

Segment Outsee

Material Type Insights

What created the Plastics Segment Dominant in the Europe Flexible Packaging Market in 2024?

The plastics segment dominates the market, with a share of approximately 50% in 2024, due to its versatility, lightweight nature, cost-effectiveness, and excellent barrier properties. It offers superior protection against moisture and contaminants, ensuring product freshness. Additionally, advancements in recyclable and bio-based plastic materials further enhance their adoption across food, beverage, and pharmaceutical applications.

The biodegradable / compostable materials segment is the quickest-growing in the market due to rising environmental concerns, stringent EU regulations on plastic waste, growing consumer demand for sustainable solutions, and continuous innovation in bio-based and compostable packaging materials.

Packaging Type Insights

How the Pouches & Bags Dominated the Europe Flexible Packaging Market in 2024?

The pouches & bags segment dominates the market, with a share of 40%, due to their lightweight structure, cost efficiency, and excellent product protection. Their convenience, resealability, and ability to extfinish shelf life create them ideal for food, beverage, and personal care products, driving widespread adoption across various industries.

The stand-up pouches are estimated to be the quickest-growing segment in the market, driven by their attractive shelf appeal, space-efficient upright design, resealable convenience for on-the-go utilize, lightweight nature suitable for e-commerce, and wide application across food, beverage, and pet food industries.

Application Insights

Which Application Dominated the Europe Flexible Packaging Market in 2024?

The food & beverages segment dominates the market, with a share of 55%, due to rising demand for convenient, portable, and longer shelf-life products. Flexible packaging provides superior barrier protection, lightweight handling, and cost efficiency. Additionally, growing consumption of ready-to-eat meals, snacks, and beverages, coupled with sustainability-focutilized innovations, strengthens its widespread adoption across the region.

The pharmaceuticals & healthcare segment is the quickest-growing in the market due to rising demand for secure, sterile, and lightweight packaging. Increasing healthcare awareness, growing pharmaceutical production, and advancements in barrier films that ensure product safety and compliance drive the segment’s rapid expansion across the region.

End-utilizer Insights

How the Traditional Practice Management Integration Dominated the Europe Flexible Packaging Market?

The food processing & beverages segment is the dominant finish-utilizer in the market, with a share of 60% in 2024, due to increasing demand for convenient, durable, and lightweight packaging. Flexible formats ensure product freshness, extfinished shelf life, and straightforward transportation, while sustainability trfinishs and innovative designs further enhance their adoption across the region.

The cosmetics & personal care segment is the quickest-growing in the market due to rising demand for portable, aesthetically appealing, and sustainable packaging. Flexible materials offer design versatility, product protection, and convenience, aligning with consumer preferences for eco-frifinishly and travel-frifinishly beauty and personal care products.

Distribution Channel Insights

How the Distributors & Dealers Dominated the Europe Flexible Packaging Market in 2024?

The distributors & dealers segment dominates the market, with a share of 50%, as it ensures wide product availability, efficient supply chain management, and quicker market penetration. Distributors maintain strong relationships with manufacturers and finish-utilizers, enabling timely delivery, bulk purchasing advantages, and tailored packaging solutions across diverse industrial and retail applications.

The online platforms segment is the quickest-growing segment in the Europe flexible packaging market due to increasing digitalization, convenience in bulk ordering, and wider product accessibility. E-commerce platforms enable manufacturers to reach diverse customers, offer competitive pricing, and streamline procurement processes, driving rapid adoption across various industries.

Recent Breakthroughs in Europe Flexible Packaging Market

- In June 2024, Jindal Films Europe (JFE) announced a commitment to launch 5–10 new sustainable films annually. This launch includes a new BOPE (bi-oriented polyethylene) platform under the “Ethy-Lyte” trademark, aimed at mono-PE recyclable laminate structures replacing PET or foil.

- In July 2024, Mondi Group introduced its “FlexiBag Reinforced” mono-PE recyclable bag line. These bags are designed for better mechanical performance (puncture resistance, sealability) for pet food and similar applications in Europe.

- In August 2025, the third-largest manufacturer of flexible packaging in the world, Constantia Flexible, joins FACHPACK 2025 after a period of strategic investment, portfolio growth, and technology development, strengthening its position in high-finish flexible packaging and leadership in sustainability. Constantia Flexible successfully acquired Aluflexpack, a well-known European provider of customized solutions for flexible packaging.

Top Companies in the Europe Flexible Packaging Market

- Berry Global, Inc. – Berry Global offers sustainable, high-performance flexible packaging films and laminates, with a focus on incorporating recycled content for various applications across Europe.

- Sealed Air Corporation – Sealed Air provides high-barrier flexible food packaging, shrink films, and automated bagging systems, with brands like Cryovac, focapplying on extfinishing shelf life and ensuring food safety.

- Smurfit Kappa Group – Smurfit Kappa offers sustainable, paper-based flexible packaging solutions, including Bag-in-Box systems and innovative e-commerce options for beverages and liquids.

- Coveris Holdings S.A. – Coveris provides sustainable paper and plastic flexible packaging solutions across Europe for food, pet food, and industrial applications, emphasizing its circular economy strategy.

- BillerudKorsnäs AB (now Billerud) – Billerud challenges conventional plastic packaging by offering renewable, paper-based flexible materials, like its high-formable FibreForm, as sustainable alternatives for a variety of products.

- Sonoco Products Company – Sonoco delivers value-added, sustainable flexible packaging, including its paperboard-based GreenCan, to the European market, with a focus on recycled content for various consumer goods.

- Uflex Ltd. – Uflex provides a range of flexible packaging films, including advanced holographic, anti-counterfeit, and high-barrier options, for various industries across its global operations, including Europe.

- Innovia Films Ltd. – Innovia Films specializes in high-performance biaxially oriented polypropylene (BOPP) films for labels and sustainable flexible packaging, including recycled and highly functional options.

- Winpak Ltd. – Winpak manufactures and distributes high-quality flexible packaging materials and machinery, often in collaboration with its European partner Wipak, primarily for the perishable food and medical sectors.

Segment Covered in the Report

By Material Type

- Plastics (Polyethylene, Polypropylene, PET, PVC)

- Paper & Paperboard

- Aluminum Foil

- Laminates / Multi-Layer Materials

- Biodegradable / Compostable Materials

By Packaging Type

- Pouches & Bags

- Shrink & Stretch Films

- Stand-Up Pouches

- Rollstock Films

- Sachets & Sachet Packs

- Blister Packaging

- Others (Tubing, Lidding Films)

By Application

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Industrial & Chemical Products

- Others (Pet Food, Houtilizehold Products)

By End-User Industest

- Food Processing & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemicals & Industrial Products

- Retail & E-commerce

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

By Region

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of Europe

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5858

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market innotifyigence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trfinish analysis, and data-driven strategies. Our experienced consultants utilize advanced research methodologies to support companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industest.

Stay Connected with Towards Packaging:

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | TowardsAuto | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Flexible Intermediate Bulk Container (FIBC) Market Size, Segments, Regional Data & Competitive Analysis 2025–2034

- E-Commerce Flexible Packaging Market Size, Trfinishs, Growth and Sustainability Outsee (2025-2034)

- Flexible Plastic Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Compostable Flexible Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Metalized Flexible Packaging Market Growth, Innovations, and Market Size Forecast 2034

- Flexible Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Industrial Bulk Packaging Market Size 2025 to Expand with 3.25% CAGR and Strong APAC Demand

- Folding Carton in Healthcare Market Insights for 2025 Indicate Offset Printing Leadership and Digital Surge

- Sustainable Medical Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Paper Tubes Market Insights 2025 From Kraft to Composite Tubes Industest Eyes Sustainable Expansion

- Skincare Primary Packaging Market Trfinishs 2025 Plastic Leads with 58% Share, While Biopolymers See Fastest Growth

- Paper Cores Market 2025 Sees Rising Demand from Flexible Packaging and E-Commerce Expansion

- Polypropylene Corrugated Packaging Market Innovation 2025 AI and Smart Tech Integration Driving Customization and Efficiency

- Pharmaceutical Sterile Sample Bags Market Report From USD 1.53 Bn in 2025 to USD 1.88 Bn by 2034 with Smart Packaging Growth

- PET/EVOH/PE Packaging Materials Market 2025 Sustainability, Smart Packaging, and AI Driving USD 281.79 Million Future by 2034

- Chlorine-free Shrink Bags Market Trfinishs, Disruptors & Competitive Strategy

Leave a Reply