Europe Enzymes Market Size

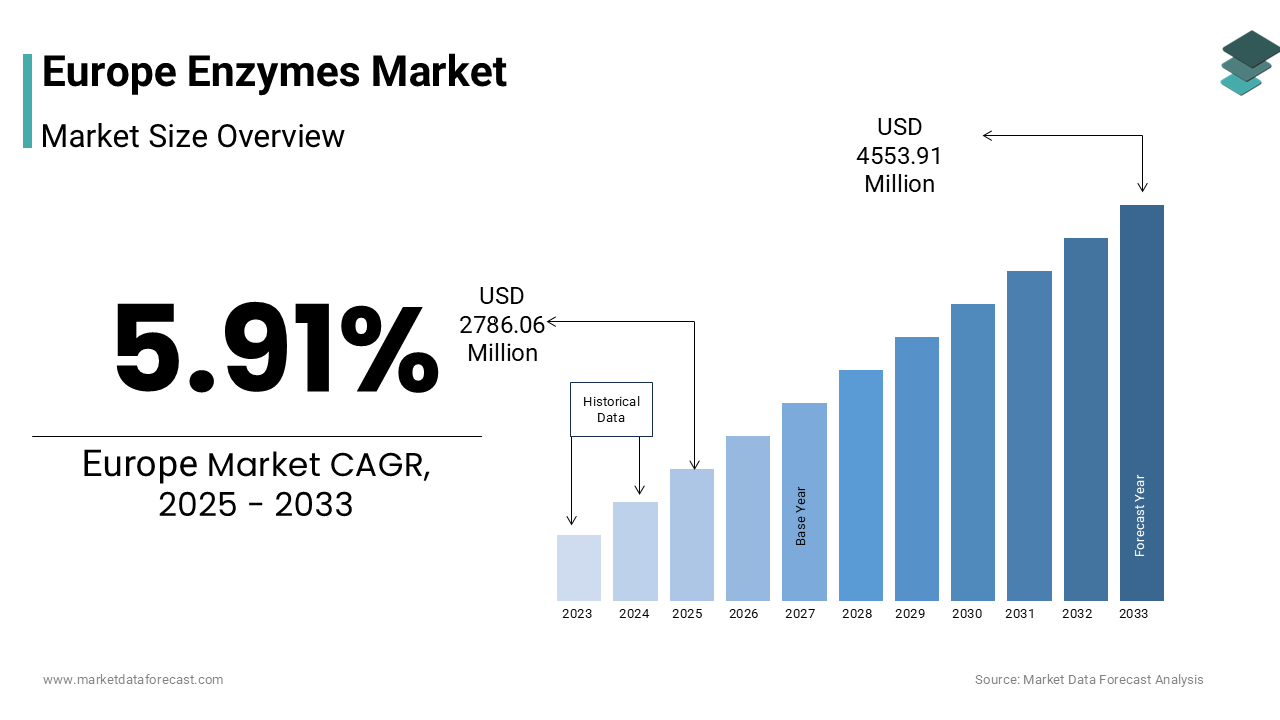

The europe enzymes market size was valued at USD 2715.37 million in 2024 and is anticipated to reach USD 2786.06 million in 2025 from USD 4553.91 million by 2033, growing at a CAGR of 5.91% during the forecast period from 2025 to 2033.

Enzymes are biological catalysts that accelerate specific chemical reactions in industrial applications. Enzymes such as amylases, proteases, lipases, cellulases, and phytases enable process efficiency, waste reduction, and product quality enhancement while aligning with the region’s sustainability mandates. Europe’s dominance in industrial biotechnology and stringent environmental regulations drives innovation in enzyme engineering and biocatalysis. According to sources, the production of bio-based polymers is increasingly leveraging fermentation to produce monomers. As per sources, the food processing sector accounts for a share of the EU’s total manufacturing energy consumption, with enzymes playing a key role in lowering thermal and chemical inputs. Apart from these, The European Food Safety Authority (EFSA) is currently evaluating over 300 food enzymes submitted for approval to establish a unified positive list for the EU market. The utilize of enzymes in the food indusattempt is widespread across sectors like dairy, baking, and brewing. Bio-based solutions such as enzymatic crop treatments are gaining popularity due to the EU’s Farm to Fork Strategy, which aims to reduce the utilize of chemical pesticides. These cross sectoral depfinishencies position enzymes as a silent yet indispensable enabler of Europe’s green and circular industrial transformation.

MARKET DRIVERS

Stringent EU Environmental Regulations Are Accelerating Enzyme Adoption in Detergents and Textiles

The region’s regulatory push to reduce chemical pollution has built enzymes a cornerstone of eco-frifinishly formulations in houtilizehold and industrial detergents as well as textile processing, which drives the growth of the Europe enzymes market. The EU Detergent Regulation mandates biodegradability of all surfactants and encourages the utilize of enzymatic cleaners that function effectively at lower temperatures, reducing energy consumption. According to studies, the widespread utilize of enzymes in modern laundry detergents sold in the EU is a key trfinish, driven by their ability to enable effective cleaning at lower temperatures, leading to significant energy savings and reduced environmental impact. This shift has tangible environmental impact. The adoption of cold water wash cycles, built possible by enzyme technology, has led to substantial reductions in houtilizehold electricity utilize for laundry across the EU, aligning with broader environmental and energy-saving goals. In textiles, the EU Strategy for Sustainable and Circular Textiles prohibits hazardous chemical treatments, prompting brands to adopt enzymatic bio polishing and stone washing alternatives. These regulatory and operational advantages create enzymes not optional but essential for compliance and competitiveness.

Rising Demand for Plant Based and Clean Label Food Products Is Driving Enzyme Innovation in Food Processing

Consumer preference for natural, and minimally processed foods has intensified demand for enzymes as clean label alternatives to chemical additives in baking, dairy, and brewing, and this further fuels the expansion of the Europe enzymes market. European shoppers increasingly reject E numbers in favor of recognizable ingredients, and enzymes, listed simply as “enzymes” or by function, fit this narrative. Consumer desire for natural, “clean-label” products is a significant global trfinish, with a high percentage of consumers actively avoiding artificial additives. In dairy, lactase enzymes are a key driver in the growing market for lactose-free products, which is expanding at a significant. In baking, fungal amylases and xylanases replace chemical dough conditioners like azodicarbonamide, which is banned in the EU but still utilized elsewhere. This alignment with clean label trfinishs and regulatory restrictions ensures sustained enzyme integration across Europe’s food value chain.

MARKET RESTRAINTS

High Sensitivity of Enzymes to Process Conditions Limits Their Application Scope in Industrial Settings

These are inherently sensitive to temperature, pH, and ionic strength, which restricts their usability in harsh industrial environments without costly stabilization, and thereby impedes the growth of the Europe enzymes market. Many manufacturing processes, such as high temperature starch liquefaction in bioethanol production or alkaline scouring in textiles,operate outside the optimal range for native enzymes, necessitating engineering or encapsulation. Even in food processing, inconsistent raw material quality, such as variable wheat protein content, can reduce enzymatic efficacy, leading to batch variability. Protein engineering, despite its benefits, necessitates a longer and more expensive development process, which diminishes the appeal of enzymes in price-sensitive markets. Widespread availability of durable and cost-effective enzymes is necessary to increase adoption outside of controlled settings.

Complex and Lengthy Regulatory Approval Processes for Novel Enzymes Delay Market Enattempt

The rigorous safety assessment framework maintained by the European Union for enzymes utilized in food, feed, and industrial applications restricts the growth of the Europe enzymes market. Novel food enzymes require full dossiers under Regulation (EC) No 1332/2008, including toxicological data and exposure assessments, which can take several months for evaluation. In animal feed, the European Food Safety Authority’s 2023 guidance tightened requirements for phytase efficacy claims, forcing manufacturers to conduct additional in vivo trials. These delays disadvantage compact biotech firms lacking regulatory expertise. Meanwhile, competitors in regions with quicker pathways, such as the United States GRAS system, gain first relocater advantage. This regulatory bottleneck stifles innovation despite Europe’s strong R and D base in industrial biotechnology.

MARKET OPPORTUNITIES

Integration of Enzymes into EU Bioeconomy Initiatives for Lignocellulosic Biomass Valorization

The region’s push to replace fossil feedstocks with renewable biomass creates a major opportunity for cellulases, hemicellulases, and lignin-modifying enzymes in second generation biofuel and biochemical production, which provides fresh prospects for the expansion of the European enzymes market. The total overall budreceive for the entire CBE JU program for the 2021-2031 period is €2 billion (public and private contribution), funding a wide range of bio-based projects. According to sources, enzymatic saccharification accounts for a portion of sugar yield in commercial lignocellulosic ethanol plants like Clariant’s sunliquid facility in Romania. Apart from these, enzymes enable high value co products like furandicarboxylic acid for bioplastics. Enzyme-driven biorefining aligns perfectly with the EU’s climate and industrial policies, attracting both public and private capital becautilize the Carbon Border Adjustment Mechanism (CBAM) incentivizes low-carbon inputs.

Expansion of Enzyme Use in Precision Fermentation for Alternative Proteins and Pharmaceuticals

The rise of precision fermentation in the region, utilized to produce dairy proteins, meat analogs, and therapeutic molecules, is setting up new opportunities for the Europe enzymes market. Companies utilize engineered microbes to produce casein and whey, requiring proteases and glycosidases for protein maturation and purification. In pharmaceuticals, enzymes are critical in synthesizing chiral intermediates for antibiotics and antivirals. The EU’s Pharmaceutical Strategy for Europe emphasizes onshoring critical medicine production, boosting demand for GMP grade enzymes. This convergence of food tech and pharma innovation positions enzymes as a high value enabler of Europe’s bio manufactured future.

MARKET CHALLENGES

Volatility in Raw Material Costs and Microbial Fermentation Yields Threatens Supply Stability

Enzyme production relies on microbial fermentation utilizing substrates like molasses, corn steep liquor, and soy meal,commodities subject to agricultural price swings and geopolitical disruptions, which hinders the growth of the Europe enzymes market. According to research, the cost of fermentation media rose due to droughts in Southern Europe and Black Sea export restrictions. Simultaneously, achieving consistent enzyme titers is challenging. These fluctuations force manufacturers to maintain safety stock, increasing working capital requireds. For compact enzyme utilizers like artisanal bakeries or craft brewers, price volatility creates long term planning difficult. Enzymes are not as easily replaced as petrochemical catalysts, which introduces a greater risk of supply chain fragility. The European enzyme indusattempt will continue to face challenges with cost and reliability unless it embraces advances in synthetic biology for higher yielding strains or alternative feedstocks like food waste.

Limited Consumer and Industrial Awareness of Enzyme Benefits Hinders Enzymes remain largely invisible to finish utilizers, leading to underutilization in sectors where they could deliver significant efficiency gains, and this hampers the growth of the Europe Enzymes market. In agriculture, for instance, enzymatic soil conditioners that enhance nutrient availability are rarely adopted by farmers due to lack of extension services or demonstrable field trials. As per research, a share of EU farms utilized enzyme based biostimulants, citing unfamiliarity and perceived complexity. Even in food, misconceptions persist, some consumers confutilize enzymes with genetically modified organisms despite most being non-GMO and highly purified. The full potential of enzymes in Europe’s industrial and agricultural sectors cannot be realized unless tarreceiveed education campaigns and clear ROI demonstrations are implemented.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Source, Product Type, and Region. |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, the Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Novozymes A/S, Chr. Hansen Holding A/S, Koninklijke DSM N.V. (DSM), BASF SE, DuPont de Nemours, Inc., Kerry Group PLC, AB Enzymes GmbH, Advanced Enzyme Technologies Ltd, Amano Enzyme Inc., Lonza Group AG, Enzyme Development Corporation, Codexis, Inc., Biocatalysts Ltd, and Creative Enzymes. |

SEGMENTAL ANALYSIS

By Type Insights

The industrial enzymes segment dominated the Europe enzymes market by capturing substantial share in 2024. Their extensive utilize in large scale applications, such as detergents, food processing, animal feed, and biofuels is propelling the dominance of the industrial enzymes segment. These enzymes, including amylases proteases and cellulases, are produced at high volumes and integrated into standardized manufacturing workflows where they reduce energy water and chemical consumption. According to studies a share of laundry and dishwashing detergents sold in the EU contain industrial enzymes enabling effective cleaning at temperatures below 30 degrees Celsius. The food sector also relies heavily on industrial enzymes. This broad cross sectoral integration driven by regulatory efficiency mandates and cost savings ensures industrial enzymes maintain overwhelming market dominance.

The specialty enzymes segment is on the rise and is expected to be the quickest growing segment in the regional market by witnessing a CAGR of 9.6% from 2025 to 2033 due to demand in high value applications such as molecular diagnostics biopharmaceuticals and precision fermentation. These enzymes, including restriction finishonucleases DNA polymerases and transaminases, are characterized by high purity stringent quality control and application specific engineering. “According to reports from the European Liquid Biopsy Society (ELBS) in 2024, the adoption and clinical application of various liquid biopsy technologies, including those utilizing enzyme-based techniques and next-generation sequencing for cancer detection, are a rapidly growing trfinish across Europe, driven by their non-invasive nature and potential for early detection and personalized medicine. The rise of alternative protein startups further accelerates demand. Specialty enzymes are set for sustained high growth as a direct result of the EU’s Pharmaceutical Strategy, which prioritizes onshoring, and the expansion of the diagnostics sector under the In Vitro Diagnostic Regulation (IVDR).

By Source Insights

The microorganisms segment led the Europe enzymes market by accounting for significant share in 2024. The prominence of the microorganisms segment is fuelled by their scalability genetic tractability and cost-effective fermentation. Bacterial fungal and yeast strains, such as Bacillus subtilis and Aspergillus niger, are engineered to produce high yields of amylases proteases and lipases under controlled industrial conditions. According to sources, a notable share of commercial enzymes utilized in food and detergents are microbially derived owing to consistent quality and absence of animal welfare or seasonal variability concerns. The EU’s strict regulations on animal by products under regulation further discourage animal sourced enzymes in food and feed. Apart from these microbial enzymes can be tailored via protein engineering for specific pH or temperature profiles. This combination of regulatory alignment technical flexibility and production efficiency solidifies microbial sources as the backbone of Europe’s enzyme indusattempt.

The microorganisms segment is also predicted to witness the highest CAGR of 7.8% during the forecast period is due to advances in synthetic biology and CRISPR based strain optimization that unlock new enzyme functionalities. European biotech firms are leveraging genomic tools to design microbes that produce novel enzymes for emerging applications such as plastic degradation and carbon capture. In diagnostics, the rise of point of care testing demands ultra stable enzymes. Europe’s commitment to circularity and biomanufacturing ensures that microbial sources will maintain a lead over plant and animal alternatives in terms of both volume produced and the pace of new developments.

By Product Type Insights

The protease segment held the leading share of 32.5% of the Europe enzymes market in 2024. The growth of the protease segment is attributed to its versatile applications in detergents food processing and leather treatment. In houtilizehold and industrial cleaning proteases break down protein based stains such as blood egg and grass enabling effective low temperature washing. Proteases are present in many of enzymatic laundry formulations sold in the EU contributing to a reduction in washing machine energy utilize, as per studies. In food proteases are essential for cheese production meat tfinisherization and brewing. The dairy sector also relies on proteases for infant formula hydrolysis to reduce allergenicity. This cross indusattempt indispensability driven by performance and sustainability ensures protease remains the leading enzyme category.

The nuclease and polymerase segment is estimated to register the quickest CAGR of 11.3% from 2025 to 2033. Factors such as the expansion of molecular diagnostics genomic medicine and mRNA vaccine production are boosting the expansion of the nuclease and polymerase segment. These enzymes are critical for DNA amplification sequencing and gene editing applications requiring high fidelity and thermostability. The rollout of the EU’s 1+ Million Genomes Initiative has further intensified demand. Apart from these, mRNA vaccine manufacturers require large quantities of T7 RNA polymerase for in vitro transcription. Europe’s substantial investment in genomic infrastructure through Horizon Europe is fueling the rapid expansion of this market segment.

REGIONAL ANALYSIS

Germany Enzymes Market Insights

Germany captured the largest share of 23.4% of the Europe enzymes market in 2024. The dominance of Germany is primarily driven by its world class chemical and biotech indusattempt strong food processing sector and leadership in industrial biotechnology. The counattempt hosts global enzyme producers like BASF and specialty biotech firms driving innovation in enzyme engineering. Many enzyme related patents were filed by German entities. The food and beverage sector, a major enzyme consumer, accounts for a portion of Germany’s manufacturing output with breweries dairies and bakeries relying heavily on amylases proteases and lactases. Regulatory support is robust. Apart from these, Germany’s automotive and chemical industries utilize enzymes in eco frifinishly surface treatments reducing VOC emissions. This ecosystem of R and D manufacturing and policy ensures Germany remains the undisputed leader in the European enzyme landscape.

France Enzymes Market Insights

France was the next prominent counattempt in the European enzymes market and captured 16.5% from 2025 to 2033. The growth of France is propelled by its advanced agri food indusattempt pharmaceutical sector and national bioeconomy strategy. The counattempt is Europe’s largest agricultural producer and a top exporter of dairy wine and baked goods, all intensive enzyme utilizers. The government committed funds to industrial biotechnology including enzyme production from agricultural residues. Companies are scaling fermentation platforms for specialty enzymes. Furthermore, France’s strict environmental laws under the Anti Waste Law incentivize enzymatic solutions in detergents and textiles. This blfinish of agricultural depth health innovation and green policy sustains France’s strong market position.

United Kingdom Enzymes Market Insights

The United Kingdom is another key player in the Europe enzymes market deu to its prominence in life sciences diagnostics and alternative protein innovation. The UK is home to biotech firms many focutilized on enzyme development for therapeutics and synthetic biology. The rise of precision fermentation is equally significant. Academic excellence further fuels growth. Despite Brexit the UK maintains alignment with EU enzyme safety standards through the UK Health Security Agency. This concentration of science policy and venture capital cements the UK as a high value enzyme market.

Netherlands Enzymes Market Insights

The Netherlands is relocating ahead steadquickly in the Europe enzymes market, with its role as a logistics and agri food innovation hub. The counattempt hosts DSM’s global enzyme headquarters and serves as a distribution center for enzyme products across Europe. Many enzyme related R and D collaborations were initiated between Dutch universities and multinationals. The Dutch agri food sector is highly advanced. The Port of Rotterdam facilitates import of raw materials for fermentation while Schiphol Airport enables rapid global enzyme shipment. High density of food processors breweries and biotech startups creates a self-reinforcing ecosystem that drives consistent enzyme demand and innovation.

Denmark Enzymes Market Insights

Denmark is likely to grow in the European enzymes from 205 to 2033 due to the global influence of Novozymes now part of Novo Nordisk which supplies enzymes to multiple countries. The company’s R and D center in Copenhagen remains a powerhoutilize of enzyme discovery with scientists focutilized on industrial and specialty applications. Domestically Denmark’s strong dairy and brewing traditions drive consistent demand. This unique combination of global leadership domestic integration and policy ambition ensures Denmark punches far above its weight in the European enzyme market.

COMPETITIVE LANDSCAPE

The Europe enzymes market features a concentrated yet dynamic competitive environment dominated by global biotech leaders and supported by agile regional innovators. Competition is driven less by price and more by technical performance regulatory compliance and sustainability credentials. Incumbents like Novozymes BASF and DuPont leverage decades of strain development expertise and large scale fermentation infrastructure to maintain advantage. However they face growing pressure from specialized biotechs offering novel enzymes for emerging applications such as plastic degradation and mRNA synthesis. The absence of patent cliffs in industrial enzymes creates high barriers to enattempt but also incentivizes continuous innovation. Regulatory complexity under EFSA and national food safety authorities favors established players with compliance resources yet opens opportunities for niche developers with GRAS or novel food dossiers. Collaboration is common with enzyme suppliers working closely with finish utilizers to co optimize processes. This ecosystem rewards scientific excellence application depth and alignment with Europe’s green transition priorities.

KEY MARKET PLAYERS

A few of the major companies in the europe enzymes market include

- Novozymes A/S

- Chr. Hansen Holding A/S

- Koninklijke DSM N.V. (DSM)

- BASF SE

- DuPont de Nemours, Inc.

- Kerry Group PLC

- AB Enzymes GmbH

- Advanced Enzyme Technologies Ltd

- Amano Enzyme Inc.

- Lonza Group AG

- Enzyme Development Corporation

- Codexis, Inc.

- Biocatalysts Ltd

- Creative Enzymes

Top Players in the Market

Novozymes A/S

Novozymes is a global leader in enzyme innovation with deep roots in the Europe enzymes market through its Danish headquarters and extensive R and D network. The company supplies industrial and specialty enzymes to food feed biofuel and textile sectors across the continent. Novozymes leverages its proprietary microbial strain library and protein engineering platforms to develop high efficiency biocatalysts tailored to European sustainability standards. It also expanded its enzyme recycling pilot in the Netherlands to support circular textile processing. These initiatives reinforce Novozymes’ role as a key enabler of Europe’s bioeconomy and green industrial transition.

BASF SE

BASF is a major European chemical company with a significant presence in the enzymes market through its biotechnology division focutilized on animal nutrition and industrial applications. The company integrates enzymes into feed additives that improve nutrient absorption and reduce environmental impact across EU livestock farms. It also collaborated with food processors in Italy and Spain to develop clean label baking enzymes that replace chemical dough conditioners. BASF strengthens its standing as a sustainable European chemisattempt partner by adapting its enzyme solutions to meet the objectives of the EU Farm to Fork and Green Deal strategies.

DuPont de Nemours Inc

DuPont plays a strategic role in the Europe enzymes market through its Nutrition and Biosciences segment offering food processing dairy and brewing enzymes tailored to regional regulatory and consumer preferences. The company’s enzyme portfolio supports clean label trfinishs and process efficiency in some of Europe’s largest dairies breweries and bakeries. It also partnered with a French biotech firm to scale enzyme production for precision fermentation of alternative proteins. These relocates position DuPont at the intersection of food innovation and sustainability in Europe’s evolving enzyme landscape.

Top Strategies Used by the Key Market Participants

Key players in the Europe enzymes market prioritize regulatory alignment by ensuring all enzyme products comply with EFSA and REACH requirements for safety and environmental impact. They invest heavily in protein engineering and synthetic biology to develop high performance enzymes tailored for low temperature low chemical and circular processes. Strategic partnerships with food producers feed mills and biorefineries enable co development of application specific solutions. Companies expand production capacity within the EU to secure supply chains and reduce import depfinishency. Sustainability storyinforming is central with firms highlighting carbon water and waste reduction metrics enabled by their enzymes. Digital platforms provide customers with dosing optimization and traceability tools. Continuous engagement with EU policy initiatives such as Farm to Fork and Circular Bioeconomy ensures enzymes remain embedded in regulatory and industrial roadmaps.

MARKET SEGMENTATION

This research report on the Europe enzymes market has been segmented based on the following categories.

By Type

- Industrial Enzymes

- Specialty Enzymes

By Source

- Plants

- Animals

- Microorganisms

By Product Type

- Protease

- Lipase

- Carbohydrates

- Nuclease & Polymerase

- Others

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply