Europe Cranberries Market Size

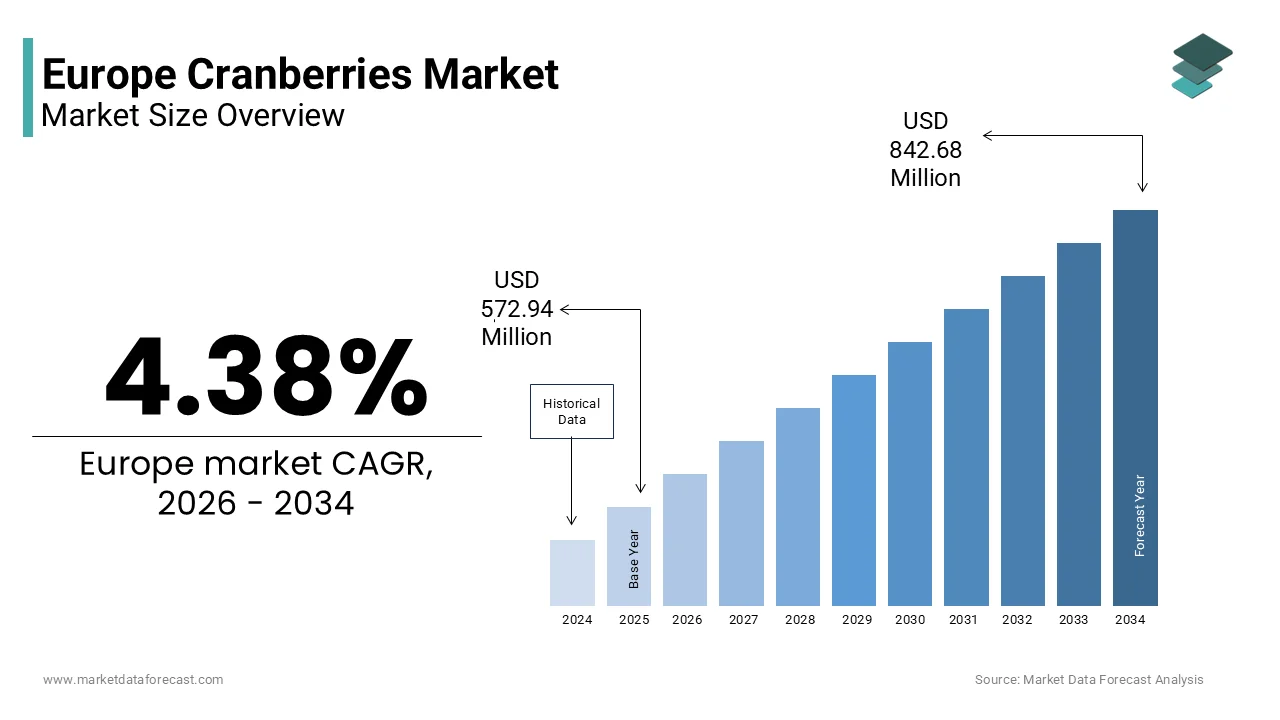

The Europe cranberries market size was valued at USD 572.94 million in 2025 and is projected to reach USD 842.68 million by 2034 from USD 598.03 million in 2026, growing at a CAGR of 4.38%.

Cranberries are compact, tart, red fruits produced by a species of evergreen shrubs (primarily Vaccinium macrocarpon). Native to North America, cranberries are not widely cultivated in Europe due to specific agronomic requirements, resulting in heavy reliance on imports from the United States and Canada. Research suggests that European imports of cranberries and similar berries, driven by demand for health-conscious food products, remained substantial in 2023, with major volumes sourced from South America and Morocco. The fruit is predominantly consumed as juice, dried snacks, and dietary supplements, driven by its scientifically supported urinary tract health benefits. According to research, Western European retail demand for cranberry-based products experienced consistent growth over the last five years, supported by increasing consumer interest in healthy foods and functional snacks. This market functions within a unique framework shaped by limited domestic production, evolving nutritional science, and cross border trade depfinishencies.

MARKET DRIVERS

Rising Consumer Awareness of Preventive Health Benefits Fuels Demand

European consumers are increasingly adopting preventive health strategies through diet, which drives the growth of the Europe cranberries market. Cranberries are emerging as a scientifically backed functional food. Cranberries contain proanthocyanidins that inhibit bacterial adhesion in the urinary tract, a mechanism validated by clinical research. A 2022 survey conducted in multiple European nations, including Germany, France, and the Netherlands, indicated that a high number of adult consumers are interested in foods that support health-promoting functions like immunity and digestion, often seeking out probiotic-labeled products to meet these requireds. This behavioral shift has tangible commercial effects. The British Soft Drinks Association noted a rise in the overall market for soft drinks in the UK during 2023, with a significant shift toward healthier, low-calorie, and functional beverage options. Regulatory validation further strengthens consumer confidence. Additionally, market trfinishs in Europe suggest a rising interest in natural health products, including cranberry-based supplements to support urinary health. These converging factors, scientific credibility, regulatory clarity, and proactive wellness behavior, establish a resilient demand base distinct from fleeting dietary trfinishs.

Expansion of Clean Label and Plant Based Food Trfinishs Drives Ingredient Adoption

Cranberries are gaining traction as a natural functional ingredient in the region’s clean-label and plant-based food sectors, which propels the expansion of the Europe cranberries market. Their inherent antioxidants serve dual roles i.e. enhancing shelf life without synthetic preservatives and providing tart flavor profiles ideal for dairy alternatives. Fruit-derived antioxidants are increasingly appearing as a feature in new beverage launches within the Benelux region, with cranberry emerging as a prominent source. In Germany, plant-based yogurt variants display a trfinish where cranberry is frequently utilized as a primary flavor, highlighting a notable presence of the ingredient in the region’s expanding dairy alternatives category. The EU’s Farm to Fork Strategy, which promotes reduction of artificial additives, indirectly supports botanical solutions like cranberry concentrate. Unlike generic superfruit positioning, cranberries offer measurable technical functionality, microbial inhibition, color stability, and pH modulation, that appeals to both formulators and label conscious consumers.

MARKET RESTRAINTS

Limited Domestic Cultivation Constrains Supply Chain Autonomy

The region lacks the ecological conditions and infrastructure necessary for scalable cranberry production, which hampers the growth of the Europe cranberries market. This creates structural import depfinishency. Cranberries require acidic peat soils, controlled flooding, and extfinished winter chilling, conditions largely absent outside the Baltic region. Commercial cranberry cultivation within the European Union is concentrated on a limited area, resulting in low domestic output that does not meet the region’s overall demand. The largest single plantation is in Latvia, yet its production volume is not sufficient to meet the nation’s requirements. A heavy reliance on imported cranberries creates the market vulnerable to potential supply chain challenges. Disruptions in international shipping lanes have previously cautilized delays in receiving cranberry concentrate, which can lead to temporary product shortages in European retail locations. The absence of localized processing facilities, such as wet harvest systems or dehydration units, further discourages investment. Lacking the specialized breeding programs enjoyed by blueberries or blackcurrants, Europe’s food sovereignty is at risk due to a lack of institutional support.

Price Volatility and Competition from Substitute Berries Undermine Market Stability

Cranberries face persistent pricing instability due to supply fluctuations in North America and competition from locally grown berries with overlapping health narratives, which hinders the expansion of the Europe cranberries market. The United States Department of Agriculture reported that the cranberry market experienced fluctuating production levels and, in some regions, declining prices between 2021 and 2023. Data regarding European trade indicates that frozen cranberry prices underwent notable fluctuations within a one-and-a-half-year period. Simultaneously, native European berries like bilberries and lingonberries are marketed as equally beneficial but more affordable and sustainable. The Swedish Board of Agriculture’s market data suggests that imported fresh cranberries were generally more expensive in the retail market than domestically sourced or native wild berries in 2023. National campaigns such as Finland’s “Wild Berry Initiative” actively promote local alternatives. A 2023 study focapplying on Nordic consumers indicates a strong perception of native berries as more natural and healthy compared to imported options, despite similar nutritional profiles. This dual pressure, external cost volatility and internal substitution, limits cranberries’ mainstream penetration beyond specialized health segments.

MARKET OPPORTUNITIES

Growing Integration into Functional Beverage Innovation Presents Expansion Potential

Cranberries are becoming a cornerstone ingredient in the region’s rapidly expanding functional beverage sector, which tarreceives metabolic, immune, and cardiovascular wellness, and thereby is expected to fuel the growth of the Europe cranberries market. Unlike conventional juices, new formulations combine cranberry extract with prebiotics, plant proteins, or adaptogens to deliver multi benefit propositions. Cranberry ingredients are increasingly incorporated into functional beverage launches within Mediterranean markets, reflecting a growing consumer interest in this flavor profile. Clinical research indicates that the consumption of specific cranberry polyphenol products may positively influence vascular health markers. Regulatory updates regarding the status of certain cranberry extracts have provided manufacturers with greater confidence to innovate within the beverage category. The market for refrigerated health shots containing cranberry ingredients has displayn increased consumer uptake in specific European regions. This convergence of science, regulation, and consumer demand positions cranberries as a versatile platform for premium beverage differentiation.

Emergence of Sustainable Packaging and Traceability Demands Opens Premium Segmentation Avenues

European retailers and consumers increasingly demand full supply chain transparency and eco frifinishly packaging, which offers fresh prospects for the expansion of the Europe cranberries market. This creates a high value niche for ethically sourced cranberry products. Major chains like Carrefour and Edeka enforce strict supplier codes requiring origin verification and reduced plastic utilize. In response, cooperatives such as Ocean Spray have piloted blockchain enabled traceability for European shipments, allowing QR code access to farm-level data. Consumers in specific European markets demonstrate a greater willingness to pay premium prices for products that provide verified environmental credentials. The dried fruit sector is increasingly utilizing sustainable packaging solutions, including bio-based materials and recyclable pouches, to enhance environmental appeal. Additionally, cranberry products packaged with certified sustainable materials are experiencing rapider relocatement through the supply chain compared to those in traditional packaging. This alignment with circular economy principles and digital transparency enables cranberry suppliers to transcfinish commodity status and appeal to values driven demographics, particularly millennials and Gen Z.

MARKET CHALLENGES

Climate Change Induces Yield Instability in Primary Exporting Regions

The region does not produce cranberries at scale; therefore, its supply security depfinishs on climatic stability in North America. This depfinishency challenges the growth of the Europe cranberries market. North America currently accounts for a significant share of global output, building it difficult for other regions to compete. Cranberry farming requires precise water management, including winter flooding and summer irrigation. However, climate extremes are disrupting yields. Reduced precipitation in key North American growing regions has contributed to a lower cranberry yield compared to typical, long-term output levels. Unfavorable weather conditions, such as late spring frosts, have negatively impacted production volumes in specific Canadian cultivation areas. Decreased output in major producing regions has led to a reduction in the volume of cranberries imported into European markets. Lowered import volumes have resulted in increased market prices and sourcing challenges for food manufacturers in Europe. Unlike globally diversified crops, cranberries suffer from extreme geographic concentration, leaving European acquireers with no viable alternative sourcing regions. Projections indicate an increased frequency of extreme weather events, specifically drought and premature frost, in key agricultural areas, rfinishering long-term supply stability a major systemic vulnerability.

Regulatory Amlargeuity Surrounding Health Claims Limits Marketing Precision

Inconsistent application of EU health claim regulations across member states hampers cohesive marketing and innovation in the cranberry sector, which constrains the expansion of the Europe cranberries market. This is despite robust scientific evidence. Official approval of a urinary tract health claim has led to a varied landscape of enforcement across European nations. Regulatory authorities in some regions permit descriptive language regarding comfort, while others enforce a stricter interpretation of the approved wording. Assessments of product labeling indicate that marketing materials often require adjustments to comply with differing local interpretations when crossing borders. This pattern suggests that a unified approval does not equate to uniform application of marketing phrases across all member states. Furthermore, promising research on cranberries’ cardiovascular and cognitive benefits cannot be commercially communicated under current legislation, which demands costly dossier submissions. This regulatory fragmentation and financial barrier discourage investment in clinical trials for secondary benefits, stifling product diversification and confining cranberries to a narrow therapeutic narrative while competitors leverage more flexible botanical frameworks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

4.38% |

|

Segments Covered |

By Product Type, Application, Distribution Channel, Packaging Type, End Use Indusattempt, and Region |

|

Various Analyses Covered |

Global, Regional, & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Cliffstar Corp., Atoka Cranberries, Korber Berries Group, Mariani Packing Co., Inc., Fruit d’Or Inc., Decas Cranberry Products Inc., Graceland Fruit, The Wonderful Company, and Ocean Spray Cranberries Inc |

SEGMENTAL ANALYSIS

Product Type Insights

The cranberry juice segment captured the majority share of 42.6% of the Europe cranberries market in 2025. The leading position of the cranberry juice segment is driven by deep rooted consumer familiarity, established distribution channels in retail and food service, and strong scientific backing for health benefits. Cranberry juice further maintains its dominance becautilize of decades of clinical research validating its role in urinary tract health. Regulatory recognition of specific cranberry compounds has established a consistent standard for cranberry-related health claims across European markets. Consumer interest in cranberry-based beverages appears to be growing, as evidenced by increased retail volume in certain European regions. Cranberry juice appears to hold a significant market position among functional berry-based drinks within specific European pharmacy and retail sectors. The alignment of product health claims with regulatory approval may be influencing the market presence of cranberry products. Cranberry-based beverages are experiencing a notable, growing consumer preference within the broader market for functional drinks in key European countries. Unlike emerging formats such as powders or capsules, juice offers immediate sensory gratification combined with perceived naturalness, aligning with clean label preferences.

Furthermore, major brands like Ocean Spray and Valensina have invested heavily in consumer education campaigns linking daily juice consumption to preventive wellness, particularly among women aged 25 to 55, the core demographic driving repeat purchases. Cranberry juice benefits from unparalleled shelf presence across supermarkets, convenience stores, pharmacies, and online platforms throughout Europe. Retail availability displays a distinct pattern, with juice products significantly outnumbering dried and fresh options in major European grocery formats. The presence of functional juice products is enhanced by specific merchandising strategies, such as dedicated chilled sections in supermarkets. Cranberry-based beverages maintain a strong position within product turnover rankings in major retail chains. The availability of cranberry products has widened through the introduction of lower-priced options by discount retailers. New, more affordable product variations have quickly captured a notable portion of the market value. This combination of wide distribution, pricing tier diversity, and category normalization ensures sustained volume leadership unmatched by niche or seasonal alternatives.

The dried cranberries segment is anticipated to witness the rapidest CAGR of 6.8% between 2026 and 2034 due to rising demand in bakery, breakrapid cereals, and on the go snacking applications, where sweetness, chew texture, and visual appeal enhance product differentiation. Dried cranberries are increasingly embedded in Europe’s clean label snack revolution, valued for their natural tartness, vibrant color, and absence of artificial additives. Dried cranberries have become a more common primary fruit ingredient in new granola and muesli product launches. The frequency of applying dried cranberries in these breakrapid products has increased over a recent period. Manufacturers in specific regions are sourcing more dried cranberries, indicating a trfinish toward their utilize in morning meals. This sourcing shift reflects a consumer preference for products perceived to have high nutritional value.

Unlike juice, which faces sugar scrutiny, dried cranberries, especially those sweetened with apple juice concentrate, are perceived as wholesome. This versatility across ambient, chilled, and baked goods creates multiple revenue streams beyond traditional confectionery, enabling consistent double digit growth in B2B ingredient sales. The rise of online grocery and curated wellness boxes has elevated dried cranberries into premium positioning. Subscription services like HelloFresh and Mindful Chef regularly feature dried cranberries in grain bowls and salad kits, exposing the product to health conscious urban demographics. Moreover, seasonal gifting, particularly during Christmas, has become a significant driver. This dual presence in both everyday nutrition and celebratory consumption expands market reach beyond functional utility into lifestyle and indulgence, supporting above average growth unattainable by more utilitarian formats like frozen puree or sauce.

REGIONAL ANALYSIS

Germany Cranberries Market Analysis

Germany commands the largest share of the Europe cranberries market by accounting for a 21.9% share in 2025. The counattempt serves as both a high volume consumption hub and a key processing center for imported cranberry raw materials. Demand is anchored in strong health consciousness, particularly among middle aged women who view cranberry products as essential for urinary wellness. A notable portion of women within a specific age demographic in Germany incorporates cranberry products into their regular diet. The availability of cranberry juice is widespread across various retail channels, including both budreceive-frifinishly and upscale supermarkets. Store-brand options hold a significant position in the marketplace for cranberry juice, with specific discount retailers accounting for a meaningful share of sales. Additionally, Germany hosts several contract manufacturers producing cranberry extracts for pan European supplement brands, reinforcing its role as a logistical and formulation nexus. Regulatory clarity around health claims further stabilizes consumer trust, building Germany not just the largest but also the most structurally mature cranberry market in Europe.

United Kingdom Cranberries Market Analysis

The United Kingdom was the next prominent counattempt in the Europe cranberries market by holding a 18.4% share in 2025, with its dynamic functional beverage sector and early adoption of cranberry health messaging. According to the British Soft Drinks Association, the UK soft drinks market continues to expand, with “Still & Juice Drinks” (including functional, fruit-based, and blfinished options) displaying robust popularity. The National Health Service’s public guidance on non antibiotic approaches to urinary tract infection prevention has indirectly boosted cranberry consumption, particularly among women. Consumer awareness reports in the UK indicate that a significant proportion of women associate cranberry products with natural infection prevention and functional health benefits. Major brands including Ocean Spray maintain dedicated UK marketing teams, while domestic players like Copella have launched cold pressed cranberry blfinishs tarreceiveing premium segments. Online retail also plays a pivotal role. Unlike continental markets where cranberries remain seasonal, the UK treats them as a year round staple, supported by consistent promotional calfinishars and integration into school and workplace wellness programs.

France Cranberries Market Analysis

France occupies a noteworthy position in the European cranberry market due to high reliance on the pharmacy distribution channel and strong preference for standardized supplements over juice. Cranberry-based dietary supplements are increasingly popular in pharmacy settings, with sales figures exceeding those of juice products over a sustained period. Consumer preferences appear to favor health-oriented, concentrated forms over traditional fruit juices, potentially reflecting a focus on tarreceiveed wellness approaches. Pharmacists are viewed by a significant portion of consumers as trusted advisors for supplement choices, often preferred over other types of health professionals. Fruit juice consumption, including cranberry, faces constraints in the market due to regulatory limitations regarding added sugars in beverages. High-quality, organic dried cranberries are growing in popularity within specialty and organic retail environments. France’s market is thus bifurcated. clinical grade supplements dominate health oriented demand, while artisanal food applications cater to niche culinary experimentation, creating a unique dual track growth model distinct from other European nations.

Netherlands Cranberries Market Analysis

The Netherlands grew steadily in the Europe cranberries market and functions as the continent’s primary import gateway. A significant portion of cranberry imports entering the European Union passes through the Netherlands, establishing the counattempt as a major logistical hub for distribution to surrounding regions. The Netherlands functions as a central supplier and re-exporter of cranberries to neighboring countries, focapplying on both raw fruit and ingredient supplies. Consumers within the Netherlands frequently consider sustainability certifications and environmental impact when purchasing imported fruit products. Major food distributors in the region are increasing their focus on sourcing cranberries from suppliers that provide documentation on water stewardship and carbon footprint. The Netherlands is a hub for business-to-business innovation, particularly in developing fortified, ingredient-focutilized products for the European sports nutrition market. Though not the largest by finish consumption, the Netherlands’ role as a trade facilitator, sustainability benchmark setter, and co manufacturing enabler creates it a disproportionately influential player in shaping market standards and supply chain ethics.

Sweden Cranberries Market Analysis

Sweden is anticipated to expand in the Europe cranberries market from 2026 to 2034. It leads in the per capita cranberry consumption, driven by a deeply embedded culture of preventive health and affinity for wild harvested botanicals. Cranberry product consumption in Sweden is higher compared to the average across the European Union. The high consumption is influenced by a strong, existing preference for native lingonberries, which creates the adoption of cranberries familiar. Cranberries are perceived as a closely related, beneficial alternative to local berries due to their similar taste and health associations. Sales of cranberry supplements have grown as these products are increasingly included in public health recommfinishations alongside common nutritional supplements. Retailers like ICA and Coop integrate cranberries into seasonal wellness campaigns, particularly during winter months when immune support is prioritized. Notably, Sweden exhibits minimal price sensitivity. This combination of cultural resonance, public health alignment, and willingness to pay premium prices positions Sweden as a high value, trfinish setting market despite its compacter population size.

COMPETITIVE LANDSCAPE

The Europe cranberries market features moderate competition characterized by a blfinish of multinational cooperatives, regional processors, and specialized import distributors. While no single entity dominates the entire value chain, established players leverage long term grower contracts and advanced logistics to secure supply reliability. Competition centers less on price and more on product differentiation through health positioning, sustainability credentials, and packaging innovation. New entrants face high barriers due to stringent EU food safety standards and the required for cold chain infrastructure. Brand recognition remains crucial in retail channels whereas B2B segments prioritize consistency and technical support. The absence of significant local cultivation intensifies reliance on transatlantic partnerships creating a unique competitive dynamic where supply chain agility and regulatory compliance outweigh traditional marketing spfinish as key success factors in this niche yet growing market.

KEY MARKET PLAYERS

Some of the notable key players in the Europe cranberries market are

- Cliffstar Corp.

- Atoka Cranberries

- Korber Berries Group

- Mariani Packing Co., Inc.

- Fruit d’Or Inc.

- Decas Cranberry Products Inc.

- Graceland Fruit

- The Wonderful Company

- Ocean Spray Cranberries Inc.

Top Players in the Market

- Ocean Spray Cranberries Inc is a global agricultural cooperative owned by cranberry growers that plays a pivotal role in shaping the Europe cranberries market. The company supplies a wide portfolio including juices, dried fruits, and ingredients to retailers, food service providers, and supplement manufacturers across the continent. In recent years Ocean Spray has intensified its focus on sustainability and traceability by launching blockchain enabled supply chain transparency initiatives for European consumers. It also introduced reduced sugar juice variants and clean label dried cranberries to align with evolving regulatory and dietary preferences in countries like Germany and France.

- Atoka Cranberries is a leading European processor specializing in frozen and IQF cranberries sourced from North American partners and limited Baltic cultivation. The company serves industrial clients in the bakery, confectionery, and beverage sectors throughout Western and Northern Europe. Atoka has recently invested in cold chain logistics infrastructure in Rotterdam to ensure year round availability and minimize post harvest losses.

- Korber Berries Group operates as an integrated fruit sourcing and distribution platform with strong ties to Scandinavian and Eastern European markets. While not a cranberry grower itself, the company has built strategic import partnerships with Canadian cooperatives to secure consistent volumes of frozen and dried cranberries. Korber has strengthened its position by developing private label solutions for major supermarket chains in Sweden, Denmark, and the Netherlands.

Top Strategies Used by the Key Market Participants

Key players in the Europe cranberries market prioritize product diversification through clean label formulations and reduced sugar variants to meet evolving consumer demands. They invest heavily in sustainable packaging innovations such as recyclable and bioplastic materials to comply with EU environmental regulations. Strategic partnerships with retail chains enable tailored private label development and enhanced shelf presence. Companies are also implementing digital traceability systems applying blockchain technology to provide origin transparency and build consumer trust. Additionally they expand cold chain logistics networks to ensure consistent quality and year round availability across diverse European climates.

MARKET SEGMENTATION

This research report on the European cranberries market has been segmented and sub-segmented based on categories.

By Product Type

- Fresh Cranberries

- Frozen Cranberries

- Dried Cranberries

- Cranberry Juice

- Cranberry Sauces

By Application

- Food and Beverages

- Nutraceuticals

- Cosmetics

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Food Service

By Packaging Type

- Bags/Pouches

- Boxes/Cartons

- Jars/Bottles

- Cans/Tins

By End-Use Indusattempt

- Food Processing

- Beverage Indusattempt

- Healthcare

- Personal Care

- Cosmetics

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply