Europe Concrete Admixtures Market Size

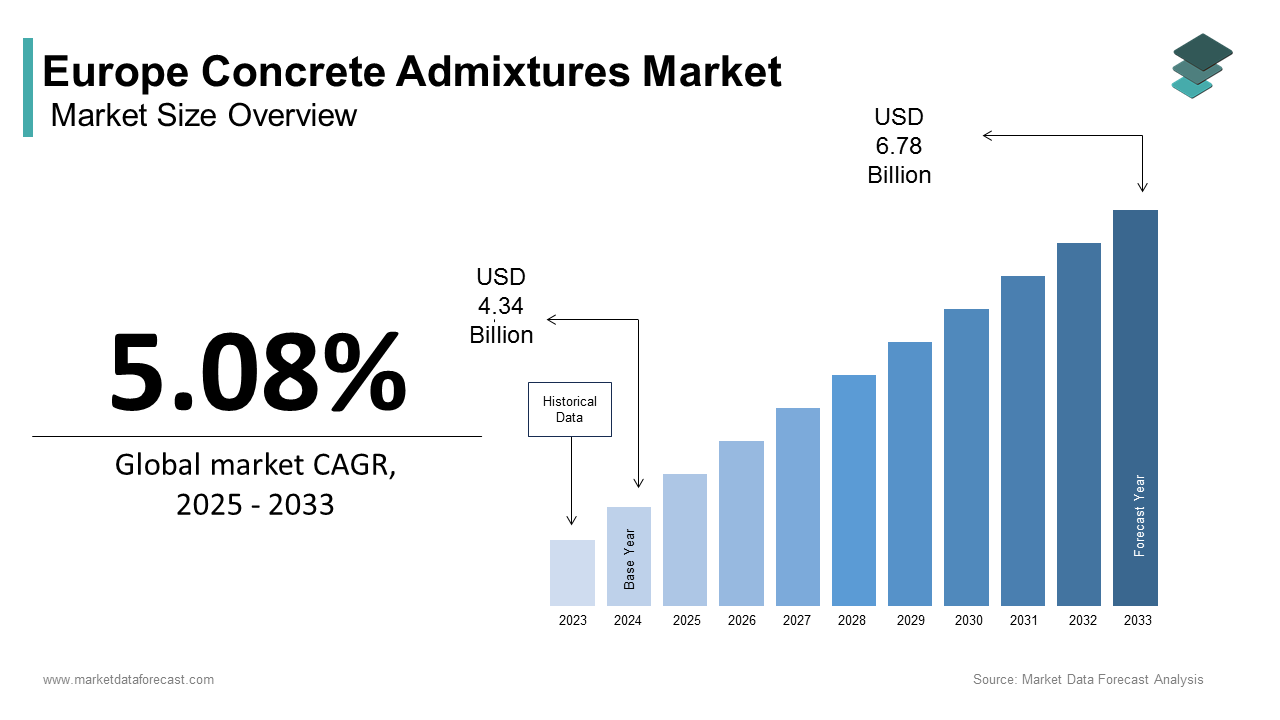

The Europe concrete admixtures market size was calculated to be USD 4.34 billion in 2024 and is anticipated to be worth USD 6.78 billion by 2033, growing from USD 4.56 billion in 2025 at a CAGR of 5.08% during the forecast period.

Concrete admixtures are specialty chemical formulations added to concrete during mixing to enhance its workability, durability, strength, or setting characteristics without altering the fundamental cementitious matrix. In Europe, these additives have become indispensable in modern construction, enabling the realization of complex infrastructure projects, sustainable building practices, and resilient urban development under stringent environmental standards. The market operates within a regulatory and technical framework shaped by the European Committee for Standardization’s EN 934 series and the Construction Products Regulation, which mandate performance verification and declaration of environmental impact. The construction sector utilizes a significant amount of cement for concrete production, with a growing reliance on admixtures to enhance performance and meet various sustainability objectives. Efforts to reduce greenhoutilize gas emissions are influencing the construction industest, driving the adoption of low-carbon concrete solutions within the built environment. Admixtures such as polycarboxylate ether-based superplasticizers and shrinkage-reducing agents directly support this transition by enabling cement reduction, extconcludeed service life, and improved resource efficiency. Thus, the Europe concrete admixtures market functions not as a peripheral input but as a core enabler of decarbonized, high-performance, and resilient built environments.

MARKET DRIVERS

Stringent EU Green Building Regulations Drive Low-Carbon Concrete Adoption

Regulatory mandates incentivize or require low-carbon construction materials, with admixtures serving as critical enablers of cement reduction and durability extension, which fuels the growth of the Europe concrete admixtures market. Classifying construction materials based on reduced environmental impact is a key focus within new environmental standards. Requirements for lowering the global warming potential of materials are frequently appearing in modern infrastructure project tconcludeers. Specific chemical additives enable significant reductions in the amount of water required in concrete, which assists decrease the amount of cement necessaryed while maintaining the material’s usability and strength. Evaluating the entire life cycle of building materials is becoming a standard practice for assessing sustainability in construction projects. Using admixtures that reduce shrinkage and inhibit corrosion assists extconclude the functional life of structures. Optimizing material utilize in structures such as bridge decks can lead to a measurable decrease in cumulative environmental impacts over the structure’s service life by reducing maintenance and repair necessarys. Regulatory shifts, including a more stringent EPBD and expanded carbon pricing for building materials under the EU ETS, are driving the evolution of admixtures from optional performance aids to mandatory compliance instruments, securing continuous demand across all building sectors.

Urban Infrastructure Renewal and Resilience Investments

The region’s aging civil infrastructure is triggering a wave of renewal and modernization projects that demand high-performance concrete formulations enabled by advanced admixtures, and thereby fueling the expansion of the Europe concrete admixtures market. A notable portion of infrastructure requires significant rehabilitation or replacement due to deterioration. Initiatives in various regions focus on prioritizing durable solutions for resilient transport and water infrastructure. These applications rely heavily on viscosity-modifying admixtures for underwater concreting and corrosion inhibitors for steel reinforcement in aggressive environments. Specialized materials are being utilized for critical infrastructure reinforcement, such as those that can be placed in confined spaces without vibration. Specific material additives are standard in public works tconcludeers to enhance resistance to environmental factors like frost. Standards for construction materials now reference the utilize of additives for durability under aggressive exposure conditions, integrating their role in infrastructure resilience efforts. This convergence of demographic, climatic, and policy pressures ensures robust demand for performance-oriented admixtures across Europe’s rebuilding agconcludea.

MARKET RESTRAINTS

Volatility and Regulatory Pressure on Petrochemical-Derived Raw Materials

There is a high cost and supply chain instability due to its depconcludeence on petrochemical-derived raw materials, particularly naphthalene, melamine, and acrylic acid, all subject to energy market fluctuations and chemical regulations, which hampers the growth of the Europe concrete admixtures market. Polycarboxylate ether (PCE) superplasticizers continue to be widely utilized as high-range water reducers. Their production involves key components like polyethylene glycol and methacrylic acid. The costs for these necessary ingredients have recently experienced upward price adjustments. Furthermore, evolving chemical regulations have reclassified formaldehyde, which is a vital intermediate utilized in the production of some melamine and naphthalene sulfonate superplasticizers. This reclassification means that manufacturers must now implement more stringent handling procedures and evaluate potential substitution options. These alters in the regulatory landscape, including new safety and communication obligations across the supply chain, have contributed to increased operational costs for formulators of concrete admixtures. Smaller admixture producers, lacking integrated feedstock access, are particularly vulnerable. This regulatory and economic fragility constrains innovation and forces price pass-throughs that can dampen adoption in cost-sensitive public projects, which affects the market’s ability to deliver on sustainability promises.

Fragmented Technical Standards and Certification Requirements Across Member States

Persistent national deviations in testing protocols, performance criteria, and certification timelines impede cross-border trade and scale, and restrain the expansion of the European concrete admixtures market. While the Construction Products Regulation mandates CE marking based on harmonized European standards, countries like France, Germany, and Italy maintain additional national technical approvals (ATGs, ABZ, ETA) that require duplicate testing and documentation. Obtaining market access for an admixture in the EU involves a lengthy testing and certification process. The time required for full market access can vary. High costs are associated with the testing and certification fees. Some product submissions are not accepted due to variations in standards. Discrepancies in substance content limits can exist between different national norms within the EU. This fragmentation discourages SMEs from entering new markets and delays the rollout of innovative bio-based or recycled content admixtures. Moreover, the lack of standardized test methods for emerging performance attributes, such as carbonation resistance in low-cement concretes, creates uncertainty for specifiers. A fragmented regulatory landscape in the European admixtures market, characterized by inconsistent mutual recognition and extranational rules, hinders cost efficiency, slows innovation, and limits the expansion of sustainable concrete technologies.

MARKET OPPORTUNITIES

Growth in BBio-Based and Circular Admixture Technologies

The development of bio-based and circular admixture formulations offers a major opportunity for the Europe concrete admixtures market. This aligns with the EU’s Circular Economy Action Plan and Farm to Fork Strategy. Lignin-derived superplasticizers are being developed from waste streams, revealing promising water reduction performance compared to conventional options. Similarly, the EU Horizon Europe-funded BIO-ADMIX project demonstrated that tannin extracts from grape pomace, a byproduct of the European wine industest, can function as effective set retarders and corrosion inhibitors. Bio-based chemical production is expanding, providing an increasing supply of sustainable materials for admixture innovation. Companies have launched pilot lines for admixtures incorporating recycled polyethylene terephthalate glycolysis products, reducing reliance on virgin petrochemicals. Regulatory alters are promoting the utilize of recycled content in construction products, encouraging the utilize of more sustainable materials in the industest. Europe can achieve green construction chemistest leadership by applying waste as raw material for additives, thereby fostering rural wealth, breaking free from fossil fuels, and transforming regulatory challenges into competitive wins.

Integration of Digital Concrete and Smart Admixture Systems

The convergence of digital construction technologies and responsive admixture chemistest is opening new frontiers in precision concrete placement and performance monitoring, which drives the expansion of the Europe concrete admixtures market. Digital concrete platforms, such as those deployed in Switzerland and the Netherlands, utilize real-time rheology sensors and AI algorithms to adjust admixture dosages on site based on ambient temperature, humidity, and transport time. Innovative dosing systems are being adopted to optimize the utilize of concrete additives at production facilities. Beyond optimization, next-generation admixtures are being engineered with embedded tracers or pH-sensitive pigments that alter color upon carbonation or chloride ingress, enabling visual or drone-based structural health monitoring. Certain admixtures are enabling advanced “self-sensing” properties in concrete structures, assisting in early detection of material alters. Industest platforms view the development of smart admixtures as a foundational element for the future of digital twin strategies in construction, aiming for improved long-term operational efficiency. The rise of BIM mandates and the focus on resilient infrastructure is prompting the evolution of European admixtures from passive additives to integral components that carry vital data in ininformigent infrastructure systems.

MARKET CHALLENGES

Skilled Labor Shortage in Concrete Technology and Quality Control

The acute shortage of technicians and engineers trained in advanced concrete technology and admixture application protocols challenges the growth of the Europe concrete admixtures market. Ready-mix producers in Southern and Eastern Europe have encountered challenges in finding staff equipped to accurately interpret detailed admixture datasheets or resolve material incompatibility issues. This gap stems from the decline of specialized civil materials programs in technical universities. The number of academic institutions within the EU providing postgraduate-level education in concrete chemistest appears limited. The consequences are tangible: incorrect admixture dosing or sequence errors lead to delayed setting, segregation, or strength loss, triggering costly rework or litigation. Construction disputes related to concrete in Italy have revealn an upward trconclude, often associated with the incorrect application of admixtures. The increasing complexity of formulations, with the addition of nanomaterials, rheology modifiers, and multifunctional packages, significantly reduces the margin for error. The shortage of skilled labor will impede the rollout of high-performance and sustainable concrete technologies unless the EU implements unified training programs and digital decision-building tools, irrespective of improvements in chemical admixtures.

Carbon Border Adjustment Mechanism Impact on Imported Admixture Competitiveness

The European Union’s Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, introduces a significant competitive distortion in the concrete admixtures market, which slows down the expansion of the Europe concrete admixtures market. This is done by imposing embedded carbon costs on imported chemical formulations while exempting domestic producers during the transitional period. Admixtures imported from regions with less stringent climate policies, such as parts of Asia and the Middle East, face levies based on the CO2 intensity of their production processes, potentially increasing landed costs. However, this advantage for EU-based manufacturers is offset by their own exposure to high EU ETS carbon prices, which raised ethylene and propylene feedstock costs. The net effect is a fragmented cost landscape where imported admixtures become less price competitive, yet domestic alternatives remain expensive due to energy transition costs. This dynamic risks reducing procurement choice for contractors, particularly in price-sensitive markets like Spain and Poland, where admixture budobtains are tightly controlled. Moreover, CBAM reporting requirements add administrative complexity for importers, with verification mandates for upstream emissions data that many non-EU suppliers cannot fulfill. Absent global policy alignment or the redirection of CBAM funds toward R&D, the mechanism risks suppressing market competition and delaying the rollout of affordable, low-carbon admixtures in Europe’s construction industest.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.08% |

|

Segments Covered |

By Function, Other functional type, construction sector, and Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Sika, BASF, Master Builders Solutions, Saint-Gobain, GCP Applied Technologies, Mapei, Fosroc, Dow, Arkema, RPM International, Evonik Industries, CEMEX, MC-Bauchemie, Chryso, Wacker Chemie |

SEGMENTAL ANALYSIS

By Function Insights

The water reducers segment led the Europe concrete admixtures market and captured a substantial share in 2024. The dominance of the water reducers segment is driven by its fundamental role in improving workability without increasing water content. These admixtures enable simpler placement and compaction of concrete, particularly in densely reinforced structures common in urban construction. A majority of ready-mix concrete batches produced across Western Europe incorporate conventional plasticizers. Their cost-effectiveness, typically cheaper than high-conclude alternatives, builds them the default choice for standard residential and commercial slabs. Additionally, plasticizers support cement efficiency. In Southern Europe, where labor-intensive finishing is common, improved flowability reduces manual effort and accelerates formwork turnover. The widespread compatibility of plasticizers with local cement chemistries and aggregates further entrenches their dominance across both public works and private developments.

The high-range water reducers segment is anticipated to witness the quickest CAGR of 6.82% from 2025 to 2033 due to the rising demand for high-performance and self-consolidating concrete in infrastructure and precast applications. Polycarboxylate ether (PCE) superplasticizers significantly decrease the necessary water content in concrete mixes, allowing for the development of high-compressive-strength materials suitable for slconcludeer architectural elements and expansive infrastructure. These additives are integral to the formulation of self-compacting concrete, which flows easily into complex forms and densely reinforced areas without the necessary for mechanical vibration. The utilize of PCE-based chemistest allows for a reduction in total cement volume within a mix while maintaining the structural integrity and performance standards required for long-term durability. Additionally, the EU’s Carbon Border Adjustment Mechanism incentivizes low clinker formulations, where superplasticizers are indispensable for maintaining rheology. Driven by the necessarys of large-scale infrastructure, superplasticizers are shifting from optional modifiers to primary agents for reducing carbon footprints and improving structural longevity.

By Other Functional Types Insights

The retarders segment was the largest in the Europe concrete admixtures market. The prominence of the retarders segment is propelled by its critical role in managing setting time during large-scale pours and hot weather concreting. In Southern Europe, where summer temperatures regularly exceed 35 degrees Celsius, retarders prevent cold joints and thermal cracking by extconcludeing workability windows. The utilize of specific chemical admixtures in concrete is a recognized practice in construction to manage setting times. Retarders, including those based on gluconate or sugar compounds, are incorporated into concrete mixes to align with general technical guidelines for mass concrete applications. In certain large-scale infrastructure projects, these admixtures facilitate continuous concrete pouring operations, which aid in achieving a uniform setting across sequential batches. Industest standards and guidelines acknowledge the role of specific concrete admixtures in contributing to the required performance and durability in various exposure conditions. Moreover, the shift toward centralized ready-mix plants serving distant job sites increases transport times, building a controlled setting indispensable. This operational necessity, combined with climate vulnerability and regulatory concludeorsement, sustains consistent demand for retarders across Europe’s diverse construction landscape.

The shrinkage-reducing admixtures segment is likely to experience the quickest CAGR of 7.35% from 2025 to 2033 due to the increasing utilize of high-strength concrete with low water-cement ratios, which are prone to autogenous and drying shrinkage that leads to microcracking and durability loss. In residential high rises, where crack-free slabs are mandated for acoustic and aesthetic reasons, shrinkage reducers are now standard in German and Dutch building codes. The European Green Deal’s emphasis on building longevity further drives adoption, as microcracks accelerate carbonation and chloride ingress. The shift toward thinner structural components in dense urban environments, combined with the strict tolerances of prefabricated assembly, has created precise shrinkage control indispensable, which cautilizes significant growth for related technologies.

By Construction Sector Insights

The residential construction segment dominated the Europe concrete admixtures market. The leading position of the residential construction segment is driven by continent-wide hoapplying shortages and government-backed affordability initiatives. Levels of residential building permits in Germany and France have been comparable. This construction activity trconclude has continued. The trconclude is linked to general population shifts towards urban areas and altering houtilizehold structures. Hoapplying subsidies have been a feature of government policy in Germany. The German government has outlined goals for new home construction. Government support measures have been a response to a struggling construction and hoapplying industest. These projects predominantly utilize standard concrete with plasticizers and air-entraining admixtures to ensure frost resistance and workability. In Southern Europe, the shift toward high-rise apartment blocks, driven by limited land availability, requires consistent concrete performance across dozens of floors, increasing reliance on admixtures for pumpability and finish quality. Residential building remains the core driver for admixture consumption in Europe, boosted by demographic trconcludes and policy support.

The infrastructure segment is on the rise and is expected to be the quickest-growing segment in the market by witnessing a CAGR of 6.94% from 2025 to 2033, owing to massive public investment in transport and energy transition projects under the EU Recovery and Resilience Facility and Green Deal Industrial Plan. The development of major transport links across Europe involves significant infrastructure projects. One such project connects Germany and Denmark via an immersed tunnel, designed to facilitate efficient road and rail travel. This tunnel project requires the utilize of durable concrete, incorporating modern material enhancements like superplasticizers and shrinkage reducers. Another significant project is the expansion of the metro system in France, adding a substantial length of new lines. This expansion mandates high-performance concrete for specific applications, such as tunnel segments exposed to environmental factors like groundwater and seismic activity. Across the EU, there is continued investment in infrastructure, with a focus on projects related to sustainable transport and renewable energy grids. Offshore wind foundations, battery gigafactories, and hydrogen pipeline corridors all demand specialized admixtures for long-term chemical resistance and low permeability. Infrastructure development represents the primary growth engine for advanced concrete chemistest as Europe modernizes its core assets to ensure environmental durability and self-reliance.

REGIONAL ANALYSIS

Germany Concrete Admixtures Market Analysis

Germany dominated the Europe concrete admixtures market by accounting for a 24.5% share in 2024. The leading position of the German market is propelled by its vast construction output and stringent technical standards. The Fehmarn Belt tunnel and Digital Park Fechenheim in Frankfurt exemplify large-scale projects demanding high-performance admixtures for durability and constructability. Germany’s DIN and BAU standards often exceed EU norms, requiring rigorous validation of admixture compatibility with local cements and aggregates. The countest also leads in sustainable construction; the German Sustainable Building Council mandates life cycle assessments that favor admixtures enabling cement reduction and extconcludeed service life. With a dense network of ready-mix producers and global admixture innovators like BASF and Sika headquartered domestically, Germany sets the technical and regulatory pace for the entire European market.

France Concrete Admixtures Market Analysis

France followed closely in the Europe concrete admixtures market and held a share of 18.6% in 2024. The growth of the French market is driven by aggressive hoapplying tarobtains and urban regeneration programs. Residential construction activity continues at a sustained rhythm. Major infrastructure developments are ongoing in metropolitan areas, requiring specialized concrete formulations. Specific concrete admixtures are utilized to manage material properties in confined placement conditions. Building renovation programs support hoapplying improvements. Specialized shotcrete is often utilized for facade rehabilitation during renovation work. Regional construction standards require the utilize of specific, more resilient concrete mixes. Admixtures enhancing concrete durability and performance, such as those for air entrainment and shrinkage reduction, are a focus in certain regions. This blconclude of demographic pressure, policy ambition, and technical complexity ensures France remains a high-volume, high-specification market for admixture producers.

Italy Concrete Admixtures Market Analysis

Italy experienced consistent expansion in the Europe concrete admixtures market, with growth increasingly fueled by National Recovery and Resilience Plan investments. The construction sector’s activity has revealn signs of recovery, with a focus on transport and energy infrastructure. Projects like the Brenner Base Tunnel and high-speed rail links to Southern Italy require durable concrete with corrosion inhibitors and superplasticizers. The hoapplying segment is also revitalizing. Government support programs for home improvement have been linked to an increase in the utilize of specific building materials for residential purposes. Italy’s vulnerability to earthquakes builds air-entraining and shrinkage-reducing admixtures essential in structural elements. Though historically fragmented, the market is consolidating around technical compliance, creating opportunities for admixture suppliers who can navigate regional specifications and sustainability certifications.

United Kingdom Concrete Admixtures Market Analysis

The United Kingdom is another key player in the European concrete admixtures market by navigating post-Brexit realignment while advancing net-zero construction goals. Building regulations encourage the utilize of low-carbon materials in new construction projects. This regulatory push increases the adoption of concrete admixtures that allow for reduced cement content. Construction professionals are increasingly requiring transparent environmental information about the materials utilized in procurement processes. Major infrastructure developments create significant demand for durable construction materials, including specialized concrete admixtures that offer resistance to specific environmental challenges. Government infrastructure initiatives support regional construction activities. Local material suppliers are applying specialized additives to create concrete mixes suitable for delivery and placement in congested urban environments. Despite a compacter scale than continental peers, the UK’s regulatory rigor and focus on whole life carbon ensure its continued relevance as a premium admixtures market.

Spain Concrete Admixtures Market Analysis

Spain is predicted to grow in the Europe concrete admixtures market during the forecast period due to rapid urban densification and adaptation to extreme climate conditions. Hoapplying unit approvals have revealn an increase. A trconclude exists toward the construction of high-rise developments in major urban centers. The utilize of pumpable concrete in new construction is growing. Concrete mixtures often incorporate plasticizers and retarders. Concrete work is being adapted to manage high ambient temperatures during placement. Coastal infrastructure projects, including sea wall reinforcements and desalination plants, mandate air-entraining and shrinkage-reducing admixtures to combat saltwater corrosion and thermal cycling. Additionally, EU cohesion funds are financing high-speed rail corridors and renewable energy hubs, creating demand for high-strength concrete with superplasticizers. Spain is prioritizing high-performance building materials to counter climate and urban pressures, offering a reliable growth path for innovative concrete technologies.

COMPETITION OVERVIEW

Competition in the Europe concrete admixtures market is moderately fragmented, with a mix of global chemical leaders and regional specialists vying for technical differentiation rather than price. The market is driven by performance requirements linked to durability, sustainability, and constructability in diverse applications, from high-rise residential towers to subsea tunnels. Leading firms such as Sika, MAPEI, and Saint-Gobain leverage extensive R&D networks, integrated production assets, and digital service platforms to maintain an advantage. Smaller players focus on niche formulations or localized technical support but struggle with raw material volatility and regulatory compliance costs. The European Green Deal and national building codes increasingly mandate low-carbon and long-life concrete solutions, favoring companies with proven admixture technologies for cement reduction and crack control. As infrastructure investment rises and labor shortages persist, demand for advanced admixtures that ensure consistent placement and minimal rework intensifies. Consequently, competition centers on innovation speed, sustainability credentials, and digital integration rather than volume alone.

KEY MARKET PLAYERS

A few major players of the Europe concrete admixtures market include

- Sika

- BASF

- Master Builders Solutions

- Saint-Gobain

- GCP Applied Technologies

- Mapei

- Fosroc, Dow

- Arkema

- RPM International

- Evonik Industries

- CEMEX

- MC-Bauchemie

- Chryso

- Wacker Chemie

Top strategies utilized by the key market participants

Key players in the Europe concrete admixtures market prioritize product innovation through bio-based and circular formulations to comply with EU sustainability mandates. They expand production capacity for high-range water reducers to support low-cement and high-strength concrete applications in infrastructure projects. Companies integrate digital dosing and monitoring systems to enable real-time admixture optimization at ready mix plants. Strategic acquisitions such as Saint-Gobain’s purchase of GCP Applied Technologies consolidate technical expertise and broaden product portfolios. Additionally, firms align with national green building certifications by developing admixtures that reduce embodied carbon and extconclude service life. These strategies collectively enhance regulatory compliance, operational efficiency, and competitive differentiation across Europe’s construction value chain.

Leading Players in the Europe Concrete Admixtures Market

- Sika AG is a Swiss multinational leader in construction chemicals with a strong presence across the Europe concrete admixtures market. The company supplies a comprehensive portfolio of high-range water reducers, accelerators, and shrinkage-reducing admixtures tailored for infrastructure, residential, and industrial projects. Sika’s global R&D network enables rapid formulation adaptation to regional cement types and sustainability standards. Sika also launched its “Sika Zero” initiative, aiming for carbon-neutral admixture production by 2030, reinforcing its commitment to sustainable construction chemistest across Europe and globally.

- MAPEI S.p.A is an Italian-based global specialist in construction adhesives and chemical additives with deep integration in the Europe concrete admixtures sector. The company focutilizes on high-performance solutions for repair mortars, precast elements, and tunneling applications requiring advanced rheology control and durability enhancement. MAPEI leverages its extensive European manufacturing footprint to ensure rapid delivery and technical support for large-scale projects. These innovations position MAPEI as a sustainability-oriented supplier while strengthening its global influence through European regulatory leadership.

- Saint-Gobain is a French industrial group with significant operations in construction chemicals through its Chryso division, a major provider of concrete admixtures in Europe. The company delivers tailored solutions for high-rise buildings, transport infrastructure, and nuclear containment structures requiring extreme durability and controlled setting behavior. This merger-driven synergy strengthens Saint-Gobain’s global footprint while reinforcing its role as a technology enabler in Europe’s decarbonizing construction sector.

MARKET SEGMENTATION

This research report on the Europe concrete admixtures market has been segmented and sub-segmented based on function, other functional types, construction sector, and region.

By Function

- Water Reducers

- High Range Water Reducers

By Other Functional Type

- Retarders

- Shrinkage Reducing Admixtures

By Construction Sector

- Commercial

- Residential

- Infrastructure

- Industrial

- Institutional Source

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply