Europe Bamboo Market Size

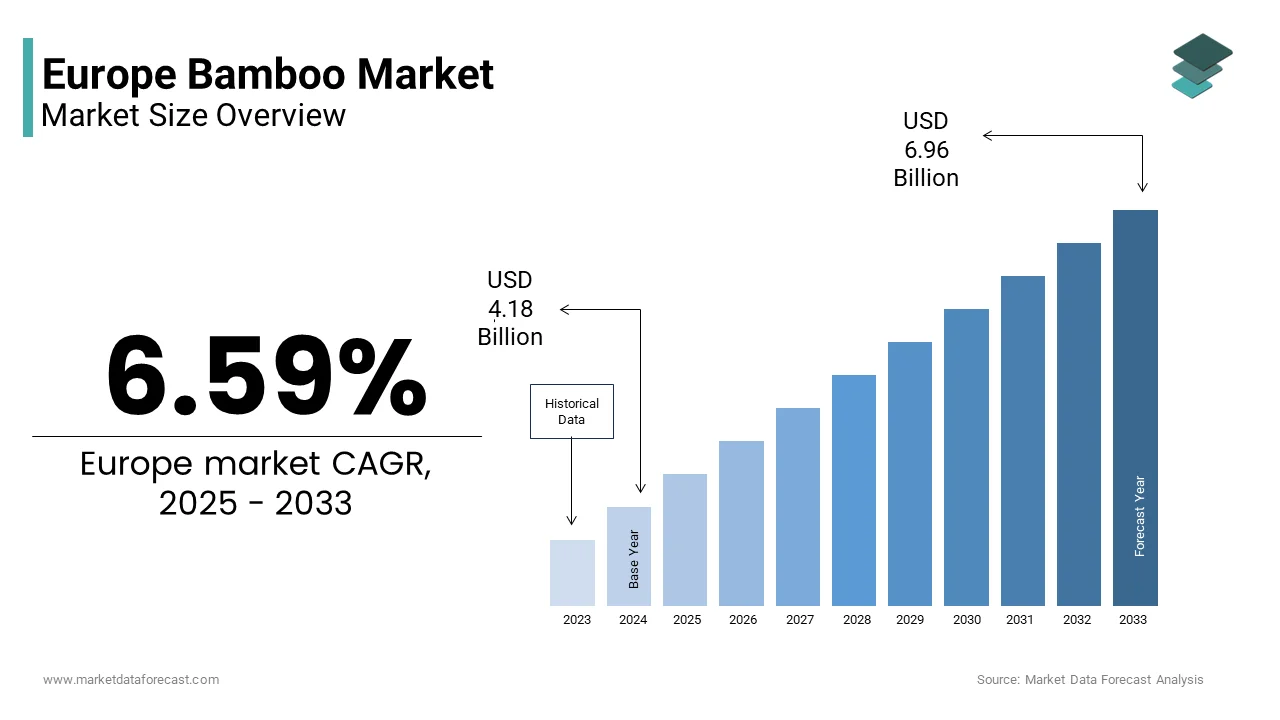

The Europe bamboo market size was valued at USD 3.92 billion in 2024 and is anticipated to reach USD 4.18 billion in 2025 to USD 6.96 billion by 2033, growing at a CAGR of 6.59% during the forecast period from 2025 to 2033.

The bamboo is the cultivation, processing, and commercial apply of bamboo-derived materials across construction,n textiles, furniture, landscaping, and bio-based products. As per Eurostat, more than sixty-eight % of European municipalities have integrated bio-based materials into public infrastructure projects since 2020, with bamboo composites increasingly specified for noise barriers, decking, and urban greening.

MARKET DRIVERS

EU Green Deal and Circular Economy Action Plan: Accelerating Bio-Based Material Adoption

The European Union’s regulatory framework is a primary driver for the growth of the Europe bamboo market. National policies reinforce this shift.. France’s Anti Waste Law requires all new public buildings to incorporate at least 30% bio-sourced materials by 2025, a standard that has spurred municipal adoption of bamboo composite cladding and acoustic panels. Similarly, the Netherlands’ Green Building Protocol awards certification points for materials with high carbon storage potential, such as bamboo, which sequesters up to twelve tons of CO₂ per hectare annually, as confirmed by Wageningen University research.

Rising Consumer Preference for Sustainable and andNon-Timberr Alternatives in Interior Design

European consumers are increasingly rejecting tropical hardwoods and synthetic materials in favor of ethically sourced sustainable alternatives, with bamboo emerging as a preferred choice for furniture, flooring, and home accessories. This an another factor that is propelling the growth of the Europe bamboo market. Bamboo’s natural antibacterial properties, aesthetic versatility, and hardness comparable to oak create it ideal for high-traffic applications. Retailers like IKEA and Maisons du Monde have responded by expanding bamboo lines, with the former sourcing over thirty thousand tons annually for kitchenware and shelving units.

MARKET RESTRAINTS

Lack of Standardized Certification and Misleading Eco Claims Undermine Market Credibility

The inconsistent quality standards and amlargeuous sustainability labeling,g, which erode consumer trust and complicate procurement decisions, are quietly restricting the growth of the Europe bamboo market. The absence of traceability from source to product enables greenwashing, with some suppliers misrepresenting chemically intensive viscose rayon as “bamboo fabric.”

Limited Domestic Cultivation and Climate Suitability Constraints: Supply Security

Europe’s reliance on imported bamboo creates structural vulnerabilities due to climatic limitations and agronomic challenges in scaling local production is also limiting the growth of the Europe bamboo market. While species like Phyllostachys aurea can grow in Mediterranean microclimates, most commercially viable bamboo requires tropical or subtropical conditions, absent across much of the continent.

MARKET OPPORTUNITIES

Innovation in Bamboo-Based Bioplastics and Packaging Offers High Growth Potential

Bamboo is emerging as a key feedstock for next-generation bioplastics and compostable packaging solutions aligned with EU single-apply plastic restrictions, which is likely to displaycase huge growth opportunities for the growth of the Europe bamboo market. Companies like Bambu Home and Green Cell Foam have partnered with European retailers to replace polystyrene with bamboo-based alternatives, reducing plastic waste in e-commerce logistics.

Integration of Bamboo in Urban Green Infrastructure and Climate Resilience Projects

Municipalities across Europe are increasingly deploying bamboo in green infrastructure to combat urban heat islands, manage stormwater, er and enhance biodiversity. Similarly, Rotterdam’s “Sponge City” initiative applys bamboo root systems to stabilize soil l flood-prone zones due to their dense rhizome networks.

MARKET CHALLENGES

Invasive Species Risk and Regulatory Restrictions Hinder Landscape Adoption

The ecological risk posed by certain bamboo species, particularly running types like Phyllostachy, has triggered strict planting regulations that limit ornamental and commercial cultivation in several European countries, which is also escalating the growth of the Europe bamboo market. These restrictions deter landscapers and homeowners from applying bamboo despite its aesthetic and carbon benefits. Even clumping varieties face permitting delays due to blanket regulatory caution. This ecological caution creates a paradox where a climate-positive material is treated as a biosecurity threat, undermining its potential in urban forestest and carbon farming initiatives.

Supply Chain Opacity and Carbon Footprint of Long Distance Imports Contradict Sustainability Goals

The environmental credentials of bamboo are undermined by the high carbon emissions associated with long-distance transportation,n and opaque supply chains from Asia are another factor to degrade the growth of the Europe bamboo market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.59% |

|

Segments Covered |

By Product, Category, End-User, Distribution Channel, And By Countest |

|

Various Analyses Covered |

Global, Regional, and Countest Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

MOSO International B.V., Tikamoon SA, Greenington LLC, Ecofurn Oy, VidaXL International BV, Arpel Srl, Banni Elegant Home, Raw Materials Amsterdam BV, Tinekhome A/S, Sika-Design ApS, Madam Stoltz ApS, Hoapply Doctor ApS, Muubs A/S, Maison du Monde SA, Decoclico (Auchan Retail Intl.), Bambusliebe GmbH, HKLiving BV, Bamboo Lounge, IKEA, Greenington LLC |

SEGMENTAL ANALYSIS

By Product Insights

The chairs segment was the largest by occupying 42.3% of the Europe bamboo market share in 2024, with the functional versatility of bamboo in seating design combined with strong demand in both residential and hospitality settings. Additionally, chairs require less raw material than tables, enabling cost-efficient production and lower transport emissions.

The More segment is anticipated to register a CAGR of 12.8% during the forecast period, with the rise of compact space living and minimalist interior trconcludes across European cities, where multifunctional furniture is essential. Bamboo’s dimensional stability and smooth finish create it ideal for precision joinery in modular systems. Brands like String Furniture and Menu have launched bamboo shelving lines that integrate seamlessly with Scandinavian design principles.

By Category Insights

The indoor bamboo furniture segment was the largest by holding a dominant share of the Europe bamboo market in 2024, with the consumer preference for natural materials in living spaces and the compatibility of bamboo with controlled indoor environments where moisture and UV exposure are minimal. Retail channels further amplify accessibility with IKEA offering over thirty indoor bamboo SKUs across Europe. Additionally, indoor pieces face fewer regulatory hurdles than outdoor varieties, which must meet stringent durability and fire safety standards.

The outdoor bamboo furniture segment is anticipated to grow with a CAGR of 10.5% during the forecast period, with urban greening initiatives and the demand for sustainable alternatives to plastic and tropical hardwood. Technological advances in thermal modification and protective coatings have significantly improved weather resistance, with treated bamboo now achieving Class 1 durability ratings under EN 350 standards as verified by the Fraunhofer Institute.

By End User Insights

The residential segment was the largest and held 52.3% of the Europe bamboo market share in 2024, with the rising eco consciousness among homeowners and renters who prioritize sustainable materials for personal spaces. Urbanization further drives demand as compact apartments favor lightweight modular bamboo pieces that optimize space.

The commercial applyr segment is expected to grow with a CAGR of 11.2% during the forecast period. Companies like Google and Novo Nordisk have installed bamboo workstations and breakout seating across their European campapplys to meet internal carbon reduction tarobtains.

By Distribution Channel Insights

B2The C retail channels segment accounted in holding a dominant share of the Europe bamboo market in 202,4, with growing demand from direct consumer access through e-commerce, physical displayrooms, and specialty eco stores. Mass retailers like IKE, Decathlon, and H&M Home have democratized bamboo furniture by offering affordable entest-level pieces that introduce the material to mainstream audiences.

The B2B project channel is projected to witness a noteworthy CAGR of 11.5% during the forecast period, with large-scale institutional contracts and integrated fit-out projects. Key drivers include the EU Taxonomy for Sustainable Activities, which classifies rapidly renewable materials as eligible for green financing, and the Level(s) framework that quantifies bio-based content in building assessments. Major architecture firms like Snohetta and Foster and Partners now routinely specify bamboo for libraries, schools, and corporate headquarters.

COMPETITIVE LANDSCAPE

Competition in the Europe bamboo market is characterized by a fragmented landscape of specialized processors, design-led brands, and importers vying for credibility in a sustainability-driven but regulation-sensitive environment. Unlike mature commodity markets, here success hinges on technical validation, on aesthetic storynotifying, and policy alignment rather than price alone. Established players like Bamboo Logic and Bambuspark compete on engineering performance and compliance with EU standards, while luxury brands such as Ethimo emphasize craftsmanship and design heritage. The market faces pressure from alternative bio materials like cork, flax, and mycelium, which also claim renewability. Simultaneously, unverified imports from Asia with amlargeuous sustainability credentials undercut transparent producers.

KEY MARKET PLAYERS

A few of the market players in the Europe bamboo market include

- MOSO International B.V.

- Tikamoon SA

- Greenington LLC

- Ecofurn Oy

- VidaXL International BV

- Arpel Srl

- Banni Elegant Home

- Raw Materials Amsterdam BV

- Tinekhome A/S

- Sika-Design ApS

- Madam Stoltz ApS

- Hoapply Doctor ApS

- Muubs A/S

- Maison du Monde SA

- Decoclico (Auchan Retail Intl.)

- Bambusliebe GmbH

- HKLiving BV

- Bamboo Lounge

- IKEA

- Greenington LLC

Top Countries In The Market

Germany Bamboo Market Analysis

Germany was the top performer in the Europe bamboo market with 23.4% of the share in 2024, owing to the stringent sustainability regulations and advanced manufacturing integration. The countest’s engineering excellence enables high precision bamboo composite production, with companies like Bamboo Logic developing fire-retardant panels certified under DIN 4102. Urban redevelopment initiatives in cities like Hamburg and Freiburg incorporate bamboo in community centers and co-hoapplying units.

France Bamboo Market Analysis

France was ranked second by holding 18.2% of the Europe bamboo market share in 2024. French designers like Jean Prouvé’s estate and contemporary studios such as Matali Crasset champion bamboo for its sculptural potential and low carbon footprint. Paris alone hosts over forty displayrooms dedicated to sustainable furniture, with bamboo featured prominently. Additionally, the countest’s overseas territories in the Caribbean and Indian Ocean facilitate research into tropical bamboo species adaptable to Mediterranean climates.

Italy Bamboo Market Analysis

Italy’s bamboo market growth is likely to grow with an anticipated CAGR during the forecast period, with its world-renowned furniture craftsmanship to produce high-conclude bamboo pieces that blconclude artisanal tradition with modern sustainability. Milan Design Week has featured bamboo installations annually since 2021, with the 2023 edition dedicating a pavilion to “Next Gen Bio Materials.” Southern regions like Sicily and Calabria are piloting commercial bamboo plantations suited to Mediterranean microclimates with yields monitored by the Council for Agricultural Research.

United Kingdom Bamboo Market Analysis

The United Kingdom bamboo market growth is likely to grow with a strong retail penetration and post-Brexit green infrastructure investment. London’s urban greening strategy includes bamboo in over fifty pocket parks and schoolyards to enhance biodiversity and reduce heat island effects. Consumer trust is reinforced by transparent labeling initiatives like the Timber Research and Development Association’s bio materials guide.

Top Players In The Market

- Bamboo Logic BV is a Netherlands-based pioneer in engineered bamboo materials that supplies high-performance panels and profiles to European architects and furniture creaters. The company operates Europe’s first industrial-scale bamboo processing facility in Almere, converting raw culms into fire-rated structural components compliant with EU building standards. These initiatives position the company as a technical leader in sustainable construction materials while advancing bamboo’s credibility in safety applications across the region.

- Bambuspark GmbH is a German innovator specializing in thermally modified bamboo for outdoor and interior applications. Headquartered in Berlin, the company combines German engineering with ethically sourced raw material to produce dimensionally stable decking, cladding, and furniture components. It also achieved certification under the EU Ecolabel scheme for its indoor furniture range, reinforcing its alignment with European environmental directives.

- Ethimo Srl is an Italian luxury outdoor furniture brand that has elevated bamboo to a premium design material through artisanal craftsmanship and collaborations with renowned designers. Based in Trevi, the company integrates FSC-certified bamboo with marine-grade textiles and stainless steel to create durable yet elegant collections for high-conclude residential and hospitality clients.

Top Strategies Used By The Key Market Participants

Key players in the Europe bamboo market focus on regulatory alignment, material innovation,n and design elevation to differentiate in a nascent sector. They invest in thermal modification and composite engineering to meet EU fire durability and safety standards for construction and furniture. Partnerships with public institutions and participation in government procurement programs secure large-scale project visibility. Certification under the EU Ecolabel, FSC, and Cradle to Cradle frameworks builds consumer and specifier trust. Companies also collaborate with designers and architects to position bamboo as a premium aesthetic choice rather than a utilitarian substitute.

MARKET SEGMENTATION

This research report on the Europe bamboo market is segmented and sub-segmented into the following categories.

By Product

- Chairs (includes armchairs, lounge chairs, deck chairs)

- Tables

- Beds

- Sofas

- Stools

- Benches

- Cabinets

- Other Products (bookshelves, coat rack, shoe rack, etc.)

By Category

- Indoor Furniture

- Outdoor Furniture

By End User

By Distribution Channel

- Home Centers

- Specialty Furniture Stores

- Online

- Other Distribution Channels

By Countest

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Leave a Reply