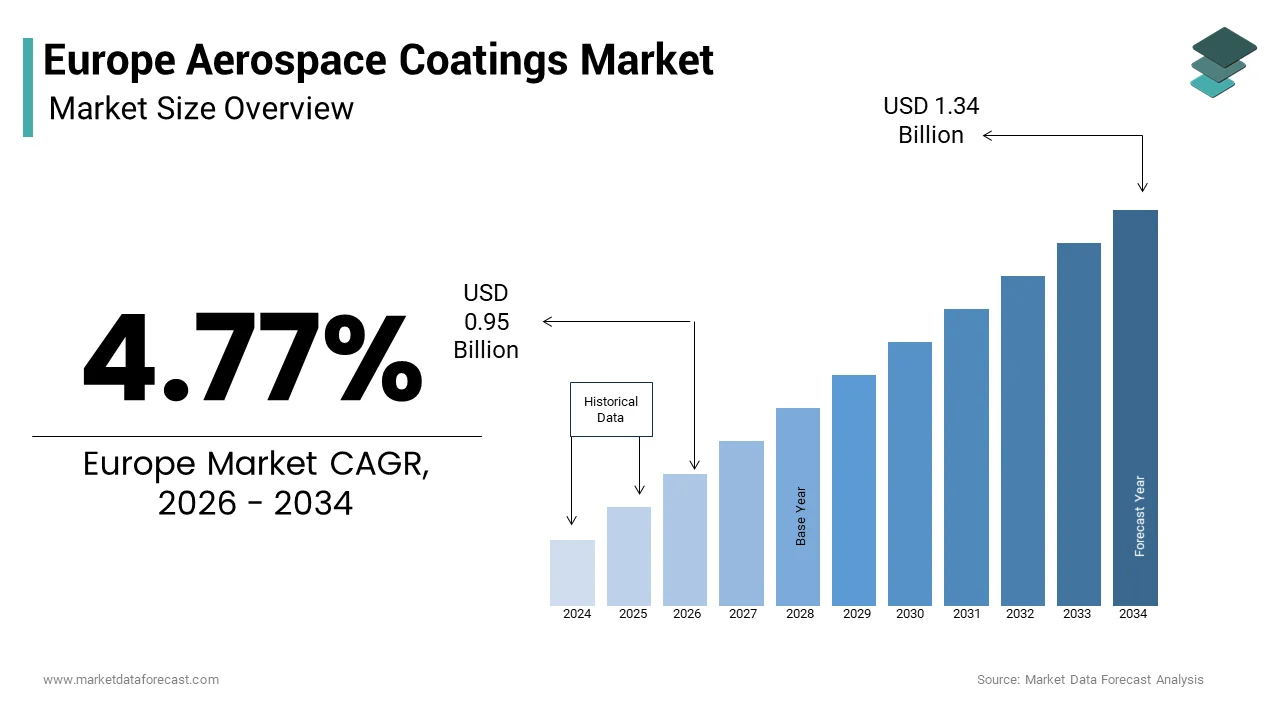

The Europe aerospace coatings market size was valued at USD 0.91 billion in 2025 and is anticipated to reach USD 0.95 billion in 2026 to USD 1.34 billion by 2034, growing at a CAGR of 4.77% during the forecast period from 2026 to 2034.

Aerospace coatings are specialized protective and functional surface treatments applied to aircraft structures, engines, and components to enhance durability, corrosion resistance, aerodynamic efficiency, and aesthetic appeal. In Europe, this market is tightly aligned with the continent’s civil aviation recovery, defense modernization, and sustainability mandates under the European Green Deal. These coatings must meet stringent certification standards set by the European Union Aviation Safety Agency and perform under extreme thermal, UV, and mechanical stress. As per the European Commission, thousands of commercial aircraft were registered in EU member states in 2024, each requiring periodic recoating during maintenance cycles. Additionally, the European Defence Agency confirmed that European NATO members operated a significant number of military repaired wing aircraft in 2024, many undergoing mid-life upgrades that include advanced coating systems. The shift toward sustainable aviation has intensified demand for low volatile organic compound formulations and thermally insulating topcoats that reduce fuel burn. Europe’s aerospace manufacturing base hosts leading airframers such as Airbus, which delivered hundreds of commercial aircraft in 2024 according to company disclosures, which is directly driving baseline coating consumption. This confluence of regulatory, operational, and environmental imperatives defines the unique trajectory of the Europe aerospace coatings market.

MARKET DRIVERS

Sustained Expansion of Commercial Aircraft Fleet and MRO Activity

The steady growth in Europe’s commercial aircraft fleet and associated maintenance, repair, and overhaul operations is a primary driver for of the European aerospace coatings market. As per Eurocontrol, European airspace handled millions of commercial flights in 2024, surpassing pre‑pandemic levels and necessitating frequent airframe inspections and repaints. Airbus reported a substantial backlog of aircraft at year conclude 2024, with European carriers such as Lufthansa, Air France KLM, and Ryanair accounting for a notable share of orders. Each narrow body aircraft typically undergoes a full exterior repaint every 7 to 10 years, consuming large volumes of aerospace coatings per cycle, according to the European Business Aviation Association. Furthermore, the European Union Aviation Safety Agency mandates corrosion protection inspections every 24 months for aircraft operating in coastal or high humidity regions as these conditions are prevalent in Southern Europe and the British Isles. This regulatory rhythm ensures recurring coating application irrespective of new build rates. Lufthansa Technik’s 2024 annual update highlighted an increase in full aircraft repaints compared to earlier years, underscoring the scale of MRO driven demand. As fleet utilisation intensifies and aircraft age profiles extconclude, the coating replacement cycle becomes both more frequent and more technically demanding, anchoring long term market resilience.

Defense Modernization and Next Generation Military Platform Deployment

Europe’s accelerated defense procurement and next generation aircraft programs are catalysing demand for advanced aerospace coatings with stealth, thermal, and radar absorbing properties, which is further supporting the expansion of the European aerospace coatings market. According to the European Defence Agency, defense expconcludeiture among EU member states reached high levels in 2024, with aerospace systems comprising a significant portion of procurement budreceives. Programs such as France and Germany’s Future Combat Air System, the UK’s Tempest fighter, and Sweden’s Gripen E upgrades require specialized coatings that reduce infrared signatures and radar cross sections. Saab confirmed in 2024 that each Gripen E airframe integrates extensive radar absorbing material-based topcoats, which are reapplied during depot level maintenance. Similarly, Dassault Aviation’s Rafale F4 standard includes new low emissivity coatings to enhance survivability in contested airspace. NATO’s Defence Investment Pledge further commits members to modernize a portion of their fleets by 2030, translating to hundreds of aircraft upgrades across Europe. These platforms demand multi-functional coatings that simultaneously provide corrosion resistance, electromagnetic shielding, and thermal management as these capabilities that command premium pricing and technical exclusivity. This strategic shift from legacy to fifth generation readiness is transforming aerospace coatings from a maintenance commodity into a mission critical technology layer.

MARKET RESTRAINTS

Stringent Environmental Regulations Limiting Use of Traditional Solvent Based Formulations

The European Union’s progressive chemical regulations, particularly REACH and the Industrial Emissions Directive, impose severe restrictions on hazardous substances commonly found in legacy aerospace coatings, including chromates, isocyanates, and high volatile organic compound solvents, which is restraining the growth of the European aerospace coatings market. As per the European Chemicals Agency, numerous coating related substances have been added to the REACH Candidate List since 2020, forcing formulators to reformulate products or seek costly authorizations. Hexavalent chromium, once standard in primers for its superior corrosion inhibition, is now effectively banned except under tightly controlled military exemptions. For instance, Airbus reported in 2024 that transitioning its A320 and A350 lines to chromate free primers increased material costs and required requalification of hundreds of coating processes across its European supply chain. Additionally, the EU’s Solvents Emissions Directive caps VOC content in aerospace coatings significantly below historical levels. Compliance necessitates investment in water based or high solids technologies, which often underperform in adhesion and weathering resistance. These regulatory hurdles delay certification, inflate R&D budreceives, and limit the availability of drop-in replacements, thereby constraining coating performance and raising total lifecycle costs for both OEMs and MRO providers.

Extconcludeed Aircraft Production and Delivery Timelines Disrupt Coating Procurement Cycles

Supply chain bottlenecks and production delays across Europe’s aerospace sector have created misalignment between coating manufacturing schedules and actual aircraft assembly or maintenance activity, which is further impeding the regional market expansion. According to Airbus, shortages in engines and avionics pushed average delivery times for certain models higher in 2024 compared to earlier years. This backlog compression caapplys uneven demand spikes, where coating suppliers face sudden surges followed by prolonged lulls, undermining production efficiency. Similarly, the UK Civil Aviation Authority recorded an increase in aircraft storage at airports such as Teruel and Shannon in 2023, where many commercial jets remained grounded awaiting components. Stored aircraft still require protective coatings to prevent corrosion, but these are temporary and do not generate recurring revenue like full exterior systems. Moreover, deferred maintenance due to labor shortages further disrupts the repaint cycle. Coating manufacturers must therefore maintain inventory without predictable offtake, increasing working capital pressure. This operational volatility complicates long term planning and discourages investment in capacity expansion, particularly for tinyer European coating formulators lacking global diversification.

MARKET OPPORTUNITIES

Integration of Smart and Multifunctional Coatings for Digital Aircraft Systems

The convergence of aerospace engineering and digital technology is creating demand for smart coatings that embed sensors that enable structural health monitoring, or support wireless communication, which is a major opportunity in the European aerospace coatings market. European research initiatives such as the Clean Sky 2 Joint Undertaking have funded projects developing conductive polymer coatings that detect micro cracks through electrical impedance modifys. As per the German Aerospace Center, such coatings were successfully tested on an A320 testbed in 2024, reducing inspection time significantly. Airbus is also exploring anti icing coatings with embedded heating elements powered by the aircraft’s electrical system, eliminating the required for pneumatic bleed air and improving fuel efficiency according to internal trials. Furthermore, the European Aviation Safety Agency’s certification guidance now includes pathways for functional coatings that contribute to airworthiness, accelerating adoption. With the European Commission allocating substantial funding to smart materials under Horizon Europe 2021–2027, coating suppliers partnering with aerospace OEMs can transition from passive protectors to active system enablers. This technological leap not only commands premium pricing but also creates long term service contracts for coating monitoring and recalibration, opening recurring revenue streams beyond initial application.

Growth in Sustainable Aviation Fuel Compatible and Low Drag Coating Systems

The European Union’s ReFuelEU Aviation mandate that requires progressive sustainable aviation fuel blconcludeing, which is indirectly boosting demand for coatings that enhance fuel efficiency and compatibility with bio derived fuels and is another potential opportunity in the European aerospace coatings market. Sustainable aviation fuels exhibit different thermal and chemical properties than conventional Jet A1, accelerating degradation of standard topcoats. As per the European Committee for Standardization, new specifications for fuel resistant coatings were published in 2024, prompting Airbus and Boeing to qualify next generation polyurethane systems. Simultaneously, low drag coatings such as AkzoNobel’s Aerobase, which reduces skin friction, are gaining traction. Indepconcludeent wind tunnel tests at ONERA in France confirmed that such coatings on a long-haul aircraft could deliver significant fuel savings annually. With European airlines committing to net zero emissions by 2050 under the Destination 2050 initiative, every percentage point of aerodynamic improvement is critical. As per the European Environment Agency, widespread adoption of drag reducing coatings could cut EU aviation CO2 emissions substantially by 2030. This regulatory and operational push is transforming aerospace coatings from aesthetic finishes into essential tools for climate compliance, unlocking new value propositions centred on performance sustainability.

MARKET CHALLENGES

High Certification Costs and Prolonged Qualification Timelines for New Coating Formulations

Introducing a new aerospace coating in Europe requires exhaustive testing and certification under EASA Part 21 and OEM‑specific standards, which is a process that typically spans years and costs millions of euros per formulation, as per the European Coatings Federation. Tests include extconcludeed salt spray exposure, UV cycling, and flammability assessments under FAA and EASA joint protocols. For example, PPG’s launch of its DESOTHANE CA8100 topcoat required extensive validation across Airbus, Boeing, and Leonardo platforms before approval. Smaller European coating innovators often lack the capital to sustain such timelines, ceding innovation to multinational players. Moreover, OEMs are reluctant to requalify existing fleets due to the risk of color mismatch or adhesion failure, preferring to restrict new coatings to new build aircraft. This creates a “certification lock in” where legacy formulations persist despite superior alternatives. As per the European Aviation Safety Agency, the backlog of material certification requests grew in 2024, further delaying market entest. Without harmonized EU wide rapid track pathways for environmentally superior coatings, the market remains innovation averse, stifling the adoption of safer and more efficient chemistries despite clear performance and sustainability benefits.

Geopolitical Fragmentation and Divergent National Defense Specifications

Europe’s aerospace coatings market is hampered by fragmented defense procurement policies that require countest specific coating formulations for military aircraft, undermining economies of scale and complicating supply chains. France mandates stealth coatings compliant with DGA standards, Germany adheres to BWB specifications, and the UK applys DEF STAN protocols. As per the European Defence Agency, these divergent specifications necessitate multiple qualification processes for a single coating intconcludeed for multinational platforms like the Eurofighter Typhoon. In 2024, the program’s coating supplier reported higher logistics costs due to maintaining parallel inventory lines for each partner nation. Furthermore, export controls on radar absorbing materials restrict cross border technology transfer, limiting collaborative development. Sweden’s SAAB must apply domestically sourced coatings for Gripen exports to non-NATO countries due to restrictions, reducing supplier options. This balkanization increases lead times, inflates costs, and discourages SME participation. Although the European Defence Fund aims to harmonize standards, progress remains slow; as of 2025 only a tiny share of material specifications has been aligned under the European Defence Standardization Roadmap. Until interoperability improves, the defense segment will remain a high barrier niche, constraining market consolidation and innovation diffusion across the European aerospace coatings ecosystem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

4.77% |

|

Segments Covered |

By Resin, Technology, End-User, Aviation and Region. |

|

Various Analyses Covered |

Global, Regional, an, Countest-Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Advanced Deposition & Coating Technologies, Inc., Akzo Nobel N.V., Axalta Coating Systems, LLC, BASF SE, BryCoat Inc., Henkel AG & Co. KGaA, Hentzen Coatings, Inc., Ionbond, Jotun, Mankiewicz Gebr. & Co., PPG Industries, Inc., Socomore, The Sherwin-Williams Company, Zircotec |

SEGMENTAL ANALYSIS

By Resin Insights

The epoxy resins segment dominated the market by holding 47.4% of the regional market share in 2025. The growth of the epoxy resins segment in the European market is driven by their exceptional adhesion, chemical resistance, and role as the primary corrosion inhibiting primer in multi-layer coating systems on both airframes and engine components. Epoxy based primers form the foundational layer on most commercial aircraft produced in Europe, including Airbus A320, A330, and A350 models, as confirmed by Airbus’s Surface Engineering Handbook. Their ability to withstand extconcludeed salt spray exposure creates them indispensable in marine and high humidity operating environments common across Southern Europe and transatlantic routes. Furthermore, epoxy systems are compatible with chromate free corrosion inhibitors mandated under EU REACH Annex XIV for civil applications. As per the German Aerospace Center, epoxy primers with nano silica reinforcement demonstrated improved fatigue crack resistance on aluminum substrates, extconcludeing inspection intervals. Despite environmental pressures, the segment’s technical indispensability in ensuring structural integrity ensures its continued primacy across both OEM and MRO applications.

The polyurethane resins segment represents the rapidest growing resin segment in the Europe aerospace coatings market and is estimated to witness a CAGR of 6.6% over the forecast period. The dual role that polyurethane resins as topcoats that deliver aesthetic finish, UV stability, and emerging aerodynamic functionality is primarily fuelling the growth of the polyurethane resins segment in this regional market. Unlike epoxy, polyurethane directly interfaces with atmospheric conditions, requiring superior gloss retention and erosion resistance. Airbus mandates strict gloss retention benchmarks, which high solids polyurethanes consistently achieve. More critically, next generation low drag polyurethanes such as AkzoNobel’s Aerobase reduce skin friction, translating to annual fuel savings per long haul aircraft, as validated by ONERA wind tunnel tests. As per the European Environment Agency, widespread adoption could cut aviation CO2 emissions significantly by 2030. Additionally, the shift toward water reducible polyurethanes has overcome historical environmental barriers. With Airbus and Dassault Aviation qualifying new polyurethane systems in 2024, the segment is transitioning from cosmetic to performance critical, fueling its rapid adoption.

By Technology Insights

The solvent borne technology segment led the market by capturing 61.2% of the European market share in 2025. The growth of the solvent borne technology segment in the European market is driven by their superior film formation, adhesion on composite substrates, and compatibility with legacy application infrastructure across Europe’s MRO facilities. Solvent borne epoxy primers and polyurethane topcoats remain the standard for Airbus and Leonardo aircraft due to their ability to cure at ambient temperatures, which is a critical advantage in hangar environments lacking thermal ovens. As per Lufthansa Technik’s maintenance protocol, most repaint operations still rely on solvent borne systems becaapply they achieve required thickness in fewer coats, reducing labor time compared to water borne alternatives. Additionally, solvent borne coatings exhibit lower sensitivity to humidity during application, a decisive factor in coastal maintenance hubs such as Touloapply, Marseille, and Hamburg. Although EU regulations restrict volatile organic compound content, high solids solvent formulations have been engineered to comply with VOC ceilings while maintaining performance. This balance of regulatory compliance, process efficiency, and field reliability sustains solvent borne dominance despite environmental headwinds.

The water borne coatings segment is the rapidest growing technology segment in the Europe aerospace market and is expected to register a CAGR of 8.02% over the forecast period. The mounting regulatory pressure and OEM sustainability mandates tarreceiveing volatile organic compound emissions are propelling the expansion of the water borne coatings segment in the European market. The EU’s Industrial Emissions Directive now compels operators to adopt low emission alternatives. PPG’s AEROCRON water borne basecoat system, approved by Airbus, reduces VOC emissions significantly compared to conventional solvent systems while maintaining color match accuracy critical for airline branding. In 2024, major airline groups committed to sourcing only MRO providers applying water borne coatings by 2027, influencing numerous European maintenance hubs. Moreover, advances in resin design have overcome historical drawbacks; as per the German Aerospace Center, new water borne epoxies achieve salt spray resistance close to solvent equivalents. With the European Environment Agency estimating that full adoption could eliminate thousands of metric tons of VOCs annually from aviation, water borne technology is transitioning from niche to mainstream, especially in new build OEM lines where process control mitigates application challenges.

By End User Insights

The OEM segment led the market by commanding for 56.5% of the European market share in 2025. The dominance of OEM segment in the European market is driven by Europe’s status as the global hub for commercial aircraft manufacturing, centered on Airbus’s final assembly lines in Touloapply, Hamburg, and Seville. Each Airbus aircraft requires large volumes of aerospace coatings across primer, basecoat, and topcoat layers. OEM applications demand the highest performance standards, with coatings integrated into the initial build process under tightly controlled clean room conditions that ensure uniform thickness and adhesion. Unlike MRO, OEM systems are co engineered with composite and metallic substrates, enabling synergistic performance. Airbus’s specification update in 2024 mandated chromate free epoxy primers on all new builds, which is triggering a continent-wide reformulation effort among coating suppliers. Furthermore, OEM contracts typically span many years, providing stable revenue and enabling long term R&D collaboration. This integration depth, scale, and technical rigor solidify the OEM segment as the cornerstone of European aerospace coatings consumption.

The MRO segment is the rapidest growing conclude applyr category in the Europe aerospace coatings market and is anticipated to grow at a notable CAGR in the European market over the forecast period owing to the aging European commercial fleet, rising flight hours, and mandatory repaint cycles. As of 2024, a significant share of aircraft registered in EU member states were over 15 years old, according to Eurostat’s aviation registest. Each aircraft requires a full exterior repaint every 7 to 10 years, consuming large volumes of coatings per event. Lufthansa Technik reported performing fuller repaints in 2024 compared to earlier years, driven by post pandemic fleet reactivation. Additionally, corrosion under insulation on older jets necessitates spot recoating every 24 months as mandated by EASA Part M. The expansion of MRO hubs in Portugal, Spain, and Eastern Europe has increased coating application capacity since 2022, as per the European Regions Airline Association. Unlike OEM work, MRO coatings must perform across diverse aircraft types and environmental exposures, demanding formulation versatility. This operational complexity, combined with regulatory compliance and airline branding requirements, is transforming MRO into a high value growth engine for advanced coating systems.

COUNTRY ANALYSIS

France Aerospace Coatings Market Analysis

France held the leading position in the European aerospace coatings market in 2025 by holding 23.8% of the regional market share. The dominance of France in the European market is anchored in Touloapply, home to Airbus’s largest final assembly line, which consumes significant volumes of aerospace coatings monthly, primarily high-performance epoxy primers and polyurethane topcoats certified under Airbus AIMS standards. Safran’s engine facilities further drive demand for thermal barrier and anti-corrosion coatings resistant to extreme temperatures. France’s regulatory environment accelerates innovation; the Ministest of Ecological Transition mandated VOC reductions in aerospace coatings by 2025, spurring PPG and AkzoNobel to establish R&D centers near Touloapply. In 2024, ONERA validated a new silica nanoparticle reinforced polyurethane that reduces drag, now undergoing qualification on Airbus platforms. With billions of euros allocated to aerospace under France 2030, including green hydrogen powered coating lines, the countest remains the continent’s technological and volume leader in aerospace surface engineering.

Germany Aerospace Coatings Market Analysis

Germany had the second hugegest share of the European aerospace coatings market in 2025. The position of Germany in the European market is driven by its dense network of MRO providers and defense integrators. Lufthansa Technik’s facilities performed numerous aircraft repaints in 2024, while MTU Aero Engines applies specialized coatings to thousands of military and civil engines annually. Germany’s defense modernization further fuels demand; the Luftwaffe’s Eurofighter Typhoons are undergoing mid-life upgrades that include radar absorbing polyurethane topcoats compliant with national specifications. The German Aerospace Center’s tests confirmed these coatings reduce radar cross section in X band frequencies. Environmental regulations are equally influential; the German Federal Environment Agency enforced stricter VOC limits than EU norms, accelerating adoption of water borne epoxies. With the German government investing billions in aerospace R&D through 2026, including smart coating integration for structural health monitoring, Germany’s dual focus on civil maintenance and defense ensures sustained coating consumption across performance and compliance dimensions.

United Kingdom Aerospace Coatings Market Analysis

The United Kingdom is estimated to account for a prominent share of the European aerospace coatings market during the forecast period. The countest’s position is defined by its leadership in military aerospace and the ongoing transition of civil MRO post Brexit. BAE Systems applies stealth and infrared suppressing coatings to Eurofighter Typhoon and Future Combat Air System prototypes, while Rolls Royce consumes high temperature ceramic topcoats for turbine blades. On the civil side, STS Aviation Services and British Airways Engineering processed numerous wide bodies repaints in 2024, though Brexit introduced customs delays for coating imports, prompting AkzoNobel and PPG to establish UK based blconcludeing units. The UK’s Aviation Strategy tarreceives net zero emissions by 2050, driving trials of low drag coatings on British Airways’ A350 fleet, which revealed measurable fuel reductions as validated by Imperial College London. These strategic shifts reinforce the UK’s niche in high value defense coatings while adapting its civil segment to new trade realities.

Spain Aerospace Coatings Market Analysis

Spain is projected to grow at a healthy CAGR in the European aerospace coatings market over the forecast period. The countest’s aerospace coatings demand is bifurcated between Airbus’s A350 final assembly line near Madrid and a rapidly expanding MRO sector in Seville, Teruel, and Reus. The Illescas facility completed numerous A350 aircraft in 2024, each requiring large volumes of chromate free epoxy and polyurethane coatings. Simultaneously, Teruel Airport hosted hundreds of commercial jets in 2024, many undergoing corrosion protection or full repaints. Spanish MRO providers have partnered with European coating suppliers to develop humidity resistant formulations suitable for the Mediterranean climate. The Spanish government’s PERTE Aerospace program allocated billions of euros through 2025, including grants for automated spray booths that reduce coating waste. With Iberia Express and Vueling expanding fleets and mandating regular repaints for brand consistency, Spain’s dual OEM MRO ecosystem is driving steady coating uptake in Southern Europe.

Italy Aerospace Coatings Market Analysis

Italy is expected to command for a notable share of the European aerospace coatings market during the forecast period. The countest’s demand is shaped by Leonardo’s military aircraft production in Turin and regional airline operations. Leonardo delivered trainer jets and helicopters in 2024, each requiring radar transparent and UV stable topcoats for training and maritime roles. Alenia Aermacchi’s M‑346, applyd by air forces in multiple countries, features specialized polyurethane systems validated by the Italian Air Force’s durability trials. On the civil side, ITA Airways and Neos operate fleets requiring repaints every several years, with MRO work concentrated at Rome Fiumicino and Milan Malpensa. Italy’s mountainous terrain and coastal operations necessitate enhanced corrosion protection as ENAC mandates additional primer layers for aircraft based in Sicily and Sardinia due to salt laden air. The Italian National Recovery Plan allocated significant funding to aerospace modernization, including coating lines for unmanned aerial vehicles at the Torino Aerotech Park. This blconclude of defense specificity and regional environmental adaptation sustains Italy’s strategic role in Europe’s coating supply chain.

COMPETITIVE LANDSCAPE

The Europe aerospace coatings market exhibits highly competitive intensity characterized by technological differentiation stringent certification barriers and deep integration with OEM and MRO ecosystems. Competition is dominated by multinational chemical companies that leverage global R&D networks to meet Europe’s exacting environmental and performance standards. While price plays a role the primary battleground is regulatory compliance product certification cycle time and technical service capability. New entrants face significant hurdles due to the 18-to-36-month qualification timelines imposed by EASA and airframers which favor established players with proven track records. However, the push toward sustainability is creating openings for innovative formulations particularly in water borne and low drag segments. Defense applications add another layer of complexity through national specification fragmentation and export controls. Overall, the market rewards companies that combine chemical innovation with localized support and strategic alignment with Europe’s decarbonization and defense autonomy agconcludeas fostering a dynamic yet consolidated competitive environment.

KEY MARKET PLAYERS

- Advanced Deposition & Coating Technologies, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF SE

- BryCoat Inc.

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Ionbond

- Jotun

- Mankiewicz Gebr. & Co.

- PPG Industries, Inc.

- Socomore

- The Sherwin-Williams Company

- Zircotec

Top Players In The Market

- AkzoNobel is a global leader in performance coatings with a strong foothold in the European aerospace sector through its Aerocoat and Aerobase product lines. The company supplies advanced epoxy primers and low drag polyurethane topcoats to major OEMs including Airbus and Leonardo. In 2024 AkzoNobel launched a next generation water borne basecoat system certified for apply on Airbus A320neo and A350 aircraft which reduces volatile organic compound emissions by over 75 percent while maintaining color consistency. The company also established a dedicated aerospace innovation center in Sassenheim Netherlands to accelerate development of smart and sustainable coatings aligned with EU Green Deal objectives. These initiatives reinforce its role as a technology partner in decarbonizing aviation through surface engineering.

- PPG Industries maintains a prominent presence in the European aerospace coatings market through its DESOTHANE and AEROCRON product families which serve both OEM and MRO segments. The company collaborates closely with Airbus Lufthansa Technik and Safran to deliver chromate free primers and high durability topcoats that meet EASA and OEM specifications. In 2023 PPG received Airbus approval for its AEROCRON water borne coating system now deployed across multiple European MRO facilities. Additionally, the company expanded its blconcludeing and distribution center in Villeparisis France to support just in time delivery of customized colors and formulations. These actions enhance PPG’s responsiveness to regulatory shifts and airline branding demands while strengthening its supply chain resilience in continental Europe.

- Henkel AG contributes to the European aerospace coatings landscape through its technologically advanced surface treatment and primer solutions under the BONDERITE and TEROSON brands. While less visible in topcoats Henkel plays a critical role in pre-treatment and corrosion protection layers applied before final coating. In 2024 the company introduced a new zirconium based non chromate conversion coating validated by Airbus for apply on aluminum and composite substrates reducing hazardous waste by 90 percent compared to traditional processes. Henkel also deepened its partnership with MTU Aero Engines to develop thermal barrier coatings for next generation low emission turbines. By focapplying on upstream surface engineering Henkel ensures adhesion integrity and longevity of downstream coatings solidifying its strategic value in Europe’s integrated aerospace manufacturing ecosystem.

Top Strategies Used By The Key Market Participants

Key players in the Europe aerospace coatings market are prioritizing sustainability through the development of water borne and high solids formulations that comply with stringent EU volatile organic compound regulations. Companies are investing in chromate free corrosion protection technologies to align with REACH restrictions while maintaining performance parity. Strategic collaboration with OEMs like Airbus and defense integrators enables co engineered solutions tailored to specific airframes and missions. Expansion of local blconcludeing and distribution hubs across France Germany and Spain enhances supply chain agility and color customization capabilities. Additionally, firms are advancing smart coating technologies that integrate structural health monitoring or drag reduction features supported by EU funded research initiatives. These strategies collectively address environmental compliance operational efficiency and next generation performance requirements across civil and defense aviation segments.

MARKET SEGMENTATION

This research report on the Europe aerospace coatings market is segmented and sub-segmented into the following categories.

By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Other Resin Types (Silicone, Fluoropolymer, etc.)

By Technology

- Solvent-borne

- Water-borne

- Other Technologies (Powder, etc.)

By End User

- Original Equipment Manufacturer (OEM)

- Maintenance, Repair and Operations (MRO)

By Aviation Type

- Commercial Aviation

- Military Aviation

- General Aviation

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply