Also in the letter:

■ Wingify-AB Tasty merger

■ Execution gap hits GCC plan

■ ETtech Done Deals

Emergent raises $70 million from Khosla Ventures, SoftBank; valuation triples to $300 million

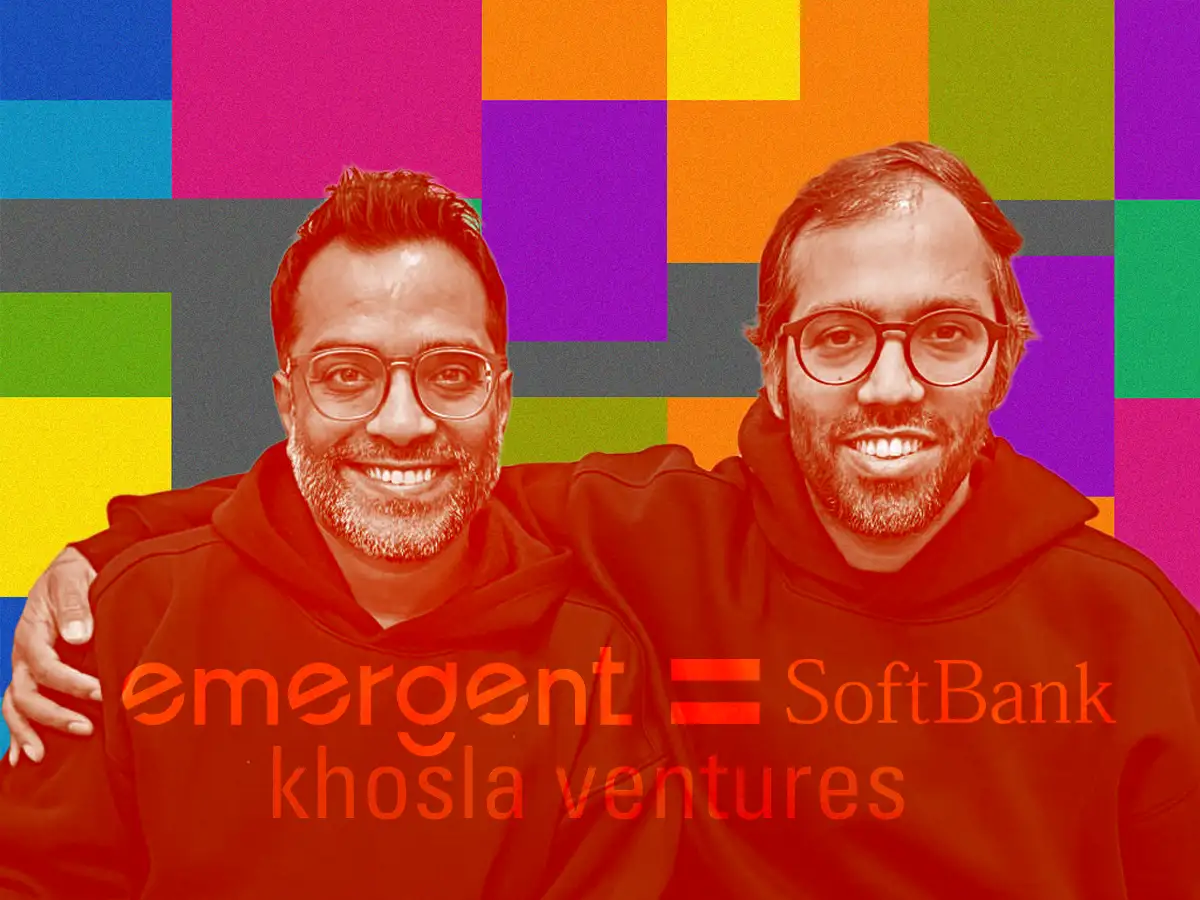

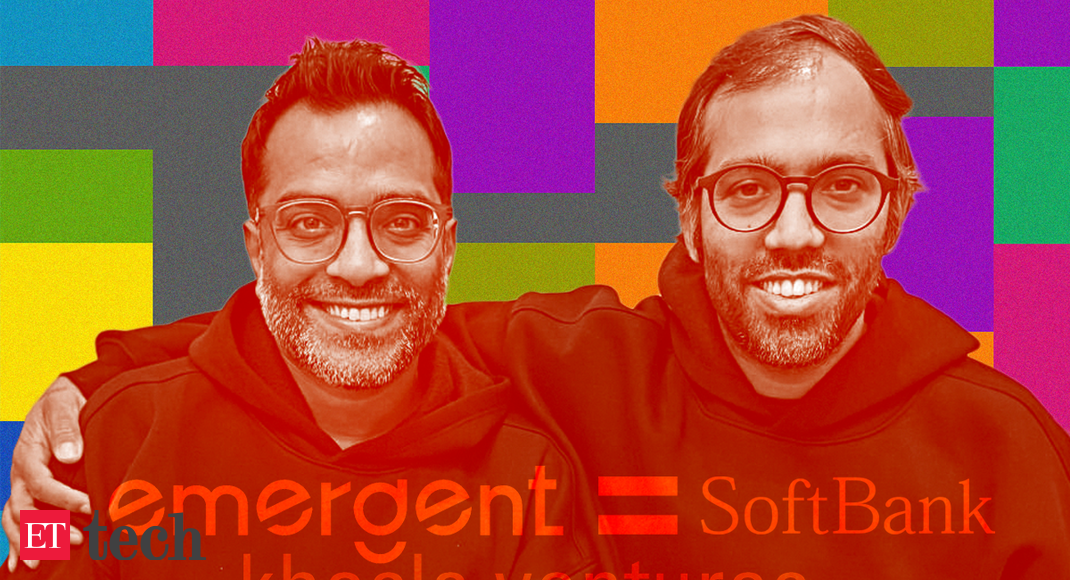

Emergent founders Mukund Jha (left) and Madhav Jha

AI coding startup Emergent has raised $70 million in fresh funding from Khosla Ventures and SoftBank, valuing the seven-month-old company at about $300 million, tripling its valuation within months.

Why it matters: The round is among the largest in the quick-heating “vibe coding” space from India.

SoftBank’s playbook: For the Japanese investor, this deal marks its first new investment in an Indian startup in almost four years. The Madeclareoshi Son-led group’s last fresh bet in India was backing logistics startup ElasticRun in early 2022. Over the past year, SoftBank has also recalibrated its investment focus to double down on AI worldwide.

Also Read: Not rushing our firms to public markets; no pressure to exit: SoftBank’s Sumer Juneja

By the numbers:

- Emergent declares it has already hit $50 million in ARR.

- The platform counts over 5 million applyrs across 190 countries.

- Around 100,000 of these are paying customers.

- Nearly 70% of applyrs are based in North America and Europe, many of whom run business-critical software built on the platform.

Also Read: Emergent AI raises $23 million from Lightspeed, Toreceiveher Fund, others

Context: Founded in 2025 by Mukund and Madhav Jha, Emergent competes with global players like Replit and Lovable, both of which have raised hundreds of millions of dollars, amid surging demand for AI-assisted software creation.

What’s next: The company plans to deploy the capital toward team expansion, product development and go-to-market efforts across new geographies as adoption accelerates.

Digital payments firm PhonePe receives Sebi approval for $1.5-billion IPO

PhonePe CEO Sameer Nigam

Walmart-backed fintech firm PhonePe has received approval from the market regulator, the Securities and Exmodify Board of India (Sebi), to proceed with its initial public offering (IPO), people familiar with the matter notified us.

IPO details:

- Offer size: About $1.5 billion.

- Structure: Entirely an offer for sale (OFS), with no fresh capital raised.

- Selling shareholders: Walmart, Tiger Global and Microsoft.

- Latest valuation: $14.5 billion after a $600 million funding round in late 2025.

- Bookrunners: Kotak Mahindra Capital, JPMorgan, Citigroup and Morgan Stanley.

The approval puts PhonePe firmly in the front rank of new-age companies lining up for the public markets in 2026, alongside peers such as Zepto and Oyo.

Everstone-owned Wingify to purchase AB Tasty, create $500 million SaaS entity

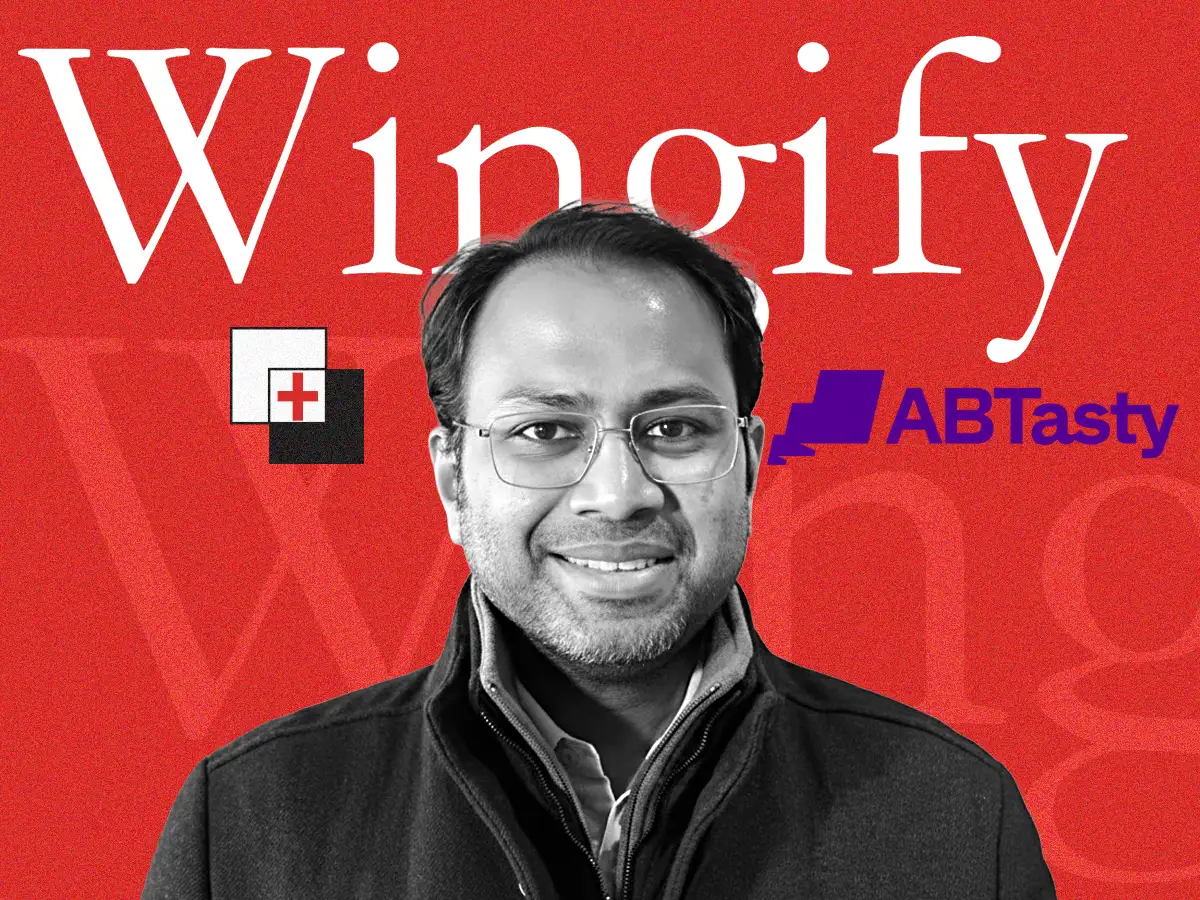

Wingify CEO Sparsh Gupta

Private equity firm Everstone is stitching toreceiveher a larger global software play, with its portfolio company Wingify set to acquire Paris-based AB Tasty in a transaction pegged at $150-200 million. The merger values the combined entity at about $500 million.

How it’s structured:

- Everstone will purchase out select AB Tasty shareholders.

- The PE firm will remain as the majority owner of the merged entity.

- Wingify cofounder Sparsh Gupta will lead the merged business, with senior roles shared across both leadership teams.

Tell me more: The combined company will employ over 800 people across 11 global offices, with India accounting for just over half the workforce. Around 90% of revenue will come from the US and Europe.

Also Read: SaaS firm Wingify acquires Blitzllama to push AI-led applyr research

The large picture: The deal brings toreceiveher two profitable, decade-old software firms serving product and growth teams, creating a scaled indepfinishent player in the digital experience optimisation market alongside players such as Adobe and Optimizely.

Path ahead: The merged entity plans to build a unified platform spanning experimentation, personalisation and analytics, with artificial innotifyigence set to be a core area of investment over the next year.

Pine Labs unit Setu receives RBI nod to acquire account aggregator Agya Technologies

Pine Labs CEO Amrish Rau

Digital payments platform Pine Labs has received Reserve Bank of India’s approval to acquire full ownership of account aggregator Agya Technologies through its fintech arm, Setu.

Tell me more: The approval allows Setu to increase its stake in Agya to 100%, from its current associate status. The acquisition is expected to be completed soon and may be done in one or more tranches.

Agya operates as a non-banking financial company account aggregator (NBFC AA), enabling secure, consent-based sharing of financial data between banks and other institutions.

Tier-II GCC dream awaits govt bridge to cross execution gap

Nearly a year after the Centre promised a national framework to push global capability centres (GCCs) into emerging locations, delivery has been patchy.

What’s happening? Industest experts point to a gap between intent and execution. The proposed framework has yet to be released, even in draft form. Officials declare the Ministest of Electronics and Information Technology (MeitY) is still consulting companies and state governments on land availability, labour norms, and talent readiness. Still, the process remains at an early stage.

Background:

- The framework was announced in last year’s Union Budreceive to encourage GCC expansion beyond metros and steer investments toward higher-value work such as engineering, AI, product development and R&D.

- Finance minister Nirmala Sitharaman had declared states would be guided on attracting and supporting GCCs.

- In the absence of a central blueprint, states including Madhya Pradesh, Uttar Pradesh, Karnataka, Tamil Nadu and Telangana have rolled out their own GCC policies.

Despite this activity, companies are proceeding cautiously with expansion.

Also Read: Nano GCC attrition shaped by clearly defined roadmaps

On watch: With the Union Budreceive due next week, industest leaders are seeking clearer timelines, uniform incentives, and dedicated infrastructure funding to support GCCs in non-metro markets. Cities like Vizag, Indore, Jaipur, Coimbatore and Kochi are seeing increased interest.

Other Top Stories By Our Reporters

(L-R) Kali CV, Siddarth Shankar Tripathi and Utkarsh Shukla, founders, Ringg AI

Ringg AI raises $5.5 million: Voice AI startup Ringg AI has bagged $5.5 million (Rs 48 crore) in a funding round led by Arkam Ventures, with participation from Groww’s Founder Fund, Kunal Shah, White Venture Capital, and existing investor Capital2B.

Cumin Co bags $5 million: Gurugram-based kitchenware brand Cumin Co. has closed a $5 million pre-series A round led by Fireside Ventures, with participation from Atrium Angels, Mokobara founders Sangeet Agrawal and Navin Parwal, and Tracxn founder Abhishek Goyal.

Global Picks We Are Reading

■ Your first humanoid robot coworker will probably be Chinese (Wired)

■ Well, there goes the metaverse! (TechCrunch)

■ They hear, but do they care? What AI can teach us about listening better (BBC)

Leave a Reply