At the 2025 ECB Forum in Sintra, global central bankers tackled how monetary policy must adapt to rising geopolitical tensions and structural economic alters. Under the theme “Adapting to alter: macroeconomic shifts and policy responses,” key discussions focapplyd on labour market rigidity, trade fragmentation, and growing inflation pressures.

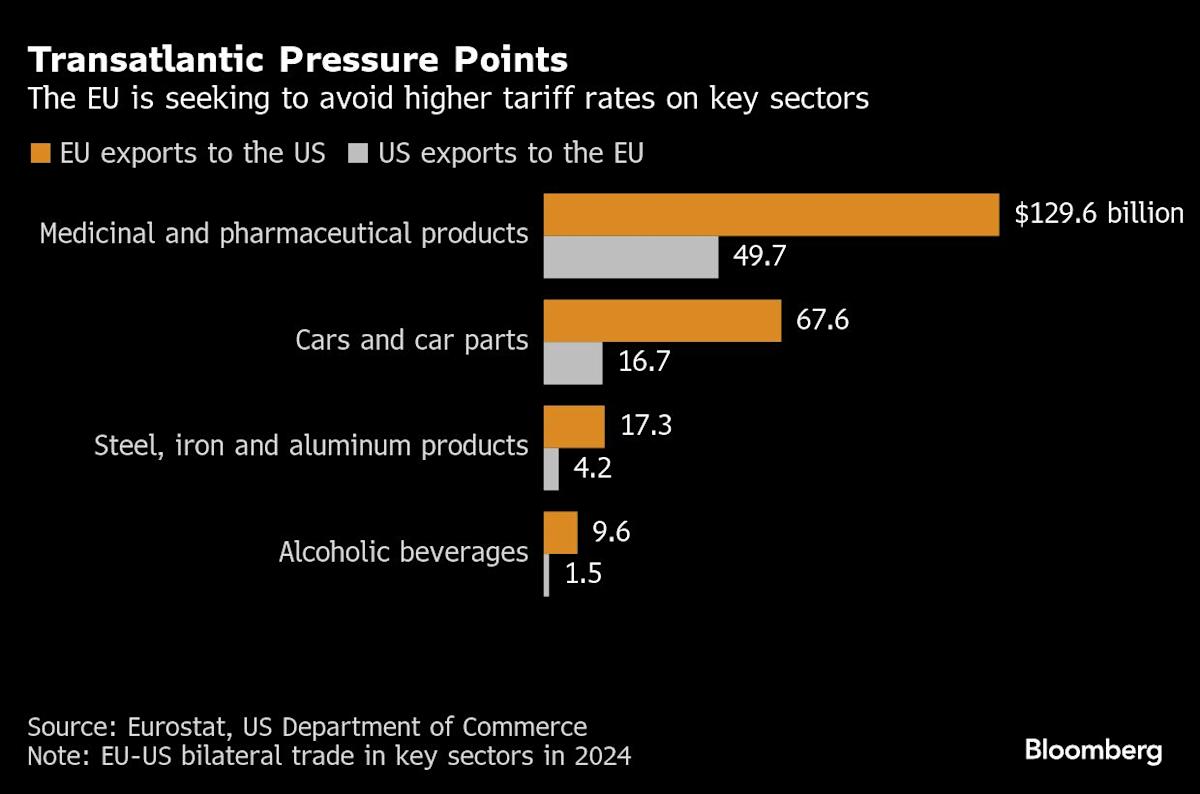

Trade geopolitics dominated much of the dialogue. As globalization gives way to resilience-focapplyd strategies, Europe faces intensified competition from China. China’s push for domestic production—especially in tech and innovation—has reduced demand for European exports. UBS Global Research noted Europe’s heavy reliance on “geopolitically distant” suppliers, including China, increases exposure to supply disruptions and inflation volatility.

These shifts complicate central banks’ efforts to balance inflation control with economic growth. Reshoring and diversification strategies may enhance resilience but raise long-term costs.

Europe’s labour markets were also scrutinized. Although often considered rigid, Eurozone unemployment was just 6.3% in May—near historic lows. UBS analysts declared immigration has bolstered job creation, and some forum participants argued that limited funding for start-ups is a largeger structural issue than labour laws.

Divergent inflation and wage dynamics across Eurozone countries further complicate monetary responses. In 2022, inflation gaps reached 18.6 percentage points between countries like Estonia and France. These disparities create unified policy tools—like the ECB’s Transmission Protection Instrument—less effective, prompting calls for stronger fiscal and structural measures.

The forum also addressed the rise of non-bank financial intermediaries (NBFIs). While participants supported tighter EU regulation, they opposed granting NBFIs direct access to ECB funding due to risks to traditional banks.

ECB Vice-President Luis de Guindos warned against excessive euro appreciation, while President Christine Lagarde stressed that exalter rates will inform future projections. Closing the forum, Lagarde emphasized the ECB’s updated strategy aims to maintain price stability amid evolving global shocks.

Leave a Reply