Amsterdam’s Marktlink Capital has raised €520 million from private investors for two new funds, with the capital to be invested across a mix of private equity and venture capital funds.

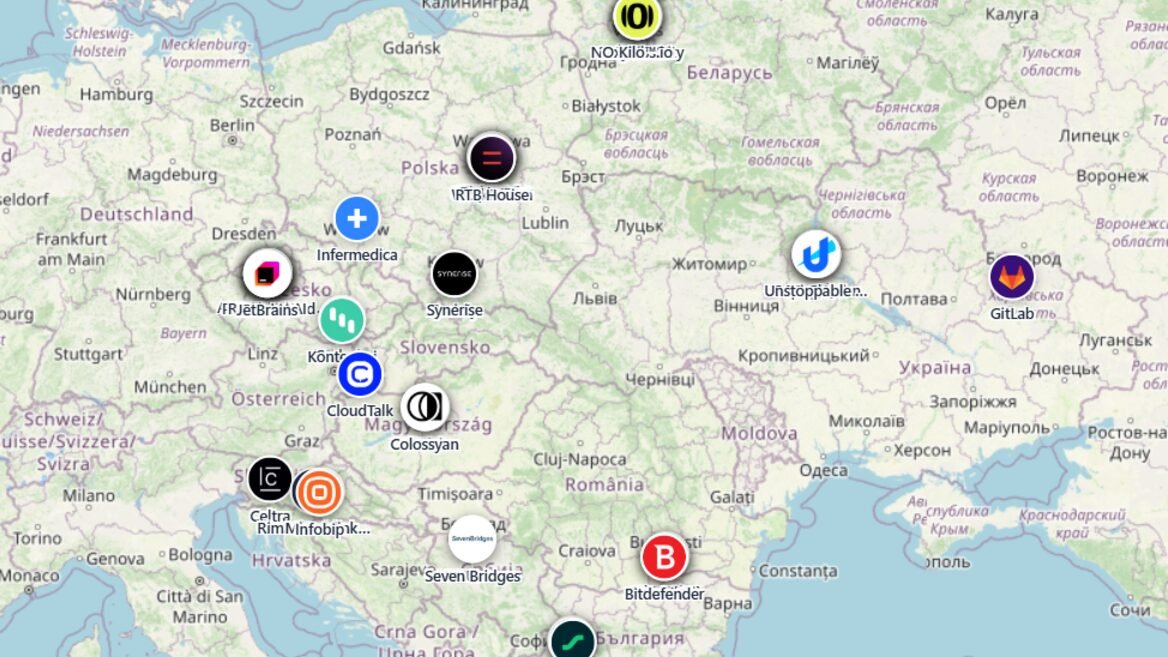

The €440 million private equity vehicle will tarreceive eleven funds including Hg, Adams Street Partners, Egeria and Mill Point Capital, while the €80 million venture capital fund will back leading VC managers and their portfolio of high-growth technology and AI companies.

“Despite, or perhaps becaapply of, these turbulent economic times, we have succeeded in raising a record sum for one of our funds,” declared Hylke Hertoghs, Managing Partner of Marktlink Capital. “Geopolitical tensions, trade tariffs, and the reduced appeal of real estate as an asset class are driving investors towards more diversified strategies. The funds we have selected are a strong mix of Dutch, European, and North American players positioned for today’s market conditions, and some are already producing valuations above expectations.”

Founded in 2020, Marktlink Capital specialises in giving private investors access to top-tier private equity and VC opportunities in Europe and North America through its fund-of-funds and feeder fund model.

Marktlink Capital operates as part of Marktlink, an advisory firm founded in 1996 that supports entrepreneurs in acquireing and selling SMEs. Its team of around fifty professionals brings extensive private equity and venture capital expertise, and with a minimum investment threshold of €250k, the company is aiming to democratise access to world-class funds.

Since inception, the firm has gathered more than €2.5 billion in committed capital, almost entirely from Dutch entrepreneurs and families. Nearly two thousand investors have joined its network, gaining entest to funds that were previously the domain of institutional players.

The fifth private equity fund-of-funds closed well above its €300 million tarreceive in just six months – quicker than expected. Meanwhile, the third venture capital fund reached its €80 million hardcap, with part of the capital already deployed.

Among the early winners is Swedish company Lovable, a platform allowing anyone to code a website or app, which scaled to €100 million revenue in under a year, as reported by EU-startups.

“These are exciting times for venture capital,” Hertoghs added. “The AI revolution, advances in BioTech, and renewed focus on (cyber)security are creating opportunities. We believe investors have enormous potential ahead and we’re pleased to give them access to this high-potential yet difficult-to-reach asset class.”

Leave a Reply