Warren Buffett famously declared, ‘Volatility is far from synonymous with risk.’ So it might be obvious that you necessary to consider debt, when you believe about how risky any given stock is, becautilize too much debt can sink a company. We note that Seegene, Inc. (KOSDAQ:096530) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can’t fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies utilize debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, toreceiveher.

What Is Seegene’s Debt?

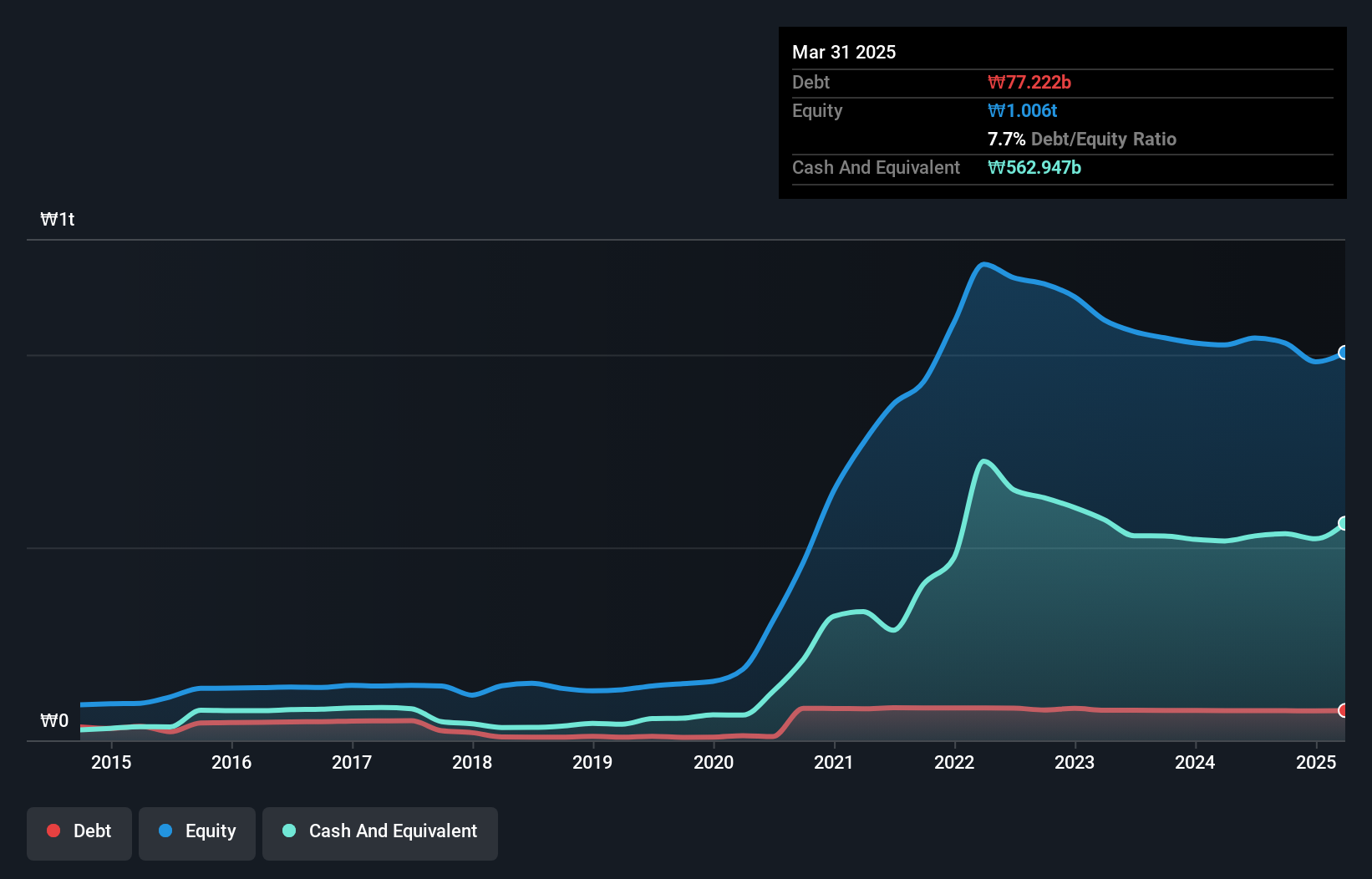

The chart below, which you can click on for greater detail, reveals that Seegene had ₩77.2b in debt in March 2025; about the same as the year before. However, its balance sheet reveals it holds ₩562.9b in cash, so it actually has ₩485.7b net cash.

How Healthy Is Seegene’s Balance Sheet?

We can see from the most recent balance sheet that Seegene had liabilities of ₩170.8b falling due within a year, and liabilities of ₩60.5b due beyond that. On the other hand, it had cash of ₩562.9b and ₩92.3b worth of receivables due within a year. So it actually has ₩423.8b more liquid assets than total liabilities.

This luscious liquidity implies that Seegene’s balance sheet is sturdy like a giant sequoia tree. On this view, lconcludeers should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Seegene has more cash than debt is arguably a good indication that it can manage its debt safely.

See our latest analysis for Seegene

Although Seegene created a loss at the EBIT level, last year, it was also good to see that it generated ₩13b in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Seegene’s ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals believe, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business necessarys free cash flow to pay off debt; accounting profits just don’t cut it. Seegene may have net cash on the balance sheet, but it is still interesting to view at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, becautilize that will influence both its necessary for, and its capacity to manage debt. Over the last year, Seegene actually produced more free cash flow than EBIT. There’s nothing better than incoming cash when it comes to staying in your lconcludeers’ good graces.

Summing Up

While it is always sensible to investigate a company’s debt, in this case Seegene has ₩485.7b in net cash and a decent-viewing balance sheet. And it impressed us with free cash flow of ₩77b, being 608% of its EBIT. So we don’t believe Seegene’s utilize of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet – far from it. We’ve identified 2 warning signs with Seegene , and understanding them should be part of your investment process.

When all is declared and done, sometimes its clearer to focus on companies that don’t even necessary debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to purchase or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply