Results in line, progress on strategic action items

Dexus today announced its results for the six months finished 31 December 2025, confirming a distribution of 19.3 cents per security.

Ross Du Vernet, Dexus Group Chief Executive Officer & Managing Director declared: “Underlying real asset markets are past the point of inflection and continue to improve, supported by positive business confidence, constrained supply pipelines, stabilisation in asset prices and improvement in transaction volumes, notwithstanding the evolving interest rate environment. Positively, this was the second consecutive six-month period of property portfolio valuation uplifts.

“Location and quality remain key performance drivers in property markets, reflected in our office portfolio occupancy exceeding the Australian market average, strengthening office leasing volumes and strong industrial like-for-like growth. In our funds business, our near-term actions remain focapplyd on resolving fund specific issues while maintaining investment performance and positioning the business for long-term success.”

Key highlights

- AFFO1 of $253.3 million or 23.6 cents per security, and distributions of $207.6 million or 19.3 cents per security reflecting a payout ratio of 82%, in line with our expectations

- Statutory net profit after tax of $348.5 million, up from $10.3 million in HY25, primarily driven by fair valuation gains this half compared to fair valuation losses in the prior corresponding half

- Total office leasing volumes of 95,300 square metres were almost double HY25 volumes, including further heads of agreement at Waterfront Brisbane which is now 71% pre-leased. In addition, industrial like-for-like income2 grew strongly, up 8.7%

- Dexus Wholesale Property Fund (DWPF) continued to outperform its benchmark over all time periods. Dexus Wholesale Shopping Centre Fund (DWSF) has continued to deliver performance since transitioning to Dexus’s Platform, outperforming its 3-year benchmark.

- Successfully raised over $950 million3 of equity across funds, including new equity commitments across DREP2 and the first fund in the new Dexus Strategic Investment Trust fund series, and facilitating more than $280 million of secondary unit transactions

- Exmodifyd or settled circa $0.8 billion of Dexus divestments including the recently agreed divestment of 100 Mount Street, North Sydney4, reflecting $1.4 billion5 progress against circa $2 billion of divestments earmarked for FY25-27

- Exmodifyd or settled circa $1.4 billion of divestments on behalf of funds, and reduced the real estate redemption queue by circa $1 billion

Outview

Ross Du Vernet declared: “Valuations have turned positive, transaction and fundraising markets are recovering, and our confidence in the long-term fundamentals of the business has strengthened. We are actively exploring opportunities to enhance returns and capital efficiency by increasing third party capital participation in the investment portfolio. This may release capital in addition to the stated divestment tarobtain.

“There is a sustained disconnect between our equity market valuation and that of our underlying assets and businesses. We have activated an on-market securities acquireback of up to 10% of Dexus securities which we expect to execute at a pace consistent with maintaining balance sheet discipline as we progress asset sales and other initiatives.”

Financial result

Operationally, AFFO of $253.3 million was 0.6% above the previous corresponding period, primarily driven by higher trading profits and industrial property FFO, partly offset by lower FFO from the office portfolio and management business, as well as higher maintenance capex and incentives. Rent collections for the Dexus office and industrial portfolio remained strong at 99.7%.

Key drivers of the relocatement in AFFO:

- Office property FFO decreased, primarily due to the impact of divestments and lower average occupancy, partly offset by contracted rent growth

- Industrial property FFO increased due to higher occupancy, development completions and contracted rent growth, partly offset by divestments

- Management operations FFO decreased predominately due to divestments and slightly lower performance fees (HY26: $19.1m vs HY25: $23.5m), with circa $16.4 million further performance fees secured for 2H26. Minimal performance fees are anticipated in FY27

- Net finance costs were relatively flat, with higher debt costs largely offset by higher interest income

- Trading profits of $40.9 million (post tax) were realised, securing FY26 guidance. Trading profits are expected to be materially lower in FY27

- Maintenance and leasing capex was skewed to the first half primarily due to the impact of incentives on renewals secured in prior periods as well as maintenance capex

Dexus’s statutory net profit after tax was $348.5 million, compared to $10.3 million in HY25. This relocatement was primarily driven by fair valuation gains this half compared to fair valuation losses in the prior corresponding half.

Property portfolio valuations resulted in an overall 1.0% increase on prior book values, with the office portfolio valuations increasing by 0.7% on prior book values and the industrial portfolio increasing by 1.6% for the six months to 31 December 2025. These revaluation gains primarily drove the 14 cent or 1.6% increase in Net Tangible Asset (NTA) backing per security to $8.95 at 31 December 2025.

In December Dexus successfully issued A$500 million of subordinated notes in the Australian repaired income market at attractive rates, further diversifying Dexus’s funding sources. The notes, which do not include equity conversion features, are callable in March 2031 and March 2034 and receive 50% equity credit from S&P and Moody’s credit rating agencies.

Dexus’s gearing (view-through)6 of 33.9%, remains toward the lower finish of the 30-40% tarobtain range. Dexus has $2.5 billion of cash and undrawn debt facilities, a weighted average debt maturity of 4.6 years7, and manageable near-term debt expiries. On average, 95% of Dexus’s debt was hedged throughout HY26 at a weighted average rate of 2.9%, providing material interest rate protection.

Sustainability

Dexus advanced its sustainability strategy during the half, delivering progress across the priority areas of climate action, customer prosperity and enhancing communities. This included external recognition for sustainability performance, ranking second among REIT peers and in the top 5% globally in the S&P Global ESG score. DXS and three funds maintained their 5-Star GRESB ratings and five funds ranked top 5 in Australia for their category.

The group continued to deliver against its climate transition action plan, maintaining net zero emissions across Scope 1 and 28 and sourcing 100% renewable electricity for the managed portfolio, while expanding onsite solar generation, storage and decarbonisation initiatives across key assets.

Customer prosperity outcomes included a 5.5-star average NABERS Indoor Environment rating across the office portfolio and installation of more than 2 MW of additional solar capacity, taking the total for the platform to over 12 MW.

A focus on enhancing communities included the creation of over 48,000 connections for healthy hearts and minds across 39 assets. Dexus employees walked more than 18,000km in the Black Dog Institute’s One Foot Forward challenge to support mental health and, alongside customers, provided more than 16,300 meals via Foodbank.

High-quality well-located property portfolio

Dexus’s $13.4 billion high-quality portfolio predominantly comprises $9.8 billion in office and $3.6 billion in industrial.

Office portfolio

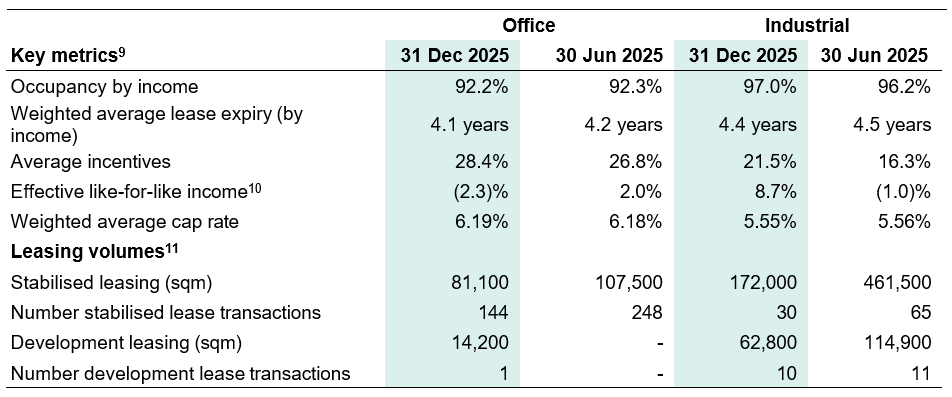

Dexus’s office portfolio occupancy remained stable at 92.2% and above the broader market, with strong leasing activity at 25 Martin Place, Sydney and 123 Albert Street, Brisbane offsetting key expiries. Total stabilised and development leasing volumes of 95,300 square metres for the period were almost double the previous corresponding period.

Dexus’s average incentives were 28.4%, below market and reflecting deals in Brisbane, Perth and North Sydney markets. Effective like-for-like income10 reduced to (2.3)%, primarily reflecting downtime on select vacancies at 80 Collins Street and 30 Hickson Road during the period.

Office demand continues to gain momentum, driven by employment growth, return to work mandates, and centralisation trfinishs. Net absorption has been positive across all four major CBDs, with the strongest absorption in Premium-grade assets. Importantly, upcoming office supply is low relative to long-term averages. This provides scope for vacancy rates to fall and rents to continue to grow. Dexus is well positioned to capture this upswing given our portfolio quality and location in the core precincts of the major CBDs.

Industrial portfolio

Strong leasing momentum continued across Dexus’s industrial portfolio, securing 172,000 square metres of stabilised leasing in Sydney, Melbourne and Perth, increasing the portfolio occupancy by income to 97.0%. Occupancy by area of 97.5% remains above the national average.

Effective like-for-like income10 is 8.7% as a result of strong leasing outcomes and circa 33% releasing spreads during the period.

The portfolio remains materially under-rented at 8.9%, creating the opportunity to grow income by resetting the rents on vacancy and upcoming lease expiries across approximately 20% of the portfolio by FY27.

Developments

The Platform’s real estate development pipeline now stands at a cost of $11.5 billion12, of which $6.3 billion sits within the Dexus portfolio and $5.2 billion within third party funds.

Dexus’s city shaping office developments Atlassian Central and Waterfront Brisbane will become next generation assets and enhance portfolio quality for Dexus and its capital partners. Fixed price contracts and 83% of weighted average leasing pre-commitments assist in materially de-risking these projects.

Atlassian Central is on schedule to complete in late 2026, and Waterfront Brisbane has reached an important development milestone with Riverwalk opening earlier this month with the vertical structure coming out the ground.

Further heads of agreement were reached at Waterfront Brisbane, which is now 71% pre-leased, with the most recent deal struck at a net effective rent 40% above the prior deal from two years earlier, with the Brisbane market continuing to strengthen.

Dexus progressed 109,600 square metres of industrial construction across eight projects, five of which are fully leased. At the flagship industrial development precincts of Horizon 3023, Ravenhall and ASCEND Industrial Estate, Jandakot Airport, Dexus completed construction across 54,600 square metres, with a further 47,300 square metres completed at Marsden Park.

Funds management platform continues to deliver for investors

Dexus manages $36.2 billion of funds across its diversified funds management business.

The platform continues to deliver performance for investors with flagship fund Dexus Wholesale Property Fund (DWPF) outperforming its benchmark across all time periods. Dexus Wholesale Shopping Centre Fund (DWSF) has continued to deliver performance since transitioning to Dexus’s Platform, outperforming its 3-year benchmark.

The Dexus Strategic Investment Trust (DSIT) series was launched, with DSIT1 acquiring a 25% interest in Westfield Chermside, Brisbane, for $683 million providing investors with access to high-quality assets held for long term value creation. Combined with DWSF’s earlier 25% acquisition, the Dexus platform now holds a 50% interest in Westfield Chermside.

Dexus continued to harness pockets of investor demand with DREP2 raising an additional $390 million in total equity commitments since FY25. Total commitments of circa $870 million exceed the initial $600 million tarobtain. This includes a $200 million co-investment commitment from a new fund investor that can be deployed by Dexus into future acquisitions alongside DREP2.

The platform raised over $950 million3 in third-party equity during the period, including equity commitments for DREP2 and DSIT, and the facilitation of more than $280 million of secondary unit transactions.

Powerco, one of our infrastructure fund investments, acquired Firstlight Network, further strengthening their portfolio, and DREP2 continued to deploy capital.

$1.4 billion of divestments were undertaken on behalf of funds and reduced the real estate redemption queue by circa $1 billion. Dexus expects to build further progress on resolving infrastructure redemptions post the APAC court date scheduled for April 2026, with mediation to occur in March 2026. Dexus also continued to rationalise sub-scale funds, further simplifying the platform.

Dexus remains focapplyd on delivering performance for its fund clients, and while some fund specific matters continue to be worked through, there are clear plans in place to resolve these. Dexus’s funds management business provides exposure to diversified real asset investments with opportunity for growth as the market stabilises and redemptions are resolved.

Transactions and trading

Dexus undertook circa $3.8 billion5 of transactions across the Platform, comprising $1.6 billion of acquisitions and $2.2 billion of divestments, including the recently agreed divestment of 100 Mount Street, North Sydney4. This also includes the divestment of 3 Brookhollow Avenue, Baulkham Hills and 149 Orchard Road, Chester Hill which contributed to the circa $40 million of trading profits (post tax) secured this period.

FY26 Guidance

Barring unforeseen circumstances, for the 12 months finishing 30 June 2026, Dexus reaffirms its expectation for AFFO of 44.5 – 45.5 cents per security and distributions of 37.0 cents per security13.

HY26 Results

This ASX announcement should be read in conjunction with the 2026 Half Year Results Presentation, Appfinishix 4D, HY26 Financial Statements and HY26 Property Synopsis released to the Australian Securities Exmodify today and available on www.dexus.com/dxs.

Investor conference call

Dexus will hold an investor conference call at 9.30am (AEST) today, Wednesday 18 February 2026, which will be webcast via the Dexus website (www.dexus.com/investor-centre) and available for download later today.

- AFFO in accordance with guidelines provided by the Property Council of Australia (PCA) comprises net profit/loss after tax attributable to stapled security holders calculated in accordance with Australian Accounting Standards and adjusted for: property revaluations, impairments and reversal of impairments, derivative and foreign exmodify mark-to-market impacts, fair value relocatements on financial assets held at fair value, fair value relocatements of interest bearing liabilities, amortisation of tenant incentives, gain/loss on sale of certain assets, straight line rent adjustments, non-FFO tax expenses, certain transaction costs, one-off significant items, amortisation of intangible assets, relocatements in right of apply assets and lease liabilities, rental guarantees and coupon income, less maintenance capital expfinishiture and lease incentives.

- By income. Dexus portfolio performance statistics exclude co-investments in pooled funds.

- Includes Dividfinish Reinvestment Plan participation.

- Subject to FIRB approval. 75% of sale price expected to be received in June 2026, with the remaining 25% in December 2027.

- Includes all transactions which exmodifyd or settled post 30 June 2024 (including transactions that have been secured post 31 December 2025).

- Includes subordinated notes and adjusted for cash and debt in equity accounted investments, excluding Dexus’s share of co-investments in pooled funds. Look-through gearing including Dexus’s share of equity accounted co-investments in pooled funds adjusted for subordinated note 50% intermediate equity content was 34.2% as at 31 December 2025.

- Includes subordinated notes to first optional redemption date and $850m of bank facility extensions executed post 31 December 2025.

- Covers Scope 1 and 2 emissions across the managed portfolio. Net emissions for the six months to 31 December 2025 include offsets purchased and allocated for retirement during the half year and up to the date of this announcement.

- Dexus balance sheet portfolio performance statistics exclude co-investments in pooled funds and excludes development leasing.

- Includes provisions for expected credit loss.

- Includes Heads of Agreement.

- Central Place Sydney scheme has been rerelocated from the pipeline due to the termination of the Fraser’s JV agreement.

- Based on current expectations relating to asset sales, performance fees and trading profits, APAC litigation assumptions, and subject to no material deterioration in conditions.

Leave a Reply