DealMaker, North America’s largest retail capital-raising platform, has raised $20 million USD in financing of equity and debt by new investor Information Venture Partners and existing partner CIBC Innovation Banking. This funding round is a testament to DealMaker’s industest leadership and rapid growth in the $2.4 trillion1 retail capital markets. This funding round follows major milestones including: DealMaker’s recent acquisition of Rally On Media, expansion of its U.S. presence and new headquarters in New York City, the launch of DealMaker Sports, and record breaking volumes in the first half of 2025.

DealMaker has supported hundreds of innovative companies across a wide range of industries raise over $2.3 billion in capital directly from individual investors—from startups and growth stage companies to pre- and post-IPO private offerings. And with the backing of Information Venture Partners and CIBC Innovation Banking, DealMaker is primed to continue to redefine the capital markets and support more companies harness the power of their communities to build their brands, increase loyalty and grow on their own terms—without giving up control.

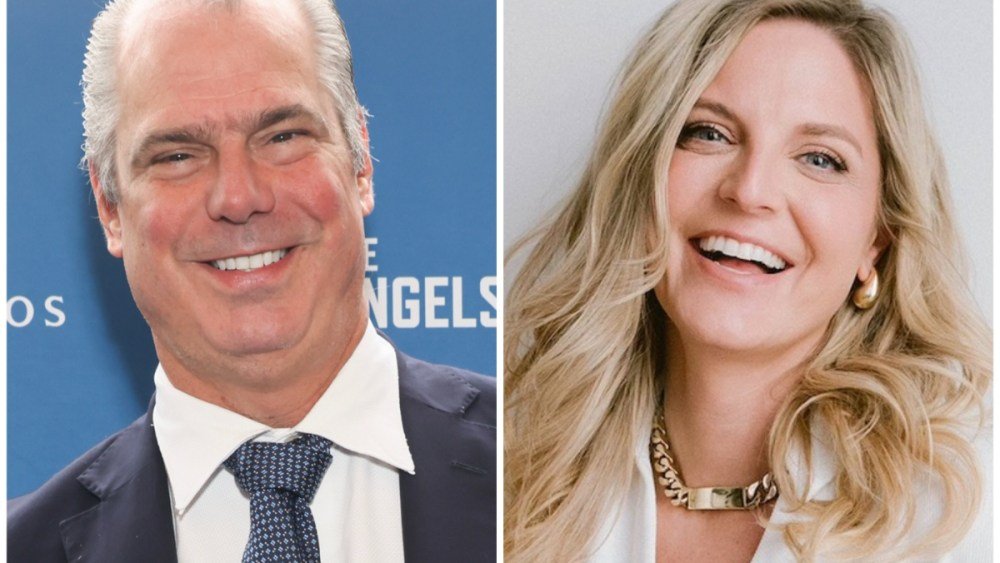

“We are very excited to have the backing of Information Venture Partners and CIBC Innovation Banking—two firms that share our vision for the democratization of capital markets and the power of direct to investor capital raising,” stated Rebecca Kacaba, DealMaker Co-Founder & CEO. “We believe it’s more important than ever to take a strategic approach to capital raising—from venture capital to retail equity to growth debt—this round allows us to accelerate the deployment of AI across our product line, capitalize on emerging ownership models across professional and collegiate sports, and deliver greater value to our customers. This positions DealMaker to be a market leader in a rapidly growing sector where more and more companies—from startups to the hottest IPOs are prioritizing retail investors.”

Today’s capital markets and ownership models are rapidly evolving as founders and operators realize the advantages of diversifying their capital stacks as strategic levers for maintaining great control as they scale – both within the private and public markets.

“We share DealMaker’s vision and believe their AI-driven white-label platform is truly differentiating,” stated Robert Antoniades, Co-Founder and General Partner at Information Venture Partners. “With a long history of backing innovations that open and modernize markets, we see DealMaker as a natural fit—where we can add meaningful value—as it unlocks retail capital in a rapidly evolving, high-growth market “

DealMaker provides the unique ability to not only raise capital directly from individual investors—but simultaneously build community, loyalty and brand value pays dividconcludes well beyond the capital raise.

“We are pleased to continue our relationship with DealMaker and to work alongside IVP in supporting the company’s next phase of growth,” stated Joshua Olawale, Director, CIBC Innovation Banking. “DealMaker’s technology-driven approach to capital raising aligns with our commitment to supporting innovative growth-stage companies.”

Leave a Reply