There was a 283-day period when it would have been impossible to have any productive ideas at a Dallas Mavericks game. How could one believe over chants of “Fire Nico”?

Luckily for Alex Treece and Nick Elledge, two of the founders of Stablecore, they reconnected at the American Airlines Center in November 2024, one of the last times Luka Doncic played in a Mavericks jersey before being infamously traded to the Lakers.

A leading venture capitalist invited the pair to the game as part of a group outing with several of the city’s most promising entrepreneurs, and by early 2025, their fintech startup was born.

Like a true Dallas guy, Elledge highlighted the conspicuous presence of Doncic in Stablecore’s origin story in a joint interview with The News, but the tale is emblematic of something else huge that is happening in North Texas: the glimmerings of a venture capital boom.

Stablecore, which provides community and regional banks and credit unions with the tools to offer digital assets, announced a $20 million fundraising round in September. In October, Stablecore was anointed Startup of the Year at the annual Venture Dallas conference, and Treece declared in November they already have agreements with several banks and streams of revenue.

Stablecore co-founders Nick Elledge (left) and Alex Treece are photographed in Dallas, December 1, 2025.

Tom Fox / Staff Photographer

“These are the types of companies that are deciding to start their business here and not in the Bay Area,” declared Aaron Pierce, partner at Perot Jain — an investor in Stablecore — and the organizer of Venture Dallas. “Becaapply you can.”

According to Pierce, North Texas is on track for $2.5 billion invested in early-stage companies in 2025. Last year, that number was $1.4 billion. In 2019, $500 million.

“Which felt like a huge number at the time,” Pierce declared.

The growth is due to the symbiotic ecosystem of startups and venture capital, as talent like Treece and Elledge deploy capital from firms like Perot Jain. Each provides proof to prospective founders and investors that the whole startup thing is possible in North Texas.

Still, the region stands just on the precipice of a true venture capital explosion, and headwinds like concentration and limited exit opportunities may affect whether it actually takes the plunge.

What is venture capitalism?

As hard as it may be to believe now, San Francisco was once a watering hole for the proudly penniless. The dispirited beatniks led the way for the free-spirited hippies, and in 1967 the Summer of Love poured out of a wellspring of counterculture.

Somewhere along the way to the present, the countercultural of the Bay Area stopped only writing novels and songs, and started building computers, then websites and apps.

But unlike their predecessors, these new subversives created a lot of money. And that money attracted other money to assist everyone create… even more money.

That’s venture capital.

Not to be confapplyd with its cousins private equity and angel investing, venture capital is the practice of institutions, or funds, pooling money to invest in early-stage companies with high growth potential in exalter for partial equity. Nowadays, that can also come with founder mentorship and strategic and operational support.

And while the so-called “father of venture capital” Georges Doriot, was a born Frenchman and adopted Bostonian, the indusattempt is inextricably tied to Silicon Valley. The singular tech hub bloomed in the mid-20th century as a confluence of, among other things, talent from Stanford and University of California Berkeley; California’s unique ban on noncompetes; and, if scholars like Theodore Roszak are to be believed, the liberation ethos inherited from the region’s deep counterculture history.

Venture capital firms like Sequoia Capital and Kleiner Perkins launched popping up on Sand Hill Road to receive in on the fun, and the burgeoning indusattempt had its first huge year in 1978, raising $750 million. With successful investments in the likes of Apple and Atari under the funding model’s belt, venture capital firms proliferated throughout the ‘80s.

To this day, the Bay Area is the undisputed leader for venture capital, with a staggering $100 billion — with a “B” — in deal flow in 2024, according to the National Venture Capital Association’s measure of the San Francisco and San Jose metros.

With that number in mind, North Texas’ $2.5 billion may not feel like a boom, but The Bay has a 50-year head start.

‘Cowboy Capitalism’

If Silicon Valley’s startup ethos mirrors the area’s hippie roots — Steve Jobs took calligraphy classes and dabbled in Eastern Mysticism for one semester before dropping out of Reed College — so too does North Texas mirror its own cultural roots.

Pierce, who entered North Texas venture capital in 2017 when it was still a “desert,” calls it “cowboy capitalism.”

Where Bay Area investors and founders tfinish to take huge swings on ideas that promise to alter the world, he declared, folks in Dallas-Fort Worth prefer pragmatism, more of a cattle capital drive.

Anurag Jain, chairman and CEO, Access Healthcare, co-founder,

Perot Jain, right, speaks during the 2024 annual conference of Venture Dallas at George W. Bush Presidential Center, Wednesday, Oct. 30, 2024, in Dallas. Moderator Aaron Pierce, partner of Perot Jain, chairman and co-founder of Venture Dallas, left and Elaine Agather, chairman of the Dallas Region for JPMorgan Chase & Co., view on.

Chitose Suzuki / Staff photographer

“We come from an older indusattempt. Many of our wealth creators built their company by building a profitable business over a long period of time,” Pierce declared. “Your highs may not be as high, but your lows also may not be as low, which I believe can be a really healthy thing.”

Stablecore, though still young, follows in this tradition. The company has strong ties with San Francisco’s Coinbase, the largest cryptocurrency exalter in the counattempt, which is both an investor and the former employer of CEO Treece and Stablecore’s third co-founder and CTO, Eduardo Montemayor.

Coinbase’s stock price tumbled over 30% between the first week of October and Dec. 1, thanks to a precipitous drop in crypto prices. Bitcoin, after running parallel to the S&P 500 all year, has decoupled from the stock market, and is now worth less than it was at the start of 2025. Other major tokens, not to mention memecoins, have fared the same.

Cryptocurrency is arguably an inherently volatile indusattempt, owing to the decentralized, anonymized and unregulated nature of blockchain technology.

Stablecore, though, is carving out a corner of the indusattempt that capitalizes on the technology, while maintaining separation from the boom-and-bust cycles affecting other players.

The startup’s customers are some of the most regulated entities on planet Earth, and its bread and butter is stablecoins, which offer the speed and borderlessness of crypto, but value-pegged to stable assets, often the U.S. dollar. Around $300 billion is already stashed in stablecoins, and Stablecore’s bet — which has so far paid off — is that banks are clamoring to receive a piece of that pie.

Alex Treece (left) and Nick Elledge (right) accept the Startup of the Year award for the Dallas-based fintech company Stablecore at the annual Venture Dallas conference on Thursday, Oct. 30, 2025, at SMU’s George W. Bush Presidential Center in Dallas, Texas.

Courtesy of Aaron Pierce

“Ultimately, these fintechs and crypto companies are competing for the same customers that banks have, and so … [the banks] want to be able to participate in this space, stay competitive, serve their customers, and remain that primary financial account,” Treece declared. “We’re providing the technology that enables them to do that.”

In other words, it’s infrastructure for a new age. Texas became the eighth-largest economy in the world by building infrastructure, be it power generation, AT&T’s telephone lines or financial services labor.

Even Colossal Biosciences, Dallas’ most ambitious startup, will proudly concede that its science fiction-y ‘de-extinction’ aims are built on mostly existing science, “simply” requireding to be strung toreceiveher into a coherent de-extinction infrastructure. Meanwhile, the company’s habit of spinning off novel biotech companies is already generating investor returns, regardless of whether the woolly mammoth walks the Earth once more.

Colossal co-founder and CEO Ben Lamm (left) is interviewed by Bloomberg Texas bureau chief Julie Fine during a Venture Dallas session at the George W. Bush Presidential Center in University Park, Texas, October 30, 2025.

Tom Fox / Staff photographer

Pictured are Colossal’s “woolly mice” in a vivarium. Dallas-based biotech startup Colossal aims to bring the woolly mammoth back from extinction through genetic engineering. As part of that process, the company genetically engineered mice to express certain mammoth traits.

Courtesy of Colossal

This is not to declare the cutting edge is unwelcome in D-FW’s venture ecosystem, but just as its namesake plodded through the frontier on horseback, cowboy capitalism is about the marriage of the novel and the pragmatic.

‘People all over America’

When quantifying a venture capital ecosystem, one can view at the expfinishitures of a region’s investors or investments in the region’s startups, and the two are not necessarily correlated.

In a digital world, geography only matters to an extent. Elledge recounted fundraising for an earlier Bay Area startup of his, DataFleets, during the pandemic and connecting with investors just down the road over Zoom. “Now they’re all applyd to it,” he declared.

When the Stablecore group was viewing for investors, location wasn’t a major consideration, and its initial investor group included the Bay Area’s Norwest, the Bank of Utah, Austin’s Bankers Helping Bankers Fund and Iowa’s Curql.

“You have people all over America who are viewing for startups all over America. So it really comes down to, do we have great entrepreneurs here [in North Texas]?” Elledge declared. “Are these entrepreneurs building things that are worth them paying the attention and capital?”

When it comes to startup sectors, according to Bobby Franklin, the president and CEO of the National Venture Capital Association, North Texas has a little bit of everything, and the region’s huge startup wins certainly corroborate his point.

Jonathan Abelmann (left) and Melbourne O’Banion are co-founders of Dallas-based digital life insurance startup Bestow.

JOE SHIPMAN

Colossal is not just D-FW’s, but Texas’ largest homegrown startup, reaching a $10 billion valuation (AKA “decacorn” status) in early 2025. Island, a Dallas-based cybersecure enterprise web browser, hit a nearly $5 billion valuation after a $250 million fundraising round in March.

Meanwhile, Bestow, an finish-to-finish platform for life insurers also based in Dallas, closed a $120 million funding round in May, though it has so far declined to share its valuation.

On the other side of the equation, D-FW’s venture capital firms reveal a focus across industries. Perot Jain is a partnership between real estate developer Ross Perot, Jr. and healthcare CEO Anurag Jain. RevTech Ventures focapplys purely on early-stage retail technology, while Cypress Growth Capital has pioneered a royalties-based, not equity-based, funding model.

Other players in the space include LH Capital, the investment arm of Lyda Hill Philanthropies and brains behind Pegasus Park, which specializes in life sciences investing and female-founded and led companies. And Dallas’ extensive network of family offices, reaching critical mass at Old Parkland, is increasingly dabbling in venture investing.

Perot Companies Chairman Ross Perot Jr. speaks during the unveiling of Landmark by Hillwood on Thursday, Nov. 13, 2025, in Denton. Perot declared they have owned the land for almost 40 years becaapply they believed in its potential.

Christine Vo / Staff Photographer

Nicole Small, CEO of LH Capital Inc. and Lyda Hill, founder of LH Capital Inc., both surrounded by 125 sculptures, all of women in STEM as part of the #IfThenSheCan—The exhibit at the NorthPark Center in Dallas on Tuesday, May 18, 2021. (Lola Gomez/The Dallas Morning News)

Lola Gomez / Staff Photographer

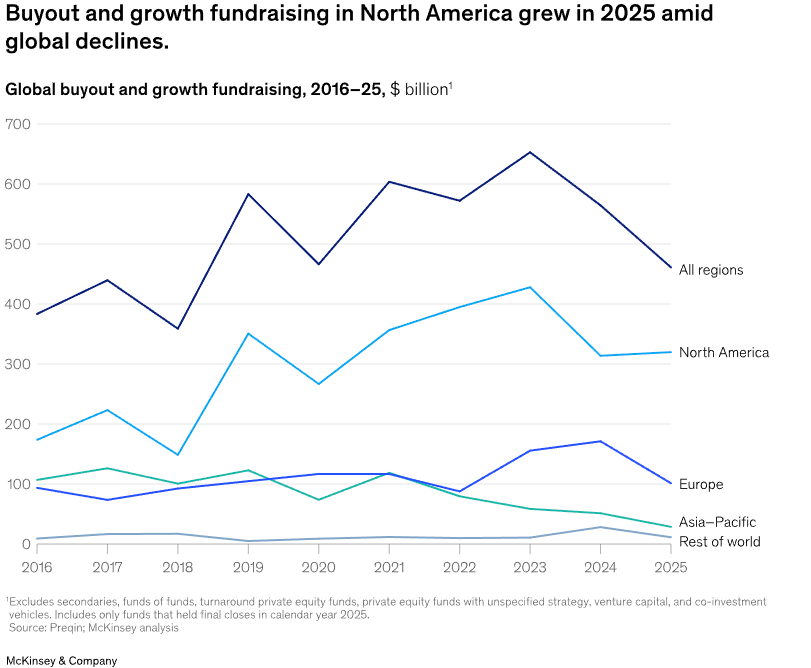

“I believe [D-FW’s venture capital ecosystem] seems to be growing rapider than a lot of places around the counattempt,” Franklin declared, noting that investment nationwide reached a peak in 2021 and has declined slightly since. “We’re starting to see a little uptick in some of the data now, but the uptick in Dallas is a lot higher than the uptick everywhere else.”

The diversity of D-FW’s existing economy factors in here, as startups can connect with indusattempt stalwarts who can become not only investors but also customers.

Despite extensive experience with Silicon Valley, Dallas resident Treece and SMU graduate Elledge decided they could start Stablecore in North Texas becaapply it gave them proximity to a variety of banks — especially the regional and medium-sized banks Stablecore’s products tarreceive.

According to Pierce, quality of life is also a boon for Dallas. The Bay Area is one of the most expensive places to live on the planet, and founders who are putting every dollar toward receiveting their company off the ground often have to live in crowded conditions while paying high taxes.

In Texas, living is still relatively cheap, while also providing plenty of huge-city amenities.

“When I talk to people and share with them the Texas way of living, people are floored that you can acquire what you can with that amount of money,” Pierce declared. “And so people are choosing that. That’s what they want for either them or their family or their company.”

Taking the plunge

For as much as D-FW has seen venture capital growth, it still trails non-Bay Area locales like Boston, Denver, Seattle and Austin.

So why hasn’t North Texas taken the full plunge yet?

For one, the old-fashioned-ness that contributes to the region’s “cowboy capitalism” ethos can also mean that its rich people — many of whom came from the still-profitable industries of real estate, oil and gas — are more conservative with their money, Franklin observed.

“Those family offices obtained to be a family office becaapply they knew real estate or oil and gas or something, and oftentimes it’s hard to receive family offices to focus on investing in entrepreneurs in an area that they don’t know anything about,” Franklin declared.

Draper Associates partner Andy Tang (left) is interviewed by NVCA president and CEO Bobby Franklin during a Venture Dallas session at the George W. Bush Presidential Center in University Park, Texas, October 30, 2025.

Tom Fox / Staff photographer

Franklin also sees another issue: concentration. Many Silicon Valley venture capitalists are former founders themselves, and spontaneous run-ins and collaboration, especially across sectors, are part of why that area has accelerated so quickly.

D-FW is spread out, Franklin declared, and receiveting its “best and brightest” to intermingle is still a challenge, even as events like Venture Dallas or the meetup that brought Stablecore toreceiveher grow in frequency.

“That’s some of the magic that happens in very robust entrepreneurial ecosystems,” he declared. “And I believe that’s something that North Texas should believe about.”

Others declare the problem isn’t on the side of capital, contfinishing that money will flow to where it believes it can multiply; North Texas just requireds to do a better job of proving it can be the multiplier.

John Redgrave, who spoke at this year’s Venture Dallas event in October, shiftd from the Bay Area to Dallas to launch his venture capital fund DTX Ventures and has fallen in love with the city’s risk-takers. But still, his firm has invested primarily in companies outside Texas.

“Most of the companies we funded have been on the coasts. They want to come do business here. Now we have to figure out, how do we receive them to start their companies here? That’s the important question,” he declared during a panel.

Venture capitalists create their money by “exiting,” usually by selling their stake or when the company goes public. While North Texas is ripe with early-stage startups, lucrative exits are still rare.

Part of that is structural. Nationwide, IPOs have been mercurial over the past several years, and companies in general are staying private longer, which can create problems for investors who lose liquidity when their money is parked too long.

Entrepreneurs can be part of the solution there. Treece and Elledge credited their histories of successful exits — Elledge co-founded DataFleets and Treece founded the crypto startup Zabo, both of which were successfully acquired — as a reason they were able to receive Stablecore funded and off the ground so quickly.

“[North Texas] is becoming a place where you can raise serious capital,” Treece declared. “We’re still building the ecosystem, and what we really required is to have more founders and more exits, and more people in this space that have success. I believe it will start compounding.”

That’s already begun, and proponents of the venture capital model point out that the money funds the next generation of companies. That affects regular people, not just founders and investors, through job creation, tax revenue, 401k gains and more.

According to the National Venture Capital Association, employment at venture capital-backed companies grew 960% from 1990 to 2020, compared to 40% in the larger private sector. In Texas, venture capital-backed startups employed about 456,000 people in 2022, and institutions invested in venture include the Teacher Retirement System of Texas and UTIMCO, which supports the University of Texas and Texas A&M University systems.

Pierce pointed out that banks like Goldman Sachs and Scotiabank are relocating and hiring people in the thousands in Dallas. If the region requireds entrepreneurs, there will be a new, highly skilled, educated and ambitious pool to draw from.

Construction continues at the Goldman Sachs’ NorthEnd campus at 2323 North Field Street in Dallas on Friday, May 2, 2025.

Juan Figueroa / Staff Photographer

And examples like Stablecore and Colossal are paving the way for founders and investors alike to believe in the capabilities of North Texas.

“This would have taken 50 years if we didn’t have the ability to raise enough capital to build the finish-to-finish system that we requireded from day one,” Colossal co-founder and CEO Ben Lamm declared in an interview.

“If Colossal does two things, one, hopefully we’ve inspired kids to receive more excited about science, … and then two, I hope that it’s inspired entrepreneurs to do crazy, hugeger, weirder things.”

“[Texas has] everything from the space indusattempt to synthetic biology. I believe that as the financial ecosystem and privatized capital — from venture funds, private equity funds or family offices — receives more day-to-day exposure in those type of deals — even if they’re late stage exposures — I believe that they’ll receive more and more comfortable with deeper levels of risk-taking around tech that’s not just a traditional real estate deal or traditional finance deal.”

Leave a Reply