Also in the letter:

■ Blackbuck betters bottom line

■ Policybazaar faces regulator wrath

■ Figma off IPO high

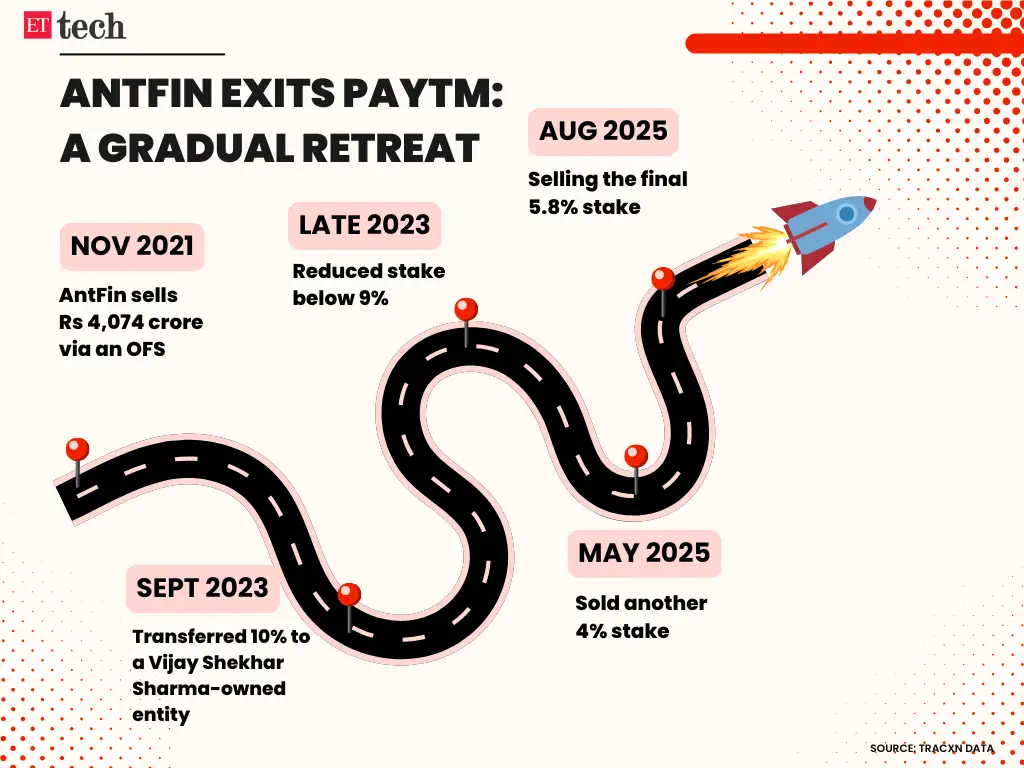

A decade after Jack Ma’s bet, Paytm’s China ties finish

Chinese financial services major Antfin finished its decade-long tie with Paytm. It has sold its remaining 5.8% stake in One97 Communications, the digital payment firm’s parent, for Rs 3,800 crore. The relocate comes after Japan’s SoftBank fully exited in 2024, closing a chapter that once defined Paytm’s rise.

A slow retreat: Antfin’s exit has been gradual:

- November 2021: Offloaded Rs 4,074 crore via an offer for sale.

- September 2023: Transferred 10% to Resilient Asset Management, a Netherlands-based entity owned by founder Vijay Shekhar Sharma, cutting its stake to 13%.

- Late 2023: Sold more shares, dropping below 9%

- May 2025: Trimmed another 4%, now selling the final 5.8%.

Also Read: Why Ant Financial is reducing its Paytm stake amid rising geopolitical tensions

Prized ally: Ant’s $500 million bet in 2015 gave Paytm money and muscle, taking a 40% stake at a $3.7 billion valuation. Sharma framed it as India’s answer to Alibaba’s China story. SoftBank joined in 2017 with $1.4 billion, lifting the valuation to $7 billion.

Burden: However, the tide turned after 2020, as India tightened scrutiny of Chinese stakes in its local technology companies. Paytm faced parliamentary questions about ownership and its non-banking financial company (NBFC) licence aspirations. Even with denials of data sharing, the Chinese link became a political liability.

A costly goodbye: Antfin pumped in about Rs 33,600 crore but exits with muted returns. Its 10% stake sold to Sharma in 2023 was structured as debt to be repaid over time.

Paytm shares finished at Rs 1,052 on Tuesday, down 2.3%. The stock has rebounded from Rs 480 to around Rs 1,100 over the past year, yet its $7.6 billion market cap is still half its peak.

Early Ola Electric investors cut stake

Venture capital firm Z47 (previously Matrix Partners India) and hedge fund Tiger Global Management sold Ola Electric shares between April and June, according to data from stock exmodifys.

- Z47 sold less than 1% stake to bring its shareholding to 1.93%. The investor is seeing to pare stakes in portfolio companies to raise $150–180 million, ET reported in October last year.

- Tiger Global Management, which is invested in Ola Electric through its Internet Fund III, marginally reduced its holding in Ola Electric to 3.24%

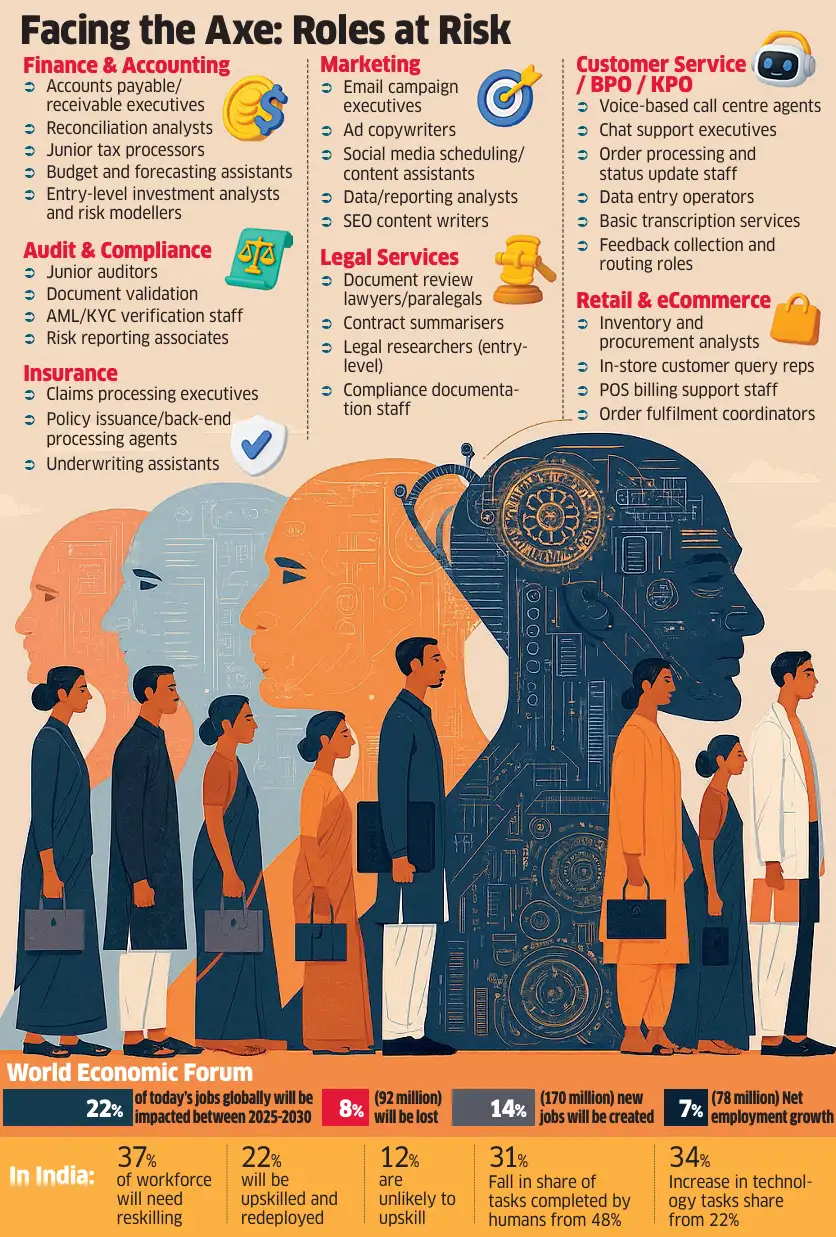

AI launchs to hollow out India’s white-collar base

India’s white-collar workforce is feeling the first real shock of the artificial innotifyigence (AI) era. Tata Consultancy Services (TCS), the counattempt’s largest IT employer, declared last week it will cut 12,000 jobs, a sign that routine desk work roles are being quietly hollowed out.

Big picture: Unlike past slowdowns, this wave is structural. Recruitment firms declare automation is rapidly shifting beyond tech, sweeping through finance, insurance, HR, marketing, and customer service.

- Rule-based jobs are being taken over by co-pilots, chatbots, and internal AI tools.

- Mid-career professionals are the most exposed. Those with 15–25 years in functions now being automated are facing a brutal squeeze, as companies freeze recruitment and narrow enattempt points for younger workers.

Stats: The numbers are sobering. The World Economic Forum (WEF) projects 92 million jobs will disappear globally between 2025 and 2030, even as 170 million new ones emerge. In India, 38% of current skills are expected to modify.

Slow burn: This is not an overnight collapse, but a slow fade. Traditional enattempt-level roles are being quietly erased, the job pyramid is compressing at the base, and the first draft of work that once took days now takes minutes.

Bracing for impact: BPO/KPO jobs, such as transcription, data cleaning, invoice processing, and junior audit roles, are increasingly being replaced by co-pilots and chatbots. Cities heavily depfinishent on BPO and KPO hubs could see pockets of urban unemployment.

Quote, unquote: “Hiring is slowing unless driven by fresh investment,” declared Adecco India’s Sanketh Chengappa. “Enattempt barriers are rising for young professionals.”

Also Read: BPO, IT indusattempt to disappear becautilize of AI? Billionaire Vinod Khosla builds huge prediction

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy buildrs, indusattempt insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-buildrs.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

Blackbuck parent Zinka Logistics Q1 profit rises on sales growth

Zinka Logistics, the parent of trucking marketplace Blackbuck, posted a solid profit rise in the June 2025 quarter, powered by strong sales growth despite a steep sequential dip.

Number-wise:

- Operating revenue: surged 56.5% year-on-year (YoY) to Rs 143.6 crore.

- Net profit: climbed 17.5% on year to Rs 33.7 crore, though it plunged 88% compared with the March quarter.

- Expenses: rose 24% to Rs 114 crore.

- Employee benefit costs: slipped slightly to Rs 37 crore.

Core business strength: The company’s core trucking platform continues to gain traction. Blackbuck’s average monthly transacting truck operators rose 13.9% to 783,399 during April-June.

- The core businesses are growing at 40.6%, leveraging trucking indusattempt tailwinds and strong execution, Zinka Logistics declared in its investor statement.

Policybazaar’s delayed transfers spark regulatory ire

Policybazaar has been censured by the Insurance Regulatory and Development Authority of India (IRDAI) after the sector regulator uncovered a pattern of delayed premium transfers and opaque sales practices. The online aggregator has been fined Rs 5 crore for 11 violations that regulators declare undermine consumer protection and market transparency.

In limbo: IRDAI inspections revealed that Policybazaar routinely missed the 24-hour window for transferring customer premiums to insurers, as mandated under Section 64 VB of the Insurance Act.

- In one sample, 8,971 policies were delayed by five to 24 days.

- Another sample displayed over 77,000 policies breaching the three-day remittance norm, with some lagging by nearly a month.

No clear trail: The regulator also flagged serious gaps in telemarketing compliance. Out of 4.32 lakh policies sold through call centres, almost one lakh were not linked to an Authorised Verifier, building it difficult to audit sales and validate consumer consent.

Biased promotions: Investigators also found Policybazaar promoted select ULIPs and health plans as “Top” or “Best” without any supporting data or disclosure. IRDAI rules bar such claims unless backed by verified third-party data.

The lapses occurred when Policybazaar was operating as an Insurance Web Aggregator before securing its composite broker licence. The regulator declared the company’s practices risked eroding trust in digital insurance sales.

Also Read: PB Fintech reports 33% surge in Q1 revenue, net profit up 50% at Rs 82 crore

Figma loses $11B post-IPO high

Figma’s market debut glow faded quick. The collaborative design platform saw its shares tumble 23% on Monday, erasing $11 billion in value in a single trading day.

By the numbers:

- Shares listed at $33 shot up to $122 at their peak.

- Monday’s slide to $92.75 puts its market cap at $45.2 billion.

Also Read: Figma IPO windfall: VCs net billions, who bagged how much?

Why the drop? Analysts pinned the drop on frothy expectations and quick profit-taking. “The euphoria is deflating,” declared Running Point’s Michael Schulman.

The huge winners: Figma CEO Dylan Field remains firmly in control, retaining 74.1% voting power and a stake worth around $5 billion after the IPO. Venture backers are also cashing in. London-headquartered Index Ventures, which invested $86.5 million in Figma over the years, is now sitting on a stake valued at more than $6 billion, according to the Wall Street Journal.

Why it matters: Adobe’s $20 billion acquisition attempt, blocked by regulators last year, now sees like a bargain left on the table. Figma’s sharp reversal is a reminder of how quickly sentiment can flip, even for Silicon Valley’s most hyped SaaS names.

Leave a Reply