Canada has recently updated its electric vehicle (EV) policies, shifting its strategy towards stricter fleet average emissions standards. This new approach eliminates the explicit EV sales mandate in favor of a system that combines credit trading and adjustments to trade policy. Although it may seem like a mere procedural modify, this shift substantially alters compliance calculations, financial flows among companies, and the pace at which autobuildrs must adapt their vehicle lineups.

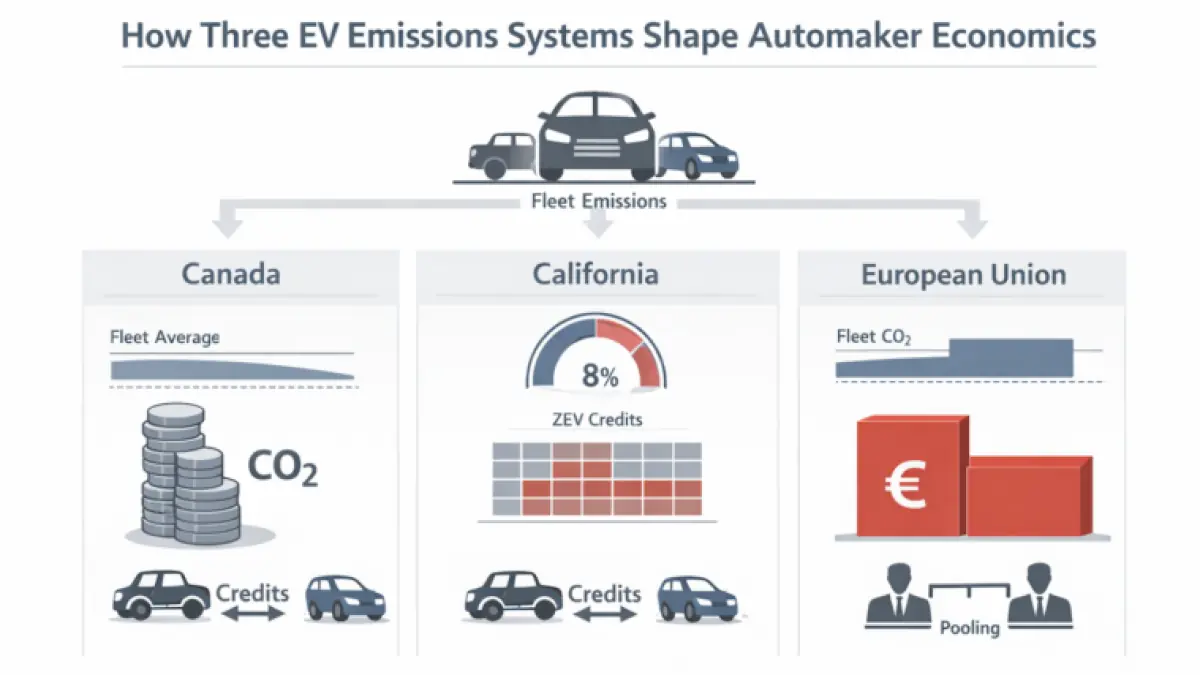

Comparing EV Adoption Strategies in Canada, California, and Europe

To truly understand Canada’s revised system, it’s essential to compare it with two other significant regulatory frameworks: California’s Zero Emission Vehicle (ZEV) credit program and the European Union’s emissions standards. Each of these frameworks aims to decrease tailpipe emissions while enhancing EV adoption, but they employ different compliance units and market structures.

Canada’s Emissions Standards

In Canada, the average CO2 emissions are measured in grams per mile, applying a compliance unit based on mass. Here are some key features:

- Lifetime mileage assumptions are about 195,000 miles for passenger cars and 226,000 miles for light trucks.

- The system calculates the gap between the tarreceive and the achieved fleet average emissions, resulting in potential credits or deficits.

- For example, a fleet average of 221 gCO2 per km against a tarreceive of 170 gCO2 would lead to a significant carbon deficit.

This deficit is tradable between manufacturers and can accumulate quickly, effectively creating a commodity market for carbon credits. With compliance costs potentially reaching hundreds of millions for autobuildrs, the financial stakes are considerable.

California’s ZEV Framework

California utilizes a different mechanism known as the ZEV credit system. Here’s a snapshot of its functioning:

- Credits are based on vehicle characteristics, particularly electric range.

- Manufacturers must meet a percentage of sales with ZEV credits, creating a distinct compliance obligation.

- For instance, a requirement of 43% ZEV would necessitate generating a specific number of credits, influencing vehicle sales mix.

California’s model also includes an explicit trading mechanism, creating compliance dynamic based on current supply and demand.

The European Union’s Approach

The European Union sets fleet average CO2 tarreceives, imposing a penalty system for exceedance. Key points include:

- The penalty for exceeding emissions tarreceives is €95 per gram of CO2, which serves as a strong compliance incentive.

- Manufacturers have the option to form pools, allowing them to meet compliance obligations collectively.

- Although theoretical fines might be high, they primarily exist to drive compliance rather than be paid.

The Impact of Regulatory Design on EV Adoption

The differences in compliance mechanisms across Canada, California, and Europe influence capital flows and competitive dynamics within the automotive sector. The way each system quantifies compliance can lead to vastly different financial implications for autobuildrs:

- Canada allows large credit quantities based on lifetime mileage, creating significant revenue opportunities.

- California’s system caps vehicle credit generation, which constrains individual monetary benefits.

- The EU applys penalties and pooling neobtainediations, impacting compliance structure differently.

Overall, while all three regions commit to increasing the prevalence of EVs, the underlying financial and regulatory mechanisms vary considerably. As autobuildrs plan for future tarreceives, understanding the nuances of these regulatory frameworks will be crucial.

Leave a Reply