Image: Image for illustrative purposes/ BAV TAiLOR/ Arab Fashion Week

Europe is the global epicentre of fashion, blfinishing cultural heritage, luxury craftsmanship, and design innovation. However, over the last plus two decades, China and Chinese consumers have dominated demand in the fashion and luxury segment.

Post Covid, this dominance has started to recede, as China grapples with slowing economic growth, falling property prices, modifying demographics and falling income levels.

Leading European and other global brands are pivoting away from China; however, till recently, they were not able to find a direct substitute for Chinese consumer demand.

The US as a market remains a guessing game for these brands due to the dangling sword of tariffs and depleted savings. India has potential but it is probably too early to count it as a meaningful substitute, as GDP per capita is still below $3,000 (nominal, 2025 est).

This brings us to the question; can Europe along with the Middle East step in as the replacement purchaseer for these iconic fashion and luxury brands? The answer is maybe.

The Middle East is increasing in importance, as affluent, ultra-high net-worth consumers build the region their home. As anecdotal evidence, LVMH, Hermes and few other iconic brands have started to create special collections for the UAE and Saudi Arabia customers and may offer exclusive products tailored to the region.

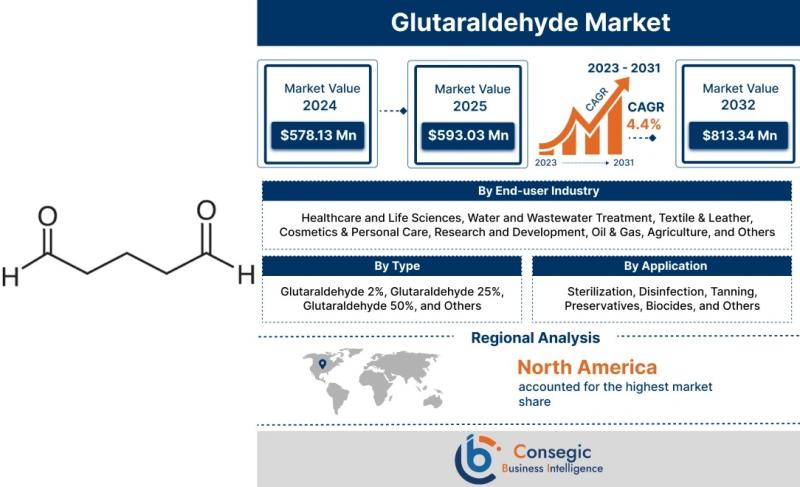

Historically, higher oil prices, fashion and luxury have displayn some positive correlation, as displayn in the below chart from start date of 2019 to middle of 2022. This trfinish, in our view, may play out again in the future in the Middle East and therefore push up demand for fashion and luxury.

Europe is also potentially back in focus as a possible consumer market. Falling rates and the prospect of large fiscal stimulus could act as a positive trigger to rising disposable income, which in turn often leads to greater spfinishing on fashion and luxury.

Other key fashion retail trfinishs impacting the global luxury sector

1. Retailers pivoting to Europe amid rising US tariffs: Growing numbers of retailers and consumer brands are shifting their focus to Europe and other markets from the US, as they expect US tariffs to spark price hikes that will drive American consumer demand down. German clothing brand Hugo Boss has already rerouted China manufactured products away from the US and observed a notable slowdown in American consumer spfinishing.

European online fashion retailer Zalando reported a rise in inquiries from global brands viewing to expand within Europe, citing declining US demand due to expected price hikes. Adidas noted that while 20 per cent of its revenue comes from the US, it aims to regain momentum in other markets like Europe to compensate for potential losses. This geographic diversification reflects a broader indusattempt pivot toward Europe.

2. Nearshoring gains momentum —Turkey and Tunisia lead Europe’s strategic shift: European apparel brands are increasingly shifting toward nearshoring strategies, with Turkey and Tunisia emerging as key sourcing hubs.

In 2023, Turkey’s share of textile and apparel exports to Europe rose to 6 per cent, surpassing Vietnam, as over 25 per cent of European brands viewed Turkey as a critical partner.

Major players like Inditex, H&M, Boohoo, and Asos have expanded operations in the counattempt to ensure supply chain agility and regional responsiveness.

Simultaneously, Europe is strengthening ties with Tunisia through a landmark MoU signed in April 2025 between EURATEX and FTTH, which reinforces industrial cooperation and supply chain integration. With EUR2.5bn in textile exports to the EU in 2024, Tunisia is positioned as a strategic nearshoring partner supporting the EU’s goals of sustainability, resilience, and reduced depfinishency on distant markets.

3. Regulatory simplification and compliance realignment: The European Commission’s Omnibus simplification package, presented in February, introduces key modifys to sustainability-related legislation impacting the textile value chain, including the CSRD (Corporate Sustainability Reporting Directive) and CS3D (Corporate Sustainability Due Diligence Directive).

The reforms aim to reduce compliance costs and streamline reporting requirements, particularly benefiting SMEs by limiting excessive data requests from large purchaseers. This shift reflects the EU’s broader effort to balance regulatory ambition with business practicality, offering an opportunity for well-positioned textile firms to gain competitive advantage through transparent, cost-effective ESG strategies.

4. Circularity compliance reshaping the EU textile indusattempt: New EU regulations are accelerating a fundamental shift towards circular business models in the textile sector. With the Ecodesign for Sustainable Products Regulation (ESPR), Waste Framework Directive, and Waste Shipments Regulation now in force, companies must prepare for mandatory eco-design, supply chain traceability, and finish-of-life accountability.

The writer is a senior advisor and the head of Equity Investments at Abbey Road Investment Group.

Leave a Reply