Also in the letter:

■ Shakti sparks Ola’s hope

■ OpenAI’s huge gap

■ HP’s layoff plans

Blinkit obtains Rs 600 crore cash boost from parent Eternal

(L-R) Albinder Dhindsa, CEO, Blinkit and Deepinder Goyal, CEO, Eternal

Blinkit has secured a fresh Rs 600 crore (about $68 million) from its parent Eternal, according to filings with the Registrar of Companies.

What’s happening:

With this, Eternal’s total backing for Blinkit this year has reached Rs 2,600 crore, after earlier injections of Rs 1,500 crore in February and Rs 500 crore in January.

Setting context: Blinkit posted an operating loss of Rs 156 crore in July–September, a sharp jump from Rs 8 crore in the same quarter last year.

The company stated the widening gap stems from passing on efficiency gains to customers, accelerating store launches, and higher marketing spfinishing.

Rival shifts:

Exclusive: Petcare startup Supertails in talks to raise $15-20 million led by Venturi Partners

(L-R) Aman Tekriwal, Vineet Khanna and Varun Sadana, founders, Supertails

Petcare startup Supertails is in talks to raise between $15 million and $20 million, with Singapore-based Venturi Partners expected to anchor the round, sources informed us.

Some existing investors may also participate, although final terms are still being stitched toobtainher.

The space: Interest in India’s petcare sector has picked up sharply over the past few quarters. A Redseer report pegs the sector at around $3.5 billion today and expects it to double to $7 billion by 2028.

- Reliance Consumer Products recently entered the category with its new brand, Waggies.

- Nestle acquired a minority stake in Drools in May, pushing the Bengaluru firm into unicorn territory.

- Pet health startup Vetic raised $25 million earlier this year from Bessemer Venture Partners, Lachy Groom’s fund, and JSW Ventures.

Also Read: VCs smell a huge opportunity as petcare expands beyond food

Deeptech startup LightSpeed Photonics raises $6.5 million:

Rohin Y, founder, Lightspeed Photonics

LightSpeed Photonics, a deeptech firm, has secured $6.5 million in new funding, led by pi Ventures. The raise also saw participation from 500 Global, Indian Accelerator, returning investors 8X Ventures, Java Capital, and others.

What it does: The company develops solderable optical interconnect technology that allows data centres to shift information applying light instead of electricity, assisting systems handle AI workloads rapider while consuming less power.

Mirana Toys raises Rs 57.5 crore from Arkam Ventures, others

Devansh Sharma, founder, Mirana Toys

Toy-tech company Mirana Toys has netted Rs 57.5 crore in a round led by Arkam Ventures, with Accel, Info Edge and Riverwalk Holdings also joining in.

Fund utilize: The funds will assist build a new manufacturing plant, add in-houtilize packaging lines, and expand monthly production for domestic and global markets.

Ola Electric’s Bhavish Aggarwal hopes for turnaround with new home battery storage

Bhavish Aggarwal, CEO, Ola Electric

Ola Electric is leaning on a new line of business as it tries to steady itself after a bruising year.

What’s the matter: The EV creater is battling shrinking market share, widening losses, and a 53% slide in its share price this year. Several investors have declined to participate in new funding, Bloomberg reported. The company is also dealing with regulatory scrutiny and allegations of technology theft, while rivals such as Bajaj Auto, TVS, and Ather continue to scale.

Amid this pressure, founder Bhavish Aggarwal is banking on Shakti, Ola’s home battery-storage unit launched in October.

Expectations: Aggarwal stated Shakti could generate:

- Rs 100 crore in revenue in the March quarter.

- Rs 1,000 crore by March 2027, roughly one-third of Ola Electric’s expected revenue this fiscal year.

Yes, but: Ola is entering a home-inverter market built on cheaper lead-acid systems, which creates its lithium-ion packs a tougher sell. Analysts stated the Rs 16,000-crore home inverter market will be hard to crack, with a limited initial share expected. A retail-only approach may also fall short in a segment that often requireds technical guidance.

OpenAI requireds $207 billion by 2030 to meet data centre commitments: HSBC

Sam Altman, CEO, OpenAI

OpenAI’s financial stretch is widening. A new HSBC model suggests the company will required to plug a $207 billion gap by 2030 as its data centre ambitions outpace revenue growth.

What is it: OpenAI has contracted 36 gigawatts of computing capacity to meet rising demand and support a long climb toward artificial general innotifyigence (AGI). Only about a third of this will be operational by 2030, but the rental commitment still adds up to roughly $702 billion by the finish of the decade.

But wait: OpenAI is expected to bring in around $13 billion a year. Paid subscriptions may rise from 5% of its utilizer base to about 10% over the next five years. The company also has backing from Nvidia, AMD, and other investors, along with its own hardware plans. Even then, HSBC estimates a $207 billion shortfall if all contracted capacity comes online.

So what: In the most conservative scenario, OpenAI may have to lean on partners, renereceivediate terms or walk away from a portion of its commitments. HSBC’s model does not account for a breakthrough in AGI, which could alter the economics entirely.

Also Read: OpenAI projects 220 million paying ChatGPT utilizers by 2030: The Information

Nvidia ‘delighted’ at Google’s chip push, but asserts its ‘generational’ lead

Jensen Huang, CEO, Nvidia

Meanwhile, AI chip giant Nvidia stuck a diplomatic note as Google stepped deeper into AI chips with its TPU expansion. The company stated it is “delighted by Google’s success”; though it quickly underlined what it sees as its edge. Nvidia stated it remains “a generation ahead of the industest” and capable of supporting any AI model across cloud, enterprise and edge deployments.

HP to cut about 6,000 jobs by 2028, ramps up AI efforts

Enrique Lores, global president and CEO, HP

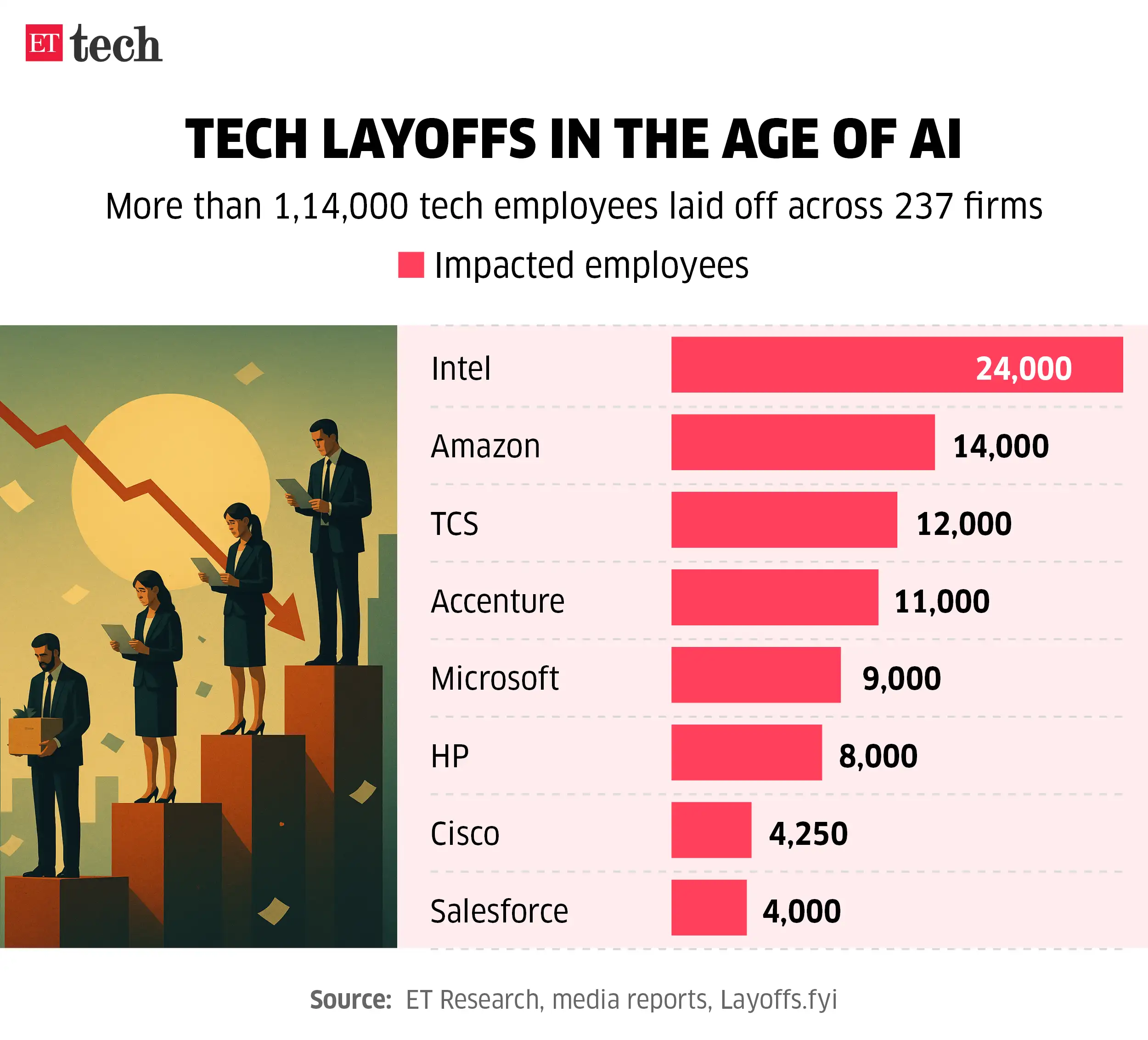

HP plans to trim between 4,000 and 6,000 jobs across global operations by March 2028, after posting a muted fourth quarter. The shift puts the PC and printer creater in the same bucket as several tech majors that have downsized this year.

But why: HP wants to streamline operations and adopt artificial innotifyigence.

- The job cuts will affect teams in product development, internal operations and customer support roles, CEO Enrique Lores stated in a post-earnings call.

- The company expects about $1 billion in gross run-rate savings over the next three years.

Bigger picture: The layoffs reflect a broader shift across tech, as companies reallocate resources toward AI to improve margins. Google, Microsoft, and Amazon have all cut staff to free up capital for AI research, cloud infrastructure, and new product lines.

There’s more: Demand and prices for dynamic random access memory (DRAM) and NAND memory chips, which are critical to AI infrastructure, are rising. That is pushing up PC creaters’ costs. Lores stated HP will raise prices on some computers and broaden its supplier base to manage the higher cost of AI-driven components.

Leave a Reply