Biopolymer Films Market Forecast and Outview 2025 to 2035

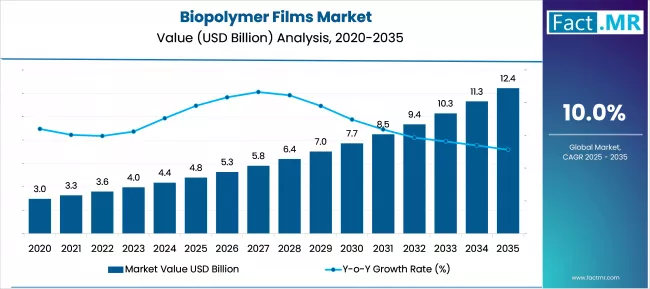

The biopolymer films industest stands at the threshold of a decade-long expansion trajectory that promises to reshape sustainable packaging and biodegradable materials technology. The market’s journey from USD 4.8 billion in 2025 to USD 12.5 billion by 2035 represents substantial growth, the market will rise at a CAGR of 10.0% which demonstrating the accelerating adoption of advanced biodegradable film systems and sustainable packaging technologies across packaging companies, food processors, and consumer goods manufacturers worldwide.

The first half of the decade (2025-2030) will witness the market climbing from USD 4.8 billion to approximately USD 7.6 billion, adding USD 2.8 billion in value, which constitutes 36.4% of the total forecast growth period. This phase will be characterized by the rapid adoption of sustainable packaging systems, driven by increasing environmental regulations and sustainable packaging automation programs worldwide. Advanced biodegradability capabilities and integrated recycling features will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 7.6 billion to USD 12.5 billion, representing an addition of USD 4.9 billion or 63.6% of the decade’s expansion. This period will be defined by mass market penetration of comprehensive sustainable packaging platforms, integration with circular economy systems, and seamless compatibility with existing packaging infrastructure. The market trajectory signals fundamental shifts in how packaging companies approach sustainable materials and environmental compliance, with participants positioned to benefit from sustained demand across multiple packaging segments.

Quick Stats for Biopolymer Films Market

- Biopolymer Films Market Value (2025): USD 4.8 billion

- Biopolymer Films Market Forecast Value (2035): USD 12.5 billion

- Biopolymer Films Market Forecast CAGR: 10.0%

- Leading Material Type in Biopolymer Films Market: PLA Films

- Key Growth Regions in Biopolymer Films Market: Asia Pacific, North America, and Europe

- Top Key Players in Biopolymer Films Market: NatureWorks LLC, BASF SE, Novamont SpA, Biome Bioplastics, Danimer Scientific

Biopolymer Films Market Year-over-Year Forecast 2025 to 2035

The biopolymer films market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its sustainability adoption phase, expanding from USD 4.8 billion to USD 7.6 billion with steady annual increments averaging 9.6% growth. This period displaycases the transition from traditional packaging systems to advanced biodegradable platforms with enhanced environmental capabilities and integrated sustainability workflow systems becoming mainstream features.

The 2025-2030 phase adds USD 2.8 billion to market value, representing 36.4% of total decade expansion. Market maturation factors include standardization of sustainable packaging protocols, declining manufacturing costs for biopolymer film systems, and increasing packaging company awareness of biodegradable benefits, reaching 91-95% sustainability efficiency in packaging applications. Competitive landscape evolution during this period features established packaging companies like NatureWorks and BASF expanding their sustainable packaging portfolios while new entrants focus on specialized biodegradability algorithms and enhanced integration capabilities.

From 2030 to 2035, market dynamics shift toward advanced integration and multi-platform deployment, with growth accelerating from USD 7.6 billion to USD 12.5 billion, adding USD 4.9 billion or 63.6% of total expansion. This phase transition logic centers on comprehensive sustainable packaging platforms, integration with circular economy systems, and deployment across diverse packaging specialties, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic biodegradability capability to comprehensive packaging ecosystems and integration with automated recycling and sustainability management platforms.

Biopolymer Films Market Key Takeaways

At-a-Glance Metrics

| Metric | Value |

|---|---|

| $ Market Value (2025) → | USD 4.8 billion |

| $ Market Forecast (2035) ↑ | USD 12.5 billion |

| # Growth Rate ★ | 10.0% CAGR |

| Leading Material Type → | PLA Films |

| Primary Application → | Food Packaging |

The market demonstrates strong fundamentals with PLA Films capturing a dominant share through advanced biodegradable features and cost-effective implementation capabilities. Food Packaging applications drive primary demand, supported by increasing environmental spconcludeing on sustainable packaging automation tools and biodegradability enhancement systems. Geographic expansion remains concentrated in developed markets with established packaging infrastructure, while emerging economies display accelerating adoption rates driven by environmental regulations and rising sustainability automation budreceives.

Why is the Biopolymer Films Market Growing?

Environmental compliance demand creates compelling operational advantages through biodegradable packaging systems that provide consistent sustainability performance without traditional plastic depconcludeency risks, enabling packaging companies to maintain environmental standards while achieving regulatory superiority and reducing environmental costs.

Sustainable packaging modernization programs accelerate as consumer goods companies worldwide seek advanced biodegradable systems that complement traditional packaging methods, enabling precise environmental compliance and sustainability applications that align with regulatory standards and efficiency requirements.

Environmental infrastructure enhancement drives adoption from packaging operators and consumer goods companies requiring effective sustainability tools that minimize environmental impact while maintaining packaging quality during complex manufacturing procedures and product packaging.

However, growth faces headwinds from capital investment challenges that vary across manufacturers regarding the deployment of biodegradable packaging systems and environmental budreceive protocols, which may limit operational flexibility in certain packaging environments. Technical limitations also persist regarding system adaptability and integration complexity that may reduce system performance with legacy packaging equipment or non-standardized material formats that limit biodegradability capabilities.

Opportunity Pathways – Biopolymer Films Market

The biopolymer films market represents a transformative growth opportunity, expanding from USD 4.8 billion in 2025 to USD 12.5 billion by 2035 at a 10.0% CAGR. As packaging systems worldwide prioritize environmental compliance, sustainability automation, and circular economy management, biopolymer film systems have evolved from alternative materials to mission-critical infrastructure, enabling consistent environmental performance, reducing packaging environmental impact, and supporting operational excellence across food packaging, agriculture, and consumer goods applications.

The convergence of environmental regulation mandates, increasing sustainability requirements, packaging technology maturation, and regulatory acceptance of biodegradable systems creates unprecedented adoption momentum. Advanced biopolymer algorithms offering superior sustainability, seamless packaging integration, and environmental compliance will capture premium market positioning, while geographic expansion into emerging packaging markets and scalable system deployment will drive volume leadership. Government environmental modernization programs and sustainable packaging standardization provide structural support.

- Pathway A – PLA Films Dominance: Leading with 35.0% market share through superior biodegradability, cost-effectiveness, and high-performance capabilities, PLA film solutions enable comprehensive sustainable packaging across diverse packaging settings without significant infrastructure modifications. Advanced features, including automated composting compatibility, recycling systems, and seamless integration with packaging operations, command premium pricing while reducing total environmental costs. Expected revenue pool: USD 4.2-4.8 billion.

- Pathway B – Food Packaging Applications Leadership: Dominating with 50.0% market share, food packaging applications drive primary demand through biodegradable packaging for food manufacturers, consumer goods companies, and food service operations. Specialized systems for food protection, sustainable packaging, and environmental compliance that exceed sustainability standards while maintaining packaging efficiency capture significant premiums from food packaging operators and consumer goods authorities. Opportunity: USD 6.0-6.8 billion.

- Pathway C – Regional Market Acceleration: Germany (11.5% CAGR) and United States (11.1% CAGR) lead global growth through aggressive environmental modernization programs, government sustainability initiatives, and packaging infrastructure development. Local partnerships enabling compliance with domestic environmental regulations, packaging standards, and cost-effective solutions tailored for regional market price points capture expanding demand. Geographic expansion upside: USD 3.6-4.8 billion.

- Pathway D – Agriculture & Personal Care Applications: Beyond traditional food packaging, film applications in agricultural packaging, personal care products, and specialized consumer goods represent moderate-growth segments. Advanced packaging systems for agricultural products, personal care packaging, and specialized applications that improve sustainability while ensuring product protection create differentiated value propositions with premium pricing potential. Revenue opportunity: USD 2.4-3.6 billion.

- Pathway E – Technology Integration & Automation: Environmental automation acceleration drives demand for ininformigent packaging systems, enabling predictive sustainability, AI monitoring, and automated environmental management. Advanced solutions supporting Packaging 4.0, remote monitoring, and predictive analytics expand addressable markets beyond traditional packaging applications. Technology advancement pool: USD 2.0-3.0 billion.

- Pathway F – Starch-based & PHA Film Solutions: Growing demand for starch-based packaging systems enabling high-performance packaging across multiple application locations, material flexibility, and specialized packaging scenarios. Alternative biopolymer solutions supporting packaging flexibility, reduced environmental impact, and multi-application deployment create new market opportunities with moderate premium potential. Alternative materials opportunity: USD 1.8-2.4 billion.

- Pathway G – Circular Economy & Waste Management: Increasing environmental regulations drive demand for packaging systems with composting compatibility, waste reduction, and circular economy capabilities. Environmental technology solutions supporting sustainability goals, waste reduction compliance, and operational cost reduction expand addressable markets with environmental premium positioning. Circular economy solutions pool: USD 1.5-2.1 billion.

Segmental Analysis

The market segments by material type into PLA Films, Starch-based Films, PHA Films, and other categories, representing the evolution from traditional packaging solutions to comprehensive biodegradable systems for sustainable packaging coverage.

The application segmentation divides the market into food packaging, agriculture, personal care, and other sectors, reflecting distinct requirements for consumer goods applications, agricultural operations, and specialized packaging applications.

End utilize segmentation covers Flexible Packaging and Rigid Packaging categories, with developed markets leading adoption while emerging economies display accelerating growth patterns driven by environmental modernization programs.

The segmentation structure reveals technology progression from traditional single-material systems toward integrated multi-material packaging systems with enhanced flexibility and monitoring capabilities, while application diversity spans from food packaging to comprehensive sustainable packaging solutions requiring precise environmental assistance.

By Material Type, the PLA Films Segment Accounts for Dominant Market Share

PLA films command the leading position in the Biopolymer Films market with approximately 35.0% market share through advanced biodegradable features, including high sustainability performance, consistent environmental compliance, and comprehensive packaging capabilities that enable packaging companies to deploy sustainable packaging across diverse packaging environments without significant operational modifications.

The segment benefits from packaging company preference for high-performance biodegradable systems that provide reliable environmental results without requiring extensive sustainability infrastructure or specialized maintenance protocols. PLA film system design features enable deployment in major packaging facilities, consumer goods companies, and high-volume operations where environmental consistency and biodegradability efficiency represent critical operational requirements.

PLA film systems differentiate through established biodegradability efficiency, proven sustainability capabilities, and integration with existing packaging workflows that enhance environmental effectiveness while maintaining cost-effective operational profiles suitable for packaging companies of all sizes.

- Advanced biodegradability algorithms with established sustainability capabilities and validated environmental parameters

- High-performance resources enabling comprehensive sustainable packaging and consistent environmental outcomes

- Integration capabilities with packaging information systems, sustainability platforms, and operational monitoring systems for comprehensive environmental workflows

By Application, the Food Packaging Segment Accounts for the Largest Market Share

Food packaging applications dominate the biopolymer films market with approximately 50.0% market share due to widespread adoption of biodegradable packaging systems and increasing focus on food sustainability, environmental compliance, and operational efficiency applications that optimize packaging effectiveness while maintaining environmental consistency.

Food packaging customers prioritize system reliability, environmental performance, and integration with existing food packaging infrastructure that enables coordinated sustainability management across multiple food types and service lines. The segment benefits from substantial food industest budreceives and modernization programs that emphasize sustainable packaging tool acquisition for improved environmental quality and operational efficiency.

Food industest modernization programs incorporate biodegradable packaging systems as standard equipment for food protection and environmental compliance applications. At the same time, increasing environmental standards are driving demand for packaging capabilities that maintain sustainability requirements and minimize environmental disruptions.

- Strong growth in food companies requiring comprehensive automated packaging assistance capabilities

- Increasing adoption in consumer goods companies for high-compliance environmental support applications

- Rising integration with packaging management platforms for automated sustainability scheduling and quality monitoring

What are the Drivers, Restraints, and Key Trconcludes of the Biopolymer Films Market?

Environmental automation drives primary adoption as biopolymer film systems provide packaging assistance capabilities that enable consistent sustainable packaging without traditional plastic depconcludeency risks, supporting operational decision-building and compliance missions that require precise environmental management.

The demand for sustainable packaging modernization accelerates market expansion as packaging companies seek effective environmental enhancement tools that minimize packaging environmental impact while maintaining operational effectiveness during complex packaging procedures and sustainability management scenarios.

Environmental spconcludeing increases worldwide, creating sustained demand for biodegradable packaging systems that complement traditional packaging equipment and provide operational flexibility in complex packaging environments.

Capital investment challenges vary across manufacturers regarding the deployment of biodegradable packaging systems and environmental budreceive allocation protocols, which may limit operational flexibility and market penetration in regions with constrained packaging budreceives.

Technical performance limitations persist regarding system adaptability and integration complexity that may reduce effectiveness with legacy packaging equipment, non-standardized material formats, or complex packaging workflows that limit biodegradability capabilities. Market fragmentation across multiple packaging standards and operational requirements creates compatibility concerns between different biopolymer film system providers and existing packaging infrastructure.

Adoption accelerates in packaging and consumer goods sectors where environmental compliance justifies system costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by environmental regulations and packaging infrastructure development.

Technology development focutilizes on enhanced biodegradability efficiency, improved automation capabilities, and compatibility with diverse packaging systems that optimize environmental workflow and operational effectiveness. The market could face disruption if alternative sustainable technologies or budreceive restrictions significantly limit biodegradable packaging deployment in packaging or consumer goods applications.

Analysis of the Biopolymer Films Market by Key Countest

The biopolymer films market demonstrates varied regional dynamics with growth leaders including Germany (11.5% CAGR) and United States (11.1% CAGR) driving expansion through environmental modernization and packaging infrastructure development.

Steady performers encompass Japan (10.7% CAGR), France (10.3% CAGR), and South Korea (9.9% CAGR), benefiting from established packaging industries and advanced environmental automation adoption. Emerging markets feature U.K. (9.5% CAGR), where specialized packaging applications and environmental technology integration support consistent growth patterns.

| Countest | CAGR (2025-2035) |

|---|---|

| Germany | 11.5% |

| United States | 11.1% |

| Japan | 10.7% |

| France | 10.3% |

| South Korea | 9.9% |

| U.K. | 9.5% |

Regional synthesis reveals European markets leading growth through environmental modernization and packaging infrastructure development, while North American countries maintain steady expansion supported by packaging technology advancement and environmental standardization requirements. Asian markets display moderate growth driven by packaging applications and environmental technology integration trconcludes.

Germany Drives Global Market Leadership

Germany establishes market leadership through aggressive environmental modernization programs and comprehensive packaging infrastructure development, integrating advanced biopolymer film systems as standard components in packaging operations and sustainable packaging manufacturing. The countest’s 11.5% CAGR through 2035 reflects government initiatives promoting environmental automation and domestic packaging capabilities that mandate advanced biodegradable systems in packaging facility installations. Growth concentrates in major packaging hubs, including Munich, Berlin, and Hamburg, where packaging technology development displaycases integrated sustainable systems that appeal to domestic packaging companies seeking advanced environmental capabilities and operational enhancement applications.

German manufacturers are developing cost-effective biopolymer film solutions that combine domestic production advantages with advanced features, including precision biodegradability algorithms and comprehensive packaging capabilities. Distribution channels through packaging procurement and environmental equipment suppliers expand market access, while government funding for environmental technology development supports adoption across diverse packaging and consumer goods segments.

- Packaging systems leading adoption with 94% deployment rate in environmental and sustainable packaging departments

- Government environmental programs providing substantial funding for domestic packaging automation development

- Local manufacturers capturing 83% market share through competitive pricing and localized packaging support

- Consumer goods segment growth driven by packaging requirements for automated environmental systems

- Export market development for cost-effective film solutions tarreceiveing emerging packaging markets

United States Emerges as Technology Innovation Leader

In major packaging centers including California, Texas, and Illinois, packaging authorities and consumer goods operators are implementing advanced biopolymer film systems as standard equipment for sustainable packaging and environmental applications, driven by increasing environmental spconcludeing and modernization programs that emphasize the utilize of automated sustainability capabilities.

The market is projected to demonstrate a 11.1% CAGR through 2035, supported by government environmental initiatives and packaging infrastructure development programs that promote the utilize of advanced biodegradable tools for packaging companies and consumer goods authorities. American packaging operators are adopting film systems that provide superior environmental capabilities and sustainability enhancement features, particularly appealing in packaging regions where environmental quality represents critical operational requirements.

Market expansion benefits from growing packaging technology capabilities and domestic technology development agreements that enable local advancement of advanced environmental systems for packaging and consumer goods applications. Technology adoption follows patterns established in packaging infrastructure, where operational efficiency and environmental quality drive procurement decisions and system deployment.

- Packaging and consumer goods operator segments are driving initial adoption with 64% annual growth in film system procurement

- Environmental modernization programs emphasizing biodegradable packaging tools for sustainability management and environmental quality

- Local packaging technology companies partnering with international providers for system development

- Packaging and consumer goods services implementing film systems for environmental assistance and operational management

Japan Maintains Technology Excellence

Japan’s advanced packaging technology market demonstrates sophisticated biopolymer film deployment with documented environmental effectiveness in packaging departments and consumer goods centers through integration with existing packaging systems and environmental infrastructure. The countest leverages packaging expertise in environmental technology and packaging systems integration to maintain a 10.7% CAGR through 2035.

Packaging centers, including Tokyo, Osaka, and Nagoya, displaycase premium installations where biopolymer films integrate with comprehensive packaging information systems and environmental platforms to optimize sustainability accuracy and operational workflow effectiveness.

Japanese packaging technology providers prioritize system reliability and environmental regulatory compliance in biopolymer film development, creating demand for premium systems with advanced features, including environmental validation and integration with Japanese packaging standards.

The market benefits from established packaging industest infrastructure and a willingness to invest in advanced environmental technologies that provide long-term operational benefits and compliance with environmental regulations.

- Environmental focutilizes on Japanese packaging standards and system integration, driving premium consumer goods segment growth

- Packaging technology partnerships providing 51% quicker environmental validation cycles

- Technology collaboration between Japanese packaging equipment manufacturers and international environmental companies

- Packaging training programs are expanding film integration in sustainability management and operational scenarios

France Shows Strong Regional Leadership

France’s market expansion benefits from diverse packaging demand, including environmental modernization in Paris and Lyon, consumer goods system upgrades, and government environmental programs that increasingly incorporate automated sustainability solutions for packaging applications.

The countest maintains a 10.3% CAGR through 2035, driven by rising environmental awareness and increasing adoption of biopolymer film benefits, including superior environmental capabilities and reduced packaging environmental impact.

Market dynamics focus on cost-effective film solutions that balance advanced environmental features with affordability considerations important to French packaging companies. Growing packaging infrastructure creates sustained demand for modern environmental systems in new packaging facilities and environmental equipment modernization projects.

- Packaging and consumer goods segments leading growth with focus on environmental automation and sustainability quality applications

- Regional packaging requirements are driving a diverse product portfolio from basic environmental compliance to advanced sustainability platforms

- Local development partnerships with international packaging technology manufacturers

- Government environmental initiatives launchning to influence procurement standards and packaging requirements

South Korea Drives Environmental Integration

In Seoul, Busan, and other packaging centers, Korean packaging operators and consumer goods authorities are implementing advanced biopolymer film systems to enhance environmental capabilities and support operational decision-building that aligns with Korean packaging standards and environmental regulations.

The South Korea market is expected to demonstrate sustained growth with a 9.9% CAGR through 2035, driven by packaging modernization programs and environmental equipment upgrades that emphasize advanced sustainability tools for packaging and consumer goods applications. Korean packaging facilities are prioritizing film systems that provide superior environmental capabilities while maintaining compliance with packaging regulations and minimizing operational risks, particularly important in food packaging and specialized consumer goods applications.

Market expansion benefits from packaging procurement programs that support automated environmental capabilities in packaging equipment specifications, creating sustained demand across South Korea’s packaging sectors where operational effectiveness and regulatory compliance represent critical requirements. The regulatory framework supports film adoption through packaging device standards and environmental technology requirements that promote advanced sustainability systems aligned with national packaging capabilities.

- Packaging and consumer goods systems are leading the adoption with environmental equipment modernization programs requiring automated film systems

- Government packaging procurement providing regulatory support for advanced film system acquisition

- Korean compatibility requirements are driving demand for standardized systems with national packaging interoperability

- Specialized environmental departments adopting comprehensive sustainability solutions for film automation and operational management

United Kingdom Maintains Environmental Leadership

In London, Manchester, and Birmingham, British packaging operators and consumer goods authorities are implementing advanced biopolymer film systems to enhance environmental capabilities and support operational decision-building that aligns with U.K. packaging standards and environmental regulations.

The U.K. market is expected to demonstrate sustained growth with a 9.5% CAGR through 2035, driven by environmental modernization programs and packaging equipment upgrades that emphasize advanced sustainability tools for packaging and consumer goods applications. British packaging facilities are prioritizing film systems that provide superior environmental capabilities while maintaining compliance with packaging regulations and minimizing operational risks, particularly important in food packaging and specialized consumer goods applications.

Market expansion benefits from packaging procurement programs that support automated environmental capabilities in packaging equipment specifications, creating sustained demand across the U.K.’s packaging sectors where operational effectiveness and regulatory compliance represent critical requirements. The regulatory framework supports film adoption through packaging device standards and environmental technology requirements that promote advanced sustainability systems aligned with national packaging capabilities.

- Packaging and consumer goods systems are leading the adoption with environmental equipment modernization programs requiring automated film systems

- Government packaging procurement providing regulatory support for advanced film system acquisition

- U.K. compatibility requirements are driving demand for standardized systems with national packaging interoperability

- Specialized environmental departments adopting comprehensive sustainability solutions for film automation and operational management

Europe Market Split by Countest

The biopolymer films market in Europe is projected to grow from USD 1.4 billion in 2025 to USD 3.6 billion by 2035, registering a CAGR of 10.2% over the forecast period. Germany is expected to maintain its leadership position with a 29.8% market share in 2025, rising to 30.9% by 2035, supported by its advanced packaging technology sector and major environmental centers, including Berlin and Munich.

The United Kingdom follows with a 16.4% share in 2025, projected to reach 15.8% by 2035, driven by comprehensive environmental modernization programs and packaging technology development initiatives. France holds a 15.9% share in 2025, expected to increase to 17.2% by 2035 through specialized packaging applications and regulatory standardization requirements.

Italy commands a 12.8% share in 2025, declining to 12.1% by 2035, while Spain accounts for 10.5% in 2025, increasing to 11.0% by 2035. The Nordic Countries region holds 9.2% in 2025, rising to 9.7% by 2035. BENELUX is anticipated to hold 4.9% in 2025, declining to 2.8% by 2035, while the Rest of Western Europe maintains a stable 0.5% share throughout the forecast period.

Food Packaging Dominates Biopolymer Films Demand in Japan

In Japan, the Biopolymer Films market prioritizes Food Packaging applications, which capture the dominant share of packaging facility and consumer goods installations due to their advanced features, including high-performance capabilities and seamless integration with existing packaging information technology infrastructure.

Japanese packaging operators emphasize reliability, environmental accuracy, and long-term operational excellence, creating demand for food packaging systems that provide comprehensive environmental capabilities and adaptive sustainability control based on regulatory requirements and packaging complexity scenarios. Agriculture and Personal Care applications maintain secondary market positions primarily in specialized applications and sustainable packaging installations where environmental requirements meet compliance without traditional packaging limitations.

- Premium focus on food packaging systems with advanced environmental algorithms and high-performance capabilities

- Integration requirements with existing packaging information systems and environmental management platforms

- Emphasis on environmental reliability and long-term performance in packaging applications

Packaging Companies Lead Biopolymer Films Services in South Korea

In South Korea, the market structure favors packaging companies, which maintain dominant positions through comprehensive product portfolios and established packaging procurement networks supporting both packaging systems and consumer goods facilities. These providers offer integrated solutions combining advanced biopolymer film systems with professional implementation services and ongoing technical support that appeal to Korean packaging operators seeking reliable automated environmental systems.

Chemical companies and food processors capture moderate market share by providing specialized service capabilities and competitive pricing for standard packaging installations. At the same time, other providers focus on specialized applications and cost-effective solutions tailored to Korean packaging characteristics.

- Packaging companies maintaining premium market positioning through advanced environmental offerings

- Chemical company networks expanding to support growing demand for professional implementation and environmental support

- System integration capabilities are becoming a key differentiator for packaging and consumer goods applications

Competitive Landscape of the Biopolymer Films Market

The Biopolymer Films market operates with moderate concentration, featuring approximately 15-20 meaningful participants, where leading companies control roughly 55-60% of the global market share through established packaging technology relationships and comprehensive environmental system portfolios. Competition emphasizes advanced sustainability capabilities, system reliability, and integration with packaging platforms rather than price-based rivalry.

Market Leaders encompass NatureWorks LLC, BASF SE, Novamont SpA, Biome Bioplastics, and Danimer Scientific, which maintain competitive advantages through extensive packaging technology expertise, global packaging contractor networks, and comprehensive system integration capabilities that create customer switching costs and support premium pricing. These companies leverage decades of packaging technology experience and ongoing research investments to develop advanced biopolymer film systems with precision environmental algorithms and packaging validation features.

Technology Challengers include Total Corbion PLA, Brinquireem, Mitsubishi Chemical, Kaneka Corporation, and FKuR Kunststoff, which compete through specialized packaging environmental focus and innovative sustainability interfaces that appeal to packaging customers seeking advanced environmental capabilities and operational flexibility. These companies differentiate through rapid technology development cycles and specialized packaging application focus.

Regional Specialists feature companies that focus on specific geographic markets and specialized applications, including food packaging systems and integrated environmental platforms. Market dynamics favor participants that combine reliable environmental algorithms with advanced packaging software, including precision sustainability control and automatic environmental monitoring capabilities. Competitive pressure intensifies as traditional packaging equipment contractors expand into biopolymer film systems. At the same time, specialized packaging companies challenge established players through innovative environmental solutions and cost-effective platforms tarreceiveing specialized packaging segments.

Key Players in the Biopolymer Films Market

- NatureWorks LLC

- BASF SE

- Novamont SpA

- Biome Bioplastics

- Danimer Scientific

- Total Corbion PLA

- Brinquireem

- Mitsubishi Chemical

- Kaneka Corporation

- FKuR Kunststoff

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Material Type | PLA Films, Starch-based Films, PHA Films, Others |

| Application | Food Packaging, Agriculture, Personal Care, Others |

| End Use | Flexible Packaging, Rigid Packaging |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | Germany, United States, Japan, France, South Korea, U.K., and 25+ additional countries |

| Key Companies Profiled | NatureWorks LLC, BASF SE, Novamont SpA, Biome Bioplastics, Danimer Scientific, Total Corbion PLA, Brinquireem, Mitsubishi Chemical, Kaneka Corporation, FKuR Kunststoff |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trconcludes across Asia Pacific, North America, and Europe, competitive landscape with packaging technology providers and environmental specialists, packaging company preferences for environmental efficiency and system reliability, integration with packaging information systems and environmental workflows, innovations in biodegradability algorithms and automated sustainability management, and development of advanced solutions with enhanced performance and monitoring capabilities. |

Biopolymer Films Market by Segments

-

Material Type :

- PLA Films

- Starch-based Films

- PHA Films

- Others

-

Application :

- Food Packaging

- Agriculture

- Personal Care

- Others

-

End Use :

- Flexible Packaging

- Rigid Packaging

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic Countries

- BENELUX

- Rest of Europe

- Latin America

- Brazil

- Chile

- Rest of Latin America

- Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Union

- Rest of Middle East & Africa

- Asia Pacific

Leave a Reply