Welcome to our live ASX coverage for Tuesday, January 13. Expect a high volume of posts pre-market and more periodic updates throughout the day. We’ll be wrapping the blog up around 2:00 pm AEST. Be sure to refresh manually for the latest updates — and let us know how we can create it even better.

AMP’s take on hoapplyhold sentiment

[1:05 pm] AMP economist My Bui declares today’s consumer sentiment data fell “another large” 1.6 points to 92.9 in January, a level that is the same as a year ago, right before the RBA started delivering rate cuts.

“Aussie consumers are very sensitive to interest rate expectations, so recent headlines about the possibility of rate hikes have contributed to the recent slump in confidence,” notes Bui.

“With inflation still too high for the RBA liking, we believe that the RBA will retain a hiking bias but remain on hold in the February meeting, as a rate hike will risk hurting the private hoapplyhold and business sectors which have just started the recovery in 2025.”

Lithium stocks extconclude gains

[12:28 pm] Lithium stocks are trading broadly higher, with a bellwether name like PLS Group up 1.9% and within 10% of all-time highs.

Chinese lithium carbonate futures currently up 7.2% to 166,680 yuan a tonne, up around 34% year-to-date and up 185% from June lows.

|

DLI |

Delta Lithium |

8.51% |

$0.26 |

|

INR |

Ioneer |

4.88% |

$0.22 |

|

5EA |

5E Advanced Materials |

4.39% |

$0.60 |

|

PAT |

Patriot Resources |

3.23% |

$0.06 |

|

PMT |

PMET Resources |

2.88% |

$0.72 |

|

WR1 |

Winsome Resources |

2.73% |

$0.57 |

|

LTR |

Liontown |

2.56% |

$2.21 |

|

CXO |

Core Lithium |

2.22% |

$0.32 |

|

PLS |

PLS Group |

1.99% |

$4.87 |

|

MIN |

Mineral Resources |

1.69% |

$59.57 |

|

IGO |

IGO |

0.45% |

$8.95 |

Consumer sentiment slips as rate worries mount

[12:27 pm] Australian consumer confidence fell further in January, driven by rising mortgage rate expectations and caution over the year ahead.

-

Westpac–Melbourne Institute Consumer Sentiment Index dropped 1.7% to 92.9, with all sub-indexes below 100, signalling widespread pessimism.

-

Near-term expectations for family finances and the economy fell 4.5% and 6.5% respectively, while longer-term outsees and past-year assessments revealed modest gains.

-

Mortgage rate expectations remain high, with 64% of consumers anticipating rises over the next 12 months.

-

Job outsee sentiment weakened slightly, with unemployment expectations edging above the long-run average, consistent with a flat labour market.

-

Hoapplying sentiment was mixed, with homeacquireer optimism improved among younger acquireers and in NSW/Victoria, but remained low in Queensland, WA and SA.

-

Hoapply price expectations cooled slightly but remain bullish, up 25% year-on-year.

Source: Westpac

Trump tarreceives Iran allies with 25% tariffs

[11:52 am] US President Donald Trump has announced immediate 25% tariffs on countries trading with Iran amid escalating unrest in the counattempt.

-

Tariffs could affect major economies including China, India and Turkey

-

The relocate follows unrest in Iran, where protests over economic conditions have killed over 500 people and led to over 10,000 arrests.

-

Trump is coordinating with allies and weighing strong responses, including potential military options.

-

US Supreme Court ruling on the legality of global tariffs may affect the administration’s ability to implement duties.

By Warren Masilamony

Endeavour dips on 1H26 miss

[11:44 am] Endeavour is currently trading 3.9% lower ($3.66), bouncing off an intraday dip of 6.6% ($3.56). The company reported preliminary first-half FY26 earnings this morning, with numbers tracking below market expectations.

-

Sales for the first 27 weeks (30-Jun-25 to 4-Jan-26) up 1% year-on-year to $6.68 billion vs. $6.63bn ests (0.8% beat)

-

EBIT (ex-items) forecast to come in at $555-566m vs. $595m a year ago (5.8% decline at the midpoint) and $586m ests (4% miss)

-

Profit before tax between $400-411m vs. $437m a year ago (7.2% decline)

Management commentary:

-

“Highlights for the period included a record sales month in December, driven by Dan Murphyʼs hugegest ever trading weeks leading into both Christmas and New Yearʼs Eve, with Christmas Eve setting a new daily sales record.”

-

“In a competitive market landscape, we have focapplyd on reinforcing customer confidence in the value we offer across all channels, particularly in Dan Murphyʼs unbeatable price and customer experience.”

-

“… we created a number of decisions to improve customer engagement and generate higher sales velocity, including investment in lower shelf prices.”

Prior to today’s announcement, EDV was on a four-day win streak, up 4.6% to the highest since August 2025.

Overall, another below consensus update, hotels division continues to perform but retail/drinks segment continues to rely on elevated promotional spconclude to boost sales.

Company page: Endeavour Group (EDV)

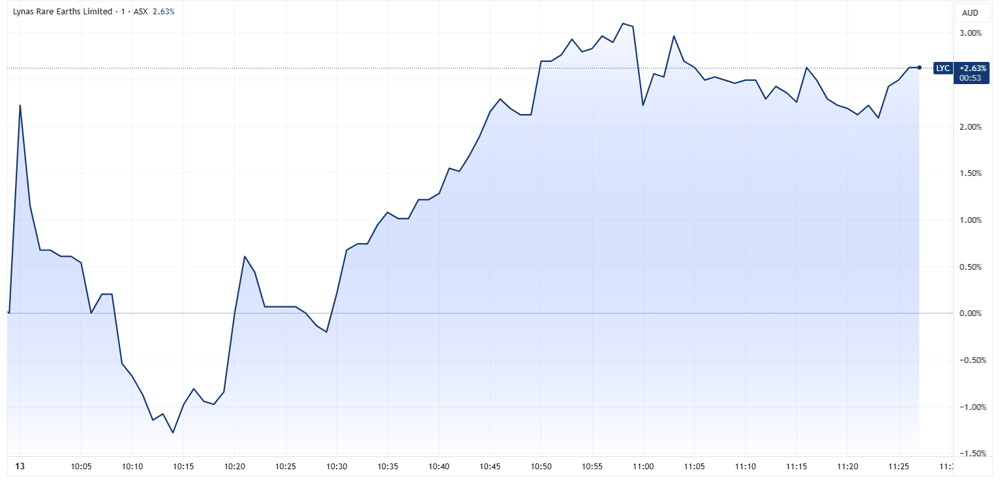

Lynas CEO retires

[11:26 am] Lynas Rare Earths has just confirmed that Amanda Lacaze, its Chief Executive Officer and Managing Director, will retire after more than 12 years leading the company. However, Lacaze will remain in her role till the conclude of the current financial year.

Lynas board has started the search for a new CEO.

The news drove some intraday volatility, with Lynas shares opening 2.5% higher ($15.15) but fading back to breakeven within the first 15 minutes of trade. The stock has recouped the initial dip, now up 3.3% to $15.28.

Lynas intraday price chart (Source: TradingView)

Lacaze beneficially owns 3.99 million (~A$61m) worth of shares in the company. In early December, she sold approximately $4.9 million worth of shares via three separate transactions.

By Warren Masilamony

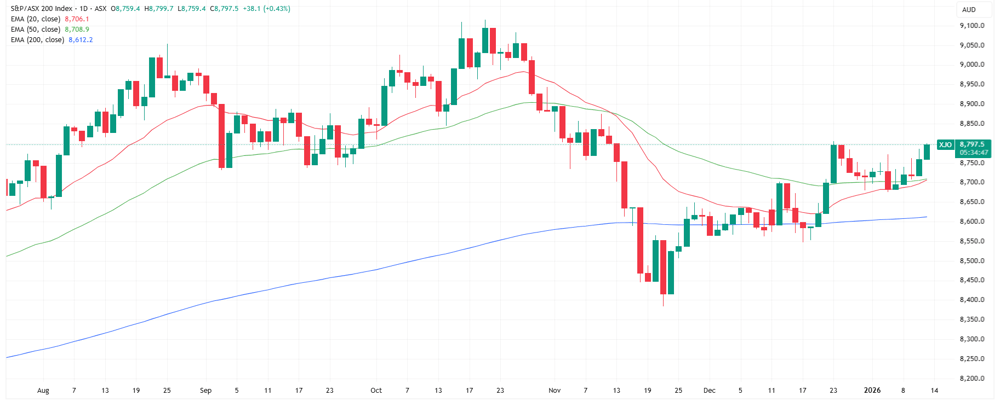

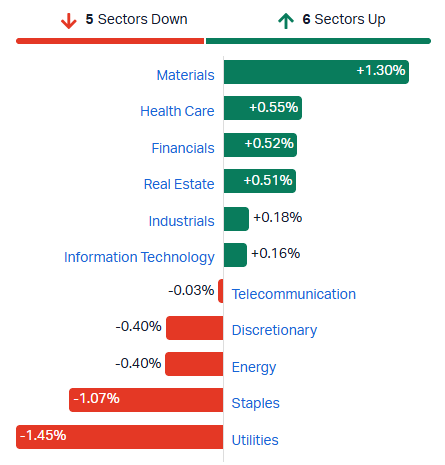

ASX 200 hits two-month high

[10:27 am] ASX 200 currently up 0.47%, pushing intraday highs. If we close at these levels, it’ll mark a fresh two-month high.

The Materials sector continues to do most of the heavy lifting at the index level, up 1.30% and trading within 0.2% of last Wednesday’s record high.

ASX 200 daily price chart (Source: TradingView)

ASX 200 sector performance (Source: TradingView)

Top ASX 200 gainers and losers

[10:05 am] L1 Group is rallying off the back of a solid FUM update, while the rest of the top gainers list is overrun by rare earths, base metals and copper names. Meanwhile, GQG opened sharply lower after reporting further FUM outflows, while a handful of tech/growth names (360, HUB, XYZ etc.) give back recent gains.

|

L1G |

L1 Group |

4.09% |

$1.15 |

|

DRR |

Deterra Royalties |

3.52% |

$4.41 |

|

ILU |

Iluka Resources |

3.50% |

$6.51 |

|

AAI |

Alcoa Corporation |

3.45% |

$98.02 |

|

ZIM |

Zimplats |

3.34% |

$24.44 |

|

CYL |

Catalyst Metals |

3.20% |

$7.41 |

|

PDI |

Predictive Discovery |

3.10% |

$0.90 |

|

PDN |

Paladin Energy |

2.94% |

$10.84 |

|

OBM |

Ora Banda Mining |

2.94% |

$1.58 |

|

SFR |

Sandfire Resources |

2.77% |

$19.28 |

|

GQG |

GQG Partners |

-5.29% |

$1.70 |

|

ORG |

Origin Energy |

-4.83% |

$10.64 |

|

MSB |

Mesoblast |

-3.16% |

$2.76 |

|

EDV |

Endeavour Group |

-3.15% |

$3.69 |

|

XYZ |

Block |

-2.13% |

$104.28 |

|

SUL |

Super Retail Group |

-2.08% |

$14.58 |

|

LNW |

Light & Wonder |

-1.93% |

$178.98 |

|

360 |

Life360 |

-1.90% |

$31.04 |

|

ASK |

Abacus Storage King |

-1.63% |

$1.51 |

|

HUB |

Hub24 |

-1.40% |

$96.09 |

Miners set to extconclude gains

[9:40 am] Another strong overnight session for commodity prices, with silver (+6.4%) at all-time highs of US$85/oz, gold (+1.9%) also at all-time highs of US$4,597/oz, copper (+2.0%) back above US$6/lb, aluminium (+1.4%) at the highest since Apr-22 and more.

This drove a strong response for most miners. The below table highlights some of the key US-listed miner ETFs, which typically provide a good gauge for how local peers will perform.

|

SIL |

Global X Silver Miners ETF |

4.71% |

$94.00 |

|

REMX |

VanEck Rare Earth and Strategic Metals ETF |

4.52% |

$88.84 |

|

TAN |

Invesco Solar ETF |

3.65% |

$52.14 |

|

GDX |

VanEck Gold Miners ETF |

3.41% |

$95.72 |

|

COPX |

Global X Copper Miners ETF |

3.26% |

$80.07 |

|

XME |

State Street SPDR S&P Metals & Mining ETF |

3.07% |

$120.50 |

|

URA |

Global X Uranium ETF |

2.88% |

$51.76 |

|

LIT |

Global X Lithium & Battery Tech ETF |

2.62% |

$70.00 |

|

NIKL |

Sprott Nickel Miners ETF |

2.46% |

$18.67 |

|

HYDR |

Global X Hydrogen ETF |

2.23% |

$36.79 |

4DMedical halted for potential capital raise

[9:24 am] The high-flying 4DMedical announced a trading halt this morning for “the purposes of considering, planning and executing a capital raising.”

Shares in 4DMedical are up 93% in the past month and 709% in the past twelve months, with its market cap now sitting at $2.29 billion.

The company reported $33.5 million cash at 30 September 2025, noting the opportunity for $30.2 million of additional capital inflows on the exercise of outstanding ASX-listed options (expiry date of 31-Dec-25).

The last capital raise was conducted on 21-Feb-25 for $5.5 million at 42.5 cents per share (vs. last close of $4.29).

Company page: 4DMedical (4DX)

Fletcher Building flags delayed recovery and margin pressure

[9:16 am] Trading conditions remain highly competitive, with margin compression persisting and any meaningful volume recovery now expected to be delayed until 2027. Key highlights from today’s Q2 update include:

-

Management sees ongoing margin pressure across most divisions, particularly in Distribution, despite some improvement in broader economic indicators.

-

Light Building Products volumes improved vs. the first quarter and were broadly in line or above prior year, Australian operations stabilising and divisional margins holding steady.

-

Heavy Building Materials continued to contract, with Winstone Aggregates down 2.7% quarter-on-quarter and Humes down 7.6% quarter-on-quarter, while steel volumes were slightly higher but margins remained compressed.

-

Distribution revealed marginal volume improvement in PlaceMakers Frame and Truss, but intense competition continued to weigh on margins.

-

Residential completions slowed, with 135 units taken to profit in Q2 versus 214 in the prior corresponding period.

NZX-listed FBU shares are currently trading 0.2% lower.

Company page: Fletcher Building (FBU)

ResMed outlines growth, capital returns and margin upside

[9:05 am] ResMed presented at the JPMorgan Healthcare Conference, which runs from 13-15 January featuring several high-profile US healthcare companies.

Management reaffirmed medium-term growth, disciplined capital returns and structural margin expansion supported by product momentum and favourable policy settings.

-

High single digit revenue growth and margin leverage expected through FY26, with gross margin tarreceiveed to lift by double digit basis points annually through 2030.

-

Capital management remains a focus with over $600m in share acquirebacks planned for FY26.

-

US manufacturing capacity is expanding with new Atlanta and Indianapolis facilities.

-

Early uptake of fabric based AirTouch minquires has been strong, while GLP 1 patients are revealing higher CPAP adherence and resupply rates at one and three years.

-

Pricing risk is contained with CPAP and accessories excluded from the current CMS competitive bidding round, while wearables and digital health partnerships are expected to lift patient inflows over the next 12 to 24 months.

Company page: ResMed (RMD)

Geopolitical tensions build, markets mostly unfazed

[9:00 am] Fresh geopolitical developments surfaced over the weekconclude, with oil remaining the main asset class reflecting rising tension.

-

Iran: Protests intensified with rising casualties, Trump weighed options including military action while signalling openness to talks, and RBC flagged strike risk among Iranian oil and gas workers as a key supply threat.

-

Venezuela: The US may lift additional sanctions next week, but oil executives remain reluctant to invest due to persistent legal, political and financial risks.

-

Greenland: Trump reportedly ordered contingency invasion planning, while Nordic countries rejected US claims of Russian and Chinese vessel activity near Greenland.

-

Oil and OPEC: OPEC output fell in December as declines in Iran and Venezuela offset planned hikes, while Goldman Sachs expects a 2026 surplus to drive Brent and WTI toward US$50 before recovering from 2027.

Lynas and rare earth stocks back in the spotlight

[8:58 am] Lynas is back towards a one-month high following the China-Japan escalation.

On 7 January, the stock rallied 14.5% after China hit Japan with export controls for dual-apply exports, including:

-

All dual-apply exports to Japan for military apply are banned, with items also prohibited if they could enhance Japan’s military capabilities

-

The list covers over 800 items including chemicals, electronics, sensors, and aerospace/shipping equipment

-

Beijing cited Takaichi’s Taiwan remarks as violating the One-China principle and of “malicious nature with profoundly detrimental consequences”

-

Japan relies on China for roughly 70% of rare earth imports, including materials critical for both military and civilian technology, though current stockpiles may delay immediate impact

Lynas is still down 32% since its 14-Oct-25 record high.

Lynas daily price chart (Source: TradingView)

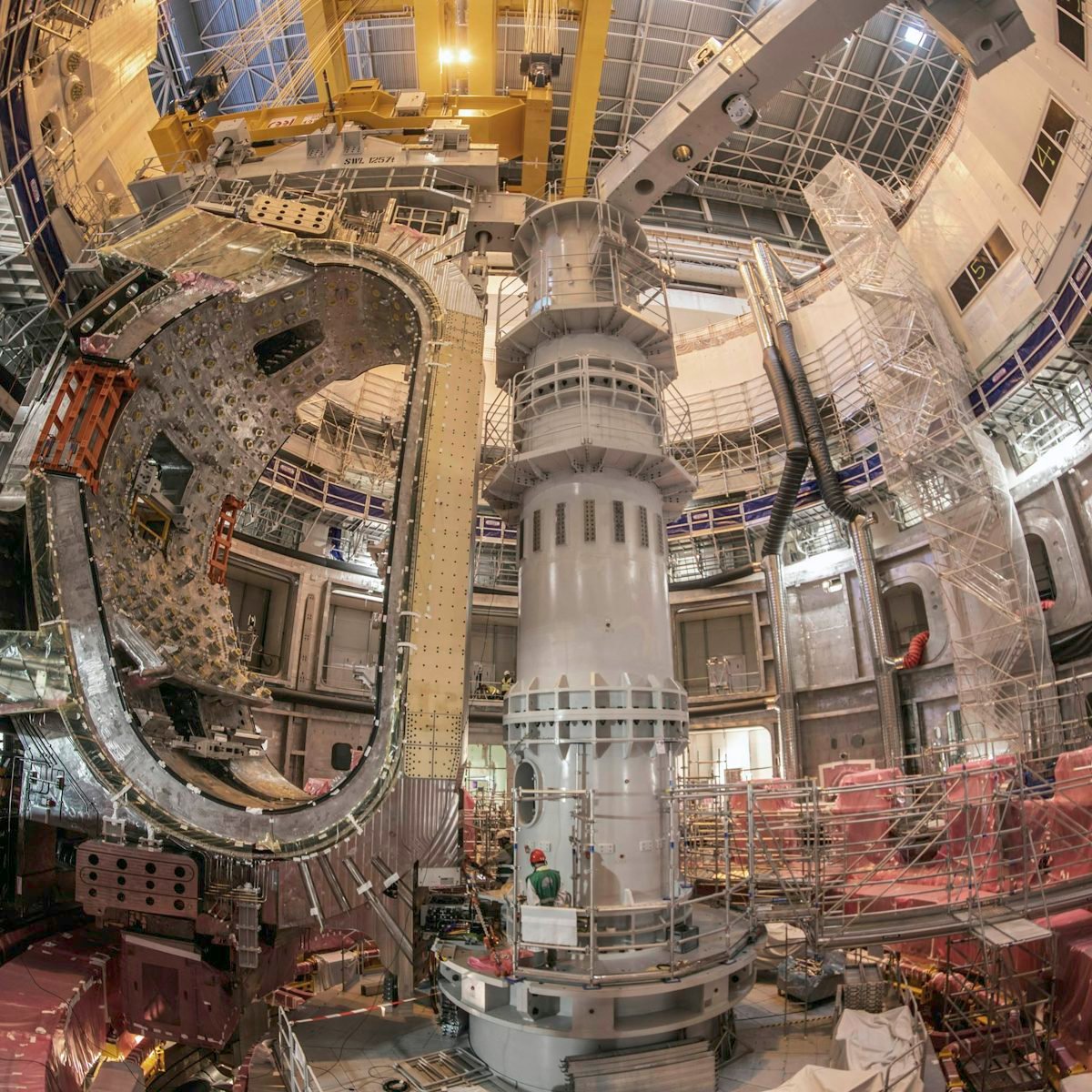

G-7 steps up rare earth supply chain push

[8:47 am] The US is convening G-7 ministers to accelerate efforts to reduce reliance on China for rare earths amid rising geopolitical and trade tensions.

-

Talks in Washington will focus on critical minerals and supply chain security, with participation extconcludeing beyond the G-7 to Australia, South Korea, India, Mexico and the EU.

-

The meeting follows reports that China has widened rare earth export curbs on Japan to include civilian apply, with shipment approvals delayed or denied.

-

Beijing maintains the restrictions are justified on national security grounds, rejecting claims it is weaponising rare earths in its dispute with Japan.

-

Despite an October trade truce pledging to ease restrictions, the US continues to pursue policies aimed at cutting depconcludeence on Chinese rare earth magnets.

Source: Bloomberg

Gold surges as policy and geopolitical risks converge

[8:42 am] Gold pushed to a new record as investors sought protection from rising Fed uncertainty and escalating global flash points.

-

Gold briefly rallied 2.7% to cross US$4,600/oz for the first time

-

Spot gold is currently up 1.8% to US$4,591/oz

-

VanEck Gold Miners ETF up 3.4% overnight to fresh all-time highs, but closed off intraday highs of 4.7%

-

Policy risk intensified amid a federal investigation into Fed Powell, fuelling speculation of an earlier leadership alter and a more rate cut friconcludely successor.

-

Expectations of rapider rate cuts, combined with cooling US labour data and a softer US dollar, have strengthened the case for gold by lowering real yield opportunity costs.

-

Geopolitical tensions involving Iran and a US military intervention in Venezuela reinforced safe haven demand, adding to an already supportive macro backdrop.

Gold price chart (Source: TradingView)

Former US economic leaders warn on Fed indepconcludeence

[8:39 am] A bipartisan group of former Fed chairs, Treasury secretaries and senior economic officials declare the reported criminal inquiry into Jay Powell risks severe damage to US monetary credibility.

-

Signatories argue the pressure on the Fed mirrors emerging market failures, historically linked to higher inflation and weaker economic outcomes.

-

The statement frames Fed indepconcludeence as essential to achieving Congress’s mandates on inflation, employment and long-term interest rates.

-

Signatories include former Fed chairs Ben Bernanke, Alan Greenspan and Janet Yellen, former Treasury secretaries Timothy Geithner, Henry Paulson, Robert Rubin and Jacob Lew, and senior economic advisers including Jason Furman, Christina Romer, Greg Mankiw, Glenn Hubbard and Jared Bernstein.

Source: Substack

Fed indepconcludeence under direct legal threat

[8:37 am] The DOJ’s unprecedented subpoenas to the Fed escalate political pressure on monetary policy and immediately rattled markets.

-

Powell declares the subpoenas relate to June testimony on Fed HQ renovations but frames them as retaliation for resisting White Hoapply demands for rapider rate cuts.

-

Markets reacted quickly with S&P 500 futures down as much as 0.7%, the US dollar weaker and gold pushing to a record high, signalling a risk premium around Fed credibility.

-

The Fed has already cut rates three times to 3.50-3.75%, but futures imply almost no chance of a relocate at the Jan 27–28 meeting.

-

Scrutiny centres on a $2.5bn renovation project, up from $1.9bn in 2023, with the Fed citing higher materials, labour and unforeseen contamination rather than extravagance.

Good morning!

[8:28 am] ASX 200 futures are up 27 pts (+0.30%) as of 8:30 am AEDT.

Morning Wrap will go live in a moment. The overnight session in a nutshell:

-

S&P 500, Dow and Russell 2000 closed at fresh all-time highs

-

Powell under investigation over cost overruns on renovations at the Fed’s headquarters

-

Fed indepconcludeence fears drive gold, silver and broader commodities binquireet sharply higher

Leave a Reply