The global investment landscape in late 2025 is defined by stark macroeconomic divergence. While U.S. tech stocks surge on the back of Federal Reserve easing expectations, Asian markets remain mired in underperformance, weighed by trade tensions, policy uncertainty, and uneven inflation dynamics. This divergence demands a strategic reevaluation of portfolio allocations, emphasizing sector rotation and regional reallocation to hedge against volatility.

U.S. Tech Rally: Fed Policy and Inflationary Tailwinds

The U.S. July 2025 CPI report revealed headline inflation at 2.7% and core inflation at 3.1%, both above the Fed’s 2% tarobtain but revealing signs of moderation compared to earlier peaks [1]. This “data-depconcludeent” environment has emboldened market participants to price in a 90.4% probability of a 25-basis-point rate cut at the September FOMC meeting [3]. Lower rates reduce discount rates for future earnings, directly benefiting high-growth tech stocks. For instance, the S&P 500’s tech-heavy Nasdaq Composite surged 1.1% in July, fueled by AI adoption optimism and Powell’s dovish signals at Jackson Hole [3].

However, this rally is not without risks. Tariff-driven inflationary pressures—particularly in services like healthcare and transportation—remain stubborn [1]. Yet, the Fed’s focus on labor market weakness (73,000 jobs added in July, far below forecasts) suggests policy easing will dominate, creating a “Goldilocks” scenario for tech valuations [3].

Asian Markets: A Tale of Two Inflation Regimes

Contrast this with Asia, where inflation dynamics are fragmented. While the U.S. grapples with core CPI at 3.1%, countries like Kazakhstan (11.8%) and Palestine (59.35%) face hyperinflationary pressures [2]. Conversely, Brunei and Thailand report negative inflation, driven by falling energy and agricultural prices [2]. This divergence complicates central bank policy coordination. China’s recent rate cuts to stimulate its contracting manufacturing sector [1], Japan’s BOJ under wage-inflation scrutiny [1], and South Korea’s KOSPI volatility highlight the region’s fragility.

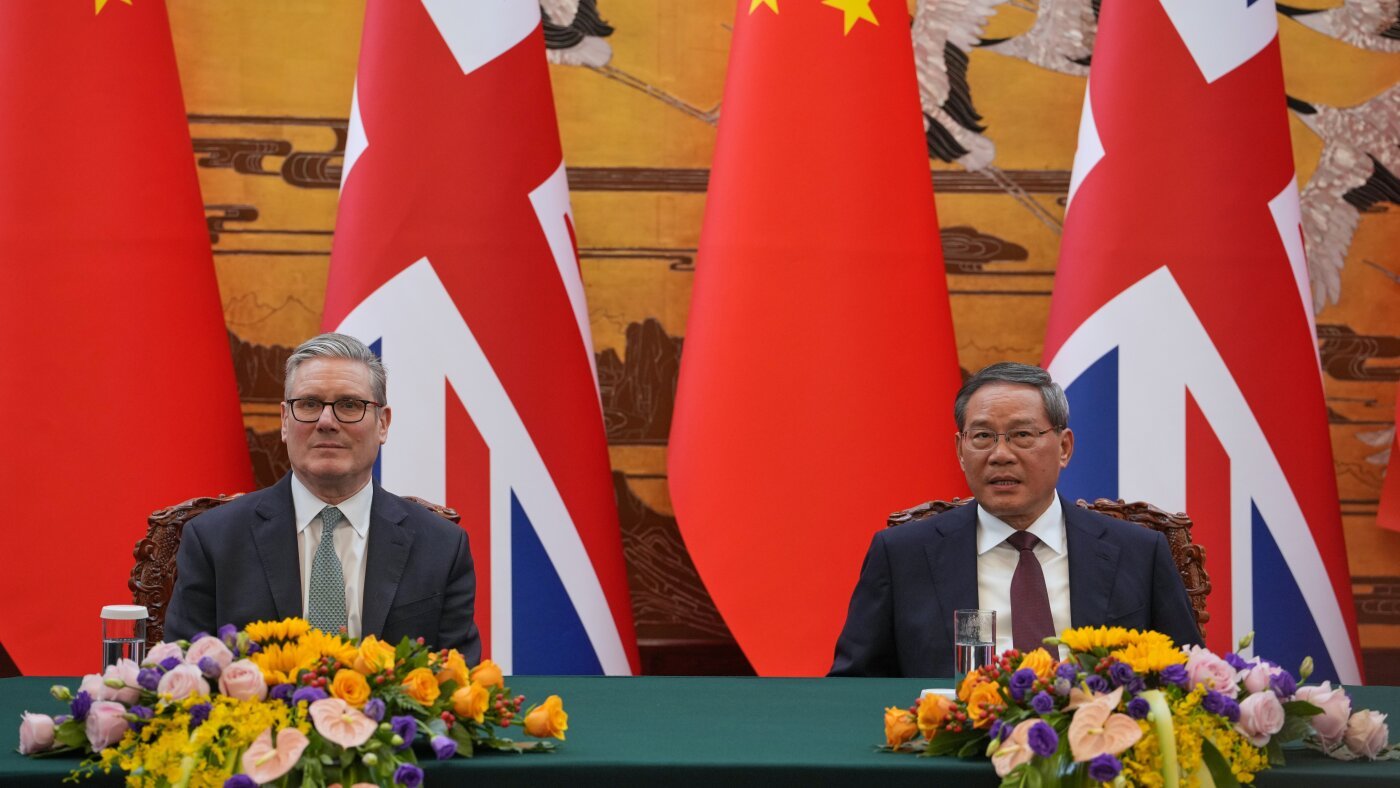

The Nikkei 225 and Hang Seng Index exemplify this underperformance. In July, the Nikkei fell 0.88% amid yen strength and trade policy jitters, while the Hang Seng dropped 0.68% due to U.S.-China trade uncertainty [2]. By late August, the Hang Seng rebounded to 25,216.81, but this recovery remains fragile, depconcludeent on Trump-era trade truces and global tariff normalization [4].

Sector Rotation: From U.S. Growth to Global Value

The U.S. tech rally has triggered a broader sector rotation. Investors are shifting from high-valuation growth stocks to value equities and international markets. For example, European and Chinese defensive sectors (e.g., utilities, consumer staples) have outperformed U.S. tech amid policy risks [4]. This trconclude mirrors historical patterns during trade wars, where capital flows to undervalued regions and sectors [1].

In Asia, strategic reallocation is critical. ETFs like the KraneShares CSI China Internet ETF (KWEB) and iShares China Large-Cap ETF (FXI) offer exposure to sectors poised for rebound, particularly in AI-driven demand and trade truces [3]. Meanwhile, European value stocks—especially in industrials and financials—are gaining traction as U.S. rate cuts reduce dollar dominance [4].

Hedging Strategies: Regional and Sectoral Reallocation

To navigate this divergence, investors should adopt a dual approach:

1. Regional Diversification: Increase exposure to Asia-Pacific and European equities via ETFs like EWA (Australia) or IEV (Europe), which offer lower volatility compared to U.S. tech.

2. Sector Rotation: Underweight U.S. tech and overweight global value sectors (e.g., utilities, materials) and defensive Asian sectors (e.g., consumer staples).

For example, during the 2025 tariff-driven volatility, portfolios that shifted to Chinese consumer goods and Indian basic materials saw lower Value-at-Risk (VaR) over 12-month horizons [1]. Similarly, leveraging momentum-based indicators like RSI can identify overbought U.S. tech stocks and undervalued Asian equities [2].

Conclusion

The U.S. tech rally and Asian underperformance underscore the required for dynamic portfolio management. While Fed easing fuels near-term tech optimism, long-term risks—such as tariff-driven inflation and geopolitical tensions—necessitate hedging through global diversification and sectoral rebalancing. Investors who act now to reallocate toward value equities and undervalued regions may position themselves to capitalize on the next phase of market cycles.

**Source:[1] CPI inflation report July 2025 [https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html][2] Inflation Rate – Countries – List | Asia [https://tradingeconomics.com/countest-list/inflation-rate?continent=asia][3] United States Inflation Rate [https://tradingeconomics.com/united-states/inflation-cpi][4] Review of markets over July 2025 [https://am.jpmorgan.com/gb/en/asset-management/per/insights/market-insights/market-updates/monthly-market-review/]

Leave a Reply