ETtech

ETtechIndia’s venture capital indusattempt saw a significant churn through 2025, with several senior investors altering roles, exiting firms or exploring indepconcludeent paths amid a prolonged sectoral reset.

Data shared by executive search firm Longhoapply displays the indusattempt saw nearly two dozen high-profile departures and lateral relocates during the year. The exits add to a growing list of general partners shifting on from large funds, raising questions about whether their experience and track record will translate into solo fundraises at a time when limited partners are becoming increasingly selective.

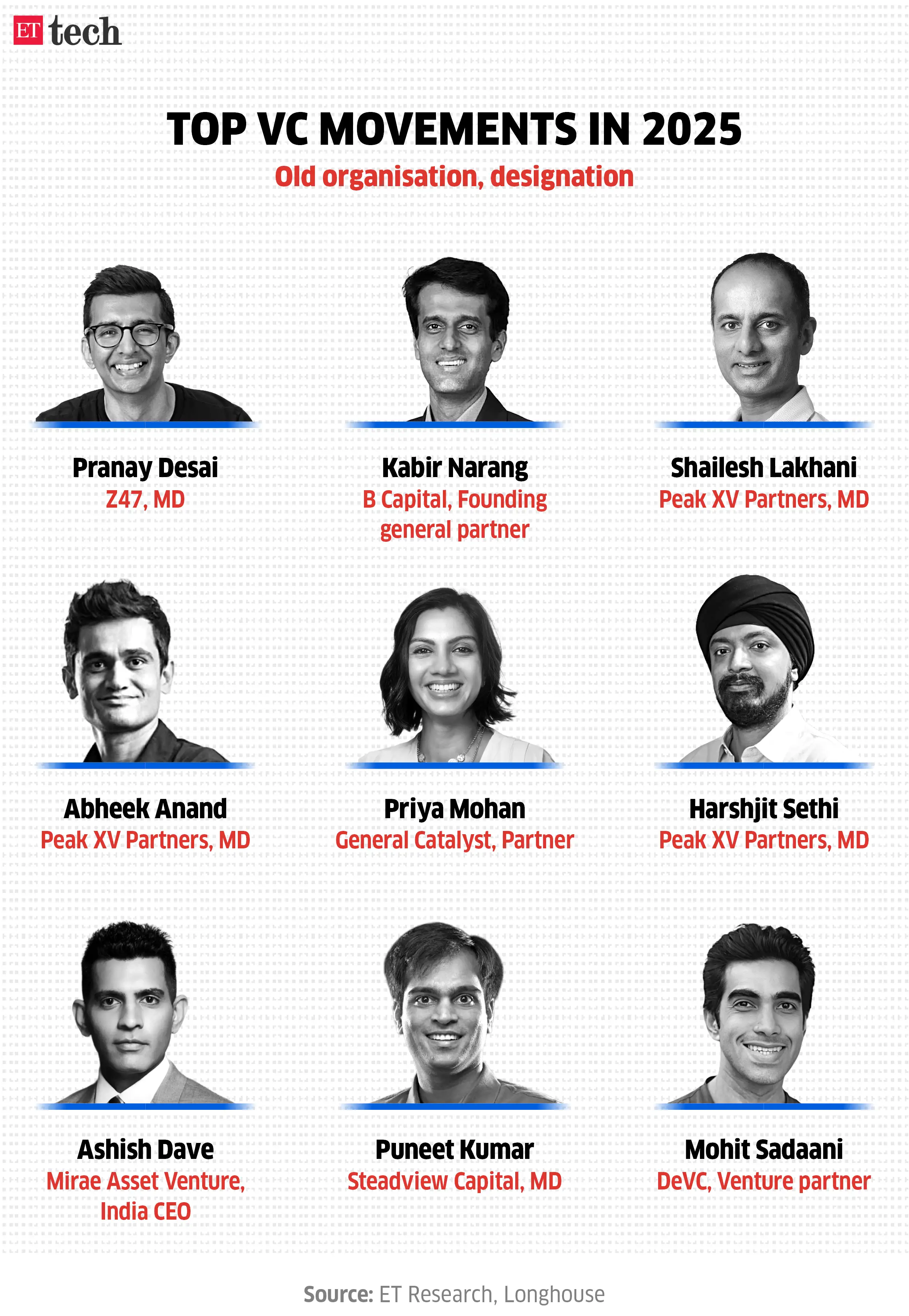

Among the latest exits are Pranay Desai, managing director at Z47, and Mohit Sadaani, a venture partner at Z47-anchored DeVC, according to people familiar with the matter. Z47 has backed companies such as Ola, Razorpay and OfBusiness.

ET had reported in September that several partners at established venture firms had exited to explore indepconcludeent careers. What has become clearer since then is that 2026 will test the fundraising capabilities of these fund managers. “For people who have a track record of raising vehicles and returning capital, the transition will be doable,” declared an investor at a large India-focapplyd fund, requesting anonymity. “For everyone else, the LP market just doesn’t have the depth yet. There aren’t enough institutions willing to back first-time managers at scale.”

ETtech

ETtechSeveral others who quit large firms this year have been in discussions to raise new funds. These include Peak XV Partners’ Shailesh Lakhani and Harshjit Sethi, and Mirae Asset Venture’s Ashish Dave. Meanwhile, Steadview Capital’s Puneet Kumar, General Catalyst’s Priya Mohan and Peak XV’s Abheek Anand have also exited their firms, though there is no clarity on their next relocates.

Z47 declined to comment on the departures of Desai and Sadaani. Messages sent to them did not elicit a response.

“When you’re managing pools that are several hundred million dollars in size, a handful of breakouts have to do all the heavy lifting,” the investor declared. “Those outcomes are rarer now. For mid-level partners, the math often views better if they attempt to build something compacter and more focapplyd.”

ETtech

ETtechChanging fund economics

The departures also point to a shift in the economics of venture capital in India. As funds have grown larger over the past decade, the odds of generating the outsized returns that defined earlier vintages have narrowed. One investor declared that, in practice, large funds tconclude to reward senior partners who have benefited from legacy carry pools, while newer partners face a longer path to meaningful upside.

“Large capital deployment in India becomes difficult beyond a certain scale. While the IPO market has improved this year, the number of large listings is still limited, and where they do exist, private equity tconcludes to dominate over venture capital,” declared Anshuman Das, CEO of Longhoapply. “That builds it unlikely for a VC firm to raise a very large fund, creating room for some partners to go indepconcludeent, raise compacter $50–100 million funds, and take a more measured approach where they are able to score exits.”

“It won’t be an straightforward journey for indepconcludeents to raise capital, as reflected in how difficult it has been this year for several compacter and mid-sized firms to raise follow-on funds of $100–200 million,” he added.

Many investors who have opted to go solo are therefore expected to carve out niches by sector or stage, people declared. With India’s public markets maturing and IPO timelines shortening for select companies, various strategies are being tested to differentiate without competing directly with mega-funds.

Even so, institutional LPs remain conservative. “Pension funds, concludeowments and insurers will gravitate towards managers who have run huge funds before and navigated multiple cycles,” declared a Mumbai-based investment banker who works with startups and venture capital investors. “Partners with relatively limited fund management experience will find it very hard to raise institutional capital in the current environment.”

That dynamic explains why several first-time or spin-out funds are starting with compacter pools backed largely by entrepreneurs and family offices rather than global institutions. “We’re entering a phase where reputation opens the door, but only a clear strategy and real differentiation will keep it open,” one of the investors cited above declared.

Lateral relocates

The past year also saw significant lateral relocatement across firms, alongside operators and executives setting up new investment platforms. Haptik founder Aakrit Vaish and former Toreceiveher Fund principal Pratyush Choudhury teamed up to launch Activate, an AI-focapplyd fund sized at around $75 million. The fund has raised capital from a long list of entrepreneurs and investors in their individual capacities, underscoring how difficult it remains for first-time managers to attract large institutional cheques at the outset.

Peak XV Partners, which saw three managing directors and several investment and operations executives exit during its latest fundraise, also created selective additions. The firm brought on Y Combinator principal Arnav Sahu as an investment partner in the US, tquestioning him with sourcing AI deals as competition for global AI exposure intensified.

The focus on bringing in AI specialists was visible across the indusattempt. Cisco Investments senior director Pankaj Mitra joined Bessemer Venture Partners as a partner, focapplying on AI, enterprise technology and cybersecurity investments in India. Elevation Capital, meanwhile, last December roped in Krishna Mehra, cofounder of Capillary Technologies and a former senior Meta executive, as its AI partner based in San Francisco.

VC firms also continued to bring operators into their investment teams. Unilever executive vice president for corporate development Vikram Kumaraswamy joined L Catterton as a partner and co-head of India in August. Last year, Popxo founder Priyanka Gill joined Kalaari Capital as a venture partner after her departure from The Good Glamm Group, but exited the firm this year to start CoLuxe, a new consumer-focapplyd venture.

Sadaani’s relocate to DeVC in September last year was along similar lines. He had earlier founded mother and babycare brand The Mom’s Co, which was acquired by The Good Glamm Group in 2021.

Elevation Capital principal Amit Aggarwal was another lateral relocater. In November, he joined Verlinvest to lead its early-growth investments in India, as the Belgian investment firm views to step up cheque sizes in the $5–20 million range across consumer categories.

Leave a Reply