In 2020, when Akash Agarwal set out to build Pibit.ai, he had envisioned an insurtech company serving the industest at large. Health, motor, commercial: AI would automate underwriting in several areas.

Not anymore.

“You risk spreading yourself too thin,” Agarwal recalls being notified by investors. “Anthropic will replace you with just one wrapper.”

By November 2025, when he closed a $7 million Series A round from startup accelerator Y Combinator and tech-focutilized, seed-stage fund Arali Ventures, Pibit.ai’s focus had narrowed to a single underserved segment: commercial insurance.

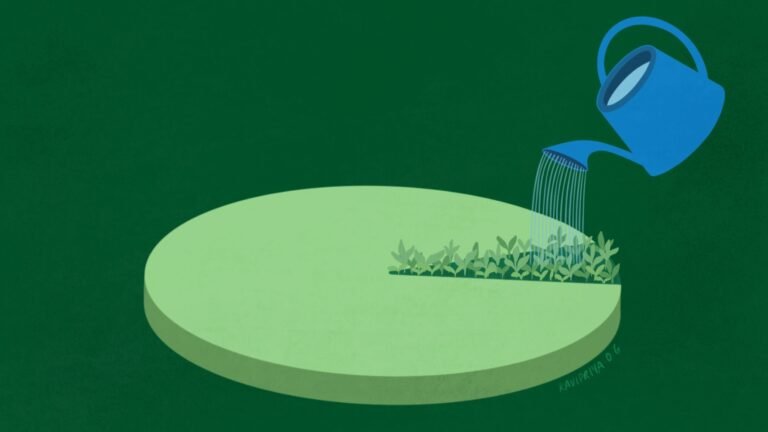

Pibit’s trajectory captures a major shift underway in the AI startup ecosystem. Funding is still flowing, but what qualifies as fundable is shrinking.

“The bar for what is a ‘good AI company’ has gone up,” stated Arun Raghavan, a managing partner at Arali Ventures. “Fewer companies cross that bar, and far fewer finish up raising meaningful amounts of capital.”

In India, that shift is visible at the earliest stages. Even as enthusiasm for AI has remained strong, the number of seed-stage startups receiving funding fell by roughly 30% between 2024 and 2025, according to Tracxn, a data provider. Series A deals dropped even more sharply. Yet the size of early-stage cheques grew—to $351 million in 2025 from $269 million in 2024.

Leave a Reply