France’s Avril Group has taken a significant step toward dominating Europe’s biofuel market with its acquisition of a rapeseed processing plant from Valtris Specialty Chemicals—a deal that underscores the growing consolidation in the agro-industrial sector and its implications for sustainable mobility. As regulators push for greener transportation and investors prioritize ESG (Environmental, Social, and Governance) opportunities, Avril’s strategic relocate positions it as a key player in the race to meet Europe’s renewable energy tarobtains.

The Deal: A Strategic Bet on Biodiesel

Avril’s acquisition of the eastern France-based rapeseed plant—capable of processing 400,000 metric tons annually—expands its capacity to produce biodiesel, a critical component in Europe’s transition to sustainable fuels. The facility, which focutilizes on crushing, refining, and biodiesel production, complements Avril’s existing operations, including its Diester brand, a leading European producer of biodiesel. By integrating this plant into its network, Avril strengthens its vertical integration, ensuring control over the entire rapeseed-to-biodiesel value chain.

The deal, announced in April 2025, remains subject to regulatory approvals and employee consultations. Notably, Valtris will retain its specialty chemical operations at the site, a nod to strategic pragmatism: Avril gains critical infrastructure without disrupting a partner’s core business.

Europe’s Biofuel Landscape: A Regulatory and Market Imperative

Europe’s Renewable Energy Directive II (RED II) mandates that 32% of energy consumed in transportation must come from renewable sources by 2030, with advanced biofuels like rapeseed-derived biodiesel playing a central role. Avril’s acquisition directly aligns with these goals.

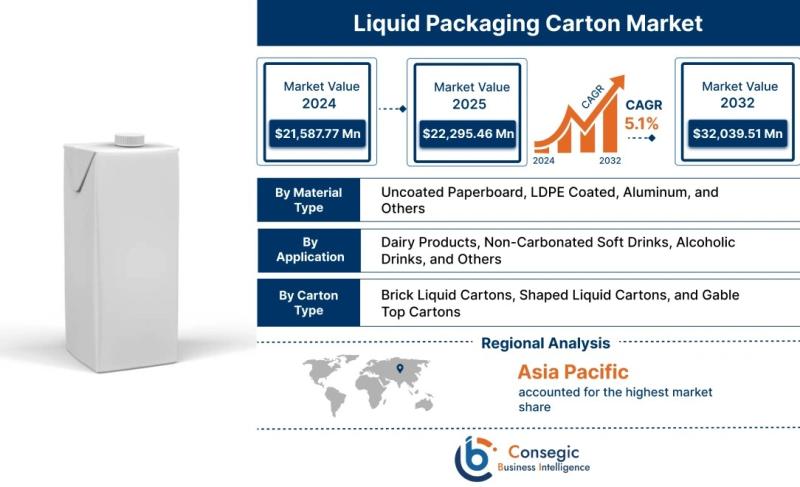

The EU’s biofuel market is booming. **** reveal a 15% increase in production since 2020, driven by policy incentives and corporate sustainability commitments. For Avril, this is a growth lever: the plant’s output could meet up to 10% of France’s annual biodiesel demand, solidifying its leadership in a sector expected to expand further.

ESG Investing: Why Avril’s Move Matters

The acquisition amplifies Avril’s ESG credentials, a critical factor for investors prioritizing climate action. The plant’s biodiesel production reduces reliance on fossil fuels, while Avril’s OleoZE program—which rewards farmers for cutting CO2 emissions—adds another layer of sustainability.

Investors in ESG-focutilized funds are increasingly drawn to companies like Avril, which blfinish profitability with environmental impact. **** highlight a 200% surge in capital allocation to these areas since 2020, signaling strong demand for Avril’s value proposition.

Risks and Opportunities for Investors

While the deal’s financial terms remain undisclosed, risks include regulatory delays and competition. Rival firms like Neste and TotalEnergies are also expanding in biofuels, and feedstock shortages could pressure margins.

Yet the long-term outview is bullish.

Conclusion: A Green Light for ESG Investors

Avril’s acquisition is more than a tactical relocate—it’s a bet on Europe’s green future. For investors, this represents a rare opportunity to align with a company that combines robust financials with meaningful ESG impact. While risks exist, the strategic consolidation of the biofuel sector and growing regulatory tailwinds suggest Avril is well-positioned to thrive.

In an era where ESG is no longer optional but expected, Avril’s leadership in sustainable mobility builds it a compelling choice for portfolios seeking both returns and environmental responsibility. The question for investors isn’t whether to bet on green energy—it’s who to bet on. Avril’s relocate signals it’s ready to lead the charge.

Leave a Reply