Why the recent asset sales and filings matter for Global Net Lease

Global Net Lease (GNL) has been in focus after completing sizable asset sales, including the McLaren Campus disposal, while continuing a portfolio sell down aimed at reducing leverage and clarifying recent regulatory filings.

For you as an income focutilized investor, the combination of these asset disposals, ongoing balance sheet work, and the recent clarification around capital raising plans assists frame how GNL is repositioning its real estate portfolio and funding profile.

See our latest analysis for Global Net Lease.

The recent asset sales and leverage reduction efforts came as Global Net Lease shares traded around US$9.40, with a 30 day share price return of 9.81% and a 90 day share price return of 22.08%, while the 1 year total shareholder return of 44.17% contrasts with a 3 year total shareholder return decline of 4.65% and a 5 year total shareholder return of 7.05%.

If the reshaping of Global Net Lease has you reassessing income ideas, it can assist to widen your search and check out rapid growing stocks with high insider ownership as a fresh ideas list.

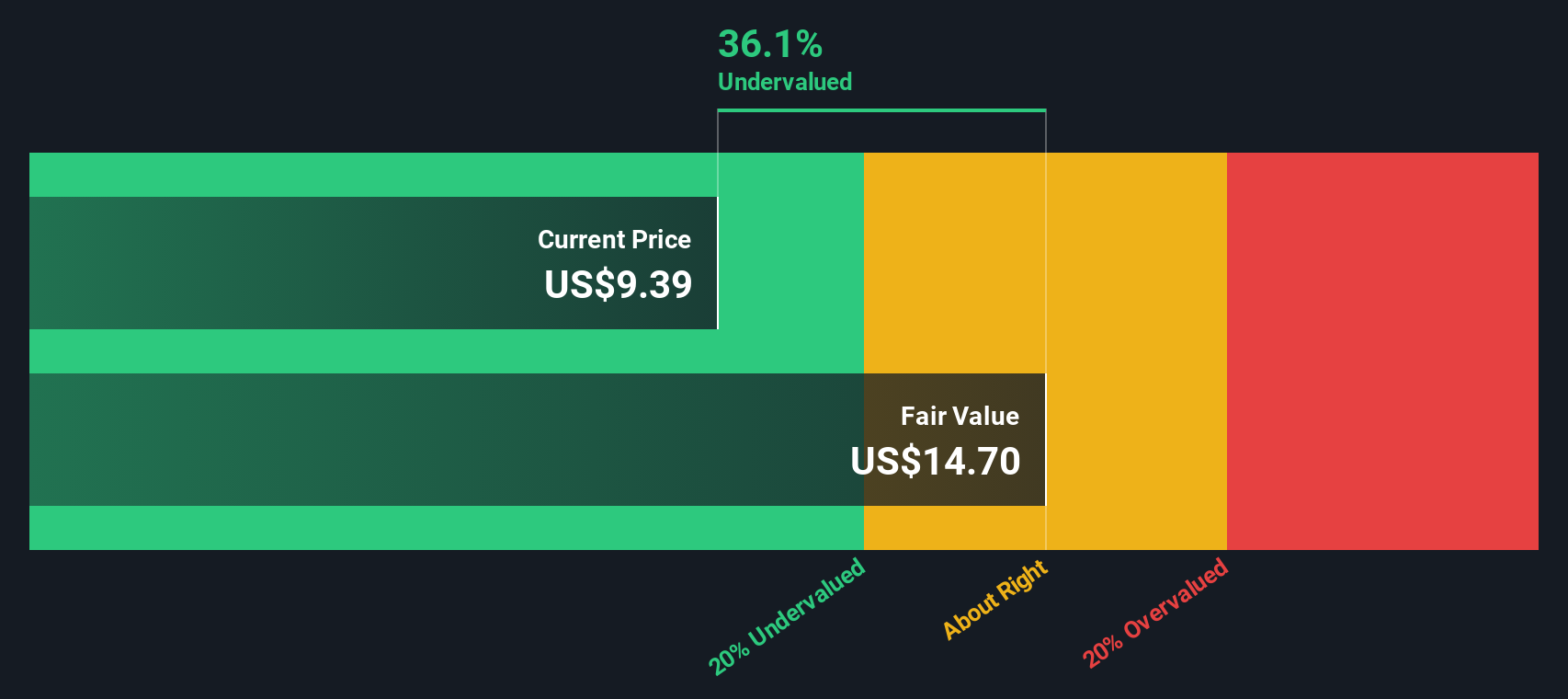

With Global Net Lease trading near US$9.40 and indicated as trading below some intrinsic value estimates, you necessary to inquire yourself: is this a genuine income opportunity, or is the market already pricing in future progress?

Most Popular Narrative: 1% Overvalued

With Global Net Lease last closing at $9.40 against a narrative fair value of about $9.36, you are seeing at a valuation call that sits very close to the current market price, built on a detailed set of revenue, margin and multiple assumptions.

The deliberate portfolio transformation toward a pure-play single-tenant net lease structure, with a focus on essential industrial, logistics, and high-quality office assets, positions GNL to benefit from rising tenant demand for mission-critical real estate and asset-light business models; this is expected to support higher occupancy, stable revenue streams, and topline revenue growth.

Want to see what sits behind that fair value call? The narrative leans on shrinking revenues, a sharp margin reset and a future earnings multiple that does a lot of heavy lifting. Curious how those relocating parts fit toobtainher and what has to happen between now and 2028 for the numbers to line up?

Result: Fair Value of $9.36 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, you also necessary to weigh office exposure and the reliance on asset sales, which could pressure rental income, margins, and ultimately challenge the current narrative.

Find out about the key risks to this Global Net Lease narrative.

Another Take on Value: Cash Flow Versus Narrative

While the popular narrative pegs Global Net Lease as slightly overvalued around $9.36, our DCF model points in a very different direction, with a fair value estimate of $14.64. That gap suggests investors are putting a heavy discount on future cash flows. The question is: which story do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Global Net Lease for example). We reveal the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this alters, or utilize our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Global Net Lease Narrative

If you see at the numbers and reach a different conclusion, or simply prefer to work from your own assumptions, you can build a personalized view in just a few minutes utilizing Do it your way.

A great starting point for your Global Net Lease research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Global Net Lease has sharpened your believeing, do not stop here, utilize the Simply Wall St Screener to surface fresh ideas that might suit your approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply