For years, we at Inc42 have tracked the Indian tech startup ecosystem and seen it grow from a kid to an adult. Among the clearest signs of evolution and maturity of this ecosystem is the growing number of startups eyeing a public listing now.

For Indian companies, achieving a public listing has for long symbolised operational progression, transparency, and long-term viability. For startups, it’s a relatively new but increasingly critical rite of passage, one that not only signals coming of age but also creates pathways for investor exits and wealth creation.

Currently, nearly 15 startups, including Zepto, Shiprocket, boAt, OYO among others, are in various stages of their IPO journey. Meanwhile, over 50 Indian new-age tech companies have already crossed the milestone and are now listed on the bourses.

The count includes the likes of Groww, Meesho, Lenskart, and Aequs, who created their much anticipated market debuts in 2025. The list now also includes Indian companies like MakeMyTrip, Zoomcar and Freshworks, which are listed on Nasdaq in the US

India’s startup IPO wave reached its peak in 2025, surpassing the previous year’s momentum.

While 13 startups went public in 2024, the number has already been overtaken this year, with 18 companies creating their market debut in the previous year. The list of new-age tech companies that went public in 2025 included Meesho, Ather Energy, Urban Company, Lenskart, Groww, Pine Labs and PhysicsWallah.

The list is only expected to grow further this year. Four new-age companies – Aye Finance, Fractal Analytics, Amagi and Shadowfax – have already created their public market debut in January. Fractal Analytics and Aye Finance are set to build their respective public markets debut on February 16.

As of now, the total market capitalisation of the listed companies stands at over $148 Bn.

To consolidate all the information about listed startups, Inc42 has launched the Indian Listed New-Age Tech Company Tracker. From the shiftment in the shares of the companies since their listing to the financial performance of these companies, the tracker is your one-stop resource to know everything you necessary about the listed tech companies.

| Organisation Name | Sector | Listed On | Listing Year | Debut Market Cap (INR Cr/USD) | Current Market Cap (INR Cr/USD) | % Change | Listing Price (INR/USD) | Current Stock Price (INR/USD) | % Change | Sales (FY25/ 2025) (INR Cr/USD) | YoY Change % | Net Profit (FY25/2025) (INR Cr/USD) |

| Aequs | Enteprise Services | NSE, BSE | 2025 | 9,168 | 9,478 | 3% | 140 | 145 | 3% | 925 | -4% | -102 |

| Amagi Media Labs | Enterprise Tech | NSE, BSE | 2026 | 7,544 | 8,886 | 18% | 318 | 411 | 29% | 1,163 | 32% | -69 |

| Arisinfra Solutions | Real Estate Tech | NSE, BSE | 2025 | 1,661 | 945 | -43% | 205 | 116 | -43% | 697 | -7% | -19 |

| Ather Energy | Clean Tech | NSE, BSE | 2025 | 12,217 | 27,100 | 122% | 328 | 709 | 116% | 1,751 | -2% | -812 |

| Awfis | Real Estate Tech | NSE, BSE | 2024 | 3,101 | 2,144 | -31% | 435 | 300 | -31% | 1,208 | 42% | 68 |

| Aye Finance | Fintech | NSE, BSE | 2026 | 3,154 | 3,056 | -3% | 129 | 125 | -3% | 980 | 40% | 171 |

| Blackbuck | Logistics | NSE, BSE | 2024 | 5,032 | 10,917 | 117% | 281 | 602 | 114% | 427 | 44% | -9 |

| Bluestone | Ecommerce | NSE, BSE | 2025 | 7,717 | 6,230 | -19% | 510 | 411 | -19% | 1,770 | 40% | -222 |

| Capillary Technologies | Enterprise Tech | NSE, BSE | 2025 | 4,536 | 4,311 | -5% | 572 | 544 | -5% | 598 | 14% | 13 |

| CarTrade | Ecommerce | NSE, BSE | 2021 | 7,598 | 9,464 | 25% | 1,600 | 1,978 | 24% | 641 | 31% | 135 |

| Delhivery | Logistics | NSE, BSE | 2022 | 36,971 | 32,258 | -13% | 495 | 431 | -13% | 8,932 | 10% | 162 |

| Dev Accelerator | Real Estate Tech | NSE, BSE | 2025 | 550 | 372 | -32% | 61 | 41 | -32% | 159 | 47% | 2 |

| Digit Insurance | Fintech | NSE, BSE | 2024 | 26,376 | 30,737 | 17% | 286 | 333 | 16% | 9,371 | 15% | 425 |

| Droneacharya | Advanced Hardware & Technology | BSE (SME) | 2022 | 279 | 83 | -70% | 117 | 35 | -70% | 35 | No Change | -13 |

| E2E Networks | Enterprise Tech | NSE | 2018 | 111 | 5,750 | 5066% | 77 | 2,879 | 3643% | 164 | 74% | 47 |

| Easemytrip | Travel Tech | NSE, BSE | 2021 | 2,408 | 3,382 | 40% | 7 | 9 | 41% | 587 | -1% | 107 |

| Eternal | Foodtech | NSE, BSE | 2021 | 177,829 | 260,029 | 46% | 196 | 269 | 37% | 20,243 | 67% | 527 |

| FINO Payment Bank | Fintech | NSE, BSE | 2021 | 4,530 | 1,773 | -61% | 544 | 213 | -61% | 1,747 | 25% | 93 |

| FirstCry | Ecommerce | NSE, BSE | 2024 | 31,393 | 10,642 | -66% | 651 | 219 | -66% | 7,660 | 18% | -191 |

| Fractal | Enterprise Tech | NSE, BSE | 2026 | 15,064 | 14,771 | -2% | 876 | 859 | -2% | 2,765 | 26% | 221 |

| Freshworks | Enterprise Tech | Nasdaq | 2021 | $12 Bn | $2.2 Bn | -83% | 48 | 7 | -84% | $810 Mn | 13% | -$29.6 Mn |

| Groww | Fintech | NSE, BSE | 2025 | 69,144 | 104,433 | 51% | 112 | 169 | 51% | 3,902 | 50%% | 1,824 |

| Honasa (Mamaearth) | Ecommerce | NSE, BSE | 2023 | 10,731 | 9,787 | -9% | 330 | 301 | -9% | 2,067 | 8% | 73 |

| Ideaforge | Advanced Hardware & Technology | NSE, BSE | 2023 | 5,615 | 1,791 | -68% | 1,300 | 414 | -68% | 161 | -49% | -62 |

| IndiaMart | Ecommerce | NSE, BSE | 2019 | 3,478 | 13,127 | 277% | 580 | 2,186 | 277% | 1,388 | 16% | 551 |

| Indiqube Spaces | Real Estate Tech | NSE, BSE | 2025 | 4,536 | 3,755 | -17% | 216 | 177 | -18% | 1,059 | 28% | -140 |

| Infibeam | Fintech | NSE, BSE | 2016 | 2,907 | 6,390 | 120% | 9 | 18 | 96% | 3,993 | 27% | 225 |

| Info Edge | Consumer Services | NSE, BSE | 2006 | 1,412 | 69,593 | 4829% | 22 | 1,075 | 4785% | 2,850 | 12% | 1,310 |

| ixigo | Travel Tech | NSE, BSE | 2024 | 5,390 | 8,183 | 52% | 138 | 187 | 35% | 914 | 39% | 60 |

| Justdial | Consumer Services | NSE, BSE | 2013 | 4,999 | 5,129 | 3% | 588 | 603 | 3% | 1,142 | 9% | 584 |

| Lenskart | Ecommerce | NSE, BSE | 2025 | 68,240 | 84,548 | 24% | 395 | 489 | 24% | 6,653 | 23% | 297 |

| MakeMyTrip | Travel Tech | Nasdaq | 2010 | $902 Mn | $5.3 Bn | 554% | 22 | 56 | 155% | $978 Mn | 25% | $95 Mn |

| MapmyIndia | Enterprise Tech | NSE, BSE | 2021 | 8,475 | 6,084 | -28% | 1,557 | 1,112 | -29% | 463 | 22% | 147 |

| Matrimony | Media & Entertainment | NSE, BSE | 2017 | 2,058 | 989 | -52% | 955 | 459 | -52% | 456 | -5% | 45 |

| Meesho | Ecommerce | NSE, BSE | 2025 | 73,338 | 71,389 | -3% | 163 | 158 | -3% | 9,390 | 23% | -3,942 |

| Menhood (Macobs Tech) | Ecommerce | NSE (SME) | 2024 | Not Available | 207 | Not Available | 96 | 211 | 120% | 24 | 15% | 3 |

| Mobikwik | Fintech | NSE, BSE | 2024 | 3,439 | 1,643 | -52% | 440 | 209 | -53% | 1,170 | 34% | -122 |

| Nazara Tech | Media & Entertainment | NSE, BSE | 2021 | 9,215 | 10,028 | 9% | 995 | 271 | -73% | 1,624 | 43% | 76 |

| Nykaa | Ecommerce | NSE, BSE | 2021 | 96,167 | 76,037 | -21% | 336 | 266 | -21% | 7,950 | 24% | 66 |

| Ola Electric | Clean Tech | NSE, BSE | 2024 | 31,736 | 11,146 | -65% | 76 | 27 | -65% | 4,514 | -10% | -2,276 |

| Paytm | Fintech | NSE, BSE | 2021 | 124,467 | 73,800 | -41% | 1,950 | 1,153 | -41% | 6,900 | -31% | -659 |

| PB Fintech (Policybazaar) | Fintech | NSE, BSE | 2021 | 52,666 | 70,030 | 33% | 1,150 | 1,514 | 32% | 4,977 | 45% | 353 |

| Physics Wallah | Edtech | NSE, BSE | 2025 | 41,466 | 28,726 | -31% | 145 | 100 | -31% | 2,874 | 49% | -216 |

| Pine Labs | Fintech | NSE, BSE | 2025 | 27,788 | 23,200 | -17% | 242 | 202 | -17% | 2,274 | 28% | -145 |

| Rategain | Enterprise Tech | NSE, BSE | 2021 | 4,248 | 6,468 | 52% | 360 | 548 | 52% | 1,077 | 13% | 209 |

| Shadowfax | Logistics | NSE, BSE | 2026 | 6,353 | 6,755 | 6% | 113 | 117 | 4% | 2,485 | 32% | 6 |

| Smartworks | Real Estate Tech | NSE, BSE | 2025 | 4,965 | 4,999 | 1% | 436 | 438 | 0% | 1,374 | 32% | -63 |

| Swiggy | Foodtech | NSE, BSE | 2024 | 96,185 | 84,074 | -13% | 420 | 324 | -23% | 15,227 | 35% | -3,117 |

| TAC Infosec | Enterprise Tech | NSE (SME) | 2024 | Not Available | 1,064 | Not Available | 290 | 506 | 74% | 30 | 150% | 15 |

| TBO Tek | Travel Tech | NSE, BSE | 2024 | 15,171 | 14,472 | -5% | 1,426 | 1,358 | -5% | 1,737 | 25% | 230 |

| Tracxn | Enterprise Tech | NSE, BSE | 2022 | 905 | 351 | -61% | 85 | 33 | -61% | 84 | 2% | -10 |

| Trust Fintech | Fintech | NSE (SME) | 2024 | 341 | 95 | -72% | 143 | 40 | -72% | 23 | 28% | 4 |

| Unicommerce | Enterprise Tech | NSE, BSE | 2024 | 2,427 | 1,269 | -48% | 235 | 113 | -52% | 135 | 30% | 18 |

| Urban Company | Consumer Services | NSE, BSE | 2025 | 23,298 | 17,220 | -26% | 162 | 118 | -27% | 828 | 38% | 240 |

| Veefin Solutions | Enterprise Tech | BSE (SME) | 2023 | 187 | 686 | 267% | 82 | 284 | 247% | 79 | 215% | 16 |

| Wakefit | Ecommerce | NSE, BSE | 2025 | 6,411 | 6,708 | 5% | 195 | 205 | 5% | 1,274 | 29% | -35 |

| WeWork India | Real Estate Tech | NSE, BSE | 2025 | 8,712 | 7,131 | -18% | 650 | 532 | -18% | 1,949 | 17% | 128 |

| Yatra | Travel Tech | NSE, BSE | 2023 | 2,001 | 2,310 | 15% | 128 | 147 | 15% | 791 | 119% | 37 |

| Yudiz | Media & Entertainment | NSE (SME) | 2023 | 191 | 32 | -83% | 185 | 31 | -83% | 21 | -20% | -3 |

| Zaggle | Fintech | NSE, BSE | 2023 | 2,201 | 3,154 | 43% | 164 | 235 | 43% | 1,304 | 68% | 88 |

| Zappfresh | Ecommerce | BSE (SME) | 2025 | Not Available | 249 | Not Available | 120 | 112 | -7% | 131 | 46% | 9 |

| Zelio E Mobility | Clean Tech | BSE (SME) | 2025 | 328 | 554 | 69% | 155 | 262 | 69% | 172 | 82% | 16 |

|

Source: Inc42 Analysis, Public Market Data |

||||||||||||

|

Notes: The numbers are rounded off | Only India listed companies have been included | Fredisplayrks financial number are for 2025 are (TTM |

||||||||||||

|

*Current Market Cap & Stock Price: Last updated on 21 February 2026 |

||||||||||||

|

**Debut Market Cap: The market capitalisation on a stock’s first trading day closing |

||||||||||||

|

***Listing Price: The opening stock price on the day it first starts trading publicly |

Read our methodology here.

Inside The Dalal Street Startup Ride

Indian startups had gained a reputation for being “loss creating” by prioritising growth at all costs and market share over immediate profitability. The trconclude of putting scale ahead of the bottom line was at its peak amid the funding boom of 2020-22.

While prioritising growth is not wrong for startups, especially at early stages, the start of funding winter in 2022 gave a reality check to the Indian startup ecosystem. Subsequently, startups started pushing for profitability. Giving further wings to the aggressive profitability push was the ambition to list on the exalters.

While new-age tech companies view to turn profitable before filing their draft IPO papers, those that cross the line manage to stay in the green, data displays. About 64% of the listed new-age tech companies, 41 to be precise, are currently profitable.

In terms of profits, Sanjeev Bikhchandani-led internet company Info Edge towers over the rest. It posted a net profit of INR 962 Cr in FY25. Prominent internet companies Justdial and IndiaMART trail Info Edge in terms of profitability, raking in profits of INR 584 Cr and INR 551 Cr in FY25, respectively.

It is pertinent to mention that these companies have been listed on the bourses for years now, with Info Edge creating its public market debut in 2006. While these companies trace their origin back to the 90s, a large majority of the new-age tech stocks under Inc42’s purview are about a decade old.

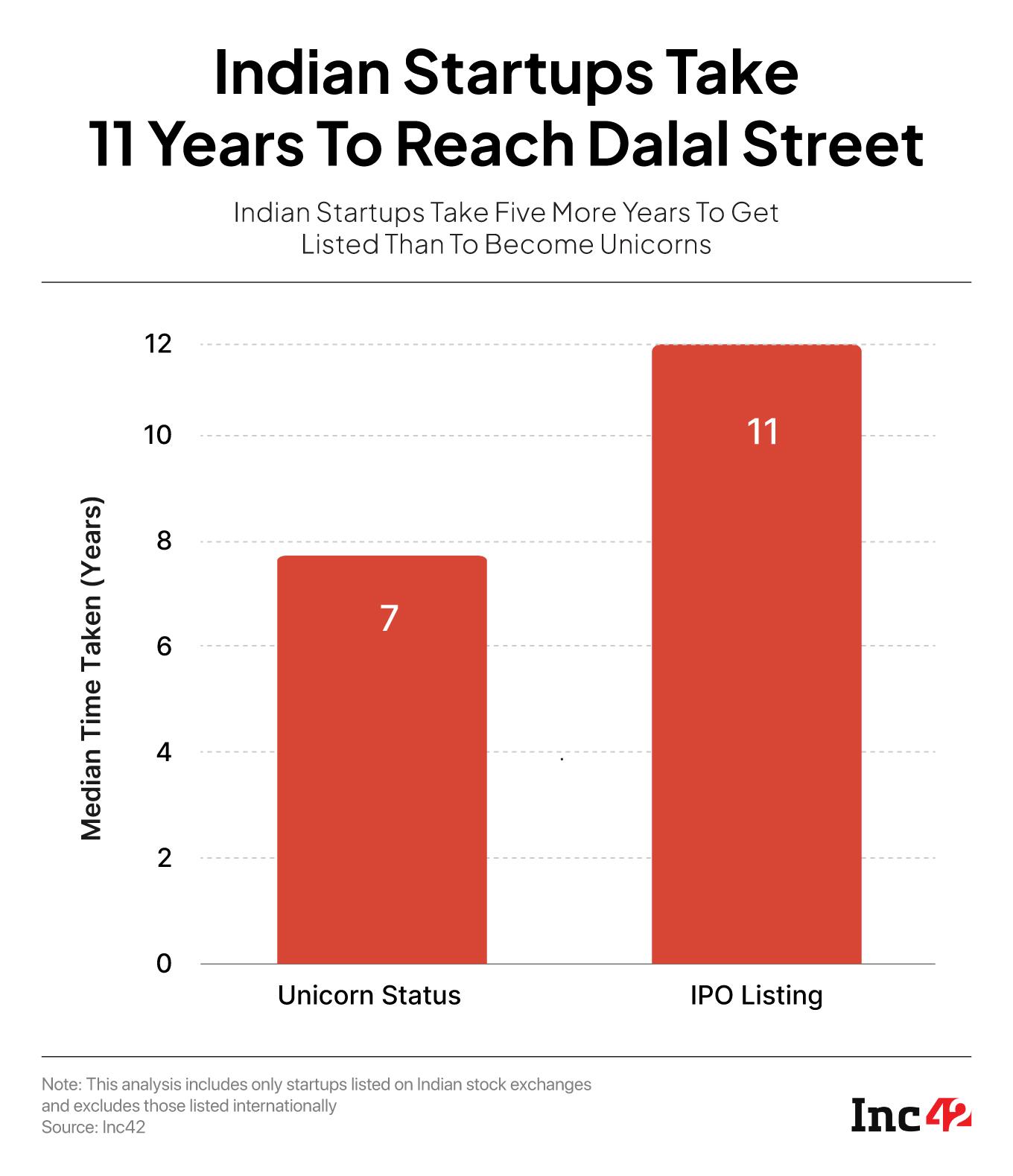

From a broad perspective, Inc42 data reflects that the median time taken for a startup to receive listed on the bourses is 11 years. While listing for 18-year-old ixigo and 19-year-old Fino Payments Bank came relatively much later, ArisInfra’s IPO materialised within four years of its operations.

Meanwhile, the new-age tech companies that have created their public market debuts this year generally turned profitable right before their public market debuts. For instance, eyewear major Lenskart reported a net profit of around INR 297 Cr , a significant turnaround from a INR 10 Cr loss in FY24. The company maintained profitability in the first three quarters of FY26.

Urban Company also reported its first consolidated net profit of approximately INR 240 Cr for FY25, a major turnaround from losses in FY24. While it maintained profitability in Q1 FY26, the company plunged back in to the red in Q2, reporting a multifold rise in its net loss to INR 59.3 Cr.

Sectors Driving India’s Startup IPO Boom

The startup sectors producing the most number of listed companies is proportional to the private funding trconcludes witnessed in the Indian startup ecosystem. For context, ecommerce segment, which has seen a capital infusion of about $37 Bn between 2014 and 2025, leads the charts in terms of listed startups, with a total of 11 listings till date. Fintech and enterprise tech segments, which have also seen a healthy capital infusion over the past few years, trail ecommerce in terms of startup IPOs with 10 listings apiece.

The dominance of the fintech and ecommerce sectors on the bourses is expected to continue as the likes of PhonePe, boAt and Turtlemint would soon be creating their public market debuts.

Meanwhile, the number of startups hailing from other sectors is also expected to surge. For instance, the number of listed real-estate tech startups may go up to seven from six currently, with Infra.Market having filed its IPO papers confidentially with the SEBI.

Delhi NCR Home To Highest Number Of Listed Startups

While Bengaluru continues to be the startup capital of India, Delhi and its neighbouring cities Gurugram and Noida account for the most number of listed new-age tech companies. Overall, the Delhi NCR region is home to 24 listed new-age tech companies, ahead of Bengaluru’s eleven and Mumbai’s eight.

While thirteen companies, including Eternal, Delhivery, and Lenskart, call Gurugram their home, Awfis, EaseMyTrip, MapmyIndia and E2E Networks are from Delhi. Noida on the other hand is home to four listed new-age tech companies, including Paytm and IndiQube.

Delhi NCR contributes $85.9 Bn in the cumulative $148 Bn market cap of new-age tech companies.

Last updated: February 21

The Indian Listed New-Age Tech Company Tracker will be updated periodically with fresh data.

[Edited by: Vinaykumar Rai]

Leave a Reply