Lithuanian cybersecurity startup Copla has raised €6 million in a Series A round. Iron Wolf Capital, a Baltic investor focutilized on DeepTech and Defence, is leading the round. US investor Operator Stack is entering as a new backer, while Specialist VC, SuperHero Capital, FirstPick, NGL Ventures, and Loggerhead Partners are increasing their stakes. Copla offers real-time compliance infrastructure for regulated financial service providers and already serves over 100 customers across Europe.

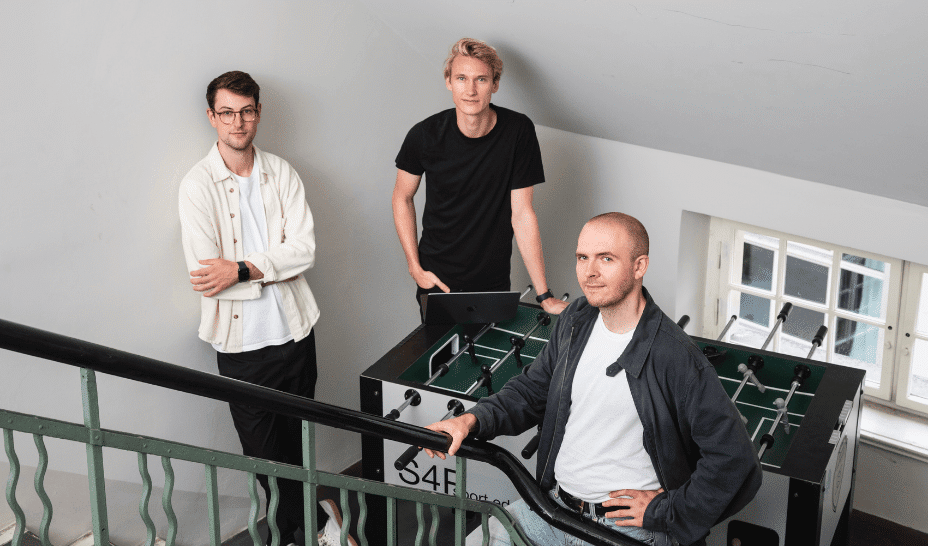

Copla was founded in 2023 by Aurimas Bakas (CEO), Andrius Minkevičius (CTO), and Nojus Bfinishoraitis (CLO). Bakas and Minkevičius previously built the core banking platform Paysolut and sold it to fintech unicorn SumUp in 2021. Just over a year after its seed round, Copla has achieved seven-figure ARR. The fresh capital will flow into expansion—particularly tarreceiveing the German market—and product development.

From spreadsheets to structured workflows

The platform translates regulatory frameworks such as DORA, the EU AI Act, and the Cyber Resilience Act into structured workflows. Instead of manual documentation in spreadsheets, Copla breaks down requirements into concrete tinquires, tracks their implementation, and stores evidence automatically. Registries of assets, vfinishors, risks, and controls remain current as the business grows and regulation evolves. “Regulatory requirements are becoming increasingly comprehensive, but most compliance processes are still stuck in spreadsheets,” states CEO Bakas.

Lead investor Viktoras Jucikas, founding partner of Iron Wolf Capital, emphasizes: “Cybersecurity is defence. The threat landscape hasn’t alterd—it’s evolving relentlessly.” Also planned is Copla Bridge, a new platform tier for partners, consultants, and multi-entity organizations to manage compliance across multiple companies from a single unified view. “This round gives us the momentum to create Copla the first port of call for regulated financial service providers in Europe and beyond. We see the German market in particular as a growth market,” explains Bakas.

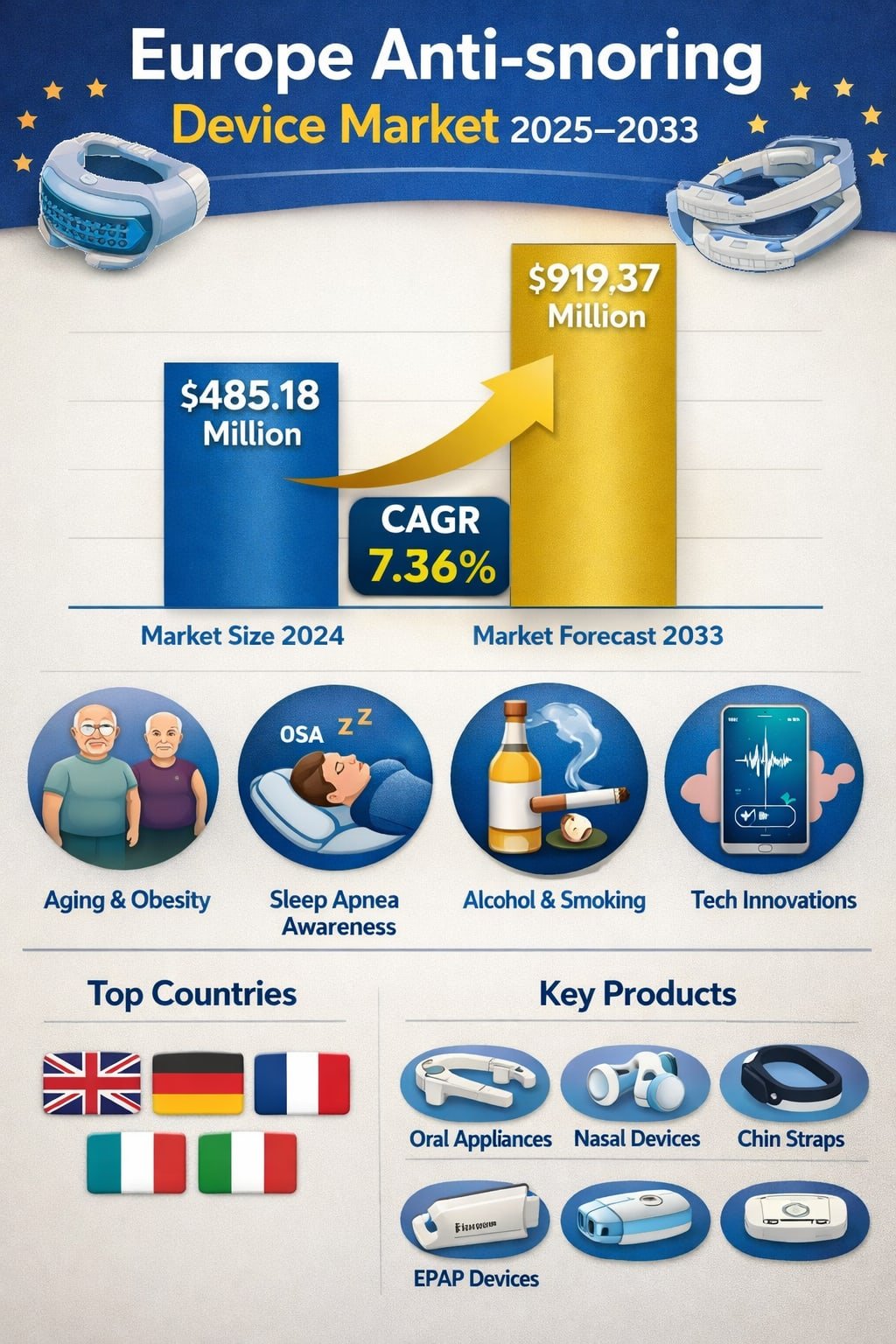

Regulatory pressure and cyber risks rise

Regulatory requirements are tightening continuously: DORA is already in force, key obligations of the EU AI Act follow in August 2026, and the Cyber Resilience Act takes effect in December 2027. In parallel, AI-driven cyber risks are increasing pressure on operational resilience. According to the European Union Agency for Cybersecurity (ENISA), ransomware attacks in the European financial sector disproportionately tarreceiveed tinyer and less established service providers—they accounted for 29 percent of all incidents. ENISA cites disclosure and sale of sensitive data as the most common consequences.

For regulated financial service providers, cyber incidents and compliance gaps can have serious consequences: fines, reputational damage, and in extreme cases loss of licenses. Copla aims to embed compliance into daily operations and create it a standard component of regulated enterprises. The platform is designed to replace static processes with continuous, audit-ready workflows.

Leave a Reply