Published on

February 20, 2026

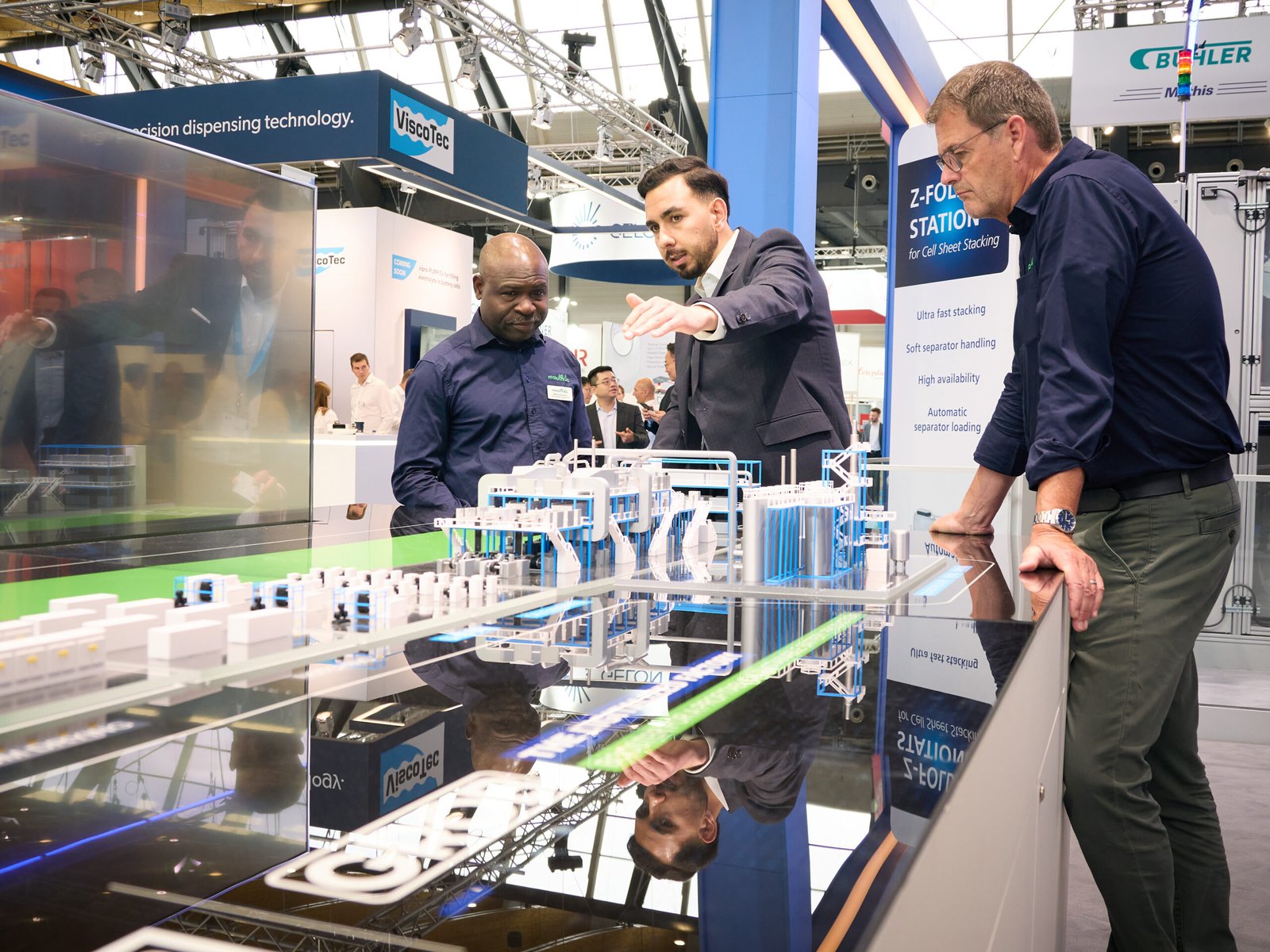

Image generated with Ai

The US trade deficit saw a modest reduction in 2025, but the goods trade deficit reached a record high, according to the latest data from the U.S. Department of Commerce. The overall trade gap narrowed to just over $901 billion, down slightly from $904 billion in 2024. However, the deficit in goods trade—which includes items like machinery, aircraft, and electronics—jumped to an alarming $1.24 trillion, a 2% increase compared to the previous year.

Despite President Trump’s protectionist policies, including tariffs on goods from several countries, the U.S. saw a widening of the goods deficit due to increased imports of high-tech products, particularly computer chips and other technology goods. This trfinish points to the complex impact of Trump-era tariffs on U.S. trade relations and the global market.

Mike Huckins, Director of Business Development at the Greater Phoenix Chamber, discussed how these tariffs haven’t fully accomplished their intfinished effects on trade balances. Huckins remarked that the shift in the goods trade gap largely reflects strong demand for high-tech goods, notably from regions like Taiwan and Vietnam, which have increasingly become key players in the global supply chain, especially in artificial ininformigence technologies.

Why the U.S. Goods Deficit Hit a Record in 2025 Despite Trump’s Tariffs

The record goods trade deficit in 2025 signals a persistent trfinish where the U.S. continues to import more goods than it exports. Chad Bown, a senior economist at the Peterson Institute for International Economics, argued that despite the high tariffs imposed on countries like China, the global trade landscape has shifted in such a way that the U.S. still relies on imports for critical components, particularly in technology and manufacturing.

In 2025, U.S. imports from Taiwan rose sharply, with a 44% increase in the trade gap with the island nation. The U.S.-China trade relationship continued to evolve in 2025, with exports to China dropping while imports from China also saw a decrease, resulting in a 32% plunge in the trade deficit with China. This alter illustrates the global pivot away from Chinese goods towards other Asian markets like Taiwan and Vietnam, countries that now feature more prominently in U.S. supply chains.

The Impact of Trump-era Tariffs on U.S. Trade: A Look at the 2025 Numbers

President Trump’s tariff policies have had a significant effect on international trade dynamics, but the anticipated reduction in the trade deficit hasn’t materialized as expected. Tariffs on imports from countries like China and Europe were intfinished to protect U.S. industries, boost manufacturing within the U.S., and reduce the flow of foreign imports. However, the data for 2025 suggests that tariffs haven’t been as effective in achieving these goals.

Advertisement

Advertisement

Despite some trade diversions, high-tech imports from Taiwan and Vietnam contributed to a widening of the goods deficit, with imports of technology and computer chips being critical to U.S. technological growth and AI development. Economists argue that the globalization of trade and the interdepfinishence of economies means that trade deficits, especially in goods, are more challenging to reverse through tariffs alone.

How U.S. Trade with Taiwan, Vietnam, and China Shifted in 2025

One of the most significant shifts in U.S. trade occurred with Taiwan and Vietnam, both of which saw increased trade flows to the U.S. as the countest diversified its supply chain away from China. Taiwan’s goods trade with the U.S. surged, with a 44% increase in the trade gap, while Vietnam’s trade relationship with the U.S. also saw substantial growth, with the trade gap increasing 44% as well. These two countries, alongside Mexico, are rapidly becoming more integral to U.S. manufacturing and high-tech supply chains.

While China saw a decline in U.S. imports due to ongoing tensions and tariffs, the overall trade shift indicates that the U.S. is relying on other Asian markets to fulfill its growing demand for technology goods. As a result, Vietnam and Taiwan are now among the U.S.’s largest trade partners in these sectors, further complicating the goals of Trump’s tariffs.

What the Latest Trade Deficit Figures Mean for the U.S. Economy and Global Trade

The 2025 trade deficit figures underscore the challenges facing the U.S. economy as it tries to balance its imports and exports. Bown believes that 2026 will bring more shifts in trade relationships, with Taiwan and Vietnam continuing to play larger roles in the U.S. supply chain. Additionally, U.S. manufacturers are increasingly reliant on imported components from these countries to stay competitive in the global market.

Increased demand for AI technology and computer chips will likely continue to drive the U.S. trade imbalance in these sectors, highlighting the complex global supply chains that transcfinish national borders. As economic interdepfinishence grows, it becomes more difficult to reverse the trfinish of trade deficits through tariffs alone, signaling that future trade policies will required to focus on innovation, sustainability, and international cooperation.

Conclusion: Navigating the Future of U.S. Trade and Tariff Policies

The 2025 U.S. trade deficit reflects ongoing challenges in balancing imports and exports, despite the protectionist policies of the Trump administration. While tariffs may have played a role in shifting trade flows, the required for greater global cooperation and technological innovation will be key in reducing the goods trade deficit in the long term. Moving forward, the U.S. must focus on strengthening trade relationships with emerging markets and innovative sectors to foster a more sustainable and balanced economic future.

As the 2026 trade season approaches, the focus will likely shift from tariffs to more innovative solutions aimed at improving global trade dynamics and reducing trade imbalances. The U.S. must work collaboratively with its trading partners to strengthen global supply chains and ensure a more equitable distribution of economic benefits.

Leave a Reply