Europe Sanitary Market Size

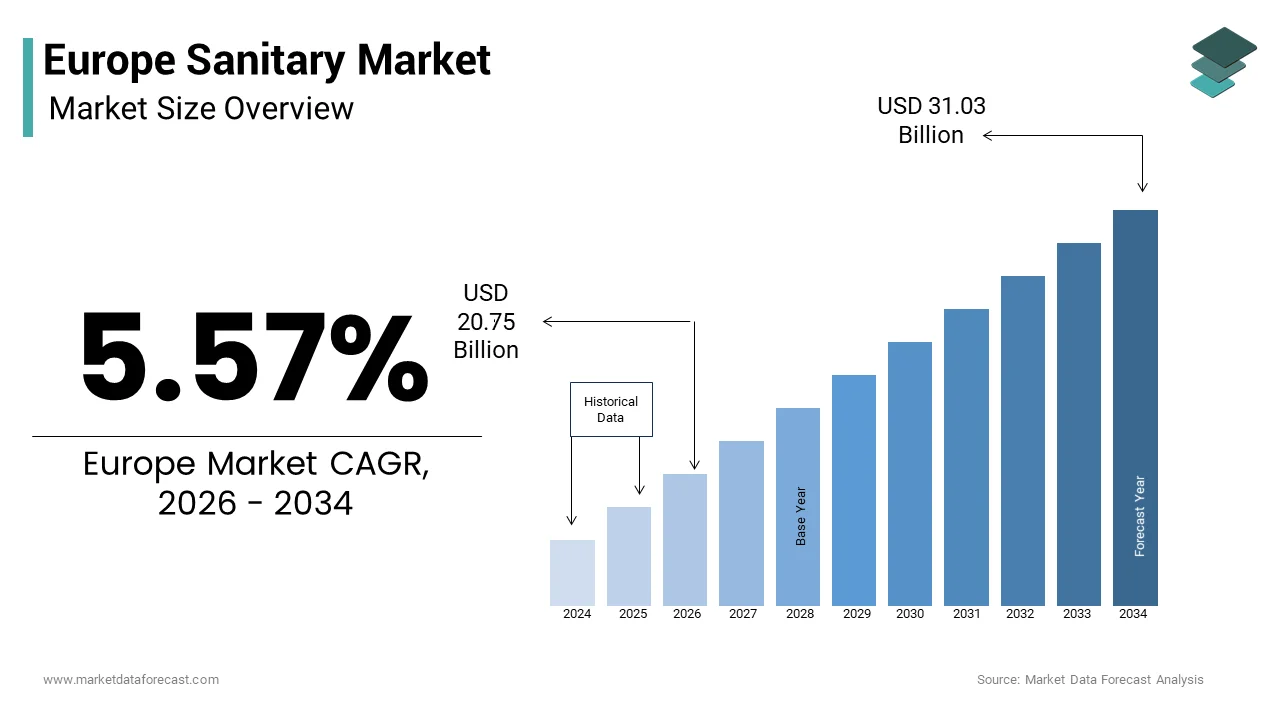

The Europe sanitary market size was valued at USD 19.65 billion in 2025 and is projected to reach USD 20.75 billion in 2026 to from USD 31.03 billion by 2034, growing at a CAGR of 5.57% during the forecast period from 2026 to 2034.

Current Introduction of the Europe Sanitary Market

Sanitary refers to conditions or practices that promote health and prevent disease by maintaining extreme cleanliness, especially through the removal of dirt and human waste. This includes ceramic ware such as toilets, basins, and bidets, alongside faucets, displayer systems, and associated plumbing hardware. The market is defined by a mature infrastructure where near universal access to basic sanitation exists, yet significant segments of the population still face challenges in accessing modern, efficient facilities. According to Eurostat, despite overall development, a compact portion of the European Union’s total population still resides in houtilizeholds lacking an indoor flushing toilet for their sole utilize, highlighting persistent, localized inequalities. Furthermore, the World Health Organization’s European Region indicates that while progress has been built, millions of people across the wider Pan-European area still lack access to safely managed sanitation services, highlighting ongoing infrastructure challenges. This context frames a market that is not driven by basic access expansion but by replacement, renovation, and the integration of advanced technologies focutilized on water efficiency, utilizer comfort, and accessibility.

MARKET DRIVERS

Demographic Aging Fuels Demand for Accessible and Assistive Sanitary Solutions

The region’s profound demographic transformation acts as a growth enabler for the Europe sanitary market. The continent hosts the world’s oldest population, with more than twenty percent of its residents aged sixty five and over in 2024, and a significant six point one percent above the age of eighty. This structural shift directly translates into a heightened prevalence of age related mobility challenges and incontinence. Consequently, there is a surging demand for bathroom environments that prioritize safety, ease of utilize, and dignity. This manifests in a robust market for accessible sanitary ware featuring higher seat heights, integrated grab bars, and non slip surfaces, alongside a rapidly expanding segment for adult incontinence products. The European market for adult disposable hygiene products is experiencing consistent growth, driven by a long-term, irreversible trfinish of an aging population requiring specialized care. The necessary is not merely for medical devices but for aesthetically integrated, home frifinishly solutions that support indepfinishent living. The expanding elderly demographic will compel both public and private hoapplying sectors to prioritize accessibility, transforming inclusive design from a specialized feature into an industest standard that reshapes the entire sanitary market.

The EU Renovation Wave Drives Replacement Cycles for Water Efficient Fixtures

The European Union’s ambitious Renovation Wave initiative is a powerful macroeconomic and policy-driven force that boosts the expansion of the Europe sanitary market. This initiative aims to fundamentally upgrade the continent’s aging building stock. The strategy tarobtains the renovation of thirty five million buildings by 2030, effectively doubling the current annual renovation rate. A core objective of these renovations is enhancing energy and resource efficiency, with water conservation being a critical component. Existing buildings, particularly those constructed before the 2000s, are often equipped with outdated sanitary resolvetures that consume excessive amounts of water. Modern low flow toilets, water saving faucets, and efficient displayerheads can reduce houtilizehold water consumption by a significant margin. This large scale, policy mandated refurbishment program creates a massive, predictable demand for new, compliant sanitary ware. The renovation wave is not just about aesthetics. It is a systemic push towards sustainability, directly linking building upgrades to the adoption of high performance, water efficient sanitary products. This government backed impetus provides a stable and growing market channel that transcfinishs typical cyclical economic fluctuations, ensuring a sustained baseline of demand for innovative and eco conscious sanitary solutions.

MARKET RESTRAINTS

Stringent and Evolving Regulatory Frameworks Increase Compliance Complexity

Rigorous and complex regulatory landscapes are a significant barrier to entest and a continuous operational challenge for established players, and thereby constrains the growth of the Europe sanitary market. Products must comply with a multi-layered framework including the Construction Products Regulation, which mandates CE marking for relevant products based on designated harmonized standards, such as those governing ceramic tiles. The Ecodesign for Sustainable Products Regulation establishes a framework for strengthening environmental performance requirements, including those for material durability, reparability, and water efficiency. Furthermore, the EU’s Green Public Procurement criteria set even higher benchmarks for public tfinishers. Navigating this intricate web of directives, regulations, and evolving standards requires substantial investment in testing, certification, and legal expertise. A single product line may necessary to be validated against dozens of specific technical parameters, and any amfinishment to these standards necessitates a costly and time consuming re certification process. This regulatory thicket not only increases the cost base for manufacturers but also slows down innovation cycles, as new designs must undergo extensive validation before reaching the market, thereby constraining agility and increasing time to market for novel solutions.

Acute Shortage of Skilled Plumbing and Installation Labor Constrains Market Realization

The severe and persistent shortage of qualified plumbers and bathroom fitters across the European Union is a critical barrier threatening to affect the growth potential of the Europe sanitary market. The European Commission has officially identified plumbing as one of forty two occupations facing acute labor shortages. This scarcity is driven by an aging workforce in the trades, a societal shift away from vocational education, and the demanding nature of the profession. The impact is profound: even with strong demand from renovation projects and new construction, the physical installation of sanitary systems is delayed or becomes prohibitively expensive. This labor gap creates a direct disconnect between product availability and actual market realization. Homeowners and contractors often face months long waiting lists for skilled installers, which can stall renovation decisions and dampen overall market activity. The problem is exacerbated by the increasing complexity of modern smart bathrooms and water efficient systems, which require a higher level of technical expertise to install correctly. The full potential of the high-finish and advanced sanitary market cannot be realized without a corresponding influx of trained professionals, regardless of market demand or policy support.

MARKET OPPORTUNITIES

Integration of Smart Technology Creates a New Value Proposition Beyond Hygiene

The convergence of the sanitary market with the Internet of Things and digital health opens the pathway for new opportunities for the Europe sanitary market. This shift is shifting products from passive resolvetures to active wellness platforms. The integration of smart technology into sanitary ware is creating a new category of products that offer value far beyond basic hygiene. Ininformigent toilets can now perform non invasive health monitoring, analyzing urine and stool for biomarkers that can indicate early signs of dehydration, urinary tract infections, or metabolic disorders. Smart displayers can precisely manage water temperature and flow for therapeutic purposes, while connected faucets can track handwashing compliance in healthcare or food service settings. This evolution is supported by a growing consumer interest in preventative health and personalized wellness data. The global market for smart bathrooms is expanding rapidly, and Europe, with its high disposable income and tech savvy urban populations, is a prime adopter. This shift allows manufacturers to shift up the value chain, offering subscription based health analytics services and creating sticky customer relationships. It transforms the bathroom from a utility room into a personal health hub, opening a vast new revenue stream and redefining the very purpose of sanitary products.

Circular Economy Models Offer a Pathway to Sustainable Growth and Brand Differentiation

The European Union’s unwavering commitment to a circular economy is a major strategic opportunity for forward-viewing sanitary brands and the Europe sanitary market. New, stringent ecodesign standards focutilized on durability and recyclability offer firms a unique opportunity to stand out through pioneering closed-loop models. This involves designing products from the outset for disassembly, applying mono materials or easily separable components, and establishing take back schemes for finish of life resolvetures. For instance, ceramic sanitary ware, traditionally destined for landfill, can be crushed and reutilized as aggregate in new ceramic production or in construction materials. Companies that invest in reverse logistics and material recovery infrastructure can secure a stable source of secondary raw materials, hedge against virgin material price volatility, and significantly reduce their environmental footprint. The European Commission is prioritizing the enhancement of product circularity and repairability as a key component of its industrial competitiveness policy, supported by sector-specific regulations and a focus on sustainable product design. Brands that successfully implement these models will not only gain a competitive advantage through cost savings and resource security but will also build powerful brand loyalty among an increasingly environmentally conscious European consumer base, turning sustainability from a cost center into a core driver of growth.

MARKET CHALLENGES

Volatility in Critical Raw Material Prices Threatens Profit Margins and Pricing Stability

The extreme volatility in raw material prices threatens the financial stability of the Europe sanitary market. The sector is heavily reliant on commodities such as copper for plumbing components, stainless steel for resolvetures and accessories, and specific clays and minerals for high quality ceramics. During 2025, the copper market experienced intense volatility and achieved record-breaking prices,, driven by severe supply limitations from major mining regions, trade-related inventory shifts, and accelerating demand from global electrification initiatives and artificial ininformigence infrastructure. Simultaneously, the European stainless steel market faced its own pressures from fluctuating scrap prices and energy costs, leading to unpredictable input expenses. This price instability builds it exceptionally difficult for manufacturers to forecast costs, manage inventory, and maintain stable pricing for their customers. Sudden spikes can quickly erode profit margins, especially for compacter firms with less bargaining power. The inability to pass on these costs immediately due to competitive pressures can lead to significant financial strain, forcing companies to either absorb losses or risk losing market share, thereby creating a constant state of financial uncertainty that hampers long term investment and strategic planning.

Persistent Inequalities in Sanitation Access Highlight a Fragmented Market Reality

Deep and persistent inequality in access to adequate sanitation facilities reveals a fragmented reality that poses a significant social and economic challenge to the Europe sanitary market. This is despite the region’s image of universal development. Access to modern infrastructure is widespread, yet a substantial minority continues to lack these benefits. According to Eurostat data for 2020, residents in the European Union living below the poverty line face a substantially higher risk of lacking basic indoor sanitation, such as a bath, displayer, or toilet, compared to the wealthier population. This disparity is not confined to the past. It persists in 2025, particularly affecting vulnerable groups such as the homeless, Roma communities, and residents in neglected rural or post industrial areas. This situation creates a dual market: one driven by premium innovation and sustainability, and another where the basic necessary for a functional, hygienic toilet remains unmet. Addressing this gap requires tarobtained social hoapplying policies and public investment, but the market itself struggles to provide affordable, durable solutions for these segments. This finishuring inequality not only represents a failure to achieve a fundamental human right but also limits the total addressable market for even the most basic sanitary products, creating a ceiling on overall market penetration and highlighting a profound social challenge that the industest alone cannot solve.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

5.57% |

|

Segments Covered |

By Product, Material, End-User, Distribution Channel, and By Countest |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

TOTO Ltd., Kohler Co., LIXIL Corporation (incl. American Standard, GROHE), Roca Sanitario S.A., Geberit AG, Hansgrohe SE, Villeroy & Boch AG, Duravit AG, Jaquar Group, Ideal Standard International, RAK Ceramics PJSC, Huida Sanitary Ware Co., Guangdong Faenza Ceramics, CERA Sanitaryware Ltd., Hindware Home Innovation Ltd., VitrA (Eczacıbaşı), Lecico Egypt, H & R Johnson (Prism Johnson), Oras Group, Colavene S.p.A., Globe Union Industrial Corp., Jabra Sanitary |

SEGMENTAL ANALYSIS

By Product Insights

The toilets and cisterns segment dominated the Europe sanitary market and accounted for a 42.7% share in 2025. The dominance of the segment is driven by its status as a non discretionary, core resolveture in every sanitation installation. The primary driver is the continent wide push for water conservation, which has built the replacement of older, inefficient models a regulatory and economic imperative. Modern dual flush and low volume cisterns can reduce per flush water consumption to as little as three liters, compared to the nine to twelve liters utilized by pre 2000 models. As per the European Environment Agency, residential toilets are responsible for nearly thirty percent of all indoor houtilizehold water utilize, creating them a prime tarobtain for efficiency upgrades. This focus is amplified by the EU’s Ecodesign Directive, which sets mandatory maximum flush volumes. Consequently, the renovation of Europe’s aging hoapplying stock, which includes over one hundred twenty million dwellings built before 1990, creates a vast and continuous replacement market. The sheer ubiquity of the product, combined with policy driven obsolescence of older units, ensures that this segment remains the bedrock of the entire sanitary industest.

The bidet segment is estimated to register the rapidest CAGR of 11.3% from 2026 to 2034 due to a confluence of health consciousness, sustainability awareness, and technological innovation. A primary catalyst is the growing consumer understanding of the hygiene and dermatological benefits of water cleansing over dry wiping, a sentiment strongly supported by medical professionals. This shift is particularly pronounced among younger demographics who view bidets as a modern wellness essential. Furthermore, the environmental argument is compelling. Environmental analysis indicates that toilet paper consumption in Western Europe contributes to significant deforestation and water pollution, prompting a gradual shift toward more sustainable alternatives. Integrated electronic bidet seats, which offer features like heated seats, warm air drying, and self cleaning nozzles, have transformed the category from a niche plumbing resolveture into a desirable smart home appliance, driving adoption far beyond its traditional strongholds in Southern Europe.

By Material Insights

The ceramic segment led the Europe sanitary market and held a significant share in 2025. The supremacy of the segment is attributed to a foundation of unmatched functional and aesthetic properties that align perfectly with consumer and installer expectations. Ceramic’s non porous, vitrified surface provides an impenetrable barrier against bacteria and stains, ensuring long term hygiene and ease of maintenance, a critical factor in a health conscious post pandemic era. High-quality ceramic and porcelain tiles provide exceptional, long-term durability for both residential and commercial applications, offering a high-value, lasting alternative to other flooring materials. The material’s versatility in manufacturing allows for a vast array of designs, from classic to ultra modern, while maintaining a premium, timeless feel. As per the European Ceramic Industest Association, the sector has also built significant strides in sustainability, reducing its average energy consumption per ton of product by over twenty five percent since 2005 through advanced kiln technologies and the utilize of alternative fuels, thereby addressing a key environmental concern without compromising on quality or performance.

The pressed metal segment is anticipated to witness the rapidest CAGR of 9.7% during the forecast period owing to a powerful trfinish towards industrial chic and minimalist design aesthetics in contemporary European bathrooms, particularly in urban apartments and boutique hospitality projects. Pressed metal resolvetures, often crafted from stainless steel or brass, offer a sleek, architectural view that contrasts sharply with traditional ceramics. Their appeal is further enhanced by their inherent strength and resistance to impact damage, creating them ideal for high traffic commercial environments like airports, offices, and public restrooms. A key driver is the material’s alignment with circular economy principles. Stainless steel, for instance, is one of the most recycled materials on the planet. This finish of life value, combined with its modern visual language and robust performance, positions pressed metal as the material of choice for designers and specifiers seeking a sustainable yet avant garde solution.

By End User Insights

The residential finish utilizer segment captured the majority share of 63.7% of the Europe sanitary market in 2025 becautilize of the market’s maturity, where new construction is a compacter contributor compared to the massive, ongoing cycle of home renovations and refurbishments. The primary engine of this segment is the European Union’s ambitious Renovation Wave strategy, which aims to upgrade the energy and resource efficiency of the continent’s building stock. Since a significant portion of a home’s water footprint originates in the bathroom, these renovations invariably include the replacement of outdated sanitary ware with modern, water saving alternatives. The average age of the European hoapplying stock is a critical factor. A significant portion of the residential building stock in the European Union was constructed before the 1980s, resulting in a widespread prevalence of dwellings that are energy inefficient and functionally outdated. This vast inventory of aging homes provides a deep and resilient demand base that insulates the residential segment from short term economic volatility.

The institutional finish utilizer segment is likely to experience the rapidest CAGR of 8.9% from 2026 to 2034. The rapid growth of the segment is propelled by a heightened and sustained focus on public health, infection control, and accessibility within government funded and managed facilities. Healthcare institutions, in particular, are undergoing a wave of modernization, with a mandate to install touchless, sensor operated faucets, automatic flush valves, and antimicrobial surface finishes to minimize cross contamination risks. Simultaneously, there is a major investment push in educational infrastructure across the continent. The European Investment Bank continued to prioritize the renovation and modernization of educational facilities across Europe, supporting projects focutilized on energy efficiency and sustainable infrastructure in schools and universities. These projects prioritize durable, vandal resistant resolvetures that are straightforward to clean and maintain, alongside full compliance with the EU’s stringent accessibility directives to ensure inclusive access for all students and staff, creating a robust and growing demand stream.

COUNTRY LEVEL ANALYSIS

Germany Sanitary Market Analysis

Germany was the top performer in the Europe sanitary market and held a share of 18.5% share in 2025. The dominance of the German market is driven by its world class manufacturing base, a culture of engineering excellence, and a highly developed renovation economy. German consumers exhibit a strong preference for high quality, durable, and technologically advanced products, which has fostered a domestic industest renowned for its precision and innovation. A key driver is the nation’s aggressive energy and water transition policies. The German Federal Environment Agency notes that average daily per capita water consumption has decreased significantly from previous decades, holding at a relatively low level due to improved technologies and greater consumer awareness of water conservation. This regulatory and cultural environment creates a fertile ground for premium, eco frifinishly sanitary solutions, solidifying Germany’s position as both a leading consumer and a global exporter of high finish bathroom systems.

France Sanitary Market Analysis

France was the second largest countest in the Europe sanitary market and accounted for a 14.2% share in 2025. The expansion of the French market is fuelled by a dynamic interplay between a rich heritage of design and a modern push for sustainability. The government-backed MaPrimeRénov program, which operates as a significant incentive for residential energy efficiency in France, continues to be a major driver for home renovations by providing financial support for insulation and heating upgrades, with a strong focus on decarbonization in 2024. This policy directly stimulates the replacement of old resolvetures with new, water saving models. Furthermore, France has a deeply ingrained cultural acceptance of bidets, a tradition that is now being revitalized through the adoption of advanced electronic bidet seats. The French National Institute of Statistics and Economic Studies notes a steady increase in houtilizehold spfinishing on home improvement, with the bathroom being a focal point for investments that blfinish comfort, hygiene, and aesthetic appeal, thus sustaining a robust and evolving market.

United Kingdom Sanitary Market Analysis

The United Kingdom is another key player in the Europe sanitary marketdue to its mature hoapplying stock and a strong do it yourself culture, which influences product distribution and design preferences. A major factor shaping current demand is the urgent necessary to address the nation’s aging infrastructure. A very high proportion of the residential hoapplying stock across England and Wales consists of older, traditionally built properties erected before the mid-sixties, resulting in a substantial volume of homes that necessitate significant energy efficiency and modern amenity upgrades. This is compounded by increasingly stringent water scarcity regulations, particularly in the South East of England, which is officially classified as an area of serious water stress by the Environment Agency. These pressures are accelerating the adoption of low flow toilets and water efficient taps, driving a steady replacement cycle that forms the backbone of the UK’s sanitary market activity.

Italy Sanitary Market Analysis

Italy grew steadily in the Europe sanitary market owing to its global reputation for design excellence and craftsmanship. Italian manufacturers are synonymous with luxury bathroom aesthetics, exporting their high finish ceramic and faucet collections worldwide. Domestically, the market is driven by a strong renovation culture where the bathroom is seen as a key space for personal expression and value addition to property. The Italian National Institute of Statistics emphasizes that in 2024, renovations for energy efficiency, such as upgrading heating systems and insulation, are a dominant focus of residential spfinishing in Italy, driven by environmental incentives and older hoapplying stock. This focus on design and quality, coupled with a growing domestic interest in wellness oriented features like hydrotherapy bathtubs and smart displayers, ensures that Italy remains a trfinishsetter and a high value market within the European landscape, where style and function are inextricably linked.

Spain Sanitary Market Analysis

Spain is likely to expand in the Europe sanitary market during the forecast period. The Spanish market is currently experiencing a strong recovery, fueled by a resurgence in both residential construction and tourism related commercial development. A key driver is the countest’s acute vulnerability to climate modify and prolonged droughts, which has placed water conservation at the top of the national agfinisha. The Spanish Ministest for Ecological Transition has implemented strict regional regulations mandating the utilize of ultra low consumption resolvetures in all new builds and major renovations. This policy framework has created a powerful incentive for the adoption of dual flush toilets and aerated faucets. Additionally, the booming short term rental and hotel sector, catering to a record number of international tourists, is investing heavily in modern, stylish, and efficient bathroom upgrades to meet guest expectations, providing a significant boost to the commercial segment of the market.

COMPETITIVE LANDSCAPE

The competitive landscape of the Europe sanitary market is characterized by a dynamic interplay between established global giants and agile regional specialists. The market is highly consolidated at the premium finish, where a handful of major players like Geberit, LIXIL, and Roca dominate through their strong brand equity, extensive distribution networks, and continuous innovation in design and technology. However, the mid and lower segments are more fragmented, with numerous local and national brands competing on price and specific regional preferences. This intense competition drives a relentless focus on differentiation, pushing all participants to invest heavily in research and development for water saving features, smart connectivity, and sustainable manufacturing processes. The entest barriers are high due to the necessary for significant capital investment, compliance with complex regulations, and the necessity of building long term relationships with plumbers and distributors, which collectively shape a sophisticated and challenging competitive environment.

KEY MARKET PLAYERS

A few of the dominating players in the Europe sanitary market are

- TOTO Ltd.

- Kohler Co.

- LIXIL Corporation (incl. American Standard, GROHE)

- Roca Sanitario S.A.

- Geberit AG

- Hansgrohe SE

- Villeroy & Boch AG

- Duravit AG

- Jaquar Group

- Ideal Standard International

- RAK Ceramics PJSC

- Huida Sanitary Ware Co.

- Guangdong Faenza Ceramics

- CERA Sanitaryware Ltd.

- Hindware Home Innovation Ltd.

- VitrA (Eczacıbaşı)

- Lecico Egypt

- H & R Johnson (Prism Johnson)

- Oras Group

- Colavene S.p.A.

- Globe Union Industrial Corp.

- Jabra Sanitary

Top Players In The Market

- Geberit AG is a leading force in the European sanitary market, renowned for its integrated plumbing and bathroom systems. The company’s strength lies in its comprehensive portfolio that spans from concealed cisterns and installation frames to high finish ceramic ware and smart displayer systems. To fortify its position, Geberit has consistently invested in expanding its production capacity within Europe and has intensified its focus on digital solutions, such as its GROHE Sense water security system, which aligns with the growing demand for smart and secure home technologies across the continent.

- LIXIL Corporation, through its prominent European brands like GROHE and American Standard, holds a significant presence by blfinishing German engineering precision with global design sensibilities. The company has been actively strengthening its market foothold by launching innovative, water saving products tailored to European regulations.

- Roca Sanitario S A is a cornerstone of the European sanitary industest, celebrated for its design led approach and extensive product range. The company has deep roots across Southern Europe and has been strategically expanding its premium and ininformigent bathroom offerings.

Top Strategies Used By The Key Market Participants

Key players in the Europe sanitary market are primarily deploying a triad of strategies to maintain and expand their competitive edge. First, they are heavily investing in product innovation, particularly in developing water efficient and smart bathroom solutions that comply with stringent EU ecodesign regulations. Second, strategic mergers and acquisitions are being utilized to consolidate market presence, acquire new technologies, and achieve economies of scale, as evidenced by the major acquisition of Ideal Standard. Third, companies are intensifying their focus on sustainability by pioneering circular economy models, utilizing recycled materials in production, and designing products for longevity and reparability to meet the demands of an increasingly environmentally conscious consumer base.

MARKET SEGMENTATION

This research report on the Europe sanitary market is segmented and sub-segmented into the following categories.

By Product Type

- Toilets & Cisterns (Water Closets)

- Wash Basins & Sinks (incl. Pedestal Basins)

- Bathtubs & Whirlpool Tubs

- Urinals

- Bidets

- Other Products (such as ceramic soap trays, soap dispensers, etc.)

By Material

- Ceramic

- Pressed Metal

- Acrylic & Plastics

- Solid Surface & Composite

By End-User

- Residential (New-build and Renovation)

- Commercial (Hospitality, Offices, Retail)

- Institutional (Healthcare, Education, Public)

By Distribution Channel

- B2C/Retail

- Multi-brand Stores

- Exclusive Brand Outlets

- Local Hardware Stores

- Online

- B2B/Project (developers, architects, interior designers, contractors, etc.)

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply