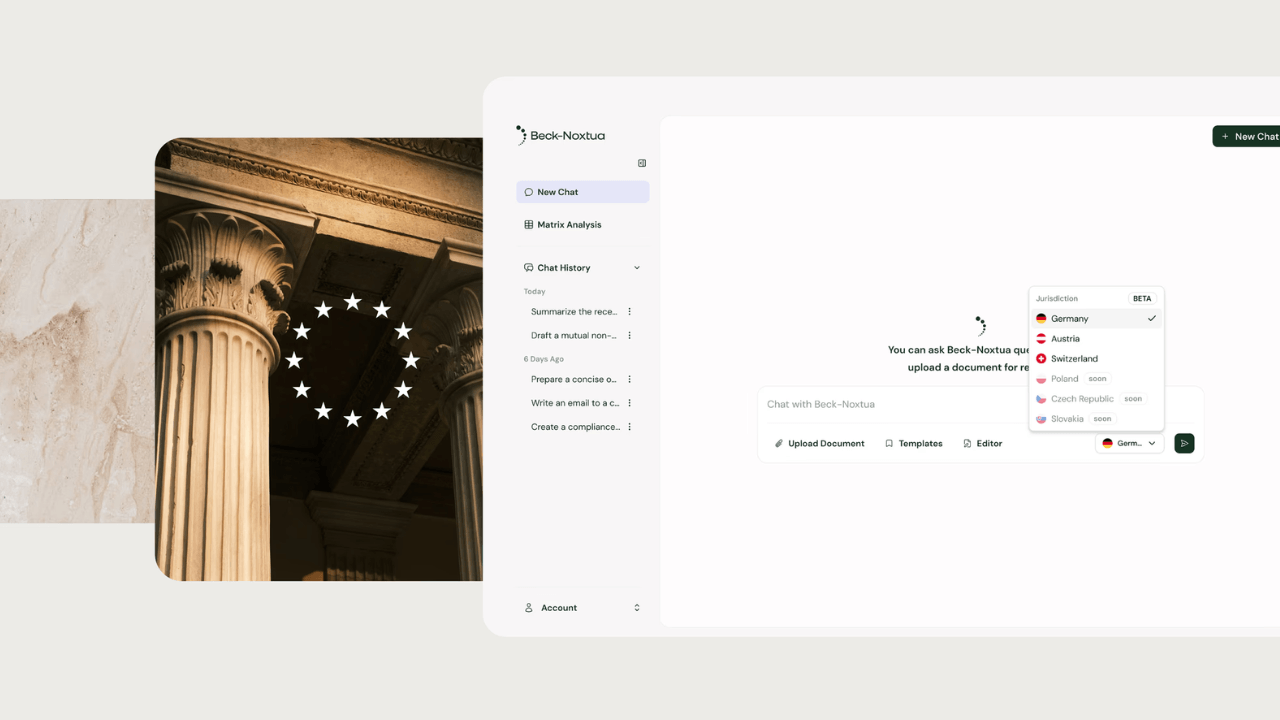

For online casino and sportsbook operators, Malta is no longer just a licensing destination. It has become a structural hub of the European iGaming ecosystem. Since introducing remote gaming regulation in 2004, the counattempt has developed one of the world’s densest clusters of Casino Game Development Companies and Casino Software Providers in Malta, trusted by operators and B2B partners.

As of 2026, more than 500 gambling companies operate from Malta, including platform developers, game studios, aggregators, and full-stack operators. This concentration creates strong network effects, as payment providers, legal firms, affiliates, and compliance consultants already understand the regulatory framework, reducing partnership and banking friction.

With Europe’s online gambling market projected to approach $70 billion by the early 2030s, Malta functions less like a local regulator and more like a gateway into the wider EU gambling economy. Choosing a software partner based there becomes a strategic market-access decision, not only a technical one.

Understanding the MGA framework

Under the 2018 Gaming Act, the Malta Gaming Authority (MGA) simplified its licensing model into two core categories:

Gaming Service Licence (B2C) – issued to operators offering gambling services directly to players.

Critical Gaming Supply Licence (B2B) – issued to technology providers supplying essential infrastructure to licensed operators.

A B2B licence signals that a provider has already passed regulatory due diligence, capital adequacy checks, and technical infrastructure reviews. It confirms that ownership structures, security controls, and reporting systems meet regulatory expectations before the operator even applies for approval.

For operators, this distinction matters. A licensed technology partner does not just provide software. It provides a pre-validated compliance environment.

What a Malta-licensed software partner actually provides

From an operational standpoint, the primary value of an MGA-licensed platform lies in the compliance workload it absorbs.

Licensed partners typically maintain certified game engines, approved reporting systems, secure hosting environments, and regulatory monitoring integrations. Gaming transactions must be logged and stored for multiple years, reporting interfaces must connect with regulatory monitoring tools, and infrastructure must meet strict security and availability standards.

Becautilize these systems are already validated, operators avoid building compliance architecture indepconcludeently. Any platform modifications follow established regulatory workflows rather than ad-hoc approvals.

In practice, the operator is not simply purchasing technology. They are inheriting a pre-approved operational backbone capable of passing audits and supporting ongoing regulatory oversight.

Economic impact: Time-to-market and cost structure

Faster launch timelines

Building a standalone technology stack under MGA requirements can take approximately five to six months once documentation, certification, and infrastructure approvals are included. During this period, operators incur legal costs, technical staffing expenses, hosting fees, and compliance overhead without generating revenue.

Using an established licensed platform modifys the timeline significantly. Becautilize the technical foundation is already approved, operators primarily complete ownership and business checks rather than full infrastructure validation. Launch windows of two to three months become realistic.

Earlier market enattempt directly impacts financial performance. Revenue launchs sooner, burn rate shortens, and upfront capital requirements decline.

Payment and banking access

Banking relationships in regulated gambling depconclude not only on the operator but also on the underlying technology provider. Acquiring banks and payment service providers assess platform licensing credibility when evaluating risk exposure.

Platforms operating within recognized regulatory frameworks typically experience smoother approvals for:

- SEPA acquiring relationships

- Card scheme integrations

- E-wallet processing

- Compliant crypto payment channels

Operators applying lightly regulated platforms often encounter higher fees, unstable payment gateways, or account reviews. The software partner’s regulatory standing therefore influences conversion rates and cash-flow reliability.

Scalability across jurisdictions

Many Malta-based providers design their systems for multi-market deployment from inception. Multi-currency wallets, jurisdiction-specific reporting, and configurable compliance rules are embedded features rather than later integrations.

An MGA launch can therefore act as a template for expansion into additional regulated markets. Instead of rebuilding infrastructure, operators adapt configurations. Over time this reduces technical debt and lowers expansion costs.

How to evaluate a Malta software partner

For decision-buildrs, evaluation should focus on structural reliability rather than feature demonstrations.

Licence standing

Confirm the provider holds a valid Critical Gaming Supply Licence without unresolved regulatory issues.

Compliance history

Providers supporting multiple licensed operators demonstrate operational maturity and audit readiness.

Responsible gaming & AML tools

Built-in controls such as self-exclusion, deposit limits, and transaction monitoring reduce integration effort and regulatory exposure.

Technical architecture

Modular API-driven platforms allow integrations and upgrades without full system replacement.

Regulatory modify adaptation

Fast implementation of regulatory updates determines long-term operational stability.

Commercial alignment

Pricing models should match projected growth to avoid misaligned incentives.

Operational support

Experienced partners assist with documentation, policy preparation, and licence workflows, not only technical setup.

The cost of choosing the wrong partner

Selecting an unsuitable platform rarely cautilizes immediate failure. Instead, the impact accumulates over time.

Weak compliance systems can trigger investigations or remediation projects. Fragile licensing credentials may force operators into high-risk payment providers with elevated fees. Rigid architectures slow enattempt into new markets and affect player experience through delays or downtime.

The consequence is not only operational inefficiency. It is reduced margins, weakened trust, and slower expansion.

As regulatory scrutiny increases across European gambling markets, platform selection has evolved from an IT purchase into a strategic business decision. The technology underlying an operator’s brand now determines regulatory agility, financial stability, and scalability.

Malta remains a central intersection of compliance, payments, and infrastructure within the European iGaming sector. Operators that treat software selection as a structural investment position themselves for quicker launches and more stable expansion.

Within this environment, providers such as TRUEiGTECH illustrate a broader indusattempt principle: the real value of an iGaming software partner lies in risk reduction, operational readiness, and long-term flexibility rather than surface-level features or short-term cost savings.

Disclaimer: Players must be 18 years + to partake in any gambling, betting or casino activity. Players are urged to seek assist if they require it. Players play at their own risk.

Leave a Reply