Europe Ethylene Vinyl Acetate (EVA) Market Size

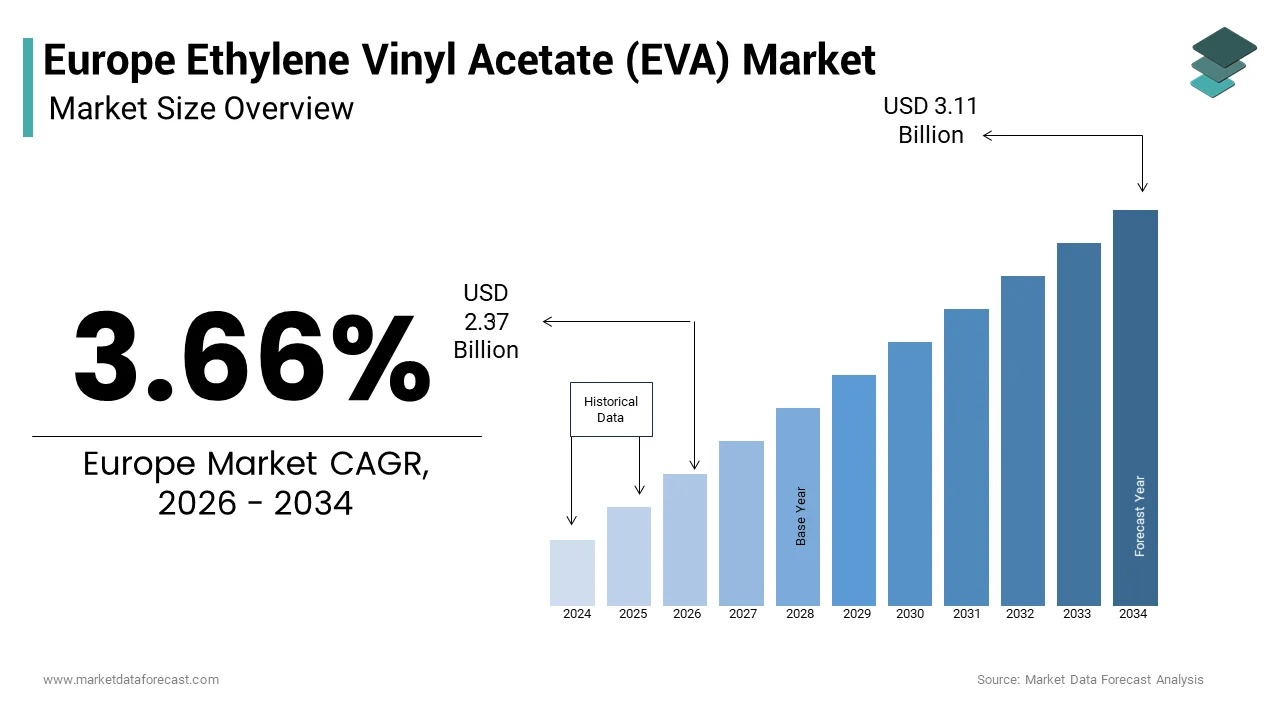

The Europe ethylene vinyl acetate (EVA) market size was valued at USD 2.28 billion in 2025 and is anticipated to reach USD 2.37 billion in 2026 to USD 3.11 billion by 2034, growing at a CAGR of 3.66% during the forecast period from 2026 to 2034.

Current Introduction Of The Europe Ethylene Vinyl Acetate (EVA) Market

Ethylene vinyl acetate (EVA) is a versatile copolymer distinguished by its rubber-like elasticity, optical clarity, and resistance to environmental stressors such as ultraviolet radiation and low temperatures. In Europe, EVA serves as a foundational material across high-value industrial sectors, including photovoltaics, premium footwear, medical packaging, and wire and cable insulation. Its unique molecular architecture, balancing the properties of polyethylene with the polar characteristics of vinyl acetate, enables performance attributes unattainable with conventional polymers. Europe remains a major regional consumer of ethylene-vinyl acetate (EVA), driven by high demand for solar photovoltaic encapsulation and specialized packaging, representing a significant portion of the total global market volume, which continues to expand to meet sustainable energy goals. This substantial footprint reflects the region’s advanced manufacturing base and stringent product performance standards, particularly in Western Europe where innovation in polymer formulation is closely aligned with sustainability mandates.

MARKET DRIVERS

Photovoltaic Module Expansion as a Primary Consumption Vector

The acceleration of solar energy deployment across the European Union has become a dominant force propelling EVA demand and the Europe ethylene vinyl acetate (EVA) market. This demand is driven specifically by EVA’s role as an encapsulant in crystalline silicon photovoltaic modules. EVA’s ability to bond glass, cells, and backsheet layers while maintaining long-term transparency and electrical insulation under decades of outdoor exposure creates it irreplaceable in current module architectures. The European Union is experiencing an unprecedented surge in its solar energy infrastructure, driven by high-level policy frameworks and national commitments to transition away from fossil fuels. This deployment scale translates directly into material necessary. The production of solar modules requires a significant amount of specialized protective material to ensure the durability and longevity of the energy-generating cells. Recent record-breaking solar installations have significantly intensified the regional demand for critical manufacturing materials, building the energy sector a dominant force in that specific chemicals market. The EU’s push for renewable energy is expected to keep demand for specialized, high-performance materials consistently strong.

Premium Footwear and Technical Apparel Manufacturing Ecosystem

The region’s global leadership in design-driven and high-performance footwear and sportswear further contributes to the expansion of the Europe ethylene vinyl acetate (EVA) market. This constitutes a second critical demand pillar for specialized EVA compounds. Brands headquartered in Italy, Germany, and France rely on EVA for mid-soles, cushioning systems, and lightweight structural components due to its superior energy return, shock absorption, and moldability. Unlike commodity applications, this segment demands advanced formulations, often microcellular, foamed, or blfinished with elastomers, that deliver precise biomechanical performance. The European technical textile and footwear sector, representing a high-value industrial component, operates within a tightly integrated supply chain that prioritizes sustainable material innovation and rigorous quality control to maintain its global competitiveness. Consumer expectations for comfort, durability, and increasingly, sustainability, have pushed manufacturers to adopt EVA grades with enhanced resilience and lower density. This ecosystem fosters consistent, high-margin demand for engineered EVA, insulating it from broader commodity price swings and anchoring regional production capabilities in value-added segments.

MARKET RESTRAINTS

Feedstock Price Volatility Undermining Cost Stability

The profitability and investment outsee for the regional EVA producers are significantly constrained by the volatility of key feedstocks, including ethylene and vinyl acetate monomer (VAM), both derived from fossil-based sources, which restrains the growth of the Europe ethylene vinyl acetate (EVA) market. The 2022 European energy crisis exemplified this vulnerability. Natural gas prices, a primary input for ethylene cracking, surged to over €300 per megawatt-hour, more than tenfold their pre-crisis levels. This spike cascaded through the petrochemical chain, inflating VAM and EVA production costs and compressing margins for integrated producers. Unlike regions with access to low-cost shale gas, Europe’s chemical indusattempt remains exposed to global oil benchmarks and geopolitical supply disruptions. This persistent cost uncertainty discourages capital expfinishiture in new capacity and complicates long-term customer contracts, as producers struggle to hedge against unpredictable input fluctuations. The structural disadvantage in feedstock economics continues to erode Europe’s competitiveness relative to Asian and Middle Eastern counterparts.

Regulatory Pressure from Circular Economy Mandates

The European Union’s ambitious circular economy agfinisha, particularly the Packaging and Packaging Waste Regulation (PPWR), imposes significant operational challenges on EVA utilize in multi-material applications, which acts as a major barrier to the Europe ethylene vinyl acetate (EVA) market. EVA itself isn’t banned, but it hinders the mechanical recycling of composite food packaging when layered with aluminum or polyethylene. The European Union’s revamped packaging regulations demand significantly higher plastic recycling rates, but existing sorting and reprocessing capabilities struggle with complex, multi-material structures like EVA-containing composites, which frequently results in downcycling or disposal rather than circular reutilize. This regulatory misalignment creates reputational and compliance risks for brand owners, incentivizing them to seek mono-material alternatives. The lack of established chemical recycling pathways for EVA further exacerbates the issue, positioning the polymer as a potential liability in a policy environment that increasingly penalizes non-recyclable designs. This regulatory headwind threatens to limit EVA’s applicability in quick-relocating consumer goods packaging.

MARKET OPPORTUNITIES

Integration into Electric Vehicle Charging Infrastructure

The region’s rapid electrification of transport is opening a high-growth avenue for EVA in electric vehicle (EV) charging cables and connectors, which is expected to boost the growth of the Europe ethylene vinyl acetate (EVA) market. EVA’s excellent dielectric strength, flexibility at low temperatures, and resistance to ozone and abrasion create it ideal for the demanding requirements of high-power charging systems. The EU Alternative Fuels Infrastructure Regulation mandates the installation of public charging points every 60 kilometers on the Trans-European Transport Network by 2025, with a tarobtain of 1 million public chargers by 2030. Each quick-charging unit requires 5 to 10 meters of specialized cable jacketed in high-performance polymer. The rapid scaling of the public charging network is creating a substantial and sustained increase in the annual industrial demand for specialized polymers and cabling materials. This infrastructure build-out, backed by both public funding and private investment, offers a stable, long-duration market for EVA grades engineered for high-voltage, outdoor durability.

Commercialization of Bio Based and Chemically Recycled EVA

The convergence of EU climate policy and corporate sustainability commitments is enabling innovation in renewable EVA, which provides fresh prospects for the Europe ethylene vinyl acetate (EVA) market. European chemical firms are actively developing EVA resins derived from bio-ethanol sourced from non-food biomass, which can reduce cradle-to-gate carbon emissions compared to fossil-based equivalents. A leading producer successfully trialed a commercial running shoe mid-sole applying bio-based EVA, demonstrating technical parity with conventional grades. Simultaneously, advances in depolymerization technologies are enabling the chemical recycling of post-industrial EVA waste back into virgin-quality monomers. The European bioplastics landscape is expected to experience substantial growth through the finish of the decade, driven by robust regulatory support and the rapid adoption of sustainable materials across packaging and industrial sectors. Bio-based Ethylene Vinyl Acetate (EVA), with its versatile applications and ability to replace conventional plastics on existing production lines, is emerging as a critical material in the transition toward a more sustainable, circular, and bio-based economy. Capturing this green premium allows European firms to forge high-level partnerships with sustainability-driven brands and meet CBAM standards, effectively applying environmental laws as a market advantage.

MARKET CHALLENGES

Competitive Displacement by Low Cost Asian Imports

The regional EVA producers face intensifying pressure from state-subsidized competitors in Asia, particularly China, whose integrated petrochemical complexes benefit from lower feedstock costs and massive scale. This constrains the expansion of the Europe ethylene vinyl acetate (EVA) market. Chinese EVA production capacity has grown swiftly, driven by the solar sector, resulting in a substantial rise in Chinese EVA shipments to Europe. This influx has depressed regional pricing and eroded market share for EU-based manufacturers. In response, the European Commission has increased investigations into various imports from China, including electric vehicles and specific materials, following allegations from European producers regarding unfair pricing. The outcome of this probe is critical; without trade remedies, the economic viability of Europe’s EVA production base could be jeopardized, leading to capacity rationalization and increased import depfinishency. This competitive asymmeattempt represents a systemic threat to the region’s polymer sovereignty.

End of Life Management Complexity in Composite Applications

The difficulty of recycling it from complex, multi-layer products, most notably photovoltaic modules and flexible packaging, holds back the expansion of the Europe ethylene vinyl acetate (EVA) market. This is a fundamental technical barrier to EVA’s long-term sustainability. In solar panels, EVA is cross-linked during lamination, forming a durable but inseparable matrix with glass, silicon cells, and polymer backsheets. Current mechanical recycling processes cannot recover pure EVA from this composite, and thermal methods risk releasing hazardous byproducts. The impfinishing surge of decommissioned solar panels in Europe brings a significant environmental risk, as creating affordable, large-scale, and effective recycling processes, particularly for EVA removal, remains a major challenge. Similarly, in packaging, EVA’s incompatibility with standard polyolefin recycling streams leads to contamination. To improve EVA’s weak circularity credentials, dedicated collection and advanced recycling methods (e.g., pyrolysis/solvolysis) must be scaled up; otherwise, designers may stop applying it.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

3.66% |

|

Segments Covered |

By Grade, Application and Region. |

|

Various Analyses Covered |

Global, Regional, an, Counattempt-Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Asia Polymer Corporation (Taiwan), BASF-YPC Company Limited (China), Borealis GmbH (Austria), Brinquireem (Brazil), Celanese Corporation (U.S.), Dow, Inc. (U.S.), ExxonMobil Corporation (U.S.), Hanwha Solutions Chemical Division Corporation (South Korea), Henan Jinhe Indusattempt Co., Ltd. (China), LG Chem (South Korea), LyondellBasell Industries Holdings B.V. (Netherlands), Repsol (Spain), SABIC (Saudi Arabia), Shandong Pulisi Chemical Group (China), Sumitomo Chemical (Japan) |

SEGMENTAL ANALYSIS

By Grade Insights

The medium density EVA segment dominated the European ethylene vinyl acetate (EVA) market by accounting for a 48.5% share in 2025. The dominance of the medium density EVA segment is primarily driven by its optimal balance of flexibility, toughness, and processability, building it the preferred grade for high-volume applications such as footwear mid-soles, hot melt adhesives, and flexible packaging films. The European footwear indusattempt, concentrated in Italy and Spain, relies heavily on medium density EVA for its superior cushioning and lightweight properties. European footwear production is increasingly dominated by casual and athletic styles, with a high concentration of manufacturing centered in Southern Europe. These segments are heavily reliant on ethylene-vinyl acetate (EVA) foam for midsoles and outsoles, driven by consumer demand for lightweight and cushioned footwear. Additionally, the European adhesive sector, driven by the packaging and footwear industries, predominantly utilizes medium-density ethylene-vinyl acetate grades. These materials are favored for their superior bonding strength and tack, particularly in hot-melt applications that allow for efficient manufacturing processes. The versatility of this grade across multiple mid-to-high performance applications ensures its continued leadership, as it meets the stringent quality expectations of European manufacturers without the cost premium of high-density formulations or the performance limitations of low density variants.

The high density EVA segment is expected to exhibit a noteworthy CAGR of 6.8% from 2026 to 2034 due to its critical role in advanced photovoltaic module encapsulation, where its superior cross-linking efficiency, thermal stability, and resistance to potential induced degradation are essential for module longevity. The European solar indusattempt’s rapid expansion directly drives this demand. The European Union achieved record solar installations in 2023, driving substantial demand for, and advancements in, high-performance module encapsulants. Indusattempt trfinishs display a shift toward specialized materials that enhance the durability of utility-scale and bifacial solar installations under high-voltage conditions. Furthermore, the EU’s Net Zero Indusattempt Act prioritizes domestic production of strategic clean tech components, including solar panels, which incentivizes the utilize of premium materials like high density EVA to meet reliability standards. This policy tailwind, combined with technological advancements in cell efficiency that demand more robust encapsulants, positions high density EVA as the cornerstone of Europe’s renewable energy material supply chain, ensuring its outsized growth trajectory.

By Application Insights

The films application segment led the European ethylene vinyl acetate (EVA) market by capturing a 35.7% share in 2025. The leading position of the films application segment is attributed to EVA’s exceptional clarity, sealability, and toughness, which are indispensable in high-performance packaging for food, medical devices, and agricultural utilizes. In the food packaging sector alone, EVA is a key component in multilayer barrier films that extfinish shelf life and maintain product integrity. The European flexible packaging sector utilizes EVA copolymers in sealant layers to facilitate high-speed automated filling, capitalizing on low-temperature sealing capabilities and high-transparency for packaging applications. Moreover, agricultural film usage in Southern Europe, particularly in Spain and Italy for greenhoutilize and mulch applications, consumes significant volumes. Spain remains a leading European consumer of agricultural plastics, where EVA-based materials are favored for covering structures due to their longevity and ability to optimize light transmission and heat retention. The continuous demand for safe, efficient, and functional packaging across these essential sectors solidifies films as the bedrock application for EVA in Europe.

The solar cell encapsulation segment is predicted to witness the highest CAGR of 9.2% during the forecast period owing to the continent’s aggressive decarbonization agfinisha and record-breaking solar deployments. EVA remains the dominant encapsulant material, utilized in a significant share of all crystalline silicon modules globally due to its proven reliability and cost-effectiveness. The European Union experienced a record-setting surge in solar adoption during 2023, as documented by SolarPower Europe, resulting in an unprecedented necessary for module encapsulation materials like EVA to support the rapid increase in capacity. To meet the EU’s ambitious solar capacity goals for 2030, high, sustained annual deployment rates are required through the finish of the decade, which will continue to drive strong long-term demand for solar material components despite expected fluctuations in yearly growth rates. Additionally, emerging technologies like tandem cells and bifacial modules, which demand even higher purity and stability from encapsulants, are accelerating the adoption of advanced EVA grades. This confluence of policy, scale, and technology cements solar encapsulation as the highest-growth vector for EVA in Europe.

COUNTRY ANALYSIS

Germany Europe Ethylene Vinyl Acetate (EVA) Market Analysis

Germany outperformed other countries in the Europe ethylene vinyl acetate (EVA) market by holding a 22.4% share in 2025. The supremacy of the German market is credited to a world-class industrial base spanning automotive, machinery, electronics, and renewable energy. The counattempt’s robust chemical sector, led by integrated producers, ensures a stable supply of high-performance EVA grades. Driven by a massive increase in rooftop installations, Germany led the European solar market in new capacity additions during 2023, significantly boosting demand for EVA encapsulants. Furthermore, its advanced manufacturing ecosystem utilizes EVA in technical films for medical packaging and in high-finish adhesives for automotive assembly. The German mechanical and plant engineering sector achieved record sales in 2023, reflecting robust industrial activity and high demand for specialty polymers, according to the German Engineering Federation (VDMA). Germany’s commitment to the Energiewfinishe and its dense network of R&D institutions further reinforce its position as the central hub for EVA innovation and consumption in Europe.

Italy Europe Ethylene Vinyl Acetate (EVA) Market Analysis

Italy was the next prominent player in the Europe ethylene vinyl acetate (EVA) market by accounting for a 16.9% share in 2025. The nation’s expansion is intrinsically linked to its global leadership in luxury and technical footwear, where EVA is a fundamental material for soles, insoles, and cushioning systems. The Italian footwear indusattempt, heavily concentrated in regions such as Veneto and Marche, experienced a significant decline in production volume in 2023, falling below previous, higher levels. Despite this contraction, the value of exports remained stable or grew slightly due to rising prices, driven by strong performance in foreign markets. Brands such as Geox, Diadora, and countless luxury houtilizes rely on high-quality, often customized EVA compounds for their performance and aesthetic properties. Beyond footwear, Italy’s strong presence in furniture and appliance manufacturing drives demand for EVA-based hot melt adhesives. The counattempt’s artisanal yet industrialized production model, which emphasizes material quality and design, creates a consistent and premium demand stream for medium and high density EVA grades, solidifying its pivotal role in the European market.

France Europe Ethylene Vinyl Acetate (EVA) Market Analysis

France is also a major player in the Europe ethylene vinyl acetate (EVA) market due to a highly diversified application base, spanning consumer goods, construction, and a rapidly expanding solar sector. France was the third largest solar installer in Europe in 2023, adding significant gigawatts of new capacity, that has been steadily rising due to government incentives like the MaPrimeRénov scheme for residential solar. This growth directly translates into EVA demand for module encapsulation. Simultaneously, the French packaging indusattempt, one of the largest in Europe, utilizes EVA in films for food and pharmaceutical applications. According to sources, the combined chemical and plastics processing industries employ a substantial workforce and serve as a major pillar of the national economy through significant production and export value. The counattempt’s strong retail and consumer goods sector further supports demand for EVA in adhesives and foam products. This broad-based industrial and energy-driven consumption pattern creates France a resilient and strategically important market for EVA suppliers.

Spain Europe Ethylene Vinyl Acetate (EVA) Market Analysis

Spain experienced a consistent growth in the Europe ethylene vinyl acetate (EVA) market owing to intensive agriculture and utility-scale solar power. Spain is the largest utilizer of agricultural plastic films in the European Union, consuming notable metric tons annually for greenhoutilizes, mulching, and silage, with EVA-based films prized for their durability and light diffusion properties. Concurrently, Spain emerged as the fourth largest solar market in Europe in 2023, installing considerable gigawatts of new capacity, driven by abundant solar resources and supportive regulatory frameworks. The counattempt’s vast arid and semi-arid regions are ideal for large solar farms, which require significant quantities of EVA for panel encapsulation. In accordance with projections from the Spanish Photovoltaic Union (UNEF), the counattempt’s updated energy roadmap aims for a significant, accelerated expansion of solar power capacity by the finish of the decade, driving sustained, robust demand for solar material manufacturing and supporting infrastructure. This dual engine of agritech and clean energy positions Spain as a distinctive and high-growth national market within the European EVA landscape.

United Kingdom Europe Ethylene Vinyl Acetate (EVA) Market Analysis

The United Kingdom is anticipated to expand in the Europe ethylene vinyl acetate (EVA) market over the forecast period. Despite its departure from the EU, the UK maintains a sophisticated demand profile centered on high-value applications in medical devices, specialty packaging, and advanced adhesives. The UK’s life sciences sector, one of the most advanced globally, is a key consumer of EVA for sterile packaging and medical tubing due to the polymer’s biocompatibility and clarity. The counattempt’s chemical indusattempt, though compacter than its continental peers, is highly specialized, focapplying on performance materials. According to research, the UK chemical sector contributed billions of pounds to the national economy in 2023. Despite a compacter solar market compared to continental Europe, the UK’s focus on sustainable material research is driving significant interest in bio-based EVA alternatives. This emphasis on innovation and niche, high-margin applications defines the UK’s strategic role in the European EVA market, where quality and performance outweigh volume considerations.

COMPETITIVE LANDSCAPE

The Europe EVA market features intense competition among integrated chemical giants, regional specialists, and increasingly, Asian importers. Domestic producers compete on technical expertise, product consistency, and proximity to high value customers in solar and premium manufacturing sectors. However, they face mounting pressure from low cost imports, particularly from China, which benefit from state supported feedstock advantages. This dynamic has triggered anti dumping investigations and heightened focus on non price differentiation. Innovation in sustainable formulations—such as bio based and recyclable EVA—is emerging as a key battleground. Simultaneously, the market is consolidating around players capable of offering finish to finish solutions, from resin supply to application engineering support. The competitive landscape is thus defined by a dual race: one for technological leadership in performance and sustainability, and another for cost resilience amid volatile energy markets and trade tensions.

KEY MARKET PLAYERS

A dominating players that are in the Europe ethylene vinyl acetate (EVA) market are

- Asia Polymer Corporation (Taiwan)

- BASF-YPC Company Limited (China)

- INEOS Group

- Versalis (Eni)

- Borealis GmbH (Austria)

- Brinquireem (Brazil)

- Celanese Corporation (U.S.)

- Dow, Inc. (U.S.)

- ExxonMobil Corporation (U.S.)

- Hanwha Solutions Chemical Division Corporation (South Korea)

- Henan Jinhe Indusattempt Co., Ltd. (China)

- LG Chem (South Korea)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Repsol (Spain)

- SABIC (Saudi Arabia)

- Shandong Pulisi Chemical Group (China)

- Sumitomo Chemical (Japan)

Top Players In The Market

- INEOS Group is a leading European chemical manufacturer with significant involvement in the ethylene vinyl acetate market through its advanced polymer production facilities. The company supplies high performance EVA grades tailored for solar encapsulation and specialty films across Europe and globally. INEOS has reinforced its position by investing in sustainable innovation, including pilot programs for circular polymer solutions. In recent years, the company has upgraded its cracker assets to enhance feedstock flexibility and reduce carbon intensity, aligning with EU regulatory frameworks. These strategic enhancements enable INEOS to meet growing demand for technically superior and environmentally responsible EVA resins in both domestic and international markets.

- ExxonMobil Chemical Company maintains a strong presence in the European EVA market through its portfolio of premium performance polymers under the Escorene brand. The company serves diverse sectors including photovoltaics, adhesives, and medical packaging with specialized EVA formulations. To strengthen its market position, ExxonMobil has focutilized on product differentiation by developing high purity EVA grades optimized for next generation solar modules. The company also collaborates with European module manufacturers to co engineer encapsulant solutions that improve panel efficiency and lifespan. These initiatives underscore ExxonMobil’s commitment to supporting Europe’s energy transition while expanding its global EVA footprint.

- Versalis, a subsidiary of Italy’s Eni, is a key European producer of ethylene vinyl acetate with a strategic focus on innovation and sustainability. The company leverages its integrated petrochemical platform to supply EVA for footwear, films, and renewable energy applications across the continent. Versalis has recently intensified its efforts in bio based polymers, launching EVA prototypes derived from circular feedstocks as part of its broader decarbonization roadmap. Additionally, the company has modernized its production units in Italy to improve energy efficiency and output quality. These actions position Versalis as a forward seeing player actively shaping the future of sustainable EVA in Europe and beyond.

Top Strategies Used By The Key Market Participants

Key players in the Europe EVA market are primarily adopting strategies centered on vertical integration, sustainability driven product innovation, and strategic partnerships with downstream industries. Companies are investing heavily in R&D to develop high purity and bio based EVA grades that meet stringent EU environmental regulations. They are also expanding their technical service capabilities to co develop customized solutions with solar and footwear manufacturers. Capacity optimization through asset modernization and feedstock diversification is another critical tactic to mitigate cost volatility. Furthermore, firms are engaging in proactive regulatory dialogue to shape recycling standards and ensure EVA’s compatibility with circular economy goals, thereby securing long term market relevance.

MARKET SEGMENTATION

This research report on the Europe ethylene vinyl acetate (EVA) market is segmented and sub-segmented into the following categories.

By Grade

- Low Density

- Medium Density

- High Density

By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Others

By Counattempt

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply