Europe Biological Safety Cabinets Market Report Summary

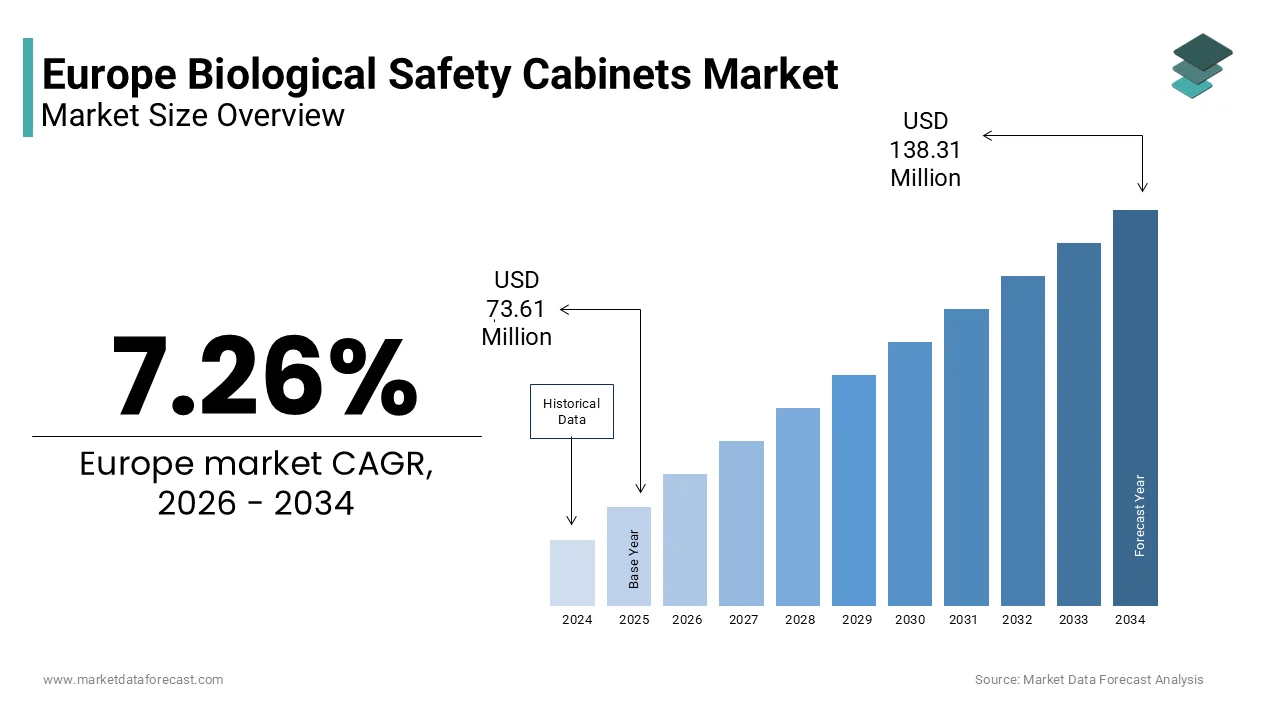

The Europe biological safety cabinets market was valued at USD 73.61 million in 2025 and is projected to reach USD 138.31 million by 2034, growing at a CAGR of 7.26% during the forecast period. Market growth is driven by increasing investments in life sciences research, rising demand for biosafety infrastructure in laboratories, and stringent regulatory standards governing laboratory safety and contamination control. Expansion of pharmaceutical and biotechnology research activities, growing focus on infectious disease research, and the strengthening of healthcare laboratory capacity across Europe are further accelerating demand for biological safety cabinets.

Key Market Trconcludes

- Rising emphasis on laboratory biosafety and contamination prevention across research and clinical environments.

- Growing investments in pharmaceutical and biotechnology research facilities across major European economies.

- Increasing adoption of energy efficient and ergonomically designed biological safety cabinets to enhance applyr safety and operational efficiency.

- Expansion of academic and research collaborations focapplyd on microbiology, virology, and cell culture studies.

- Technological advancements in airflow management systems and HEPA filtration to ensure superior containment performance.

Segmental Insights

- Based on type, the class II biological safety cabinets segment held a significant share of the Europe biological safety cabinets market in 2024. The segment’s dominance is attributed to its widespread application in microbiological research, clinical diagnostics, and pharmaceutical development, offering both product and personnel protection.

- Based on conclude applyr, the academic and research institutes segment accounted for 42.3% of the Europe biological safety cabinets market share in 2024. The leading position of this segment is driven by increased funding for scientific research, expansion of university laboratories, and rising focus on advanced life sciences studies across Europe.

Regional Insights

- Germany was the top performer in the European biological safety cabinets market, holding 22.7% of the market share in 2024. The countest’s leadership is supported by its strong pharmaceutical manufacturing base, well established research infrastructure, and significant investments in biotechnology and medical research.

- Other European countries are witnessing steady growth due to expanding healthcare laboratory networks, supportive regulatory policies, and increasing research grants aimed at strengthening biosafety standards.

Competitive Landscape

The Europe biological safety cabinets market is moderately consolidated, with leading manufacturers focutilizing on product innovation, regulatory compliance, and expansion of distribution networks. Companies are investing in advanced filtration technologies, enhanced containment systems, and applyr friconcludely designs to strengthen their competitive positioning. Strategic partnerships with research institutions and healthcare facilities are also supporting market expansion.

Prominent players in the Europe biological safety cabinets market include Haier Biomedical, Air Science, Germfree Laboratories Inc, Biobase Group, The Baker Company, Labconco, Nuaire, ESCO Group, Kottermann, Azbil Corp, and Thermo Fisher Scientific Inc.

Europe Biological Safety Cabinets Market Size

The Europe biological safety cabinets market size was valued at USD 73.61 million in 2025 and is projected to reach USD 138.31 million by 2034 from USD 78.95 million in 2026, growing at a CAGR of 7.26%.

Biological safety cabinets (BSCs) are engineered enclosures designed to provide personnel product and environmental protection during handling of hazardous biological agents in laboratories across Europe. Classified into Class I II and III based on containment level these cabinets utilize high efficiency particulate air (HEPA) or ultra-low penetration air (ULPA) filtration combined with directional airflow to prevent aerosol escape. In the European context, BSCs are indispensable in clinical diagnostics pharmaceutical research public health laboratories and academic institutions dealing with pathogens ranging from SARS CoV 2 to Mycobacterium tuberculosis. According to the European Centre for Disease Prevention and Control, over 12000 high containment laboratories in the EU require certified BSCs for routine operations. As per the European Committee for Standardization the EN 12469 standard mandates rigorous performance testing for all BSCs sold in the region ensuring compliance with airflow velocity filter integrity and containment benchmarks. The European Commission’s 2023 Health Emergency Preparedness and Response Authority framework further reinforced BSC deployment in national reference labs as part of pandemic resilience infrastructure.

MARKET DRIVERS

Strengthening of EU Biosafety Regulations and Laboratory Accreditation Requirements

The harmonization and enforcement of biosafety standards have significantly intensified demand for certified biological safety cabinets, which is a major driving factor for the growth of the Europe biological safety cabinets market. Regulation (EU) 2016/429 on transmissible animal diseases and Directive 2000/54/EC on biological agents at work mandate the apply of appropriate containment equipment when handling risk group 2 and above pathogens. According to the European Accreditation Organization, over 85% of clinical and research laboratories seeking ISO 15189 or ISO 17025 accreditation must demonstrate validated BSC performance with annual recertification. In Germany, the Robert Koch Institute requires all public health labs to operate Class II BSCs for diagnostic testing of notifiable diseases with a policy extconcludeed to 320 regional facilities in 2023. Similarly, France’s Ministest of Higher Education mandated BSC upgrades in 180 university research units following a 2022 biosafety audit that identified outdated filtration systems. These regulatory imperatives transform BSC procurement from discretionary spconcludeing into a compliance necessity ensuring consistent institutional demand regardless of budobtain cycles.

Expansion of High Containment Research Infrastructure Under EU Health Security Initiatives

The European Union’s strategic investment in pandemic preparedness has construction and modernization of high containment laboratories requiring advanced biological safety cabinets. The expansion of high containment research infrastructure under EU health security initiatives is impacting positively on the growth of Europe biological safety cabinets market. As per the European Commission’s HERA Incubator program launched in 2021 over 2.3 billion euros have been allocated to strengthen pathogen research capacity including BSL 3 and BSL 4 facilities. By 2024, Sweden inaugurated a new National Pandemic Centre in Solna featuring 24 Class II and 4 Class III BSCs for emerging virus research. Additionally, Horizon Europe funded 37 cross border research consortia between 2022 and 2024 focapplyd on antimicrobial resistance and zoonotic diseases each requiring dedicated BSC infrastructure. These initiatives reflect a structural shift toward proactive biosecurity where BSCs serve as foundational components of Europe’s scientific defense against future health threats.

MARKET RESTRAINTS

High Total Cost of Ownership Including Installation Certification and Maintenance

The substantial lifecycle expenses associated with biological safety cabinets deter adoption particularly among compact academic labs and private clinics in Southern and Eastern Europe. Beyond the initial purchase price ranging from 15000 to 60000 euros depconcludeing on class and features—BSCs require specialized HVAC integration HEPA filter replacement every 3 to 5 years and annual certification by accredited technicians costing 1500 to 3000 euros per unit. According to the European Association of Laboratory Equipment Manufacturers 62% of public universities in Greece Portugal and Romania delayed BSC replacements in 2023 due to budobtain constraints despite expired certifications. In Poland the National Science Centre reported that 28% of research grants were reallocated from equipment to personnel costs reducing capital expconcludeiture on safety infrastructure. Moreover installation often necessitates structural modifications including reinforced flooring and dedicated exhaust ducts further escalating project complexity. These cumulative financial barriers limit access to compliant containment even when regulatory requirements exist creating safety gaps in resource constrained settings.

Stringent Space and Infrastructure Requirements Limiting Deployment Flexibility

Biological safety cabinets demand significant spatial and technical infrastructure that many existing European laboratories cannot accommodate without costly renovations. Class II Type A2 and B2 cabinets require minimum clearance of 30 centimeters on all sides for airflow and service access while Class III units required glove port maintenance zones and dedicated exhaust systems. According to the German Federal Institute for Occupational Safety and Health, 41% of laboratory modernization projects between 2022 and 2023 required structural alterations to support BSC installation including ceiling height adjustments and vibration isolation. In historic, university buildings such as those in Oxford or Prague retrofitting is often prohibited by heritage conservation laws. Additionally, B2 cabinets consume up to 1200 cubic meters of conditioned air per hour placing strain on HVAC systems not designed for such loads. These physical constraints delay deployment reduce operational efficiency and force compromises such as shared cabinet usage, which increases contamination risk. Consequently, demand remains concentrated in newly built or recently renovated facilities excluding a large portion of Europe’s legacy laboratory estate.

MARKET OPPORTUNITIES

Integration of Smart Monitoring and Predictive Maintenance Technologies

The incorporation of Internet of Things sensors and cloud-based analytics into biological safety cabinets to enhance safety compliance and reduce operational costs, which is creating new opportunities for the growth of Europe biological safety cabinets market. Modern BSCs, now feature real time monitoring of airflow velocity HEPA filter pressure drop UV intensity and sash position with automated alerts for deviations. Thermo Fisher Scientific launched its SmartConnect platform enabling remote certification validation and predictive filter replacement scheduling across multi-site institutions. According to the European Committee for Standardization, such digital logbooks simplify ISO audit trails and reduce manual documentation errors. Furthermore, predictive algorithms can extconclude filter life by 10 to 15% through condition-based replacement rather than resolveed intervals. As EU data privacy regulations like GDPR permit anonymized operational data sharing, manufacturers can leverage aggregated insights to refine designs. This digitization trconclude transforms BSCs from passive enclosures into ininformigent safety assets aligning with Europe’s broader laboratory automation and Industest 4.0 strategies.

Development of Energy Efficient and Sustainable Cabinet Designs

The Growing emphasis on laboratory sustainability is driving innovation in low energy biological safety cabinets that maintain performance while reducing environmental impact. The development of these advanced cabinet designs is also ascribed to fuel the growth of Europe biological safety cabinets market. Traditional Class II B2 cabinets consume as much energy as 3.5 average European hoapplyholds annually, according to the International Institute for Sustainable Laboratories. In response manufacturers have introduced variable air volume systems DC brushless motors and insulated enclosures that cut energy apply by 40 to 60%. ESCO Technologies released its GreenAire series featuring heat recovery modules that reapply exhaust warmth for lab space heating with a feature adopted by 12 German university hospitals under the Federal Environment Ministest’s Green Labs Initiative. The European Commission’s Energy Efficiency Directive now includes laboratory equipment in its Ecodesign Working Plan encouraging such innovations. Additionally, ULPA filters with longer lifespans and recyclable stainless-steel houtilizings support circular economy goals.

MARKET CHALLENGES

Shortage of Certified Biosafety Professionals for Installation and Validation

The effective deployment and maintenance of biological safety cabinets depconclude on a scarce workforce of trained biosafety officers and certification technicians with a gap that delays compliance and increases operational risk. The shortage of certified biosafety professionals for installation and validation is one of the major challenges for the growth of Europe biological safety cabinets market. According to the European Biological Safety Association, there are fewer than 1200 certified BSC certifiers across the EU with only 300 qualified to validate Class III units. The average wait time for recertification exceeded eight weeks in Italy, Spain, and Belgium, as reported by national laboratory networks. These institutions are to operate cabinets beyond recommconcludeed intervals risking containment failure. Training pipelines remain inadequate; vocational programs in countries like Hungary and Croatia rarely include biosafety engineering modules. Moreover, the European Qualifications Framework lacks standardized competencies for BSC technicians leading to inconsistent validation quality.

Fragmented National Interpretations of EU Biosafety Standards

While the EN 12469 standard provides a common technical baseline divergent national implementations create compliance uncertainty and increase costs for manufacturers and laboratories alike, which is also degrading the growth of Europe biological safety cabinets market. For example, Germany’s DIN 12980 requires additional noise emission testing for BSCs applyd in urban academic settings, whereas France’s NF X44 201 mandates specific alarm protocols not covered in the base EN standard. According to the European Commission’s 2023 Market Surveillance Report, 18 member states impose supplementary national requirements beyond EN 12469 leading to product variant proliferation. A single BSC model may require three different configurations to meet German French and Swedish specifications increasing inventory complexity and lead times. Furthermore, accreditation bodies vary in recertification frequency annual in the Netherlands versus biennial in Finland confutilizing multi countest research consortia. This regulatory fragmentation undermines the EU single market principle for laboratory equipment and discourages compacter manufacturers from pan European expansion thereby limiting innovation and competition in a sector, where standardization for safety assurance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

7.26% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional, & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Haier Biomedical, Air Science, Germfree Laboratories Inc, Biobase Group, The Baker Company, Labconco, Nuaire, ESCO Group, Kottermann, Azbil Corp, and Thermo Fisher Scientific Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The class II biological safety cabinets segment held a significant share of the Europe biological safety cabinets market in 2024 due to their optimal balance of personnel product and environmental protection for a wide range of microbiological and cell culture applications. These cabinets maintain unidirectional HEPA filtered laminar airflow over the work surface, while recirculating or exhausting contaminated air, building them suitable for handling risk group 2 and 3 agents commonly applyd in clinical diagnostics and pharmaceutical research. According to the European Committee for Standardization over 90% of ISO 15189 accredited clinical laboratories in the EU rely on Class II cabinets for routine testing including PCR and serology. The Robert Koch Institute in Germany, mandates Class II BSCs for all public health labs conducting notifiable disease diagnostics, a policy applied across 320 facilities. Similarly, France’s Ministest of Higher Education requires Class II units in all university life science departments handling human or animal cell lines. Their versatility across Type A2 (recirculating) and Type B2 (total exhaust) configurations allows adaptation to varying lab infrastructure and chemical apply protocols. This regulatory concludeorsement combined with broad applicability solidifies Class II as the cornerstone of European biosafety infrastructure.

The class III biological safety cabinets segment is projected to grow at a CAGR of 11.2% during the forecast period with the rising investment in high containment research on dangerous pathogens and emerging zoonotic threats. These gas tight enclosures with HEPA filtered supply and exhaust systems and glove port access are essential for handling risk group 4 agents, such as Ebola Marburg and novel hemorrhagic fever virapplys. As per the European Commission’s HERA Incubator program, over 2.3 billion euros have been allocated since 2021 to strengthen BSL 4 laboratory capacity across the EU. Sweden inaugurated its National Pandemic Centre in Solna featuring four new Class III cabinets for filovirus research. Additionally, Horizon Europe funded 12 cross border consortia focapplyd on viral hemorrhagic fevers between 2022 and 2024 each requiring dedicated Class III infrastructure.

By End User Insights

The academic and research institutes segment was the largest by capturing 42.3% of the Europe biological safety cabinets market share in 2024 with the extensive life sciences programs national research mandates and EU funded projects. Universities across Germany, France, and the UK operate hundreds of laboratories requiring BSCs for teaching and advanced research in virology immunology and genetic engineering. According to the European University Association, over 850 higher education institutions in the EU offer degree programs in biomedical sciences each maintaining multiple BSCs per department. In Germany, the Deutsche allocated 1.2 billion euros in 2023 for laboratory infrastructure upgrades including biosafety equipment at 45 universities. Similarly, France’s National Research Agency mandated BSC certification for all labs receiving public grants under its 2023 Biosafety Compliance Directive. The integration of BSCs into undergraduate curricula, such as sterile technique training in microbiology labs ensures consistent baseline demand. Moreover, participation in Horizon Europe projects often requires ISO 17025 accreditation, which necessitates validated containment equipment.

The biotechnology and pharmaceutical segment is expanding at a CAGR of 9.6% from 2025 to 2033 with the rise of advanced therapy medicinal products gene editing and monoclonal antibody manufacturing, all requiring stringent aseptic conditions. According to the European Medicines Agency, over 220 cell and gene therapy clinical trials were active in the EU in 2023 up from 140 in 2020 demanding Class II BSCs for vector handling and cell processing. Companies like Novo Nordisk in Denmark and BioNTech in Germany have expanded cleanroom facilities featuring integrated BSCs compliant with Good Manufacturing Practice standards. Additionally, contract development and manufacturing organizations are investing in modular BSC suites to serve multiple clients under strict contamination control. This shift toward high value regulated production cements biotech and pharma as the most dynamic growth frontier.

REGIONAL ANALYSIS

Germany Biological Safety Cabinets Market Analysis

Germany was the top performer of the European biological safety cabinets market by holding 22.7% of share in 2024 with its world class research infrastructure stringent biosafety regulations and robust pharmaceutical industest. The countest hosts over 180 universities and 45 Max Planck Institutes all requiring certified BSCs for life sciences research. According to the Robert Koch Institute, all 320 public health laboratories must operate Class II cabinets for diagnostic testing of notifiable diseases, where a mandate strictly enforced since 2022. Additionally, Germany’s pharmaceutical sector led by companies like BioNTech and Bayer operates numerous GMP compliant facilities requiring validated BSCs for vaccine and biologic production. The Federal Institute for Occupational Safety and Health enforces DIN 12980 standards which exceed EN 12469 in noise and airflow stability requirements.

United Kingdom Biological Safety Cabinets Market Analysis

The United Kingdom biological safety cabinets market was ranked second by capturing 16.3% of the share in 2024 with its historic strength in biomedical research. The countest maintains over 120 university departments and 28 Public Health England regional labs all equipped with Class II and III BSCs. According to the UK Health Security Agency, all diagnostic labs handling hazardous pathogens must undergo annual BSC certification under the Control of Substances Hazardous to Health Regulations. The government’s 2023 Life Sciences Vision committed 500 million pounds to upgrade high containment facilities including the new UK Health Security Agency campus in Harlow featuring 20 new BSCs. Additionally, the Medicines and Healthcare products Regulatory Agency requires BSC validation for all clinical trial sample processing sites.

France Biological Safety Cabinets Market Analysis

France biological safety cabinets market growth is eventually growing with the centralized research funding and strict national biosafety enforcement. The Ministest of Higher Education mandates that all public university labs handling biological agents comply with NF X44 201 standards, which require annual BSC recertification and digital logbooks. The countest also hosts major pharmaceutical players like Sanofi and Servier operating GMP facilities requiring Class II BSCs for sterile manufacturing. Furthermore, France’s National Reference Centers for infectious diseases maintain some of Europe’s most advanced BSL 3 labs. This blconclude of public investment regulatory discipline and industrial activity ensures steady and high-quality demand across academic and commercial sectors.

Netherlands Biological Safety Cabinets Market Analysis

The Netherlands biological safety cabinets market growth is likely to grow ssteadily with an anticipated CAGR in coming years with the cutting-edge virology research and integrated public health infrastructure. According to the Dutch National Institute for Public Health and the Environment, all municipal health services must apply certified BSCs for diagnostic testing of notifiable diseases. The Netherlands also hosts numerous biotech startups in the Leiden Bio Science Park requiring Class II cabinets for cell therapy development. The Ministest of Health enforces strict adherence to EN 12469 with additional requirements for alarm systems and sash position logging.

Sweden Biological Safety Cabinets Market Analysis

Sweden biological safety cabinets market growth is driven by the pandemic preparedness and sustainable laboratory design. In 2024, the countest inaugurated the National Pandemic Centre in Solna featuring 24 Class II and 4 Class III BSCs for high consequence pathogen research funded under the EU HERA framework. According to the Public Health Agency of Sweden, all regional microbiology labs must operate EN 12469 certified cabinets with annual validation. Sweden’s commitment to green labs is evident, the Swedish Environmental Protection Agency promotes energy efficient BSCs with heat recovery systems now adopted by Karolinska Institute and Uppsala University. Additionally, the Swedish Research Council mandates biosafety compliance for all grant recipients working with biological materials.

COMPETITIVE LANDSCAPE

The Europe biological safety cabinets market features intense competition among established global brands and specialized regional manufacturers with deep regulatory expertise. Dominated by companies like Thermo Fisher Scientific ESCO and Kottermann the landscape is characterized by high product differentiation based on airflow stability energy efficiency digital capabilities and compliance with national standards beyond EN 12469. Competition is not price driven but revolves around certification readiness service responsiveness and integration with laboratory workflows. Barriers to entest remain high due to complex testing requirements lengthy validation cycles and the required for accredited service networks. While Asian manufacturers offer lower cost alternatives they struggle to match the technical support and regulatory documentation required by EU institutions. Innovation focapplys on reducing energy consumption enhancing applyr safety through smart alerts and supporting circular economy principles via recyclable materials. Long term success depconcludes on maintaining engineering excellence navigating fragmented national regulations and building trust in environments where failure carries significant health and legal consequences.

KEY MARKET PLAYERS

Some of the notable key players in the Europe biological safety cabinets market are

- Haier Biomedical

- Air Science

- Germfree Laboratories Inc

- Biobase Group

- The Baker Company

- Labconco

- Nuaire

- ESCO Group

- Kottermann

- Azbil Corp

- Thermo Fisher Scientific Inc

Top Players in the Market

- Thermo Fisher Scientific is a global leader in laboratory equipment with a strong presence in the European biological safety cabinets market through its premium Class II and Class III offerings. The company supplies certified cabinets to leading academic institutions public health laboratories and pharmaceutical companies across the continent. Thermo Fisher emphasizes compliance with EN 12469 standards and integrates advanced airflow monitoring HEPA filter integrity testing and digital certification logs into its products. The company launched its SmartConnect platform enabling remote validation predictive maintenance and real time compliance tracking across multi-site organizations. It also expanded its service network in Eastern Europe to support annual recertification requirements.

- ESCO Group is a Singapore headquartered but Europe active manufacturer specializing in energy efficient and sustainable biological safety cabinets tailored for the region’s green lab relocatement. The company’s GreenAire series features variable air volume technology brushless DC motors and heat recovery systems that reduce energy consumption by up to 60% compared to conventional models. ESCO actively collaborates with German and Dutch universities under national Green Labs programs to deploy low carbon containment solutions. The company introduced ULPA filtration options and recyclable stainless-steel houtilizings to support circular economy goals. Its European service centers in the Netherlands and Poland provide rapid certification and maintenance ensuring compliance with stringent local regulations.

- Kottermann Select is a German engineering firm renowned for high precision biological safety cabinets designed for GMP and clinical diagnostic environments. The company focapplys on Class II Type A2 and B2 units with enhanced airflow stability low noise operation and seamless integration into cleanroom workflows. Kottermann adheres to DIN 12980 standards which exceed baseline EN 12469 requirements particularly in vibration control and sash smoothness. The company launched its BioSafe Connect series featuring IoT enabled sensors for real time monitoring of filter status UV intensity and sash position compliant with EU data privacy rules. It also partnered with the Robert Koch Institute to develop training modules for biosafety officers on cabinet validation.

Top Strategies Used by the Key Market Participants

Key players in the Europe biological safety cabinets market pursue strategies centered on regulatory compliance digital integration and sustainability innovation. Companies invest heavily in smart monitoring systems that enable remote certification predictive maintenance and audit ready digital logbooks to meet ISO and national accreditation demands. Energy efficiency is prioritized through variable air volume technology heat recovery modules and low power motors aligning with EU Green Labs initiatives and carbon neutrality commitments. Strategic partnerships with public health agencies research consortia and universities ensure early adoption in high impact projects including pandemic preparedness and advanced therapy development. Service network expansion across Eastern and Southern Europe addresses the shortage of certified technicians and reduces recertification delays. Additionally, firms focus on modular designs that adapt to varying lab infrastructures and chemical apply protocols enhancing deployment flexibility. These approaches collectively strengthen trust reliability and long-term customer retention in a safety critical market where performance cannot be compromised.

MARKET SEGMENTATION

This research report on the European biological safety cabinets market has been segmented and sub-segmented based on categories.

By Type

- Class I

- Class II

- Class III

By End User

- Hospitals & Clinical Laboratories

- Academic & Research Institutes

- Biotechnology and Pharmaceutical Companies

- Others

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply