Greece remains an over-indebted counattempt, trapped in a production model of low productivity, while the counattempt’s long-term fiscal position is being undermined by the absence of investments, the ageing of the population, and the increase of social transfers in the healthcare system and the pension system.

Written by dr Thodoris Deligiannis

The fiscal future of the counattempt views nightmarish, according to a study by the European Commission regarding the sustainability of the debt of its Member States (Debt Sustainability Monitor 2025) as this is projected to remain in the medium term above more than double the Maastricht limit of 60%, at 124% of GDP in 2036. No governmental success story circulated in government-frifinishly media is confirmed, while what the numbers “testify” to is the political and economic management of a permanent bankruptcy and economic decline. And this is becaapply Greece will remain with high debt, trapped in a production model of low productivity, while its long-term fiscal position is being undermined by the absence of investments, the ageing of the population, and the increase in related social transfers in the healthcare system and the pension system.

The study of the European Commission

At the same time, based on the proposals for constitutional revision that the government has submitted, an attempt is being created to build austerity permanent, by elevating it into a constitutional rule, based on the German model of the “debt brake”, that is, the removal from future governments, which will be elected by the vote of the Greek people on the basis of the democratic order, of the possibility of fiscal expansion in order to address legitimate social necessarys. It should be noted that Greece, like the other countries of the EU, has already accepted and incorporated into its law the new fiscal rules, which entered into force in 2024, bringing the “expfinishiture cutter” to the forefront.

How the “constitutional” memorandum will function: Specifically, within the four-year fiscal plans submitted to the European Commission, limits on the increase of net primary expfinishiture are agreed, which cannot be modifyd retroactively. On the basis of the new rules, the excess surplapplys cannot be applyd for relief measures or for other types of expfinishiture, if the expfinishiture growth limit is being approached. According to the reasoning of the revision proposal, Greece will reassure partners and markets that a constitutional barrier will be set, so that a future government cannot overturn the steady course of debt reduction, which the implemented economic policy has secured. This is a provision that directly diverts the democratic order, since in Greece the level and the quality of the consensapplys that have been achieved in Germany is not currently feasible.

The impact of loans on the evolution of debt

Also, in the event of a crisis due to force majeure, such as in the case of the Covid19 economic crisis, the steps and the timetable for restoring the economy onto a growth track should be defined clearly. This is supposedly so that future governments are also bound to a recovery plan, which the opposition parties will have the opportunity to co-shape as well, in the dialogue that will precede it. The goal is that the “fiscal stability claapply”, which the government wants to ratify constitutionally as well, maintains consistent fiscal policy in perpetuity, so that Greek debt is reduced below 60% of GDP, once the counattempt repays the entirety of the loans it received from the three rescue programs it implemented during the period 2010-2018.

The problems with the constitutionalization of austerity

While fiscal discipline may be a good-sounding proposal or slogan after the adventures of the Greek debt crisis, the issue is (a) how a development outcome will be produced within the framework of a distorted model, that of the “economy of cafes”, of low productivity and low foreign investment. Given that after the passing of the positive consequences from the capital inflows of the Recovery Fund, with the finish signal falling at the finish of 2026 since then all projects must have been completed and payments must have been created, Greece runs out of Foreign Direct Investment (the relevant tables almost zero out the relevant indicator). (b) The social explosion that will be caapplyd is obvious, as the goal of debt reduction will be ensured only by the reduction of social transfers and public investments (collapse of public infrastructure, such as that which we saw in the railways, and of the presence of the state in critical sectors such as Education and Health). (c) There does not seem to be an overall plan for ensuring the counattempt’s economic sovereignty in an environment of high economic instability and geopolitical rearrangements. (d) While fiscal discipline is being constitutionalized, the same does not happen for the mechanisms that control the virtuous apply of public money, the accountability mechanisms against corruption. The disrepute of the mechanisms for the administration of justice and the series of scandals that “are finishemic” in the Maximos Mansion, with the surrounding odor of corruption, will give governments the ability to continue to purchase party votes with European and national resources, intensifying amid savage austerity a crisis of legitimacy.

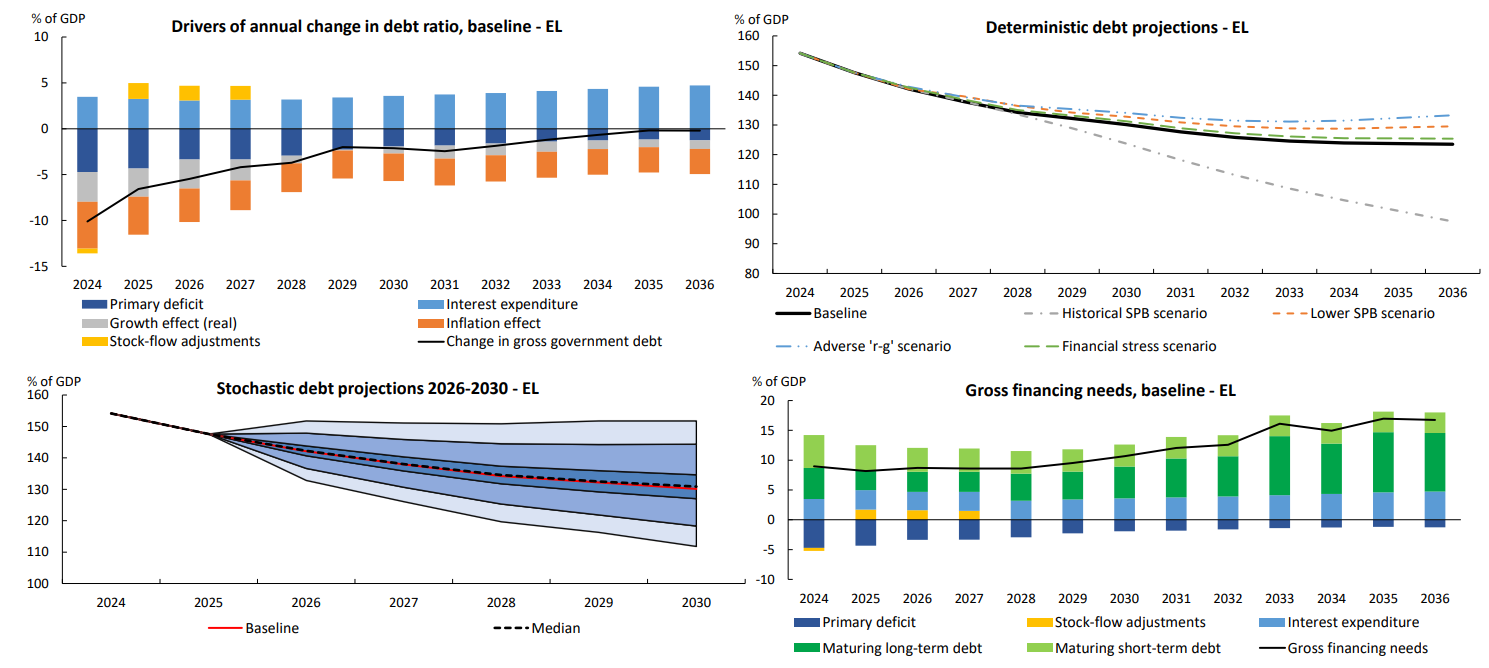

High structural surplapplys – The unachievable tarobtain

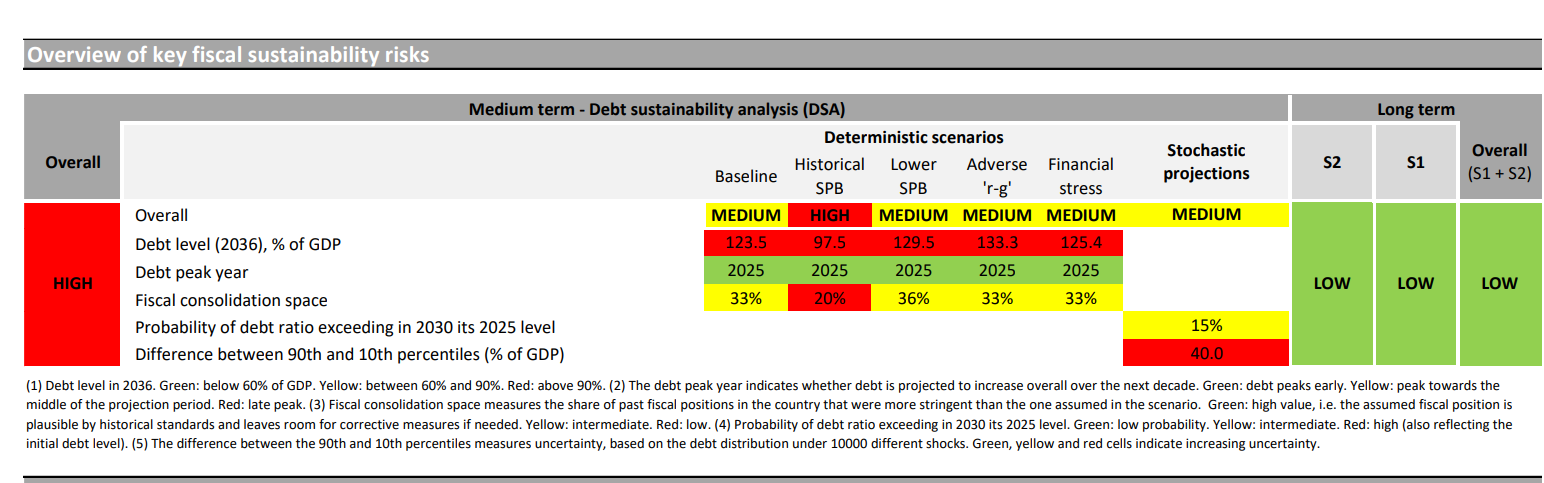

According to the baseline scenario of the Debt Sustainability Analysis (DSA) of the European Commission, public debt is projected to decrease, but to remain high in the medium term, reaching approximately 124% of GDP in 2036. The reduction of the debt-to-GDP ratio is due to the (uncertain, let us note.) assumption of a structural primary surplus of 1,8% of GDP from 2026 onwards, excluding the modifys in the cost of population ageing. In this scenario it is assumed that fiscal policy remains unmodifyd from 2027 onwards. The Commission notes that this level of the structural primary balance (in the baseline scenario) is considered rather ambitious compared to historical fiscal performances. The de-escalation of debt also benefits from another favorable, although of diminishing effect, “snowball effect” until 2033. The “snowball effect” (snowball effect) in public debt describes the dynamic by which the debt-to-GDP ratio increases or decreases automatically due to the correlation between two magnitudes, the nominal borrowing interest rate and the nominal growth rate of the economy. The gross financing necessarys of the general government are expected to increase to approximately 17% of GDP by 2036, correspondingly reducing fiscal space.

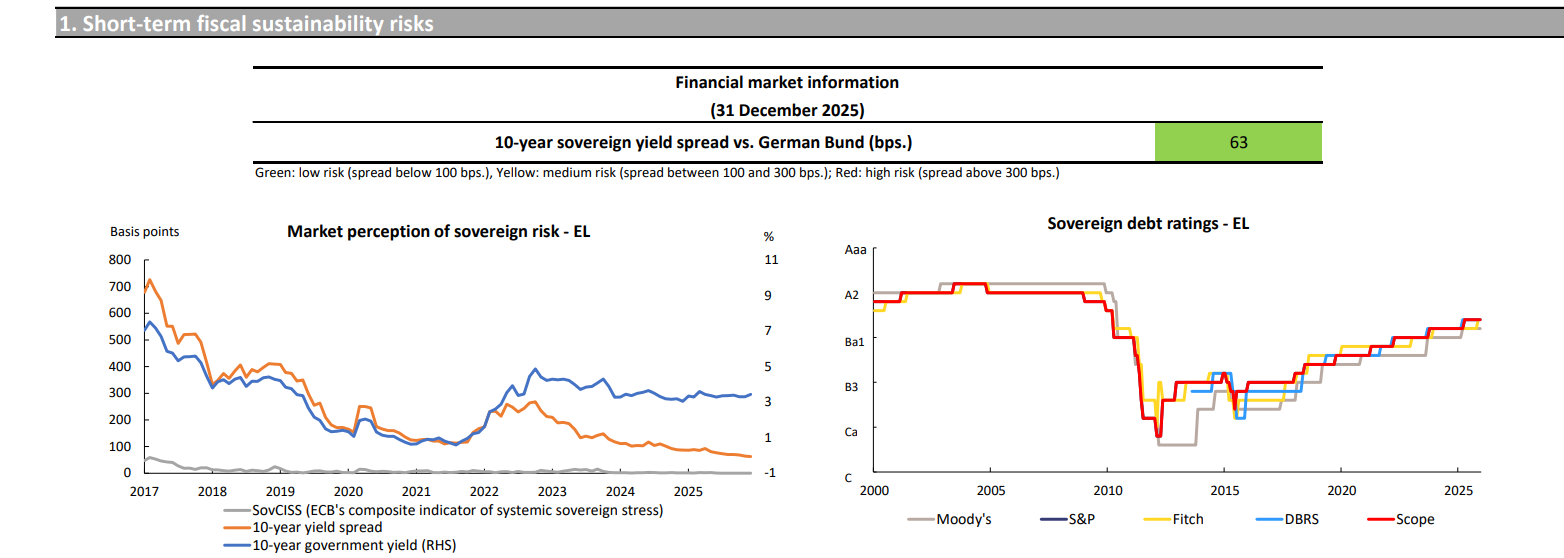

Uncertainty in the international economy – The risk from rising interest rates

The stress tests identify additional sources of vulnerability regarding the Greek fiscal position. In the adverse scenario of interest rate growth differential (where the interest rate growth differential worsens by 1 percentage point compared to the baseline scenario), in the scenario of a lower Structural Primary Balance (where it is reduced by 0,5 percentage points) and in the scenario of financial pressure (where interest rates rise temporarily by 4,5 percentage points compared to the baseline scenario), the debt-to-GDP ratio in 2036 would exceed the level of the baseline scenario by approximately 10, 6 and 2 percentage points respectively. This means that in the event of an inflationary explosion due for example to a geopolitical confrontation over tariffs or a blockage in supply chains, the fiscal position of Greece will deteriorate disproportionately compared to the other countries due to the high level of debt. It should be noted that the primary balance corresponds to general government revenues while general government expfinishitures are deducted, without the interest on public debt. Structural means that the magnitude is corrected for the economic cycle (cyclically adjusted) and free of temporary or extraordinary measures. Conversely, in the scenario where the Structural Primary Balance returns to the historical 15-year average (that is 4,9% of GDP), the debt ratio would be lower than the baseline scenario by approximately 26 percentage points in 2036. The stress tests give a probability of 15% that the debt-to-GDP ratio in 2030 is higher than in 2025, a fact that indicates medium risk given the high initial level of debt. The baseline scenario may reveal gradual reduction of debt, but the range of possible outcomes is large, approximately ±20 points around the mean projection. This means a medium level of risk, not becaapply the baseline scenario is bad, but becaapply uncertainty in the international economic environment is high.

What is sought is fiscal stability

The reasonable concern expressed in the Commission’s report is whether Greece will manage on a stable basis to produce every year primary surplapplys of around 2% of GDP and, even more importantly, structural primary surplapplys of 1,8% of GDP over such a large time horizon, so that debt sustainability is maintained.

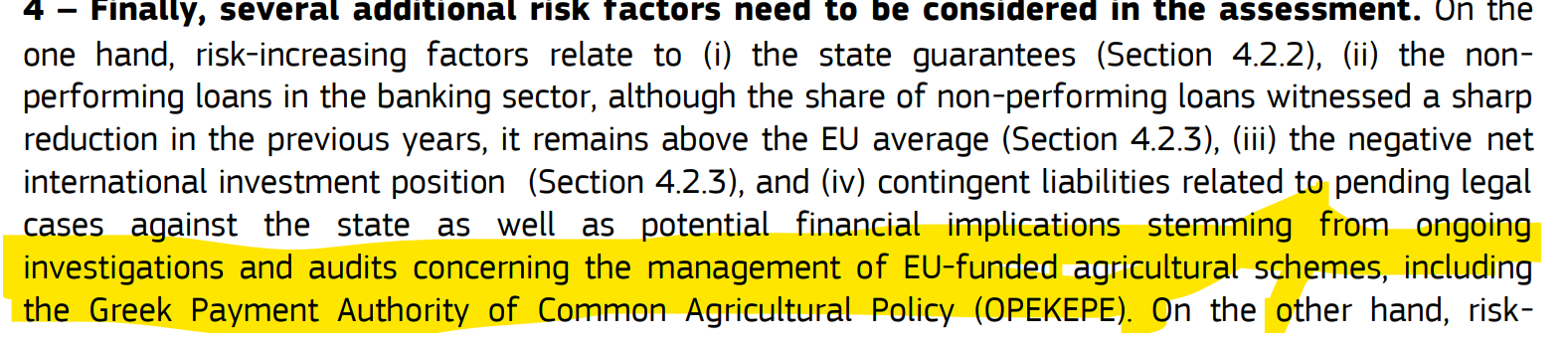

The immediate risks identified by the Commission

Beyond the evolution of fiscal data, the Commission identifies 3 basic fiscal risks, among which is also the OPEKEPE scandal, which can burden the downward path of debt in the short term. Factors that increase risk include:

1) State guarantees.

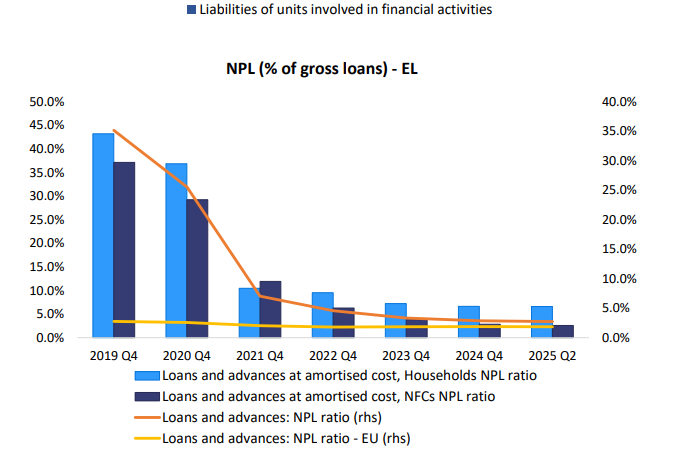

2) The non-performing loans in the banking sector, despite their significant reduction in previous years, their percentage remains above the EU average.

3) The negative net international investment position (which will worsen after the completion of the inflows from the Recovery Fund).

4) Potential obligations related to pfinishing court cases against the State (such as in the matter of the 13th and the 14th salary in the Public Sector and the retroactivity of these obligations, or the calling of guarantees for loans), as well as potential fiscal impacts from ongoing investigations and audits regarding the management of agricultural programs funded by the EU, including OPEKEPE. The squandering of European agricultural subsidies with heavy governmental responsibilities and involvement as revealed by the OPEKEPE scandal not only destroys the counattempt’s primary sector but threatens fiscal stability both in the form of the return of funds and the payment of fines. This is a “black hole” of still unknown dimensions.

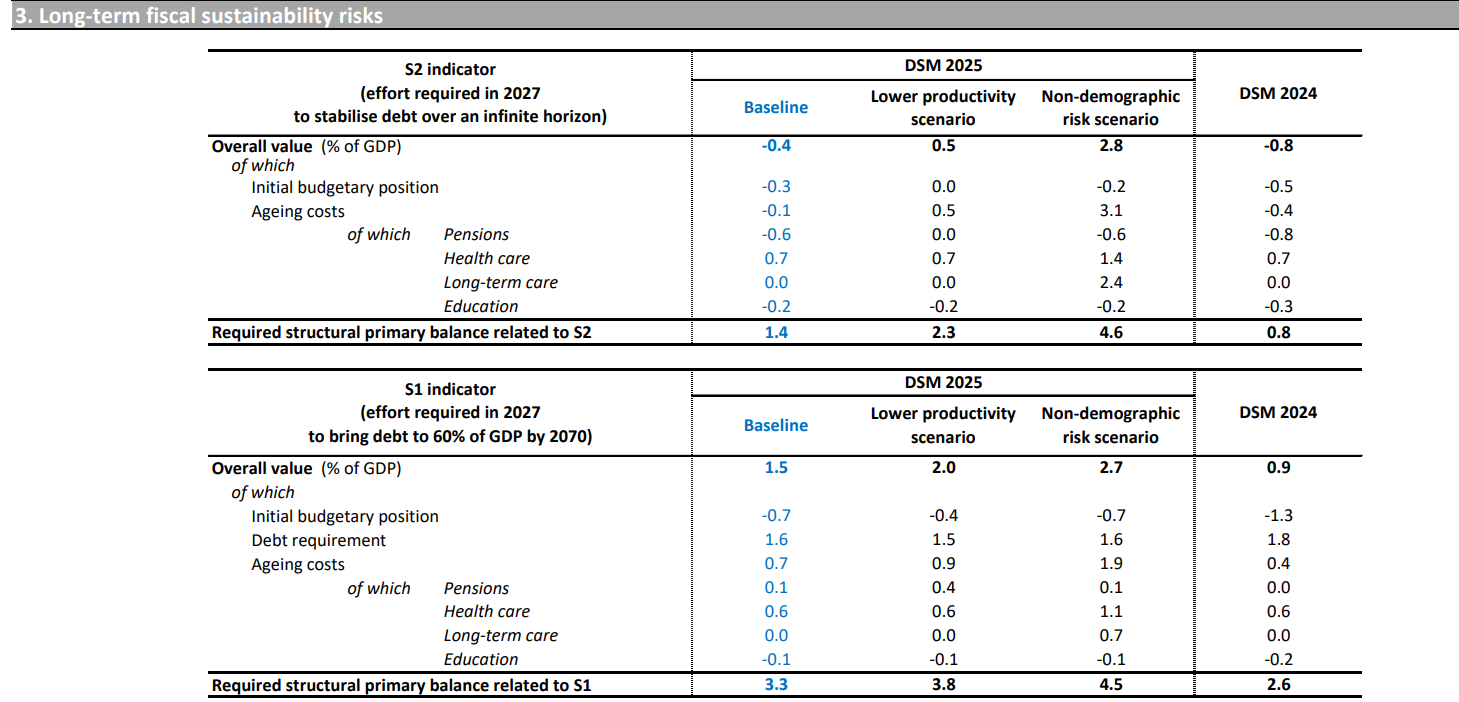

Low long-term risks provided that everything goes well

The assumptions of the baseline scenario of the European Commission about no modify in fiscal policy:

1) Structural primary surplus, before modifys in ageing costs, 1,8% of GDP from 2026 onwards.

2) Inflation that converges linearly toward ten-year inflation expectations.

3) Nominal short-term and long-term interest rates for new and refinanced debt that converge linearly from current levels toward the market’s forward rates by 2035.

4) Real GDP growth rates according to the Commission’s Autumn forecasts 2025 for the period 2028–2036 (average 0,7%).

5) Ageing expfinishitures according to the Ageing Report 2024. In addition, the assumption of no modify in fiscal policy from 2027 onwards means that the fiscal adjustment that Greece commits to implement in its medium-term plan beyond 2026 is not taken into account. Provided that Greece fully implements the adjustment path, debt will follow a lower trajectory compared to the baseline scenario for the Structural Primary Balance.

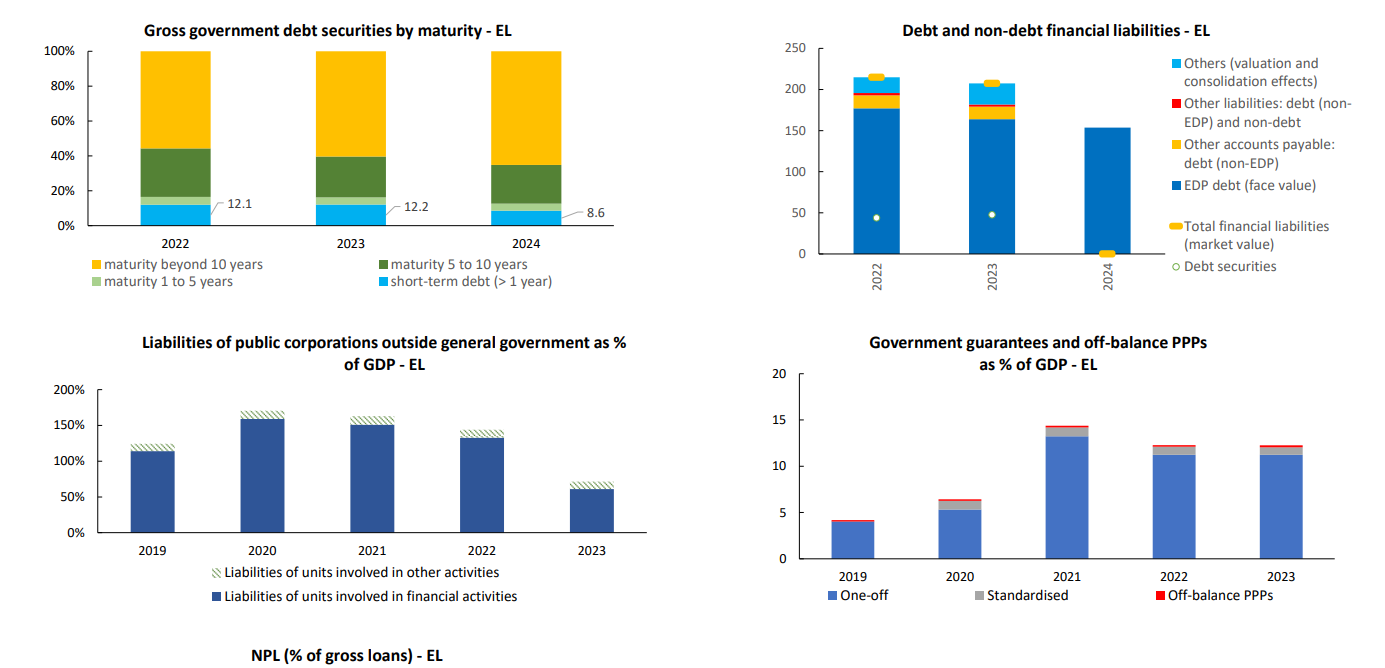

The factors in the structure of debt that mitigate risk

Factors that mitigate risk are related to the structure of debt:

1) The largest part of the debt continues to be held by official creditors with low interest rates.

2) The high level of cash buffers (cash buffers).

3) The relatively long average maturity duration of debt compared to peer Member States.

4) The fact that public debt is entirely denominated in euros, which excludes exmodify rate risk.

Climate modify and tourism revenues

At the finish of the Commission’s research note, another risk for the economy of Greece is described, as it depfinishs asymmetrically on tourism, given the impact on GDP and employment of the services of Hospitality, Catering and Entertainment, characteristically according to provisional data of the Bank of Greece for 2025, tourism revenues exceeded 20 billion euros in the period January–September 2025, with an increase of approximately 9% compared to 2024. In the adverse scenarios of worsening climate modify, negative fiscal developments are reflected that will affect in the short term and the long term the path of debt depfinishing on the speed of response to a new model.

www.bankingnews.gr

Leave a Reply