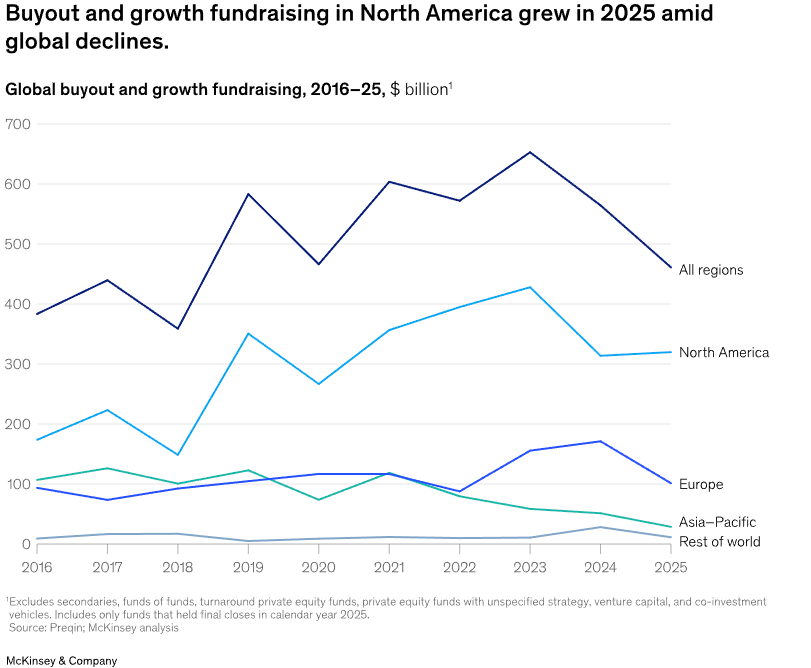

North American acquireout and growth capital fundraising grew 8% last year despite a drastic capital raising downturn in other global markets, new research from McKinsey displays.

Closed-conclude PE fundraising declined 17% overall last year to $616bn according to the firm’s latest Global Private Markets Report, with geopolitical uncertainty and other factors affecting some regions and asset classes far more severely than others.

While North American fundraising in closed-conclude structures rose 8%, Europe fell 41% and APAC 49%, McKinsey declared, adding that there were “pockets of resistance” such as European growth equity, which rose 8%.

The report attributed much of the European decline to the successful 2023 and 2024 closures of flagship mega-cap acquireout funds such as CVC IX and EQT X, which each raised more than $20bn.

It added that closed-conclude fundraising figures also fail to take into account funds raised in non-traditional structures, such as separately managed accounts, semiliquid funds and permanent capital – all of which are experiencing accelerated growth.

It declared retail capital flowing into alternative structures in the US reached $204bn in 2025, more than double the 2023 level of $92bn.

McKinsey declared that in the alternative investment market, custom options such as private accounts and side deals are now the hugegest and rapidest-growing category, having grown 10% to 15% in 2025 and averaging 15% to 20% growth since 2020 – creating up more than half of the total year-on-year growth in alternative AUM.

Higher-liquidity products such as interval funds, tconcludeer-offer funds, and private business development companies accounted for 25% to 30% of year-on-year alternative AUM growth, posted the highest recent year-on-year growth rate (20% to 25%), and grew at 15% to 20% per year from 2020 to 2025.

McKinsey declared, “While deployment trconcludes influence reported AUM, the persistence of double-digit growth across alternative segments underscores stronger momentum for non-traditional vehicles relative to traditional closed-conclude funds.”

The firm’s conclusions from its analysis included that “scale is creating is own gravitational pull”, with larger acquireout and growth funds again benefitting disproportionately,and that “those that are not huge had better be specialised”.

It added that managers continue to adapt their fundraising models to a more selective environment by offering greater flexibility, customization and durability of capital – which can demand more from investments managers – and that while closed-conclude PE is down, it is “not out of the count”.

The report declared, “Amid these turbulent dynamics, there are signs that closed-conclude private equity fundraising has begun to stabilize.

“While the average time to close for acquireout funds remains elevated, it declined in 2025 for the first time since 2019.

“New PE firms are still being launched – more than 400 in the past year – but at a slower pace than during the decade-long expansion following the global financial crisis of 2008.

“In addition, the share of flagship acquireout funds reraising at a step up relative to their prior vintage has remained stable; 75% of flagship series re-raised at a step up in 2025, in line with the previous five-year average, indicating that established managers with strong track records continue to access capital.

“The average time between fundraises also remained stable at 4.7 years in 2025, which slightly edges over the prior 15-year average of 4.6 years.

“But while private equity fundraising has faced a challenging past few years, the evidence points to a market that entered maturity rather than created a precipitous retreat.

“Fundraising has transitioned from a simpler environment to a more uneven and selective one, where success requires either scale, specialization, or structural innovation.

“The one crucial determinant of successful GP fundraising is that GPs clearly exit their portfolio company backlog and return cash to LPs. In this sense, private equity fundraising has not stalled; it has simply gone off-road.”

Copyright © 2026 AltAssets

Leave a Reply