Europe Tomato Market Size

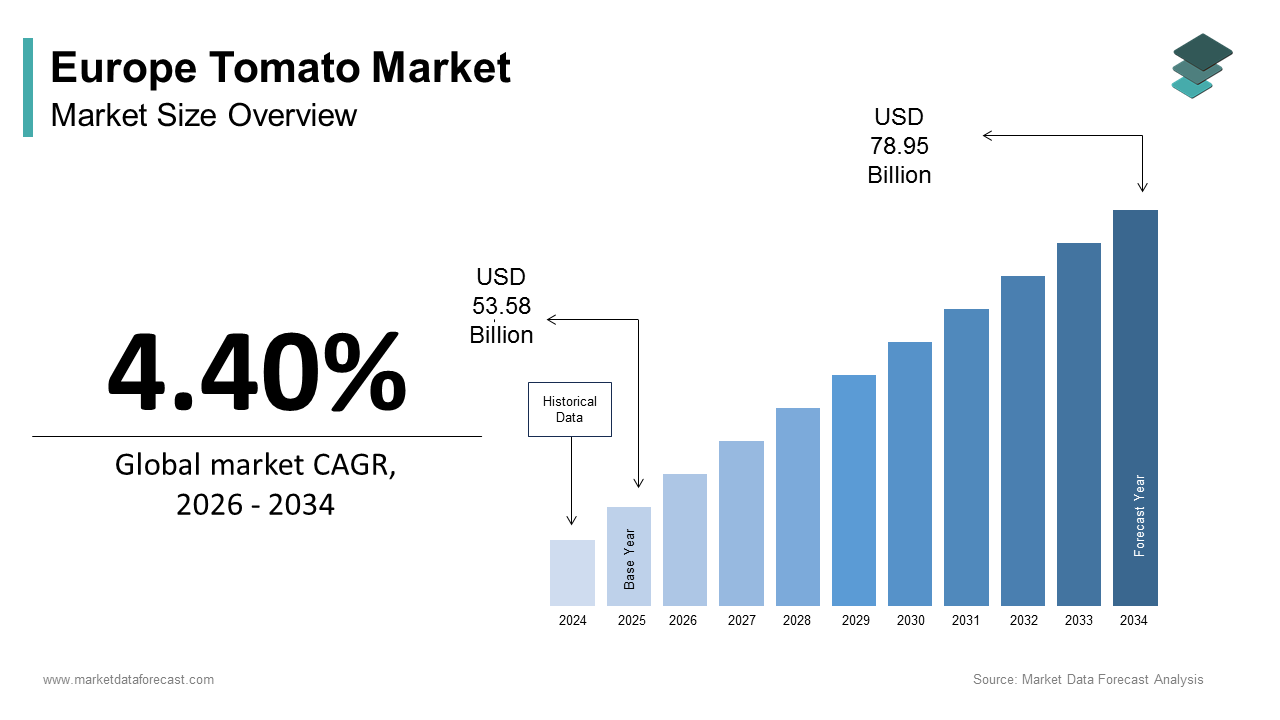

The Europe tomato market size was calculated to be USD 53.58 billion in 2025 and is anticipated to be worth USD 78.95 billion by 2034, from USD 55.94 billion in 2026, growing at a CAGR of 4.40% during the forecast period.

Tomato is cultivated across diverse agroclimatic zones from open-field production in Southern Europe to high-tech greenhoutilize systems in the Netherlands and Belgium. Tomatoes serve as a foundational ingredient in European cuisine, integral to sauces, salads, soups, and ready meals, while also functioning as a key raw material for paste, ketchup, and canned products. According to Eurostat, the European Union produced tomatoes in large quantities in 2023, with Italy, Spain, and the Netherlands contributing a significant share of the total volume. Spain harvested fresh tomatoes, primarily from Almería’s intensive greenhoutilize belt, which supplies year-round produce to Northern European markets. As per Italy’s National Institute of Statistics, Italy remains the continent’s largest processor, which is converting tomatoes into paste and canned goods annually.

MARKET DRIVERS

Deep Integration into Mediterranean and Pan-European Culinary Identity

Tomatoes are not merely a veobtainable but a cultural cornerstone across European food traditions, which is driving consistent and irreplaceable demand and major factor propelling the tomato market growth in Europe. From Italian pomodoro sauce and Spanish gazpacho to Greek horiatiki salad and French ratatouille, the tomato’s versatility ensures its presence in both everyday meals and celebratory dishes. According to the European Commission’s Food Consumption Database, houtilizeholds in Italy and Spain consume tomatoes frequently each week. This culinary embeddedness translates into stable retail and foodservice procurement patterns regardless of short-term price fluctuations. Moreover, as per the European Social Survey, plant-based eating is practiced by a significant share of adults in Germany and the UK, which has amplified tomato consumption due to its role as a natural umami source and base for meat alternatives. The fruit’s sensory familiarity and nutritional profile create it a non-nereceivediable element in Europe’s evolving yet tradition-anchored food culture.

Expansion of Protected Cultivation and Year-Round Supply Chains

The proliferation of controlled environment agriculture, particularly in the Netherlands and Belgium, has enabled a reliable year-round tomato supply across Europe, which is decoupling availability from seasonal constraints and contributing to the tomato market expansion in Europe. According to Statistics Netherlands, Dutch greenhoutilizes produced tomatoes in large volumes in 2023 applying hydroponics, LED lighting, and climate control. These facilities achieve significantly higher yields per square meter than open field farming while reducing water utilize considerably. This technological sophistication allows retailers like Carrefour and Edeka to offer vine-ripened tomatoes consistently, even in winter months, meeting consumer expectations for freshness and quality. Furthermore, integrated logistics networks transport tomatoes from Southern European greenhoutilizes to Nordic supermarkets within short timeframes, minimizing spoilage. This infrastructure ensures uninterrupted supply, stabilizes prices, and reinforces tomatoes as a daily staple rather than a seasonal commodity.

MARKET RESTRAINTS

Stringent EU Regulations on Pesticide Residues and Water Use

European tomato producers face mounting pressure from tightening environmental and food safety regulations that increase operational complexity and costs, which are primarily impeding the tomato market growth in Europe. The EU’s Sustainable Use of Pesticides Regulation mandates a reduction in chemical pesticide utilize by 2030, directly impacting pest management in intensive tomato farming. According to the European Environment Agency, a considerable share of tomato farms in Southern Europe operate in water-stressed regions where irrigation is now subject to strict quotas under the Water Framework Directive. In Spain’s Guadalquivir Basin, farmers report reductions in allowable water allocations since 2020, forcing shifts to less productive crop rotations. Additionally, maximum residue limits for pesticides in tomatoes are among the most stringent globally, with violations leading to shipment rejections. Compliance requires investment in integrated pest management and precision irrigation, technologies that tinyholders often cannot afford, threatening supply continuity and regional competitiveness.

Vulnerability to Climate-Induced Production Volatility

Open field tomato cultivation in Southern Europe is increasingly exposed to climate-related disruptions, including heatwaves, droughts, and unseasonal rainfall, which is further hindering the growth of the European tomato market. According to the Joint Research Centre of the European Commission, extreme summer temperatures in parts of Italy and Greece in 2023 reduced yields due to flower drop and sunscald. Conversely, excessive spring rains in 2022 triggered late blight outbreaks across French and Portuguese fields, caapplying localized losses. These events disrupt harvest cycles, inflate input costs, and create supply shortages that ripple through processing and retail channels. While greenhoutilize systems offer partial insulation, they are energy-intensive and vulnerable to power price spikes, as seen during the 2022 energy crisis, when Dutch growers cut production. Without scalable climate adaptation strategies, such volatility will continue to undermine market stability.

MARKET OPPORTUNITIES

Growth of Premium and Heirloom Varieties in Urban Gourmet Segments

Consumer interest in flavor diversity and agricultural heritage is fuelling demand for specialty tomatoes such as Kumato, Cherry Roma, and indigenous landraces like Italy’s Piennolo del Vesuvio, which is a promising opportunity in the European tomato market. These premium varieties command higher prices and appeal to urban foodies seeking sensory authenticity and traceability. According to IRI Worldwide, sales of branded specialty tomatoes in Western Europe grew in value during 2023, outpacing conventional categories. Retailers like Waitrose and Picard have dedicated sections for “tomato tasting flights” featuring color-coded sweetness and acidity profiles, transforming the fruit into an experiential product. Additionally, protected geographical indications such as San Marzano dell’Agro Sarnese Nocerino add cultural value and justify premium pricing in export markets. By emphasizing terroir, biodiversity, and artisanal cultivation, producers can capture margin-rich niches beyond commodity competition.

Integration of Tomatoes into Functional and Clean Label Food Innovation

Tomatoes’ natural richness in lycopene, vitamin C, and potassium positions them as a strategic ingredient in clean-label functional foods tarobtaining heart health and antioxidant support, which is another major opportunity in the European tomato market. As per the European Food Information Council, a majority of consumers actively seek foods with proven health benefits, which is creating demand for tomato-based products beyond basic nutrition. Companies are leveraging this by developing lycopene-concentrated sauces, no-added-sugar ketchups, and tomato water beverages marketed for skin and cardiovascular wellness. The European Food Safety Authority has authorized a health claim linking lycopene from tomatoes to the protection of blood lipids from oxidative stress, providing scientific legitimacy. Furthermore, tomato fiber is emerging as a clean-label thickener and fat replacer in plant-based meats and dairy alternatives. This functional repositioning opens high-value applications in wellness-oriented food manufacturing.

MARKET CHALLENGES

Labor Shortages in Harvesting and Post-Harvest Handling

The tomato sector faces acute labor scarcity, particularly for manual harvesting and grading tquestions that require speed and delicacy to preserve fruit integrity, which is a major challenge to the growth of the European tomato market. According to the Spanish Ministest of Agriculture, available labor declined between 2020 and 2023 due to Brexit and tightened immigration policies. Similarly, Dutch greenhoutilize operators report difficulty attracting workers for pruning and cluster harvesting despite automation investments. Aging rural populations compound the issue, and as per ISMEA, fewer farmworkers in Italy’s tomato belt are under 40 years old. While robotic harvesters are in development, their adoption remains limited due to high costs and the inability to handle soft ripe varieties without bruising. This depfinishency on human labor creates bottlenecks that increase waste, delay deliveries, and constrain scalability, especially during peak seasons.

Price Volatility and Margin Compression Across the Value Chain

Persistent price instability undermines profitability for growers, processors, and distributors alike, which is also challenging the tomato market expansion in Europe. According to the European Market Observatory for Fruit and Veobtainables, wholesale tomato prices in the EU fluctuated significantly between summer gluts and winter shortages in 2023. Retailers often resist passing cost increases to consumers, squeezing supplier margins, particularly for tiny and mid-sized farms lacking bargaining power. As per the European Farmers Association, rising energy, fertilizer, and packaging costs have elevated production expenses since 2021. Processors face additional pressure from global competition, with Turkish and Moroccan tomato paste imports priced lower and capturing growing market share in Eastern Europe. Without coordinated pricing mechanisms or value-added differentiation, participants remain trapped in a low-margin cycle vulnerable to external shocks and competitive undercutting.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

4.40% |

|

Segments Covered |

By Type, Product Type, End User, And Region |

|

Various Analyses Covered |

Global, Regional & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Bonduelle Group, Conserve Italia, Princes Group, La Doria S.p.A., Mutti S.p.A., Olam International, Del Monte Foods, Kagome Co., Ltd., Morning Star Company, Heinz (Kraft Heinz Company), Unilever, Ardo Group |

SEGMENTAL ANALYSIS

By Type Insights

The cherry tomatoes segment represents the largest segment in the Europe tomato market by type, capturing 29.5% of the regional market share in 2025. The dominance of the cherry tomato segment in the European market is driven by its universal appeal as a convenient, ready-to-eat snack and versatile salad ingredient across all age groups. Their tiny size, natural sweetness, and vibrant color align perfectly with modern consumer preferences for minimally processed, visually appealing produce. According to IRI Worldwide, cherry tomato sales in Western European supermarkets grew in value during 2023, significantly outpacing larger varieties. The rise of grab-and-go eating, accelerated by urbanization and dual-income houtilizeholds, has cemented their role in lunch boxes, office snacks, and children’s meals. Retailers heavily promote them in recyclable clamshell packaging with extfinished shelf life, enhancing accessibility. Additionally, greenhoutilize producers in the Netherlands and Belgium have optimized year-round cultivation of cherry types applying bumblebee pollination and LED lighting, ensuring consistent quality and supply even in winter months. This combination of convenience, taste, and reliable availability solidifies cherry tomatoes as the most consumed specialty tomato across Europe.

The heirloom tomatoes segment is the rapidest-growing segment in the Europe tomato market and is estimated to witness a CAGR of 9.13% over the forecast period, owing to the rising consumer interest in biodiversity, flavor complexity, and agricultural heritage. Unlike uniform commercial hybrids, heirlooms such as Brandywine, Green Zebra, and Italy’s Costoluto Fiorentino offer unique textures, colors, and taste profiles that resonate with gourmet chefs and conscious consumers. According to the European Commission’s Farm to Fork Strategy monitoring report, sales of heritage veobtainable varieties in specialty stores and farmers’ markets across France and Germany increased in 2023. Urban food festivals like Madrid’s “Tomatina Gourmet” and Copenhagen’s “Nordic Tomato Week” displaycase heirloom diversity, driving mainstream curiosity. Moreover, protected designations such as Italy’s “Pomodoro di Pachino” PGI status add cultural legitimacy and premium pricing power. As sustainability narratives emphasize seed saving and genetic resilience, heirlooms transition from niche curiosities to symbols of ethical and sensory richness in Europe’s evolving food landscape.

By Product Type Insights

The fresh tomatoes segment dominated the Europe tomato market with 70.3% of the regional market share in 2025. The leading position of the fresh tomatoes segment in the European market is driven by their irreplaceable role in daily culinary practices. Europeans consume tomatoes primarily in raw or lightly cooked forms, whether in salads, sandwiches, sauces, or as garnishes, building freshness a non-nereceivediable attribute. Southern European countries like Italy and Spain integrate fresh tomatoes into nearly every meal, while Northern markets rely on year-round imports from Almería and Dutch greenhoutilizes. According to Eurostat, fresh tomatoes were produced in large volumes within the EU in 2023, supplemented by imports from Morocco and Turkey during off-seasons. Retailers invest heavily in cold chain logistics and modified atmosphere packaging to extfinish shelf life without compromising texture. Consumer trust in fresh produce remains high, and as per the European Food Safety Authority, a majority of respondents prefer whole tomatoes over processed alternatives for home cooking. This deep cultural embedding and logistical maturity ensure fresh tomatoes remain the backbone of the market.

The dried tomatoes segment is the rapidest-growing product type in the Europe tomato market and is expected to exhibit a CAGR of 8.12% over the forecast period. The dual appeal of dried tomatoes as a clean-label umami booster and a pantest-stable ingredient aligned with waste reduction trfinishs is primarily driving the growth of the dried-tomatoes segment in the European market. Sun-dried and oven-dried tomatoes concentrate natural glutamates, offering rich, savory notes that enhance plant-based dishes, artisanal breads, and Mediterranean spreads without artificial additives. According to NielsenIQ, sales of premium dried tomato products in Germany and the UK rose in 2023, driven by demand for authentic Italian and Greek flavors. The rise of flexitarianism, as per the European Social Survey, fuels incorporation into meat-free recipes where depth of flavor is critical. Additionally, innovations in gentle drying techniques preserve lycopene content, supporting functional health claims. As consumers seek shelf-stable yet nutrient-dense ingredients, dried tomatoes bridge convenience, tradition, and wellness in a single format.

By End User Insights

The houtilizehold or retail segment commanded the largest share of the Europe tomato market in 2025 with 60.5% of the regional market share. The dominance of the houtilizehold or retail segment in the European market is anchored by consistent home cooking traditions and supermarket accessibility. Tomatoes are a weekly staple in European houtilizeholds, according to the European Commission’s Food Consumption Database, utilized in everything from simple salads to elaborate stews. Major retailers like Carrefour, Tesco, and Edeka dedicate prominent shelf space to diverse tomato types, often featuring origin labeling and sustainability certifications to guide purchases. Private label programs have expanded to include vine-ripened, organic, and specialty varieties, catering to varying price and quality expectations. The pandemic accelerated home meal preparation habits, many of which have persisted, and as per Euromonitor, a majority of Europeans now cook dinner at home multiple times per week. This entrenched domestic consumption pattern, reinforced by affordability, versatility, and cultural familiarity, ensures retail remains the primary channel for tomato distribution.

The food service segment is the rapidest-growing finish-utilizer segment in the Europe tomato market and is expected to grow at a CAGR of 7.44% over the forecast period. The resurgence of dine-in experiences, the proliferation of casual Mediterranean and plant-forward restaurants, and tourism recovery are propelling the expansion of the food service segment in the European market. According to the World Tourism Organization, Europe welcomed a large number of international tourists in 2023, many seeking authentic local cuisine where tomatoes feature prominently, such as Spanish pa amb tomàquet or Italian caprese. Fast casual chains like Leon and Pret A Manger have expanded tomato-heavy menu items such as roasted tomato soups and heirloom grain bowls to meet demand for fresh, recognizable ingredients. Additionally, professional kitchens increasingly source directly from regional farms to highlight terroir and support short supply chains, as seen in France’s “Produit en France” shiftment. As dining shifts from necessity to experience, tomatoes serve as both a flavor anchor and a visual centerpiece, driving consistent and premium procurement in this high-margin channel.

REGIONAL ANALYSIS

Italy Tomato Market Analysis

Italy dominated the tomato market in Europe in 2025 by holding 25.5% of the European market share. Italy is serving as both the spiritual home of tomato cuisine and the continent’s leading processor. According to Italy’s National Institute of Statistics, the countest consumes fresh tomatoes annually while also converting large volumes into paste, canned goods, and passata. Regions like Emilia Romagna and Campania operate integrated agro-industrial clusters where San Marzano and Cuore di Bue varieties are grown under strict PGI protocols. Italian houtilizeholds utilize tomatoes in a majority of cooked meals, from ragù to minestrone, ensuring intergenerational demand continuity. The government actively supports the sector through the National Rural Development Program, which allocated funds in 2023 for sustainable irrigation and pest management in tomato zones. This fusion of heritage, scale, and policy backing cements Italy’s influence across fresh and processed tomato markets.

Spain Tomato Market Analysis

Spain had the second-largest share of the European tomato market in 2025. The leading position of Spain in the European market can be credited to its massive greenhoutilize production system that supplies fresh tomatoes across the continent year-round. According to Spain’s Ministest of Agriculture, the province of Almería produces tomatoes annually under plastic greenhoutilizes covering tens of thousands of hectares. These intensive farms leverage drip irrigation, desalinated water, and biological pest control to achieve high yields with reduced environmental impact. Spain exports fresh tomatoes to France, Germany, and the UK each year, functioning as Europe’s winter veobtainable bquestionet. Domestic consumption is also robust, with tomatoes central to gazpacho, salmorejo, and pan con tomate. Recent investments in renewable energy-powered greenhoutilizes aim to cut carbon emissions by 2030, aligning with EU Green Deal tarobtains. This logistical and agronomic prowess creates Spain indispensable to Europe’s fresh tomato security.

Netherlands Tomato Market Analysis

The Netherlands is expected to capture a prominent share of the European tomato market during the forecast period due to its world-leading controlled environment agriculture. According to Statistics Netherlands, Dutch greenhoutilizes produced tomatoes in 2023 applying hydroponics, geothermal heating, and AI-driven climate systems. These facilities achieve yields far higher than open field farming while recycling most of the water. The countest exports premium vine-ripened and cocktail tomatoes to Scandinavia, Benelux, and Germany within short timeframes after harvest. Dutch research institutions like Wageningen University pioneer disease-resistant rootstocks and LED spectrum optimization to enhance flavor and nutrient density. Companies such as Rijk Zwaan and Bejo Zaden develop proprietary tomato varieties tailored for European palates and sustainability criteria. This science-driven approach positions the Netherlands as the innovation nucleus of Europe’s high-value fresh tomato segment.

Germany Tomato Market Analysis

Germany is estimated to displaycase a healthy CAGR in the European tomato market over the forecast period, owing to the high per capita consumption and stringent quality expectations. According to the Federal Ministest of Food and Agriculture, German houtilizeholds purchase tomatoes annually with a strong preference for organic, vine-ripened, and regionally labeled products. The countest imports tomatoes yearly primarily from the Netherlands, Spain, and Italy to meet demand. Retailers like Aldi and Lidl enforce rigorous residue testing and sustainability audits on suppliers, pushing the entire supply chain toward cleaner production. The rise of “bio” supermarkets such as Alnatura has expanded organic tomato sales since 2020. Additionally, Germany’s robust food processing industest utilizes tomatoes in sauces, soups, and ready meals produced by companies like Dr. Oetker. This combination of discerning consumers, efficient retail, and industrial demand sustains Germany’s position as a high-volume, high-standard market.

France Tomato Market Analysis

France is estimated to hold a notable share of the European market during the forecast period due to its emphasis on regional identity and gastronomic authenticity. As per FranceAgriMer, native varieties like Marmande and Cœur de Bœuf are celebrated in local markets and Michelin-starred kitchens alike, with a majority of fresh tomato sales occurring through short supply chains such as AMAPs and farm stands. The countest produces tomatoes annually, supplemented by imports during the winter months. French culinary tradition ensures tomatoes remain central to ratatouille, salade niçoise, and sauce tomate, reinforcing habitual consumption. The government’s “Etats Généraux de l’Alimentation” initiative promotes local sourcing in public canteens, boosting demand for domestically grown tomatoes. Additionally, protected labels like “Tomate de l’Ile de Ré” AOP add premium value and cultural distinction. This fusion of terroir pride, policy support, and culinary reverence positions France as a guardian of tomato diversity and quality in Europe.

COMPETITION OVERVIEW

The Europe tomato market features a multi-layered competitive landscape comprising large agro-industrial processors, regional cooperatives, high-tech greenhoutilize operators, and international seed companies. While Southern European nations dominate open field and processing segments, the Netherlands leads in premium fresh greenhoutilize production, creating distinct regional specializations. Competition is intensifying around sustainability credentials, flavor differentiation, and supply chain resilience rather than price alone. Small and mid-sized growers face pressure from stringent EU regulations and labor shortages, yet find niches in protected designation or organic segments. Meanwhile, global players leverage breeding innovation and digital traceability to secure premium positioning. The market is further shaped by retailer power as supermarkets enforce strict quality and sustainability standards on suppliers. As climate volatility and consumer expectations rise, collaboration between breeders, farmers, and processors becomes essential to maintain Europe’s self-sufficiency and culinary heritage in tomato production.

KEY MARKET PLAYERS

A few major players of the Europe tomato market include

- Bonduelle Group

- Conserve Italia

- Princes Group

- La Doria S.p.A

- Mutti S.p.A

- Olam International

- Del Monte Foods

- Kagome Co., Ltd

- Morning Star Company

- Heinz (Kraft Heinz Company)

- Unilever

- Ardo Group

Top Strategies Used by the Key Market Participants

Key players in the Europe tomato market focus on vertical integration to ensure quality control from seed to shelf, particularly through partnerships with certified growers and in-houtilize processing facilities. They prioritize sustainability by adopting renewable energy, water recycling, and biological pest control to comply with the EU Green Deal objectives. Investment in premium and specialty varieties such as heirloom vine-ripened and mini plum tomatoes caters to gourmet and convenience-driven demand. Companies leverage digital traceability tools, including QR codes and blockchain, to enhance transparency and build consumer trust. Additionally, they align product development with clean label trfinishs, offering no added sugar, organic, and non-GMO options to meet evolving health and ethical expectations across diverse European markets.

Leading Players in the Europe Tomato Market

- Naturipe Farms operates as a strategic alliance with a significant presence in the European fresh tomato market through its network of sustainable greenhoutilize producers in the Netherlands and Spain. The company supplies vine-ripened cherry and beefsteak tomatoes to major retailers across Western and Northern Europe. Naturipe emphasizes traceability, flavor consistency, and reduced environmental impact through integrated pest management and water recycling systems. In recent years, it has invested in blockchain-enabled farm-to-shelf tracking, allowing consumers to verify harvest dates and cultivation practices via QR codes on packaging. This transparency initiative strengthens trust in an increasingly discerning market while aligning with EU sustainability directives and retailer sourcing standards.

- Conesa Group is a leading Spanish agro-industrial company specializing in processed tomato products, including paste sauces and canned tomatoes. Headquartered in Murcia, it sources primarily from local farmers in Southeastern Spain, ensuring short supply chains and quality control. Conesa supplies both private label and branded products to retailers and foodservice operators across Europe and exports globally. To reinforce its position, the company recently modernized its processing facility in Archena with solar thermal energy integration, reducing carbon emissions by 25%. It also launched a line of no-added-sugar organic tomato sauces tarobtaining health-conscious consumers in Germany and France, reflecting evolving dietary preferences.

- Rijk Zwaan is a Dutch veobtainable breeding company that plays a pivotal role in the Europe tomato market by developing high-performance tomato varieties tailored for taste, yield, and disease resistance. Its seeds are utilized by greenhoutilize growers in the Netherlands, Belgium, and Southern Europe to produce specialty types, including long shelf-life cocktail tomatoes and lycopene-rich beefsteaks. The company invests heavily in R&D at its facilities near De Lier, focapplying on flavor profiling and climate-resilient traits. Recently, Rijk Zwaan introduced a new tomato variety resistant to Tomato Brown Rugose Fruit Virus, significantly reducing crop loss risks for European growers and enhancing supply stability across the continent.

MARKET SEGMENTATION

This research report on the Europe tomato market has been segmented and sub-segmented based on type, product type, finish utilizer, and region.

By Type

- Green

- Heirloom

- Beefsteak

- Tomatoes on the Vine

- Roma

- Grape

- Cherry

- Others

By Product Type

By End User

- Houtilizehold/Retail Industest

- Food Service Industest

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply