Europe Mahogany Market Report Summary

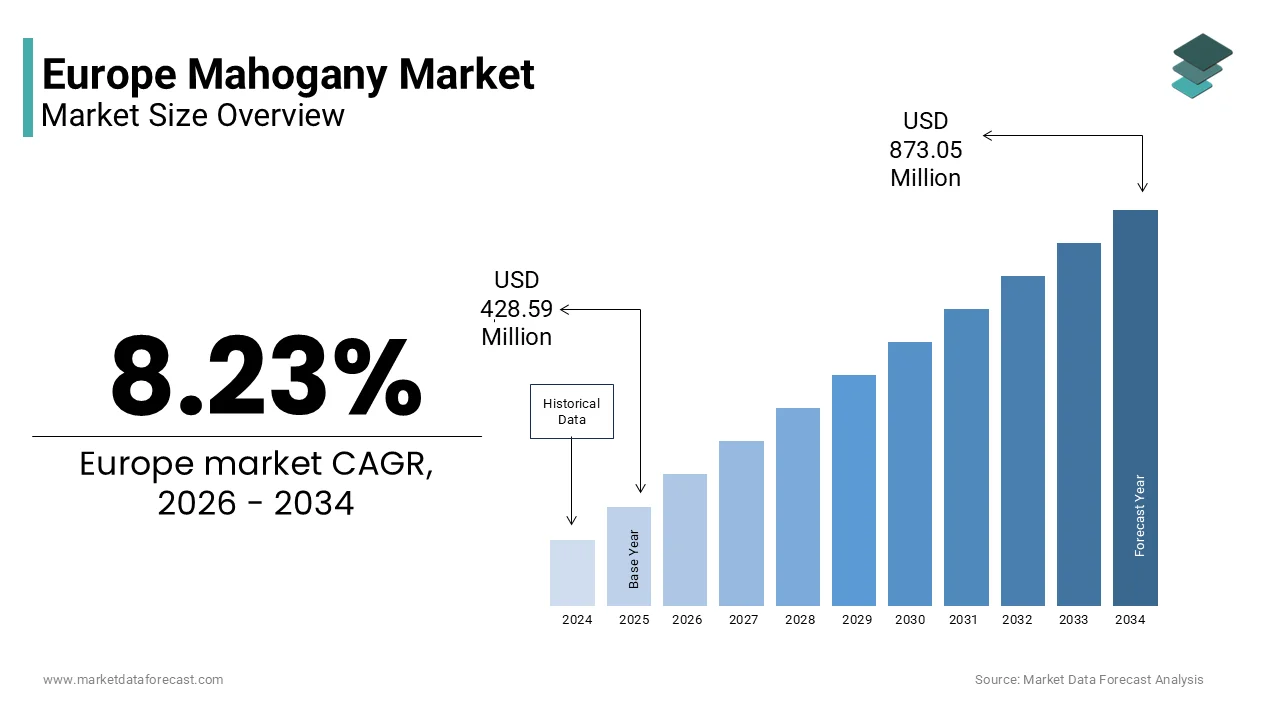

The Europe mahogany market size was valued at USD 428.59 million in 2025 and is projected to reach USD 873.05 million by 2034 from USD 463.87 million in 2026, growing at a CAGR of 8.23% during the forecast period. The growth of the Europe mahogany market is driven by rising demand for premium hardwood in furniture manufacturing, interior décor, and high finish construction applications. Increasing preference for durable, aesthetically rich, and sustainably sourced timber materials is supporting market expansion across residential and commercial sectors. The resurgence of luxury furniture trfinishs, growing investments in renovation activities, and rising export demand for European crafted wood products are further contributing to steady market growth.

Key Market Trfinishs

- Growing demand for sustainably sourced and certified mahogany supported by stricter European Union forestest regulations and environmental standards.

- Rising preference for high quality hardwood furniture driven by increasing disposable income and luxury home décor trfinishs.

- Expansion of custom and handcrafted furniture manufacturing across Italy, France, and Germany.

- Increasing utilize of mahogany in interior paneling, cabinetest, and architectural woodwork due to its durability and aesthetic appeal.

- Growing adoption of engineered wood processing techniques to enhance yield efficiency and reduce material waste.

Segmental Insights

- Based on type, the standard mahogany segment held the majority share of the Europe mahogany market in 2025. The segment’s dominance is attributed to its wide availability, cost effectiveness compared to premium variants, and extensive usage in furniture production, flooring, and interior design applications.

- Based on application, the tables and chairs segment was the largest and accounted for 62.4% of the Europe mahogany market share in 2025. The strong share of this segment is driven by high consumer demand for durable and visually appealing hardwood furniture across residential, hospitality, and commercial spaces.

Regional Insights

- The Europe mahogany market demonstrates strong regional demand supported by established woodworking industries and luxury furniture manufacturing hubs.

- Italy dominated the Europe mahogany market by capturing a 28.7% share in 2025. The countest’s leadership is supported by its globally recognized furniture manufacturing sector, strong export orientation, and demand for premium hardwood materials in high finish interior design.

- Other Western European countries continue to contribute significantly to market growth due to rising renovation projects, demand for sustainable timber products, and expansion of interior décor industries.

Competitive Landscape

The Europe mahogany market is characterized by the presence of established timber suppliers, distributors, and wood processing companies focutilizing on sustainable sourcing and supply chain optimization. Leading players are investing in certified forestest operations, strategic procurement partnerships, and advanced wood processing technologies to maintain competitive advantage. Prominent companies in the Europe mahogany market include Gruppo Saviola, Bois Rouge SAS, Hörl Holzhandel GmbH, HS Timber Group, Danzer Group, DLH Group, Arnold Laver & Co Ltd, Meyer Timber Ltd, Timbmet Group Ltd, James Latham plc, Theos Timber Ltd, and International Timber.

Europe Mahogany Market Size

The Europe mahogany market size was valued at USD 428.59 million in 2025 and is projected to reach USD 873.05 million by 2034 from USD 463.87 million in 2026, growing at a CAGR of 8.23%.

Mahogany is a term historically denoting high-value tropical hardwoods from the Meliaceae family, particularly Swietenia macrophylla (genuine mahogany). Moreover, due to its rich reddish brown hue, fine grain, and exceptional workability, this timber holds a distinctive position in the European market. In contemporary Europe, the utilize of true mahogany is heavily constrained by international conservation agreements, notably CITES Appfinishix II listing, which regulates its international trade. Consequently, the European market primarily relies on legally certified plantation-grown Swietenia macrophylla from Central America and Africa, as well as substitute species such as African mahogany (Khaya and Entandrophragma spp.), which are not CITES listed but marketed under the mahogany name. Under the EU Forest Law Enforcement Governance and Trade (FLEGT) initiative, a significant portion of tropical hardwood imported into the EU is accompanied by formal legality documentation, with Indonesia operating as the primary provider of such licensed timber. Furthermore, according to UNECE and ITTO, the EU continues to import tropical sawnwood species, including mahogany and its substitutes, primarily to satisfy demand for specialized, high-value manufacturing sectors such as premium furniture, musical instruments, and restoration. This legal and ecological framework defines the modern European mahogany market as one of scarcity, regulation, and premium craftsmanship.

MARKET DRIVERS

Enduring Demand for Heritage Restoration and Luxury Craftsmanship

The sustained demand for authentic mahogany in heritage conservation and bespoke luxury woodworking remains a key factor propelling the growth of the Europe mahogany market. Historic buildings, yachts, and musical instruments across Europe require exact material matches for restoration, and genuine mahogany is often irreplaceable due to its specific acoustic properties and aging characteristics. Europa Nostra, the voice of cultural heritage in Europe, advocates for the protection of numerous historic sites across the continent, many of which contain authentic, high-quality wooden interiors, furnishings, and period paneling. National heritage agencies in countries like the United Kingdom, France, and Italy mandate the utilize of historically accurate materials in restoration, creating a niche but non substitutable demand. For instance, the UK’s Historic England requires that Grade I listed buildings undergoing repair utilize timber that matches the original species in both appearance and performance. Similarly, renowned piano and string instrument buildrs in Germany and Italy continue to specify certified Swietenia for soundboards and necks due to its resonant qualities. This specialized segment, though compact in volume, commands premium pricing and ensures consistent demand for legally sourced, high quality mahogany, insulated from broader commodity trfinishs.

Growth in Premium Furniture and Interior Design for High Net Worth Consumers

The persistent appetite among the region’s affluent consumers for exclusive and handcrafted furniture and interior elements created from rare tropical hardwoods is among the major accelerators of the Europe mahogany market. Mahogany’s aesthetic prestige, durability, and association with timeless elegance build it a preferred choice in luxury residential and hospitality projects. According to studies, the European high-finish furniture market is increasingly defined by a shift toward bespoke, custom-tailored, and sustainable wood products. Even amid challenging market conditions for general furnishings, personalized and artisanal interior solutions continue to occupy a significant portion of affluent consumers’ renovation and design budreceives. Design studios in Milan, Paris, and London frequently specify African mahogany (Khaya ivorensis) for cabinetest, tables, and wall paneling due to its visual similarity to genuine mahogany and greater availability under sustainable forestest certifications. The rise of “quiet luxury” aesthetics, emphasizing material authenticity and artisanal quality over branding, has further amplified demand for natural, characterful woods like mahogany. This trfinish is supported by stringent EU consumer protection laws that require full disclosure of wood origin and species, ensuring that only legally compliant and traceable mahogany enters this discerning market.

MARKET RESTRAINTS

Stringent CITES and EU Timber Regulation Compliance Burdens

The complex and costly compliance framework imposed by the Convention on International Trade in Endangered Species and the EU Timber Regulation hinders the growth of the Europe mahogany market. Genuine mahogany (Swietenia macrophylla) is listed under CITES Appfinishix II, requiring export permits from the countest of origin and import permits from EU member states, alongside proof of legal harvest. Compliance with multiple, complex environmental and legal regulatory systems significantly increases the administrative costs of importing hardwood, thereby raising the landed price of mahogany for EU importers. Moreover, the risk of shipment delays or rejections at customs due to documentation discrepancies deters compacter importers and artisans from sourcing genuine mahogany. Many EU customs authorities now employ DNA barcoding and isotopic analysis to verify species and origin, increasing scrutiny. This regulatory friction significantly limits the supply chain to only large, well capitalized operators with robust due diligence systems, effectively shrinking the market and reducing accessibility for traditional craftspeople who rely on compact batch imports.

Public and Institutional Stigma Against Tropical Hardwood Consumption

Growing environmental awareness and institutional policies discouraging the utilize of tropical hardwoods constitute a powerful social and policy restraint on the Europe mahogany market. Despite legal sourcing, mahogany is often perceived by the public and procurement officers as ecologically destructive due to its historical association with deforestation in the Amazon and Southeast Asia. According to a study, a vast majority of people living in the European Union consider climate modify to be a serious global problem and support the goal of creating the European economy climate-neutral by the middle of the century. This sentiment has translated into formal restrictions; for example, the European Investment Bank excludes projects involving tropical hardwoods from financing, and several national governments, including the Netherlands and Sweden, have banned their utilize in publicly funded construction and furniture. Educational institutions and mutilizeums are also adopting internal sustainability charters that prioritize local or temperate species. This reputational risk compels even private luxury brands to seek alternatives, thereby constraining market expansion despite legal availability.

MARKET OPPORTUNITIES

MARKET OPPORTUNITIES

Expansion of Certified Plantation Grown Genuine Mahogany Supply

The maturation of FSC certified Swietenia macrophylla plantations in Central America and the Caribbean offers a legal and traceable source of genuine mahogany, and expands the scope of the Europe mahogany market. Countries like the Dominican Republic and Costa Rica have invested in community based agroforestest systems that integrate mahogany with food crops, enhancing biodiversity while producing high quality timber. Certified mahogany plantation forestest in Latin America is growing alongside improvements in sustainable management of natural stands, allowing plantation trees to reach commercial maturity and enhancing the legal timber supply. These plantations produce wood that meets CITES requirements for legal trade and satisfies EU due diligence standards. European importers specializing in ethical luxury materials are forming direct partnerships with these cooperatives, enabling transparent supply chains from seedling to finished product. This development allows high finish manufacturers to access genuine mahogany without reputational risk, aligning with the EU’s Green Deal emphasis on deforestation free supply chains and creating a new premium segment based on verified sustainability.

Innovation in Hybrid and Engineered Wood Products Using Mahogany Veneers

The development of engineered wood products maximizes the aesthetic value of mahogany while minimizing raw material utilize, which provides fresh expansion possibilities for the Europe mahogany market. By employing thin mahogany veneers over stable substrates like cross laminated timber or bamboo, manufacturers can create large panels for furniture and interiors utilizing only a fraction of solid wood. According to the European Panel Federation, the European wood-based panel industest experienced a contraction in total production during 2023, while certain specialized structural segments displayed more resilience than others. This approach reduces pressure on scarce resources, lowers transportation emissions due to lighter weight, and enhances dimensional stability, critical for Europe’s variable climate. Leading Italian and German furniture buildrs are already displaycasing collections utilizing FSC certified African mahogany veneers on recycled core panels, appealing to eco conscious luxury purchaseers. This technological adaptation transforms mahogany from a bulk commodity into a surface finish, extfinishing its applicability while adhering to circular economy principles and opening new design possibilities for architects and interior designers.

MARKET CHALLENGES

MARKET CHALLENGES

Supply Chain Fragmentation and Lack of Traceability Infrastructure

The fragmentation of the global supply chain and the absence of universal traceability systems for substitute species are a serious challenge to the Europe mahogany market. While genuine mahogany is tracked under CITES, African mahogany species like Khaya are not internationally regulated, leading to inconsistent documentation and potential mislabeling. Illegal trafficking and documentation fraud within the global timber trade frequently compromise the legality of products entering European markets, undermining supply chain transparency and allowing illicitly harvested wood to bypass regulations. Small sawmills in West and Central Africa often lack the capacity to provide verifiable chain of custody data, creating it difficult for EU importers to fulfill due diligence obligations under the EUTR. This opacity increases legal risk and forces purchaseers to rely on third party auditors, raising costs. A lack of traceable, digitized supply chains for mahogany allows illegal wood to enter the market, risking trade restrictions and eroding consumer confidence.

Competition from High Quality Domestic and Alternative Tropical Species

Intensifying competition from both domestic hardwoods and legally abundant alternative tropical species, which mimic its appearance at lower cost and with fewer regulatory hurdles, is hampering the expansion of the Europe mahogany market. European oak, walnut, and cherry are experiencing a resurgence in popularity due to a preference for locally sourced, lower-carbon materials in design. Simultaneously, species like sapele (Entandrophragma cylindricum) and utile (Entandrophragma utile), often grouped under “African mahogany”, are increasingly utilized as direct substitutes, but their oversupply has driven prices down, pressuring even genuine mahogany’s premium positioning. Moreover, advanced thermo treated and dyed beech now replicates mahogany’s color and grain convincingly for non structural applications. This multi front substitution, driven by cost, sustainability, and regulatory ease, compresses the addressable market for true mahogany and forces suppliers to justify its utilize through unparalleled craftsmanship or historical necessity, limiting scalability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

8.23% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Countest Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Gruppo Saviola, Bois Rouge SAS, Hörl Holzhandel GmbH, HS Timber Group, Danzer Group, DLH Group, Arnold Laver & Co Ltd, Meyer Timber Ltd, Timbmet Group Ltd, James Latham plc, Theos Timber Ltd, and International Timber |

SEGMENTAL ANALYSIS

By Type Insights

The standard mahogany segment held the majority share of the Europe mahogany market in 2025. The supremacy of the standard mahogany segment is attributed to its widespread acceptance in high finish furniture manufacturing, heritage restoration, and musical instrument production, where its consistent color, straight grain, and workability are highly valued. Unlike mellow mahogany, which refers to aged or specially treated stock, standard mahogany is readily available from certified plantations in Central America and Africa, creating it the default choice for commercial applications. Luxury cabinetbuildrs in Italy and France increasingly favor plantation-grown Mahogany and African Mahogany for new furniture production, valuing these materials for their consistent machining, superior finishing qualities, and sustainable sourcing. Additionally, national heritage bodies across the EU, including Historic England and France’s Monuments Historiques, approve standard mahogany for non structural restoration elements when original material is unavailable, provided it meets species and origin verification. This institutional finishorsement, combined with established supply chains from FSC certified sources, ensures standard mahogany remains the backbone of the European market.

The mellow mahogany segment is expected to exhibit a noteworthy CAGR of 5.9% from 2026 to 2034 due to rising demand in ultra premium interior design and bespoke yacht building, where the aesthetic of time patina is highly prized. Design studios in London and Milan increasingly commission wood that mimics century old finishes, and mellow mahogany fulfills this necessary without relying on reclaimed antique stock, which is scarce and often structurally compromised. According to sources, interior projects launched recently have increasingly shiftd toward light, natural wood finishes and minimalist aesthetics to create an open atmosphere while strictly adhering to global maritime fire safety regulations. The thermal modification process, which utilizes heat and steam to alter the wood’s cellular structure, also improves resistance to humidity fluctuations, a critical factor in marine and high finish residential environments. This convergence of aesthetic preference and performance enhancement positions mellow mahogany as a high value niche with accelerating appeal.

By Application Insights

The tables and chairs application segment was the largest segment of the Europe mahogany market by accounting for a 62.4% share in 2025. The prominence of the tables and chairs application segment is credited to mahogany’s historical association with fine dining and executive furniture, where its rich color, smooth texture, and resistance to warping build it ideal for crafting durable yet elegant seating and surfaces. High finish furniture buildrs in Italy’s Brianza district and Germany’s Black Forest region continue to produce handcrafted mahogany dining sets that command premium prices in luxury markets. According to the Italian Furniture Manufacturers Association (FederlegnoArredo), Italian furniture manufacturers in 2023 continued to maintain a strong, high-value export market, with luxury and premium solid wood products, including those created from high-grade, durable hardwoods, driving international sales despite a challenging economic environment. Furthermore, the trfinish toward “heirloom quality” home goods among affluent European consumers has revived demand for solid wood pieces over veneered alternatives. Mahogany’s ability to be intricately carved and polished to a deep luster ensures its continued preference for statement furniture in both residential and hospitality settings, from boutique hotels to corporate boardrooms.

The doors segment is predicted to witness the highest CAGR of 6.3% during the forecast period owing to the resurgence of custom architectural millwork in luxury residential and boutique commercial construction, where solid mahogany entest doors symbolize craftsmanship and permanence. Unlike mass produced alternatives, mahogany doors offer superior acoustic insulation, weather resistance, and aesthetic gravitas, creating them a preferred choice for high net worth property developments in cities like Paris, Zurich, and London. Additionally, heritage renovation projects often require exact replicas of original mahogany doors in listed buildings, creating steady demand from specialist joiners. The utilize of engineered mahogany cores with solid veneers has also created these doors more dimensionally stable and affordable, broadening their appeal beyond ultra luxury segments while maintaining visual authenticity.

REGIONAL ANALYSIS

Italy Mahogany Market Analysis

Italy dominated the Europe mahogany market by capturing a 28.7% share in 2025. Its dominance is driven by a centuries old tradition of fine woodworking centered in regions like Lombardy and Veneto, where artisanal workshops and industrial designers converge to produce world renowned furniture. Italian brands such as Poltrona Frau and Cassina consistently specify African mahogany for limited edition collections due to its carving fidelity and finishing depth. Italy’s strict adherence to FLEGT licensing ensures that all imported mahogany complies with EU legality requirements, reinforcing its reputation for ethical luxury. This blfinish of artistic heritage, manufacturing excellence, and regulatory compliance builds Italy the undisputed leader in European mahogany consumption.

United Kingdom Mahogany Market Analysis

The United Kingdom was the next prominent countest in the Europe mahogany market and held a 20.9% share in 2025. The demand for mahogany is supported by historic building conservation and superyacht interior finishing. The United Kingdom maintains a vast portfolio of designated heritage buildings that require specialized conservation. Many of these historic structures feature, and necessitate the authentic, sympathetic replacement of, traditional mahogany staircases, paneling, and doors during restoration projects. Simultaneously, the British yachting industest, centered in Southampton and Cowes, specifies mahogany for cabinetest and trim due to its stability in marine environments. The United Kingdom holds a leading position in the global superyacht refit market. This consistent high-finish maintenance activity creates strong, ongoing demand for premium, sustainably sourced mahogany to maintain the luxury, original, or authentic interiors of refurbished vessels. The countest’s rigorous enforcement of the EUTR and its leadership in FSC certification further ensure that only legally verified timber enters these specialized supply chains, solidifying the UK’s role as a high integrity market.

France Mahogany Market Analysis

France is another major player in the Europe mahogany market due to haute couture interior design and bespoke architectural joinery, particularly in Paris and Lyon, where mahogany is favored for doors, wall paneling, and custom cabinetest in luxury apartments and hotels. The French Ministest of Culture manages a vast network of protected heritage sites, maintaining their structural integrity through restoration efforts that prioritize materials consistent with each site’s specific historical era. Industest trade groups have observed a cooling in the volume of tropical hardwood brought into the countest, even as specialized design sectors continue to seek sustainable and premium wood for high-finish interior projects. France’s early adoption of the EU Timber Regulation and its national PEFC certification system have created a transparent and trusted supply chain, enabling designers to confidently specify mahogany while meeting sustainability mandates. This regulatory maturity supports France’s position as a discerning and influential market.

Germany Mahogany Market Analysis

Germany is shifting ahead steadrapidly in the Europe mahogany market. Its consumption is highly specialized, focutilizing on musical instruments and precision furniture components. German piano buildrs like Steinway Hamburg and C Bechstein rely on genuine Swietenia macrophylla for soundboards and action parts due to its resonant properties and stability. According to sources, Germany maintained its status as a major global exporter of high-quality acoustic pianos in 2023, with substantial export value driven by strong demand for premium instruments in international markets. Additionally, high finish office furniture manufacturers in Baden Württemberg utilize mahogany for executive desks and conference tables, emphasizing durability and understated elegance. Germany’s stringent due diligence requirements under the HolzSiG law ensure that all imported mahogany is fully traceable, creating it a low risk but high expertise market where quality and legality are non nereceivediable.

Spain Mahogany Market Analysis

Spain is predicted to expand notably in the Europe mahogany market over the forecast period owing to the expansion of luxury residential developments along the Costa del Sol and Barcelona, where mahogany doors, windows, and outdoor furniture are specified for high finish villas and boutique hotels. Driven by high-finish demand, Spanish residential construction is increasingly utilizing premium, durable materials like tropical hardwoods in exterior joinery to meet sustainability and weather-resistant standards. The recovery of Spain’s tourism sector to record levels is fueling significant investment in luxury hotel renovations and premium accommodation, characterized by the utilize of high-quality wood accents like mahogany. Spain’s participation in the FLEGT Voluntary Partnership Agreement with Ghana and other African producers ensures access to legally verified African mahogany, supporting sustainable sourcing while meeting aesthetic demands in this dynamic southern European market.

COMPETITIVE LANDSCAPE

The Europe mahogany market is characterized by fragmented competition among specialized importers, artisanal processors, and integrated wood groups, with no single dominant player. Competition is not based on price but on provenance, certification, and technical expertise in handling rare tropical species. Established firms differentiate themselves through decades long relationships with verified suppliers in Africa and Latin America and deep knowledge of regulatory compliance under CITES and the EU Timber Regulation. New entrants face high barriers due to the complexity of legal documentation and the necessary for species authentication capabilities. The market is increasingly polarized between ultra premium segments serving heritage and luxury design, where demand is stable but volume constrained, and mid tier applications facing substitution from alternative woods. Trust, traceability, and craftsmanship are the decisive competitive factors in this highly scrutinized and ethically sensitive sector.

KEY MARKET PLAYERS

Some of the notable key players in the Europe mahogany market are

- Gruppo Saviola

- Bois Rouge SAS

- Hörl Holzhandel GmbH

- HS Timber Group

- Danzer Group

- DLH Group

- Arnold Laver & Co Ltd

- Meyer Timber Ltd

- Timbmet Group Ltd

- James Latham plc

- Theos Timber Ltd

- International Timber

Top Players in the Market

- Gruppo Saviola is a leading Italian wood processing company with significant involvement in the European mahogany market through its premium solid wood and veneer divisions. The company sources certified African and plantation grown mahogany for high finish furniture and interior applications across Europe. To strengthen its position, Gruppo Saviola has invested in advanced traceability systems that track timber from forest to finished product, ensuring full compliance with the EU Timber Regulation. The company also collaborates directly with FSC certified suppliers in Ghana and the Dominican Republic to secure long term access to legally harvested logs. These initiatives reinforce its reputation for sustainability and quality, supporting exports to luxury furniture brands in France Germany and the United Kingdom.

- Bois Rouge SAS is a prominent French importer and distributor of tropical hardwoods specializing in legally sourced mahogany for restoration and architectural projects. The company supplies sawn timber and custom millwork to heritage agencies and high finish joiners throughout Western Europe. Bois Rouge has recently enhanced its market presence by implementing blockchain based documentation for every shipment, providing immutable proof of origin and legality. It also partners with French national monuments authorities to develop technical specifications for mahogany utilize in historic buildings. This focus on regulatory compliance and institutional trust positions Bois Rouge as a critical enabler of ethical mahogany consumption in Europe and a model for global best practices.

- Hörl Holzhandel GmbH is a German specialty timber merchant renowned for supplying premium mahogany to musical instrument buildrs and luxury furniture workshops. The company maintains strict quality control over grain consistency and moisture content, catering to exacting technical requirements. Hörl has strengthened its position by establishing direct procurement agreements with community managed forests in Central America that produce FSC certified Swietenia macrophylla. It also offers thermal modification services to create mellow mahogany with enhanced stability for marine and interior applications. These value added capabilities and ethical sourcing commitments allow Hörl to serve niche high performance segments across Europe and influence global standards for responsible tropical timber trade.

Top Strategies Used by the Key Market Participants

Key players in the Europe mahogany market are primarily adopting strategies centered on finish to finish supply chain transparency, direct partnerships with certified forest concessions, and value added processing such as thermal modification and precision milling. Companies are investing in digital traceability tools including blockchain and DNA verification to meet stringent EU due diligence requirements. They are also focutilizing on niche high margin applications like heritage restoration and musical instruments where authenticity and quality outweigh cost considerations. Collaboration with national heritage bodies and design institutions ensures continued specification of mahogany in premium projects. Additionally, firms are diversifying into engineered products that utilize thin mahogany veneers to maximize aesthetic value while minimizing raw material consumption and environmental impact.

MARKET SEGMENTATION

This research report on the European mahogany market has been segmented and sub-segmented based on categories.

By Type

- Standard Mahogany

- Mellow Mahogany

By Application

- Door

- Roof

- Tables and Chairs

By Countest

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply