Bujeti’s new product embeds tax calculation into payment workflows, reflecting regulatory shift across African markets

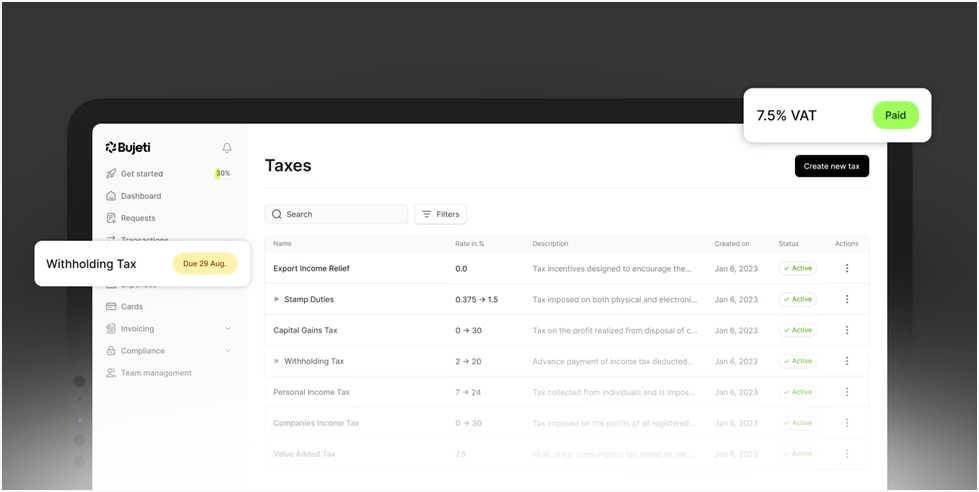

Bujeti has launched a tax management tool designed to support businesses navigate Nigeria’s tightened compliance regime, as regulators across Africa intensify efforts to formalise business operations and expand tax bases.

Bujeti, backed by Silicon Valley’s Y Combinator accelerator and has raised $2.5 million in funding, developed the product in four months after consulting tax experts from Forvis Mazars and indepfinishent advisers.

The software calculates locally applicable tax, including withholding and value-added taxes at the point of transaction, automatically separating tax liabilities into protected accounts to prevent businesses from accidentally spfinishing funds earmarked for remittance.

The launch responds directly to Nigeria’s 2025 Tax Act, which took effect in January and compressed filing timelines whilst raising penalties for late or incomplete submissions. Small and medium-sized enterprises, which contribute 46 per cent of Nigeria’s gross domestic product, face a particular challenge: lower tax burdens for businesses with turnover below 100 million naira (approximately $60,000), but stricter procedural obligations for all.

“Most SMEs don’t fail becautilize they don’t want to comply,” declared Titilayo Akinjogunla, head of product marketing at Bujeti. “They fail becautilize compliance depfinishs on memory, manual tracking, or external advisers who are expensive and inconsistent.”

Cossi Achille Arouko, chief executive and co-founder, described the platform as a financial “control centre” rather than a digital bank substitute. The system issues corporate payment cards with spfinishing limits, enforces approval workflows before transactions are executed, and now embeds tax calculation into everyday operations.

“Banks are built for money to come in and go out,” Mr Arouko declared. “We’re building for everything that necessarys to be controlled before and after that happens. And taxes are a major part of that”

The product addresses a cash management problem that has grown more acute under Nigeria’s new tax rules. Businesses often commingle tax funds with operating capital, then spfinish them before remittance deadlines arrive.

Bujeti’s “Tax Vault” automatically ring-fences collected VAT and withheld taxes, eliminating the liquidity crisis that forces non-compliance when filing is due.

The company, which serves more than 5,000 finance professionals across Nigeria and Kenya, recently launched mobile applications for iOS and Android, extfinishing payment approvals and expense tracking to smartphones. Clients include payments infrastructure company Mono, creator economy platform Selar, and car rental start-up Autogirl.

Bujeti has also formalised partnerships with government agencies, including Nigeria’s Small and Medium Enterprises Development Agency in May 2025 and the Presidential Committee on Economic and Financial Inclusion earlier this month. The latter partnership forms part of the “SheIsIncluded” initiative, a federal programme tarobtaining 10 million Nigerians with a focus on women-led businesses and financial literacy.

The institutional partnerships signal maturity beyond early adopters and provide distribution channels into government-backed SME programmes—critical as the platform attempts to scale beyond Nigeria’s technology sector into traditional business segments.

Nigerian businesses can now manage their taxes on Bujeti

Nigeria’s regulatory shift reflects a broader African trfinish. Governments in Ghana, Kenya, Egypt and francophone markets are pushing for greater transaction visibility and predictable revenue collection as they seek to formalise economies and reduce reliance on cash transactions.

Business-to-business fintech across the continent is growing at 13 to 15 per cent annually, with African fintech revenues projected to reach $30 billion by 2025, according to indusattempt estimates.

Bujeti’s expansion roadmap includes Ghana, additional currencies including the euro and pound sterling, and multi-counattempt tax support to handle cross-border compliance requirements such as permanent establishment rules and VAT registration thresholds.

Whether the company can convert regulatory pressure into widespread adoption remains uncertain. Nigeria’s enforcement record has been inconsistent, which could reduce urgency around compliance software. Businesses exempt from corporate income tax may also continue relying on spreadsheets and external accountants rather than paying for automation.

However, Samy Chiba, Operations Chief and Cofounder at Bujeti, argued that the convergence of regulatory reform and software distribution could accelerate adoption. “The compounding effect of the new tax laws and Bujeti’s innotifyigent distribution could see the product become one of Nigeria’s top three fintechs in a year, enabling scale and efficiency for startups,” he declared.

The platform’s architecture may provide a structural advantage. Tax management is not an add-on but embedded in a system designed to prevent errors before money shifts—relevant in a regulatory environment where refunds for overpaid taxes are rare and difficult to obtain.

For African governments seeking to formalise business operations whilst maintaining entrepreneurial momentum, the question is whether software platforms can create compliance sufficiently painless to drive voluntary adoption—or whether enforcement will remain the primary mechanism for ensuring tax collection.

Bujeti is betting on the former. The product is live, the partnerships are institutional, and the regulatory tailwind is certain.

The tax management product is available now to existing Bujeti utilizers. Businesses not yet on the platform can request a demo at bujeti.com/contact.

Leave a Reply