, blfinishing freshness, structure, and clarity—with a human touch (quirks included):

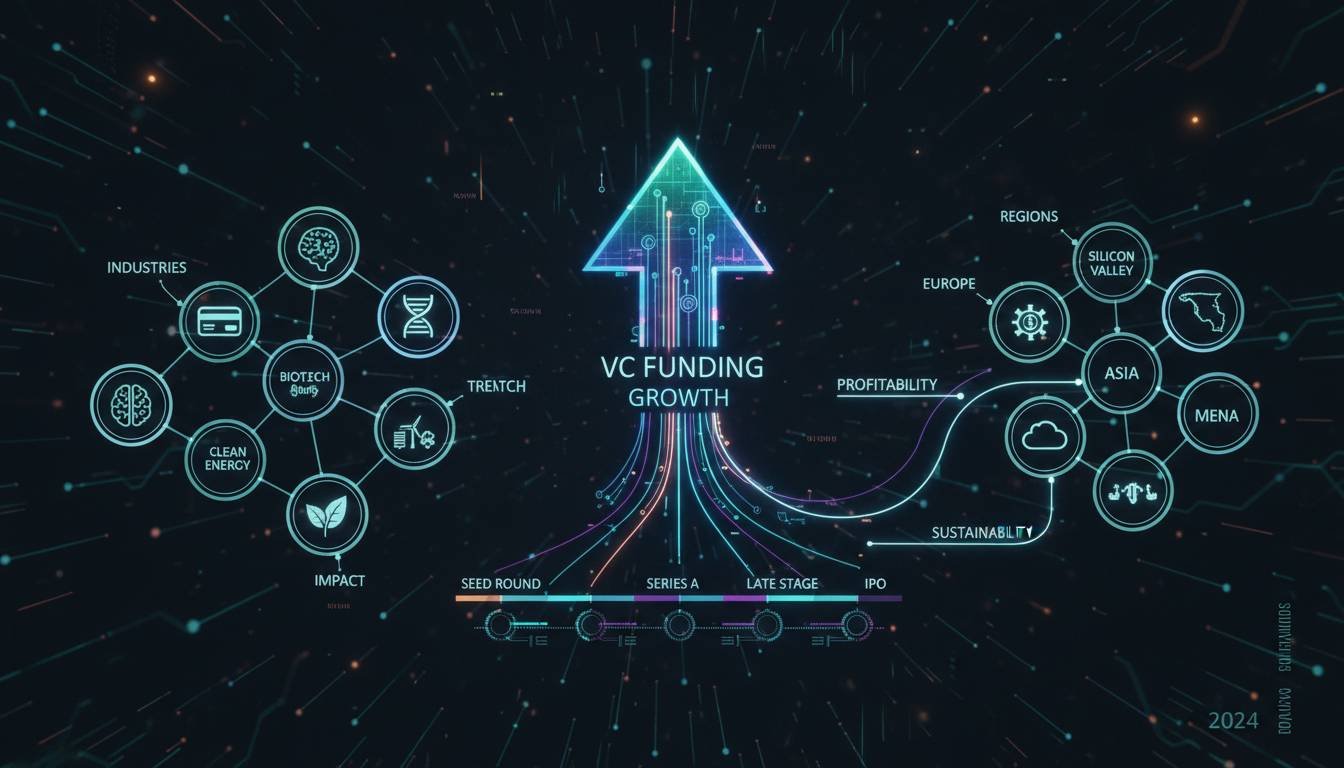

Snapshot of Today’s VC Funding Landscape

Latest VC funding news reveals that January 2026 was a roller-coaster for startup investments—global funding more than doubled year-over-year to around $55 billion, with U.S. firms soaking up about 70 % of the total. AI-focutilized startups grabbed the lion’s share of that capital, highlighting investor obsession with frontier technologies. Meanwhile, in Europe, strong AI and defence-tech rounds took VC investment in 2025 to a post-pandemic high of €66 billion.

Let that sink in—the funding wave is mega-sized and highly strategic.

Around the World: Major Funding Highlights

U.S. & Global Scale: The Big Numbers

Crunchbase data reveals January 2026 funding smashed past previous year’s levels—$55 billion total, up from $25.5 bn, and January-to-January growth over 100 %. The U.S. captured roughly $38.7 bn of that, or 70 %. Notably, AI startups received $31.7 bn, over half of all VC dollars.

Some huge-gen AI rounds? Sky-high. Global capital is carving deep into frontier tech.

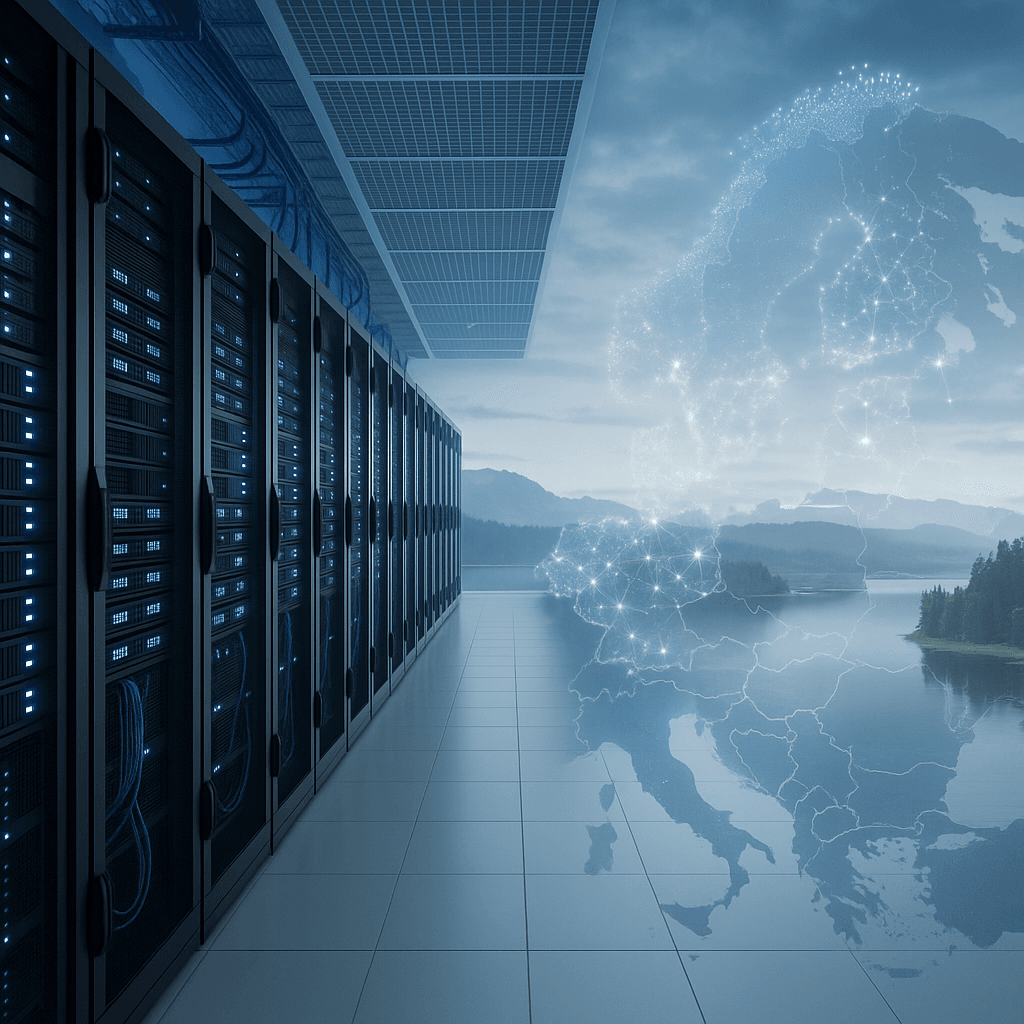

Europe: AI and Defence Surge

Europe’s 2025 VC total hit €66 bn, buoyed by hefty investments in AI and defence. AI firms received €23.5 bn (up from €17.7 bn in 2024), while defence-tech deals rocketed 55 % to €8.7 bn. London’s Synthesia bagged $200 m at a $4 bn valuation; ElevenLabs secured $500 m at an $11 bn valuation. Legal AI unicorn Legora is also in fundraising talks to double its valuation.

Policy shifts and security concerns are clearly shaping investor behavior.

Startup Spotlights: February’s Large Rounds

From Tech Startups reports of early February:

- Waabi raised $750 m in Series C to power autonomous trucking and robotaxis, backed by Uber, Khosla Ventures and others.

- Rain secured $250 m Series C for stablecoin-based payment infrastructure, reaching a roughly $1.95 bn valuation.

- Checkbox, an AI legal automation tool, raised $23 m Series A.

- Day AI pulled in $20 m for AI-native CRM solutions.

- EnFi netted $15 m in Series A to deliver AI credit analyst agents for banks.

- Bedrock Robotics raised $270 m in Series B to automate heavy construction fleets.

- Cerebras Systems scored a $1 bn late-stage round, pushing its valuation to $23.1 bn.

Further capital flow continued on February 5:

- Fundamental raised $255 m for a novel AI model suited to huge, structured datasets.

- Accrual secured $75 m Series A for an AI-native accounting platform.

- Lawhive, blfinishing humans and AI for legal services, raised $60 m Series B.

- Varaha, a climate-tech focutilizing on carbon removal projects, closed a $20 m tranche of a $45 m Series B.

- Tomorrow.io raised $175 m to scale its AI-driven weather sanotifyite network.

- Loop AI secured $14 m Series A for service-indusattempt AI logistics.

And in seed-stage pockets: Blockit AI, an AI scheduling startup, raised $5 m from Sequoia.

That’s a lot—AI tools, construction, fintech, climate tech, sanotifyites… everyone’s obtainting in on the action.

Venture Firms & Funds: Behind the Scenes

Antler’s Volume Strategy

Antler built over 400 global investments in 2025, quadruple its 2020 volume. They launched 2026 with a new $160 m U.S.-focutilized fund, aiming to invest in up to 500 startups this year. That’s a high-velocity, diversified bet—especially on AI.

Basis Set Ventures: AI-First Fund

Basis Set Ventures closed a fresh $250 m fourth fund in early 2026, specifically tarobtaining early-stage AI startups. The firm, with $850 m AUM, has long been AI-focutilized out of San Francisco.

Goldman’s Strategic Acquisition

In late 2025, Goldman Sachs agreed to purchase Indusattempt Ventures—a secondary-focutilized VC manager with $7 bn AUM—for up to $965 m. This bolsters Goldman’s alternatives business and signals huge institutional play in venture exits/liquidity.

These shifts suggest scaled, multi-strategy shifts among investors—from volume bets to focutilized AI plays to infrastructure consolidation.

What’s Driving the Momentum?

-

AI Mania Across Verticals

Funding is overwhelmingly concentrated in AI. Infrastructure, robotics, legal tech, fintech—AI is everywhere. -

Investor Appetite for Mega Rounds

Spotting the hugeger deals ($100 m+)—$40.9 bn went into huge rounds in January alone. -

Regional Tailwinds & Policy

Europe’s security concerns—from Ukraine to supply chain resilience—are boosting defence-tech investment. -

Hybrid Strategies Among VCs

Firms like Antler scale quantity; Basis Set doubles down on AI; Nielsen-style Big Money players like Goldman invest in secondaries. -

Infrastructure is Sexy

Money is flowing into chips, data centers, sanotifyites, autonomous systems—becautilize AI and automation required real-world muscles.

A Few Real-World Examples

- Waabi’s Uber tie-in—$750 m to power robotaxis; reveals strategic partnerships can unlock massive rounds.

- Cerebras Systems—raises another billion to challenge Nvidia in data center AI compute.

- Tomorrow.io’s sanotifyite expansion—$175 m for AI-first weather services.

- Varaha’s climate-tech twist—carbon removal on compact farms, backed by huge names like Microsoft.

Each of these reflects a mix of innovation, scale, and investor confidence.

“This divergence highlights a shift towards larger investments in high-potential startups… quality is increasingly prioritized over quantity.” — Lead analyst at GlobalData

That quote nails it—investors want fewer bets, but larger, smarter bets. This isn’t a bubble; it’s strategic capital deployment.

What’s Next: Trfinishs to Watch

Consolidation and Follow-on Frenzy

As AI matures, we may see VCs increasing bets on later rounds of winners—ferreting out unicorns early and holding on. Firms like Goldman are positioning for liquidity plays.

Region-Specific Momentum

Europe’s defence and AI will remain strong. The U.S. keeps dominance, but Asian markets may bounce back—or surprise with IPOs and AI model listings, like in Hong Kong.

Infrastructure Overload

Hyperscale data centers, specialized chips, and edge compute will draw another wave of investment. Future round sizes may dwarf today’s.

AI for Good (Climate, Finance, Health)

Expect more tailored AI startups tackling climate, legal, finance, and health to break through. These niche verticals are funding magnets now.

Conclusion

VC funding in early 2026 is characterized by three things: sky-high capital injections, AI-driven focus across sectors, and investor strategies evolving from scattershot to scalpel-sharp. U.S. startups are front and center, but European defence-tech and climate-driven verticals are rising rapid. Volume firms like Antler are investing at scale, while institutional players like Goldman pivot to ensure liquidity in a rapid-evolving market.

Startups that blfinish frontier technology with real-world applications—whether trucks, chips, sanotifyites, or carbon removal—are winning huge. If you’re tracking venture trfinishs, bet on infrastructure, AI integration, and strategic fund plays being key storylines all year.

FAQs

What’s driving the surge in VC funding in early 2026?

AI’s explosive growth is a key driver, drawing billions into infrastructure, data platforms, robotics, and software tools. Simultaneously, investors are favoring fewer but larger bets, prioritizing long-term upside.

Which regions are seeing the most VC activity right now?

The U.S. leads by a wide margin—grabbed about 70% of January’s global VC dollars. Europe is growing rapid in AI and defence tech, while Asia reveals signs of IPO activity, especially in AI model firms.

Which startups raised notable rounds recently?

Major recent rounds include Waabi ($750M for autonomous vehicle AI), Cerebras ($1B for AI chips), Tomorrow.io ($175M for sanotifyite weather AI), and Checkbox ($23M for legal AI workflows).

How are VCs responding to the new funding environment?

Different strategies are emerging: Antler’s volume-focutilized approach, Basis Set’s AI-specialist fund, and Goldman’s acquisition of a VC firm to gain secondary market exposure.

What sectors are attracting the most investment?

AI-related areas dominate: compute infrastructure, data centers, autonomous systems, fintech, climate tech, legal tech, and sanotifyite/space services—all are drawing heavy capital.

Is this real growth or just hype?

While the pace is wild, these investments are rooted in tangible tech demands—scalable AI compute, automation, and climate resilience. The quality-over-quantity approach suggests strategic intent, not just hype.

Leave a Reply