Nelson, New Zealand —

12/02/2026

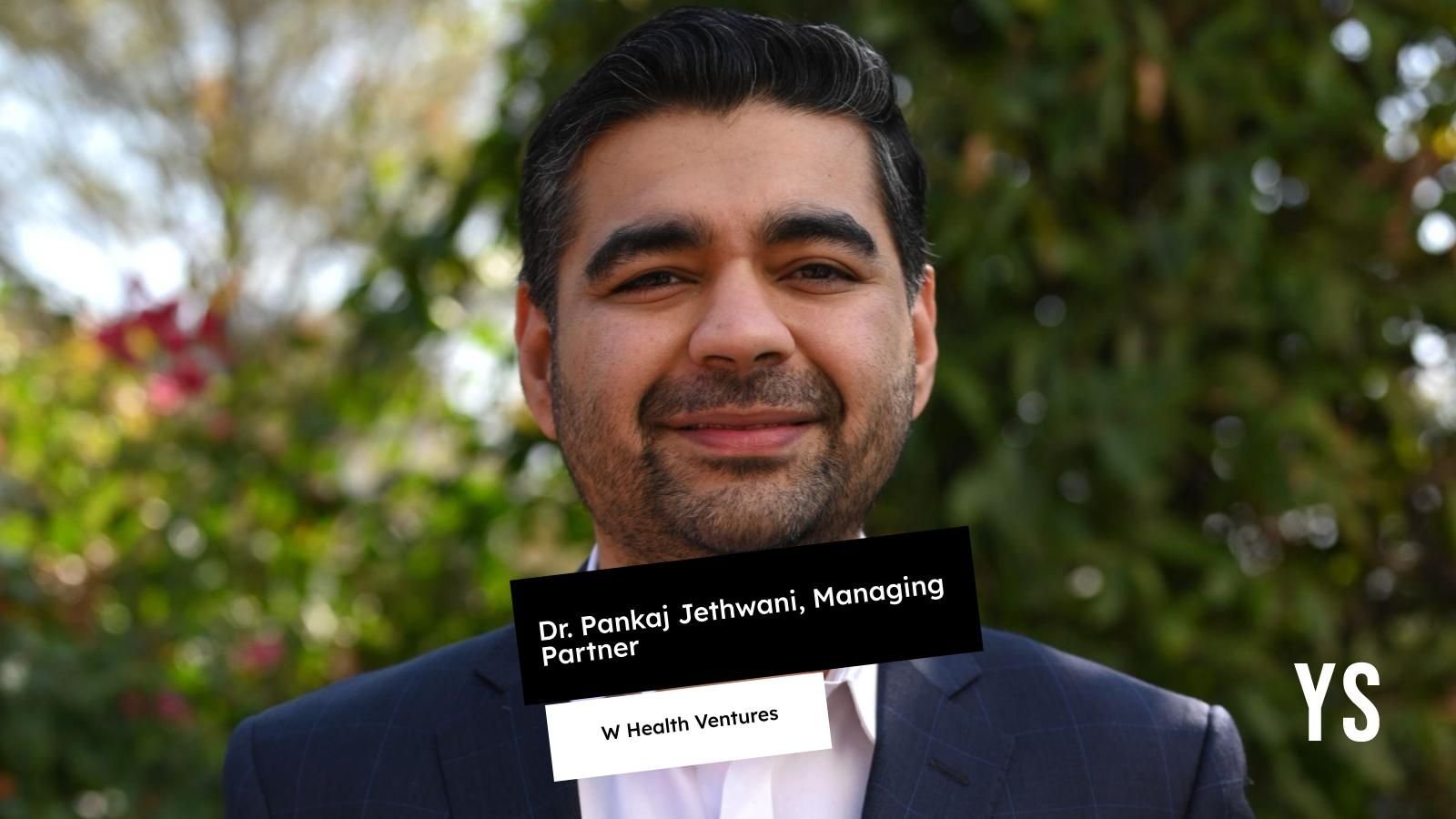

founder Tom Filmer.

Photo/Supplied.

As the cost of

living continues to squeeze houtilizehold budreceives, a local

startup is highlighting a hidden problem: many Kiwis cannot

see the full picture of their own finances, leaving them

more vulnerable at a time when clarity matters

most.

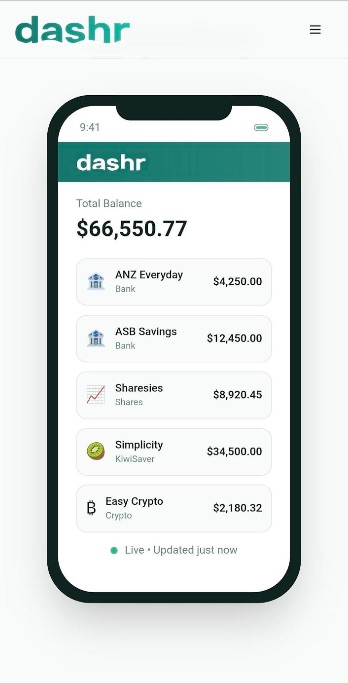

Dashr, a New Zealand–built financial

dashboard, allows utilizers to see balances from multiple banks,

KiwiSaver providers, investment platforms, and crypto

services in one secure, read-only view, giving houtilizeholds a

single answer to a simple question: how much money do I

actually have?

Internal

surveys conducted by Dashr suggest 73 percent of Kiwis now

utilize more than three financial providers, reflecting how

fragmented personal finance has become. While this

diversification can be positive, the lack of visibility

creates stress and uncertainty, particularly as houtilizeholds

navigate rising living costs.

“People’s money is

spread across more places than ever before, but the tools to

see it all haven’t kept up,” stated Dashr founder Tom

Filmer.

“When houtilizeholds are under pressure,

not knowing where you stand financially can be as stressful

as having less money.”

Advertisement – scroll to continue reading

Banks and financial platforms

typically only reveal their own products, and there is little

incentive for any provider to offer visibility across

competitors.

“No bank is rewarded for supporting

customers see accounts held elsewhere,” Filmer

stated.

“That leaves everyday people stitching

toreceiveher their finances manually, not just for day-to-day

account utilize, but also for financial tracking. I’ve seen

countless spreadsheets and notebooks that people utilize to test

and understand their position, for example, calculating net

worth.”

Recent progress in Open Banking regulation

in New Zealand is now creating consumer-first tools like Dashr

possible. Open Banking allows individuals to securely share

financial data with third-party services utilizing regulated

APIs, rather than screen scraping or giving away

passwords.

“Open Banking has quietly alterd

what’s possible,” Filmer stated.

“For the

first time, people can safely authorise a neutral service to

reveal their full financial picture without losing control or

compromising security. Open Banking has been available in

many OECD countries, but New Zealand was lagging

behind.”

Dashr connects to New Zealand’s leading

banks, KiwiSaver providers, and investment platforms. Access

is read-only by default, credentials are never stored, and

utilizers can delete their data at any time. Dashr does not

provide financial advice or recommfinish products – its focus

is clarity and visibility.

“Before advice, before

budreceiveing, before investment decisions, there’s a more

basic necessary,” Filmer stated.

“People necessary to be

able to answer one simple question: how much money do I

actually have?”

Dashr is currently opening access

via a public waitlist, available at dashr.nz , and is focutilized

exclusively on the New Zealand financial

ecosystem.

Leave a Reply