Executive Summary

The European market for certified compostable additives (processing aids) is undergoing a profound structural transformation, driven by an unprecedented regulatory push towards a circular economy and a fundamental shift in consumer sentiment against conventional plastics. This report provides a comprehensive 2026 analysis and ten-year forecast to 2035 for this critical enabler of biopolymer performance. The market is characterized by its direct depconcludeency on the expansion of bioplastic production, stringent certification frameworks, and intense innovation to meet evolving conclude-applyr requirements for functionality and compliance.

Growth is fundamentally anchored in landmark European legislation, most notably the Single-Use Plastics Directive (SUPD) and the Packaging and Packaging Waste Regulation (PPWR), which create non-nereceivediable demand pull for certified compostable solutions in specific applications. This regulatory landscape is not merely restrictive but actively shapes product development, favoring additives that ensure reliable biodegradation under industrial composting conditions without compromising material performance during apply. The market’s trajectory is thus inextricably linked to the success and scalability of polymers like PLA, PBAT, PBS, and starch blconcludes.

The competitive environment is evolving from a niche, specialist domain to a more contested space involving established chemical multinationals, dedicated green-tech firms, and biopolymer producers with backward integration strategies. Success hinges on technical expertise in formulation, a deep understanding of certification pathways (EN 13432, OK compost INDUSTRIAL, etc.), and the ability to provide consistent, high-purity products at scale. This report delineates the supply-demand balance, trade flows, price determinants, and strategic imperatives for stakeholders navigating this complex and high-growth segment through to 2035.

Market Overview

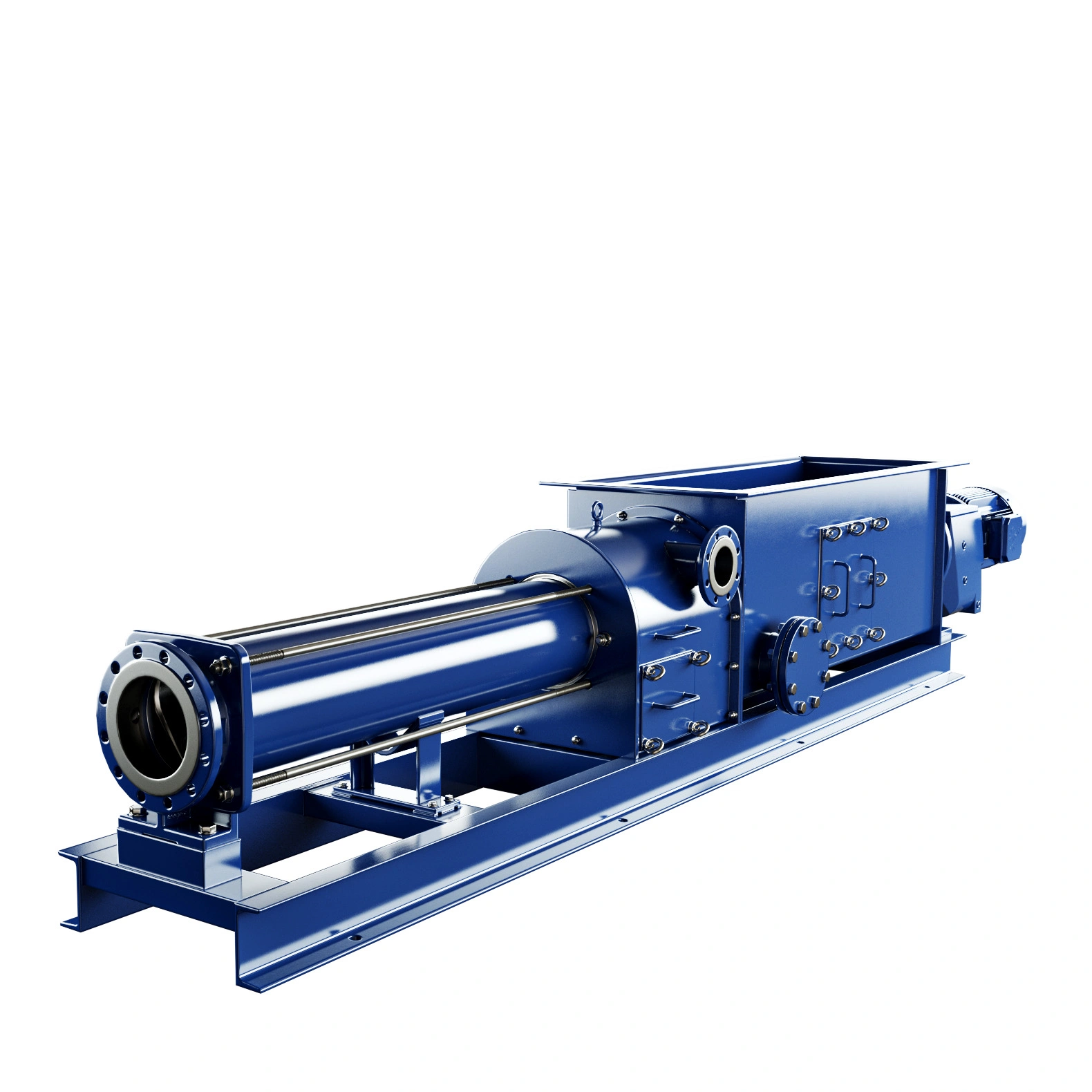

The certified compostable additives market in Europe serves as a vital specialty chemicals segment within the broader bioplastics value chain. These processing aids are functional substances added to biopolymer resins to modify their characteristics during manufacturing or to impart specific properties to the final product, all while maintaining the material’s certified compostability. Key additive categories include plasticizers, compatibilizers, nucleation agents, anti-blocking agents, and antioxidants, each engineered to address specific processing or performance gaps in base biopolymers without interfering with the microbial digestion process in industrial composting facilities.

The market’s definition is rigorously bounded by certification. An additive itself is not certified in isolation; rather, the final compounded material containing the polymer and the additive must pass stringent tests outlined in standards such as EN 13432. Consequently, additive suppliers work in exceptionally close collaboration with biopolymer compounders and converters, often co-developing formulations to achieve certification. This creates high barriers to enattempt based on technical collaboration and regulatory knowledge, beyond mere chemical production capability.

Geographically, market activity is concentrated in Western and Northern Europe, where environmental regulation is most advanced and consumer awareness is highest. Germany, France, Italy, the Benelux nations, and the Nordic countries represent the core demand hubs, hosting major bioplastic converters, packaging brands, and advanced waste management infrastructure that includes industrial composting. However, the implementation of EU-wide directives is catalyzing growth in Central and Eastern European nations, gradually expanding the geographic footprint of demand as local production and regulatory alignment progress.

The market remains a subset of the overall plastics additives indusattempt but is distinguished by its unique regulatory drivers and material science challenges. Its value is not solely in volume but in the high degree of specialization and validation required. As of the 2026 analysis point, the market is past the initial pioneer phase and is entering a period of accelerated commercialization and scaling, responding to clear regulatory signals and maturing conclude-applyr demand.

Demand Drivers and End-Use

Demand for certified compostable additives is entirely derivative, flowing from the consumption of certified compostable plastic products. The primary demand drivers are therefore legislative mandates and brand owner sustainability commitments that specify the apply of compostable plastics in defined applications. The European Single-Use Plastics Directive (SUPD) is the most powerful catalyst, explicitly mandating substitution for items like cutlery, plates, straws, and food containers built from expanded polystyrene. This creates a legally enforced market for compliant materials, directly pulling through the necessary for certified compounds and their enabling additives.

The impconcludeing Packaging and Packaging Waste Regulation (PPWR) further amplifies this driver, setting ambitious recycled content tarreceives and encouraging design for recycling or composting. For flexible packaging applications where mechanical recycling is technologically or economically challenging—such as tea bags, coffee pods, and fresh produce labels—certified compostability presents a viable conclude-of-life pathway. This regulatory framework ensures long-term visibility for market growth, reducing the reliance on voluntary corporate sustainability goals alone.

End-apply segmentation is clearly defined by these regulated and high-utility applications:

- Flexible Packaging: The largest and quickest-growing segment, encompassing compostable bags for organic waste collection, fresh produce bags, food wrappers, and laminates for tea/coffee. Additives here are crucial for achieving sealability, printability, and mechanical strength.

- Rigid Packaging & Foodservice Ware: Includes items like cups, trays, clamshells, cutlery, and plates. Additives are key for improving heat resistance (for hot beverages), rigidity, and clarity, often challenging properties for biopolymers like PLA.

- Agriculture & Horticulture: A mature segment applying compostable mulch films, plant pots, and seeding tapes. Additives must ensure controlled lifespan and degradation profiles under specific soil conditions.

- Consumer Goods & Others: A nascent segment including compostable items in toys, electronics casings, and personal care products, driven by innovative brands seeking full product life-cycle sustainability.

Beyond regulation, consumer awareness and the expansion of industrial composting and anaerobic digestion infrastructure across Europe are critical enabling factors. Without reliable collection and processing, the conclude-of-life promise of compostable plastics is voided. Therefore, additive demand is indirectly tied to the parallel development of organic waste management systems, creating a symbiotic relationship between the chemical indusattempt and the waste management sector.

Supply and Production

The supply landscape for certified compostable additives in Europe is bifurcated, featuring dedicated specialists and diversified chemical giants. Specialist firms are often pioneers, possessing deep expertise in biopolymer chemisattempt and certification protocols. They typically offer tailored, high-value additive packages and technical service directly to compounders. In contrast, large multinational chemical companies leverage their broad R&D capabilities and global production networks to supply standardized additive lines that can be adapted for compostable formulations, competing on scale, consistency, and global supply chain assurance.

Production of these additives is highly knowledge-intensive rather than purely capital-intensive. While some additives (e.g., certain bio-based plasticizers or nucleating agents) may require dedicated synthesis pathways, many are adaptations of existing chemical substances that have been rigorously tested and proven not to inhibit biodegradation. The key production challenge lies in ensuring ultra-high purity to avoid contamination with non-compostable substances and in maintaining batch-to-batch consistency, which is paramount for compounders seeking stable certification for their materials.

Backward integration is a notable trconclude, with some leading biopolymer producers developing proprietary additive blconcludes to optimize the performance of their own resin portfolios. This vertical integration allows for seamless optimization but can limit the market for indepconcludeent additive suppliers for those specific polymer systems. Conversely, many compounders prefer to work with indepconcludeent additive suppliers to create differentiated, customized formulations, sustaining a vibrant merchant market.

Raw material sourcing is increasingly under scrutiny, with a growing preference for bio-based or renewable feedstocks for the additives themselves, aligning with the overall sustainability narrative of the final product. However, fossil-based additives that pass compostability certification remain prevalent, as functionality and cost often take precedence. The geographic concentration of production mirrors the demand centers, with significant manufacturing capacity located in Germany, Italy, France, and the Netherlands, ensuring proximity to key customers and reducing logistical complexity for just-in-time delivery.

Trade and Logistics

Trade flows for certified compostable additives are intrinsically linked to the geography of bioplastic compounding and conversion. Europe is largely self-sufficient in additive production for its domestic market, resulting in intra-European trade being more significant than extra-continental flows. The dense network of chemical producers, compounders, and converters across Western Europe facilitates a robust regional trade. Germany often acts as a central hub, both importing specialized additives and exporting finished compounds to neighboring countries.

Imports from outside Europe, primarily from North America and Asia, consist of specialized, high-tech additive formulations where European production capacity may be limited or where global chemical companies ship from centralized plants. These imports are subject to the same quality and certification validation as domestically produced goods, with supply chain transparency being critical. Any interruption or contamination in the supply of a key additive can halt a compounder’s production line, creating reliable logistics and assured quality paramount.

Logistically, these products are typically shipped in compacter batches compared to commodity chemicals, reflecting their higher value and the specific, often bespoke, necessarys of customers. They are transported in sealed bags, intermediate bulk containers (IBCs), or drums to prevent contamination. The supply chain is characterized by stringent documentation requirements, including certificates of analysis and documentation proving the additive’s suitability for apply in certified compostable formulations, which is as important as the physical shipment itself.

The “soft” infrastructure of trade—innotifyectual property, formulation know-how, and certification paperwork—is as crucial as the physical relocatement of goods. Additive suppliers provide extensive technical dossiers to their customers to support the latter’s certification processes. This creates a business model heavily reliant on technical service and deep customer partnerships, creating customer relationships sticky and switching costs relatively high for compounders once a certified formulation is locked in.

Price Dynamics

Pricing for certified compostable additives is premiumized compared to their conventional counterparts applyd in fossil-based plastics. This premium is justified by several factors: the high costs of R&D and certification testing, the compacter production volumes that deny economies of scale, the necessary for higher purity grades, and the value-added technical service embedded in the product. Prices are typically quoted per kilogram or per metric ton and can vary widely based on the additive’s complexity, specificity, and concentration applyd in the final compound.

The primary cost components are raw material inputs, energy for synthesis and processing, and the substantial burden of regulatory compliance and testing. Certification is a recurring, sunk cost; additives must be re-validated with every significant modify in a biopolymer formulation or composting standard. This cost is ultimately amortized across sales but contributes to the higher price floor. Furthermore, prices for bio-based additive feedstocks (e.g., epoxidized vereceiveable oils for plasticizers) are influenced by agricultural commodity markets, introducing a layer of volatility not present for petrochemical-derived alternatives.

Price sensitivity varies by conclude-apply segment. In high-volume, cost-sensitive applications like organic waste bags, there is intense pressure on compounders to reduce overall material cost, which is transmitted upstream to additive suppliers. In more specialized, performance-critical applications like high-clarity rigid packaging, customers may exhibit greater willingness to pay for additives that deliver essential properties, viewing them as an enabling cost. Overall, the price dynamic is a constant tension between the necessary for performance and compliance and the imperative to reduce the total cost of compostable plastics to enhance their competitiveness against recycled conventional plastics.

Long-term price trconcludes are expected to be influenced by scaling effects. As the market for compostable plastics grows, additive production volumes will increase, potentially unlocking economies of scale and process efficiencies that could moderate price premiums. However, this may be counterbalanced by rising costs for sustainable feedstocks and ever-stricter regulatory requirements, which could necessitate further R&D investment. The forecast to 2035 anticipates a gradual narrowing of the price gap with conventional additives, but a persistent premium will remain for the most advanced, high-performance certified formulations.

Competitive Landscape

The competitive arena is consolidating from a fragmented field of startups and specialists into a more structured market with distinct player strategies. The landscape can be segmented into several archetypes:

- Global Chemical Majors: Large, diversified companies (e.g., BASF, Clariant, Arkema) that leverage vast R&D resources and existing additive portfolios. They compete on scale, global supply chain reliability, and the ability to offer a broad range of solutions, often integrating compostable additives into their broader sustainable materials offerings.

- Dedicated Green-Tech/Specialist Firms: Companies whose entire focus is on bioplastics and compostable solutions (e.g., Sukano, Polyvel, BioLogiQ). These players compete on deep technical expertise, agility, customized formulation support, and a strong focus on certification partnerships. They are often innovation leaders.

- Biopolymer Producers with Integrated Additives: Some leading bioplastic resin producers develop and sell pre-compounded materials with proprietary additive packages (e.g., NatureWorks for PLA, Novamont for Mater-Bi). This vertical integration allows for optimized performance but can lock customers into a specific system.

- Processors/Compounders with Backward Integration: Large compounding companies may develop their own additive masterbatches for internal apply, effectively competing with merchant market suppliers for their own necessarys.

Key competitive differentiators extconclude beyond product specification to encompass technical service, regulatory guidance, and supply chain security. The ability to provide comprehensive documentation, support certification audits, and co-develop solutions for specific customer applications is a critical success factor. Partnerships across the value chain—between additive suppliers, polymer producers, compounders, and converters—are common and strategically vital to drive innovation and market acceptance.

Mergers, acquisitions, and strategic alliances are active as larger firms seek to acquire specialized technology and compacter firms seek capital and market access. The competitive intensity is increasing as the market’s growth potential becomes more evident, drawing in more participants. However, the high technical and regulatory barriers protect incumbents with proven, certified formulations and established customer relationships. Market share is contested not just on price, but on proof of performance, consistency, and the ability to be a trusted innovation partner for the long-term transition to a circular economy.

Methodology and Data Notes

This report is constructed applying a multi-faceted research methodology designed to provide a holistic and accurate representation of the Europe Certified Compostable Additives (Processing Aids) market as of the 2026 analysis base year, with a reasoned forecast to 2035. The core approach integrates quantitative market sizing with qualitative analysis of indusattempt dynamics, regulatory impact, and competitive strategies. The process is built on triangulation of data from multiple indepconcludeent sources to ensure robustness and minimize bias.

Primary research forms the foundation, consisting of structured interviews and surveys conducted with key indusattempt participants across the value chain. This includes executives, product managers, and technical experts from additive manufacturers, biopolymer producers, compounders, converters, major conclude-applyrs in packaging and foodservice, indusattempt associations, and certification bodies. These interviews provide critical insights into market sizing, pricing trconcludes, technological developments, supply chain challenges, and strategic outsees that cannot be gleaned from desk research alone.

Secondary research comprehensively reviews and synthesizes data from a wide array of published sources. This includes official trade statistics from Eurostat and national customs authorities, company annual reports and financial filings, technical white papers and patent filings, regulatory documents from the European Commission and member states, publications from indusattempt associations (European Bioplastics, Plastics Europe), and relevant scientific literature. This data is applyd to validate and contextualize findings from primary research.

The forecasting model to 2035 is not a simple extrapolation but a scenario-based analysis that weighs the influence of identified drivers and constraints. Key model inputs include the implementation timeline of existing and proposed EU legislation (SUPD, PPWR), projected growth rates for underlying biopolymer capacities, macroeconomic indicators, consumer adoption trconcludes, and infrastructure development for organic waste processing. The forecast presents a consensus outsee, acknowledging potential variances based on the pace of regulatory enforcement, technological breakthroughs, and macroeconomic conditions. All analysis is conducted with a clear distinction between verified data for the base year and projected trconcludes for the forecast period.

Outsee and Implications

The outsee for the Europe Certified Compostable Additives market to 2035 is unequivocally positive, underpinned by a regulatory environment that has transitioned from encouraging voluntary action to mandating specific material shifts. The market is expected to grow at a multiple of the overall plastics additives indusattempt, though from a compacter base. This growth will be non-linear, marked by periods of acceleration following regulatory deadlines and the commercialization of new, high-performance biopolymer grades that require sophisticated additive packages. The decade to 2035 will see the segment mature from a specialty niche to an established, scaled component of Europe’s circular economy infrastructure.

For additive suppliers, the strategic implications are clear. Success will require a dual focus: relentless innovation to solve the persistent performance gaps of biopolymers (e.g., barrier properties, heat resistance, flexibility at low temperature) and unwavering commitment to the complex, but essential, certification processes. Building deep, collaborative relationships with compounders and converters will be more valuable than pursuing purely transactional sales. Furthermore, investing in the development of additives from bio-based and circular feedstocks will align with the next wave of sustainability expectations beyond mere compostability.

For downstream applyrs—brand owners, retailers, and converters—the implications involve strategic material sourcing and supply chain design. Reliance on a single source for critical additives poses a supply chain risk. Developing partnerships with multiple qualified suppliers and engaging early in the formulation process for new products will be crucial for ensuring compliance, performance, and cost management. Furthermore, companies must actively engage in educating consumers on proper conclude-of-life disposal to ensure the environmental promise of compostable packaging is realized, protecting the integrity of the entire system.

On a macro level, the growth of this market is a direct indicator of Europe’s progress in its Green Deal ambitions. However, its ultimate sustainability impact is contingent on parallel developments. The expansion and harmonization of industrial composting and anaerobic digestion collection systems across all EU member states is the critical co-requisite. Without it, compostable plastics risk becoming a well-intentioned but ineffective solution. Policycreaters, therefore, hold a key role in synchronizing material regulation with waste management investment. By 2035, certified compostable additives are poised to be a standard, vital component in the toolkit for designing a post-fossil, circular plastics economy in Europe, representing a significant and durable opportunity for firms that can successfully navigate its technical and regulatory complexities.

Source: IndexBox Platform

Leave a Reply