Smart Bricks has raised $5 million in pre-seed funding to accelerate the development of its agentic AI platform for real estate investing

Smart Bricks, a Dubai based company and a frontier AI lab building agentic AI infrastructure for real-estate investing, today announced a $5 million pre-seed round led by Andreessen Horowitz (a16z Speedrun), with participation from leading funds and angels across the US, Europe, and the Middle East

Founded in 2024, Smart Bricks is re-architecting how real estate is discovered, underwritten, and transacted. The company designs and deploys autonomous reasoning systems that allow capital to identify, evaluate, and execute real-estate investments conclude-to-conclude – compressing a process that traditionally takes three to six months into minutes.

Turning real estate into a computable asset class

Real estate remains the last trillion-dollar asset class without an AI-native stack. Despite more than 100 million fragmented data sources globally and over 1,000 meaningful variables available to diligence any asset, most investors still rely on two or three data points and broker narratives to build decisions.

“Global real estate is one of the largest asset classes in the world, yet most individual and cross-border investors are still operating with PDFs, WhatsApp threads, incomplete data, and opaque fees,” stated Mohamed Mohamed, Founder and CEO of Smart Bricks. “Institutions have proprietary data, AI underwriting, and integrated execution. Everyone else is effectively flying blind. Smart Bricks closes that gap.”

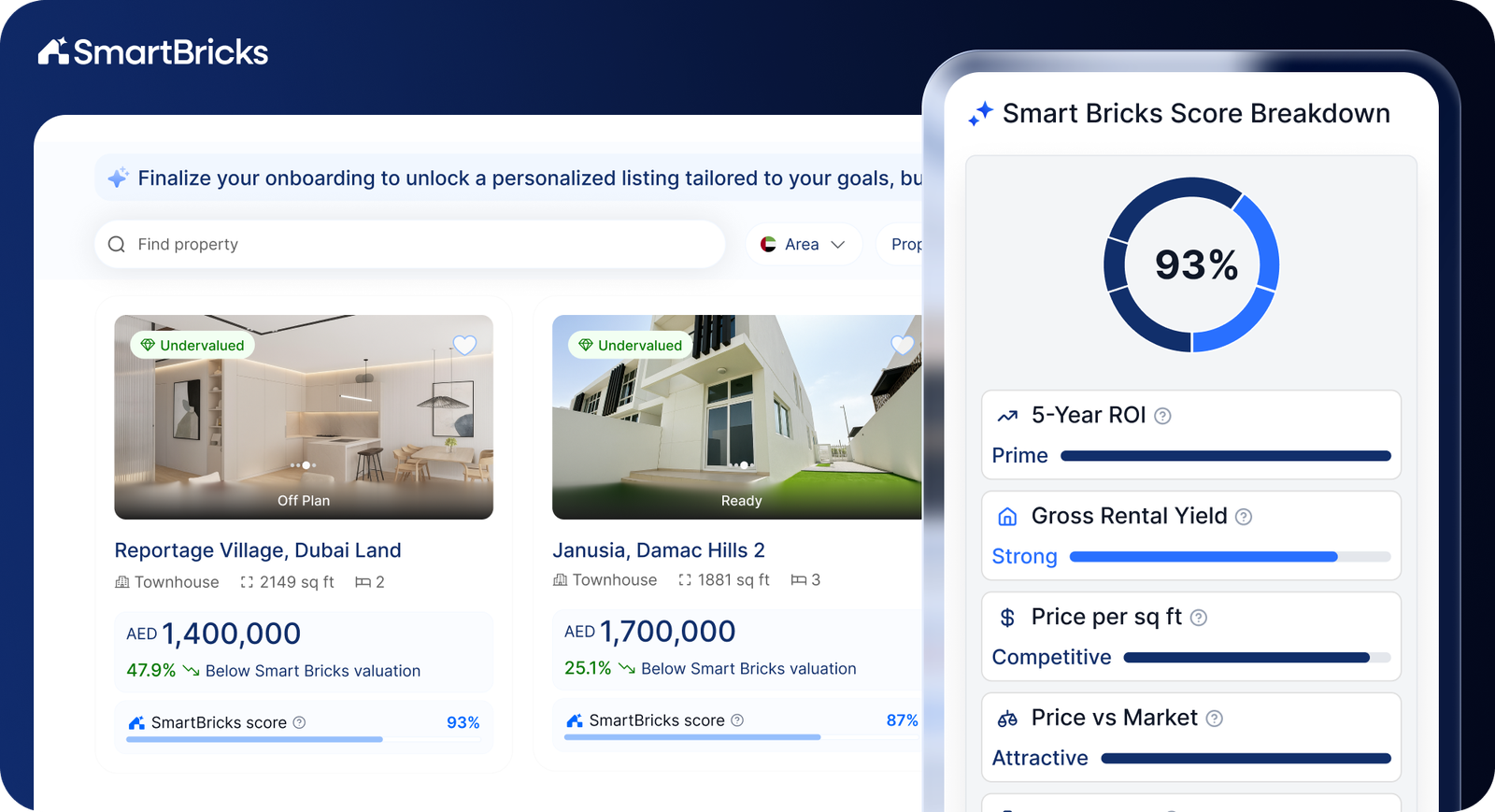

Smart Bricks ingests over one million proprietary and public data feeds and applies agentic AI to continuously analyze supply, pricing, liquidity, regulation, and risk across global markets. The platform surfaces only the top 0.1% of properties by expected risk-adjusted return, then automates up to 99% of the workflow – from valuation and underwriting through due diligence, neobtainediation, financing, and post-transaction support.

The result is a single AI-native operating system for global real-estate acquisition and ownership.

Built for retail and institutional investors

Smart Bricks is designed for retail and institutional operators deploying capital across markets such as Dubai, London, New York, Miami, and major US cities, who want to outperform competitors by leveraging the most advanced AI capabilities. Rather than acting as a marketplace or broker network, Smart Bricks serves as the AI infrastructure layer for modern real-estate investing.

Investors receive ranked opportunities, real-time innotifyigence, and execution workflows that mirror the sophistication of leading private-equity and institutional real-estate funds – without the required to assemble in-houtilize AI teams or navigate fragmented intermediaries.

“Investors in public markets already expect instant insight, scenario analysis, and AI-driven recommconcludeations,” Mohamed added. “We bring that same level of speed, innotifyigence, and confidence to global real estate, allowing capital to shift with institutional precision across borders.”

Momentum across AI and proptech ecosystems

Smart Bricks has been recognized by TechCrunch as one of the Top 200 startups globally, by Onstage Europe as a Top 20 startup in Europe, and has received nominations from leading global proptech and innovation bodies.

The company is backed by Andreessen Horowitz (a16z), Techstars, 500 Global, Cornerstone VC, South Loop Ventures, Harvard Business School Alumni Angels, Cento Ventures, alongside angel investors from OpenAI, Anthropic, DeepMind, Airbnb, and Blackstone. Smart Bricks is also an alumnus of Google AI First, Microsoft GrowthX, and NVIDIA Inception programmes.

Seasoned leadership at the intersection of AI and capital

Mohamed is a Forbes 30 Under 30 honoree with deep experience at the intersection of frontier technology and global capital allocation. Prior to founding Smart Bricks, he led AI, strategy, and investment initiatives at Boston Consulting Group and McKinsey & Company, advising governments, investment funds, and financial institutions.

He launched his career as an investor at Blackstone and Goldman Sachs, and later worked as a venture investor at Atomico and Greycroft. Mohamed is also an active angel investor in 30+ startups.

“Capital and talent have already gone global; the tooling for real-estate investing has not,” Mohamed stated. “Smart Bricks is building the innotifyigence layer that finally allows real estate to operate at the speed, transparency, and scale modern markets demand.”

![[LIVE] February 10, 2026: Bitcoin and Crypto News — Daily Highlights](https://foundernews.eu/storage/2026/02/v2u4URy9S4aLs7Yq0yiuuw.png)

Leave a Reply