As European markets reveal resilience, with the STOXX Europe 600 Index finishing higher due to strong economic data and earnings results, investors are increasingly focapplying on high-growth tech stocks that can capitalize on this positive momentum. In such an environment, a good stock might be characterized by its ability to innovate and adapt within the tech sector while leveraging favorable market conditions for sustained growth.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hacksaw | 28.53% | 33.50% | ★★★★★★ |

| Bonesupport Holding | 25.63% | 57.97% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 32.94% | 48.67% | ★★★★★★ |

| Pharma Mar | 16.39% | 34.00% | ★★★★★☆ |

| Kitron | 21.22% | 32.45% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Comet Holding | 10.92% | 37.65% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

| Gapwaves | 29.76% | 59.76% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

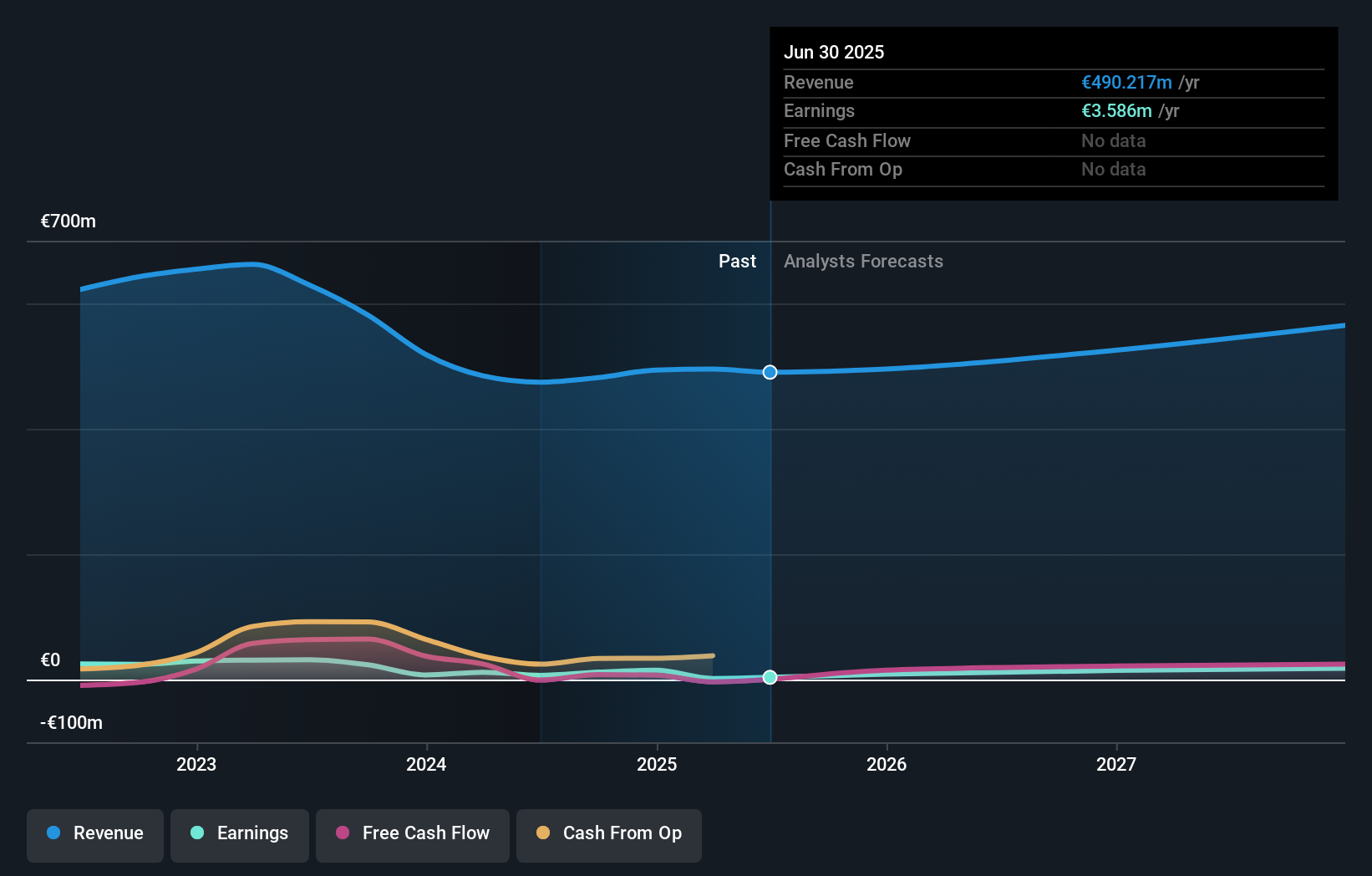

Overview: Datalogic S.p.A. is a company that specializes in manufacturing and selling automatic data capture and process automation products across various regions including Italy, the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of €223.10 million.

Operations: Datalogic generates revenue primarily from its Data Capture segment, contributing €328.76 million, and its Industrial Automation segment, which adds €158.10 million.

Datalogic, navigating through a challenging fiscal period marked by a significant one-off loss of €6.2 million, still projects an optimistic earnings trajectory with an anticipated growth rate of 68.3% annually. Despite a slight dip in sales to €359.45 million from €366.36 million and net income falling to €1.18 million from €12.57 million year-over-year, the company’s strategic focus on R&D and operational adjustments hint at robust future capabilities, especially as its revenue growth at 5.2% per year slightly outpaces the Italian market’s 5.1%. This resilience in refining its core operations and investment in innovation may well position Datalogic for recovery and growth amidst evolving market demands.

Simply Wall St Growth Rating: ★★★★★★

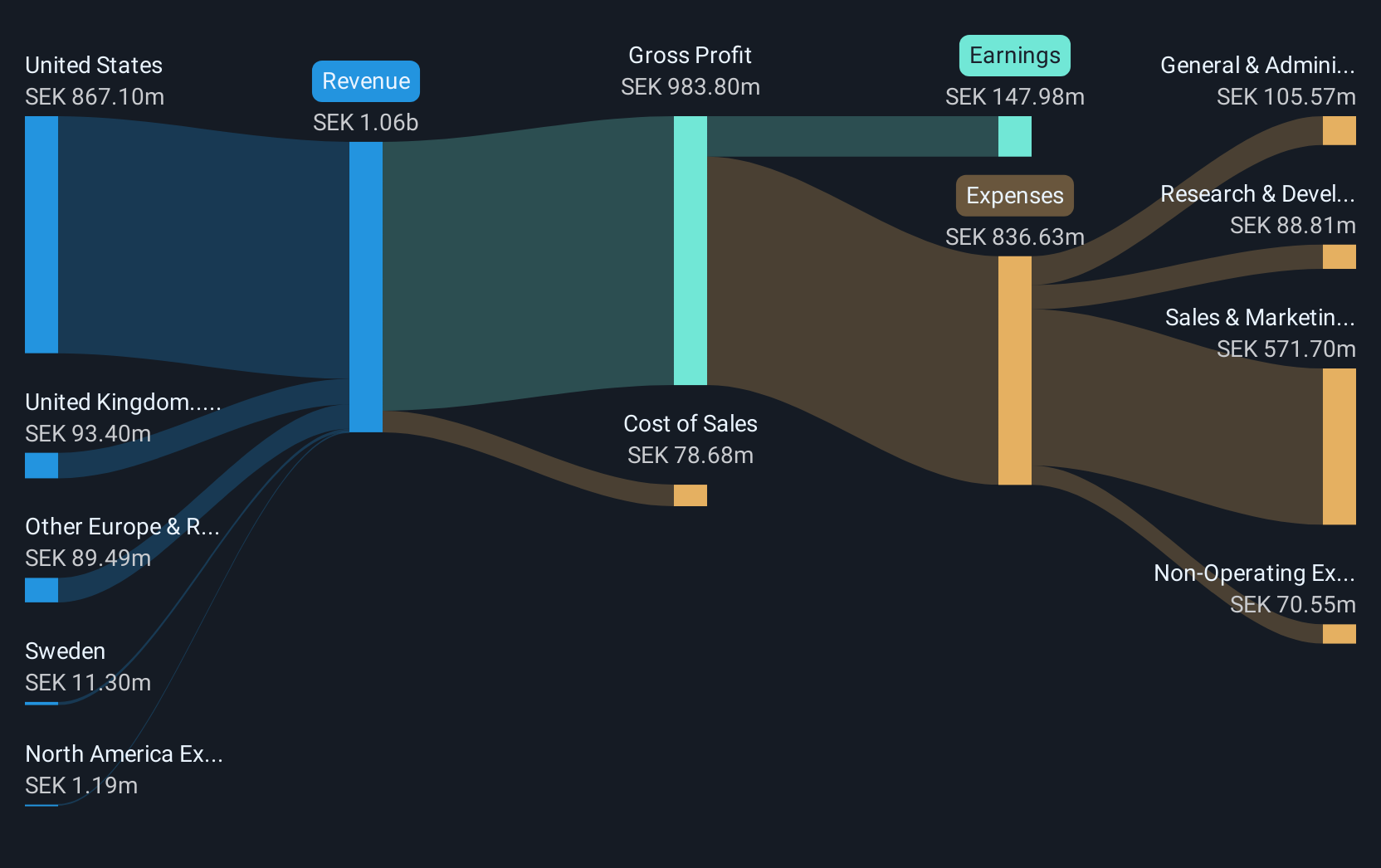

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that specializes in developing and selling injectable bio-ceramic bone graft substitutes across Europe, North America, and other international markets, with a market cap of SEK13.24 billion.

Operations: Bonesupport generates revenue primarily from its pharmaceuticals segment, amounting to SEK1.12 billion. The company focapplys on developing and selling injectable bio-ceramic bone graft substitutes in multiple regions, including Europe and North America.

Bonesupport Holding AB stands out in the European tech landscape, not just for its impressive revenue growth of 25.6% annually but also due to its strategic regulatory shifts that could redefine indusattempt standards. Recently transitioning to a De Novo process with the FDA for its CERAMENT® V, this shift could pioneer a new product category, echoing past successes with CERAMENT G. Moreover, with earnings expected to surge by 58% annually and robust returns on equity projected at 35.3%, Bonesupport is positioning itself as a formidable player in biotechnology innovations. This growth trajectory is further underscored by their latest guidance forecasting a sales increase of over 35%, signaling strong future prospects amidst evolving market conditions.

Simply Wall St Growth Rating: ★★★★☆☆

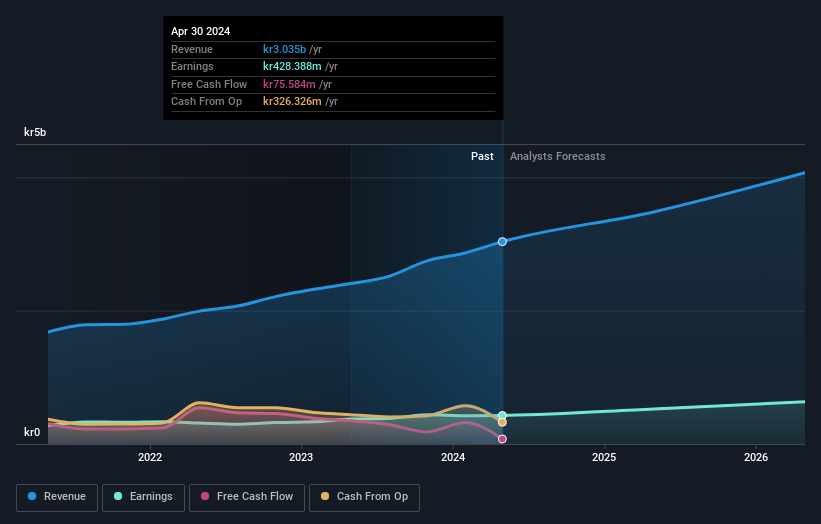

Overview: Sectra AB (publ) is a company that offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK43.27 billion.

Operations: Sectra generates revenue primarily from Imaging IT Solutions, contributing SEK2.95 billion, and Secure Communications, with SEK392.76 million. The company’s focus on medical IT and cybersecurity solutions positions it in various European markets.

Sectra’s recent strategic shifts in the digital pathology and medical imaging sectors underscore its robust growth trajectory and innovation prowess. The company’s foray into Japan with Matsunami Glass marks a significant expansion, enhancing diagnostic capabilities through digital pathology at Kameda Medical Center. Financially, Sectra demonstrated strong performance with Q2 revenues reaching SEK 903.48 million, a substantial increase from the previous year’s SEK 779.4 million, complemented by a net income surge to SEK 148.4 million from SEK 87.76 million. This financial upturn is mirrored in its operational advancements like the Sectra One Cloud service for NHS trusts, which optimizes cybersecurity and IT management while fostering collaborative diagnostics across multiple sites—revealcasing Sectra’s commitment to integrating cutting-edge technology with client-centric solutions.

Taking Advantage

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only applying an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focapplyd analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply